Biopharmaceutical drug delivery company Halozyme Therapeutics (NASDAQ: HALO) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 51.6% year on year to $451.8 million. The company expects the full year’s revenue to be around $1.76 billion, close to analysts’ estimates. Its non-GAAP loss of $0.24 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Halozyme Therapeutics? Find out by accessing our full research report, it’s free.

Halozyme Therapeutics (HALO) Q4 CY2025 Highlights:

- Revenue: $451.8 million vs analyst estimates of $449.2 million (51.6% year-on-year growth, 0.6% beat)

- Adjusted EPS: -$0.24 vs analyst estimates of $2.20 (significant miss but included acquired IPR&D expense of $284.9 million related to the Surf Bio acquisition in the fourth quarter of 2025)

- Adjusted EBITDA: $21.9 million vs analyst estimates of $303.2 million (4.8% margin, 92.8% miss but included acquired IPR&D expense of $284.9 million related to the Surf Bio acquisition in the fourth quarter of 2025)

- Adjusted EPS guidance for the upcoming financial year 2026 is $8 at the midpoint, missing analyst estimates by 2.2%

- EBITDA guidance for the upcoming financial year 2026 is $1.17 billion at the midpoint, below analyst estimates of $1.22 billion

- Operating Margin: -20.6%, down from 58.9% in the same quarter last year

- Market Capitalization: $9.34 billion

Company Overview

Known for transforming hours-long intravenous infusions into minutes-long subcutaneous injections, Halozyme Therapeutics (NASDAQ: HALO) develops and licenses its proprietary ENHANZE technology that enables subcutaneous delivery of injectable drugs that would otherwise require intravenous administration.

Revenue Growth

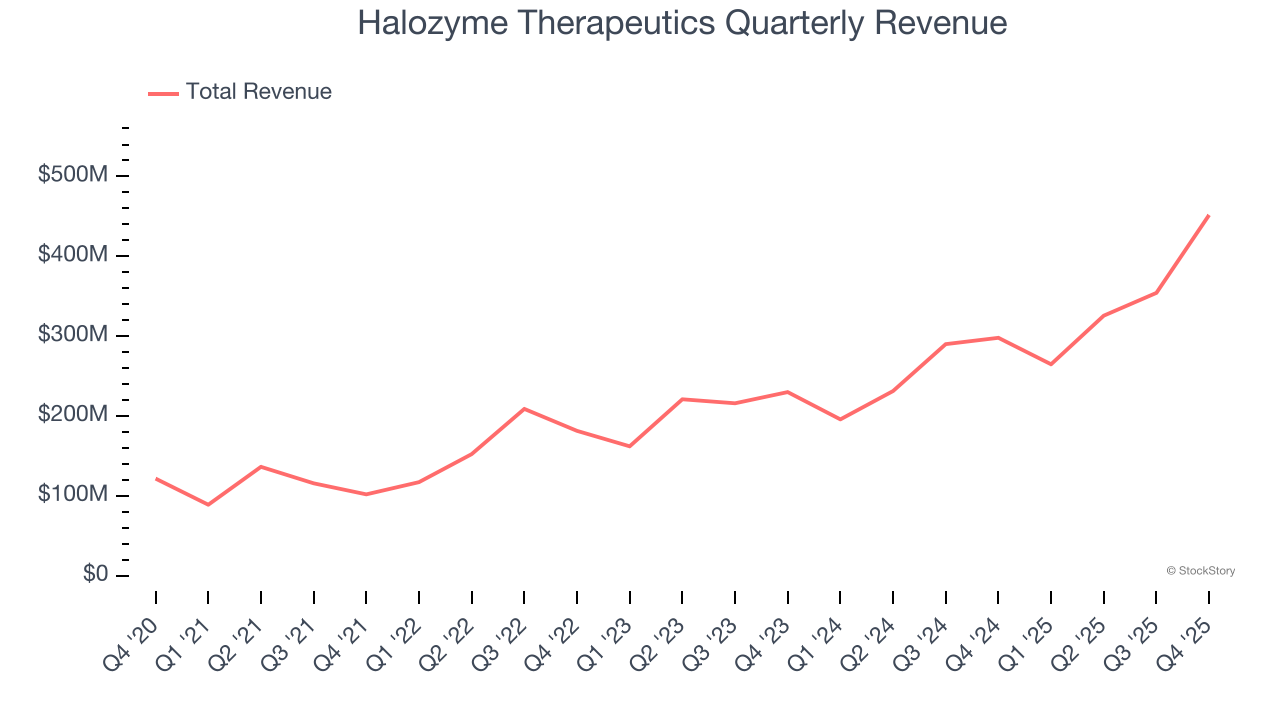

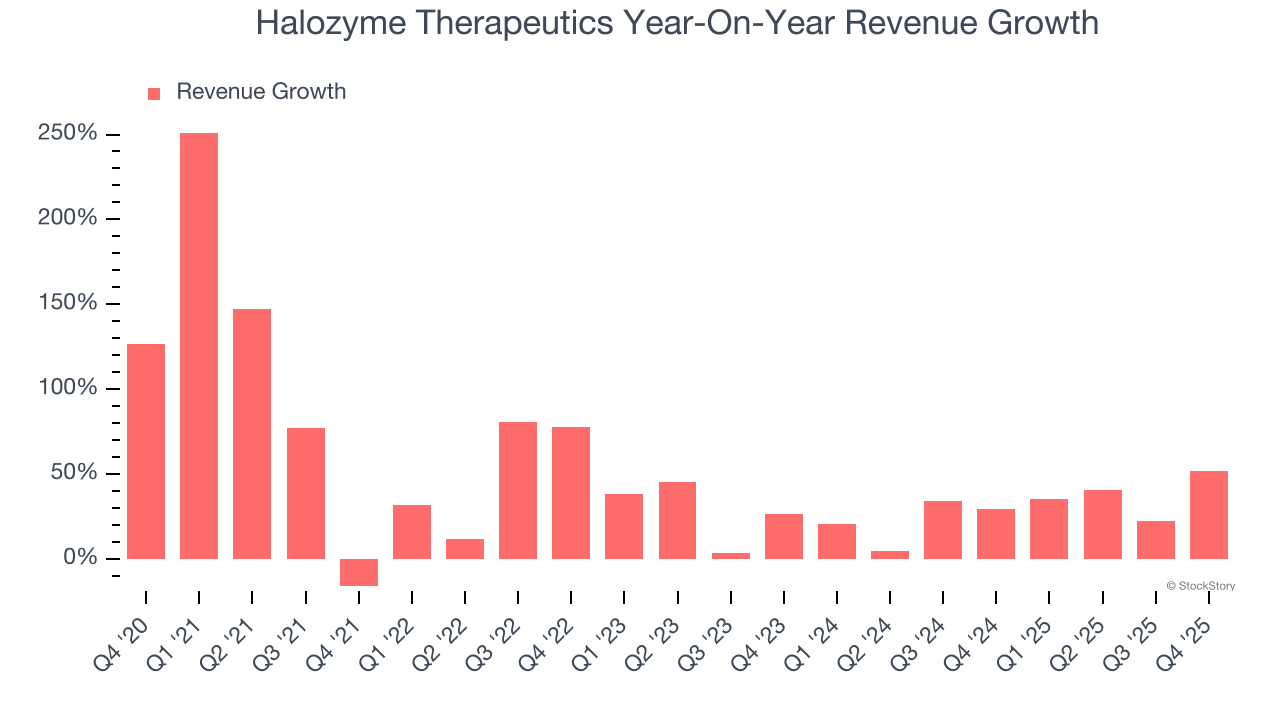

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Halozyme Therapeutics grew its sales at an incredible 39.2% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Halozyme Therapeutics’s annualized revenue growth of 29.8% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Halozyme Therapeutics reported magnificent year-on-year revenue growth of 51.6%, and its $451.8 million of revenue beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 26.1% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is admirable and implies the market sees success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

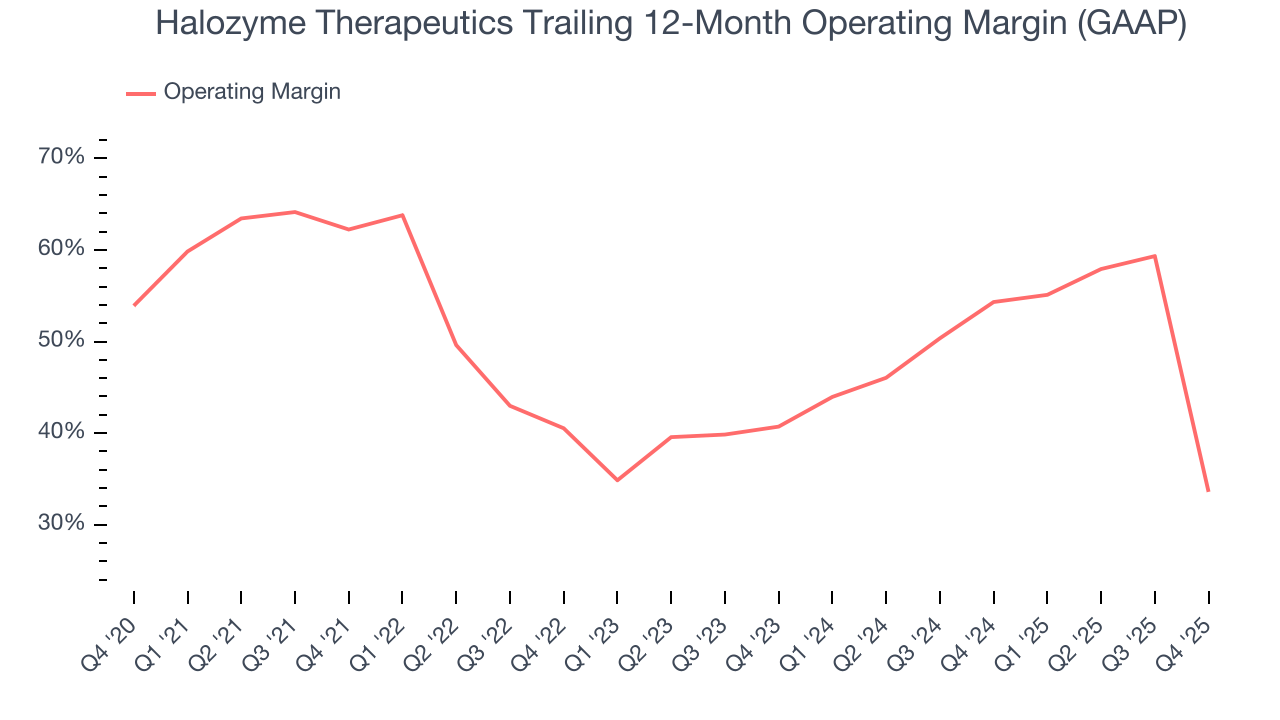

Halozyme Therapeutics has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average operating margin of 43.8%.

Analyzing the trend in its profitability, Halozyme Therapeutics’s operating margin decreased by 28.7 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 7.1 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Halozyme Therapeutics generated an operating margin profit margin of negative 20.6%, down 79.5 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

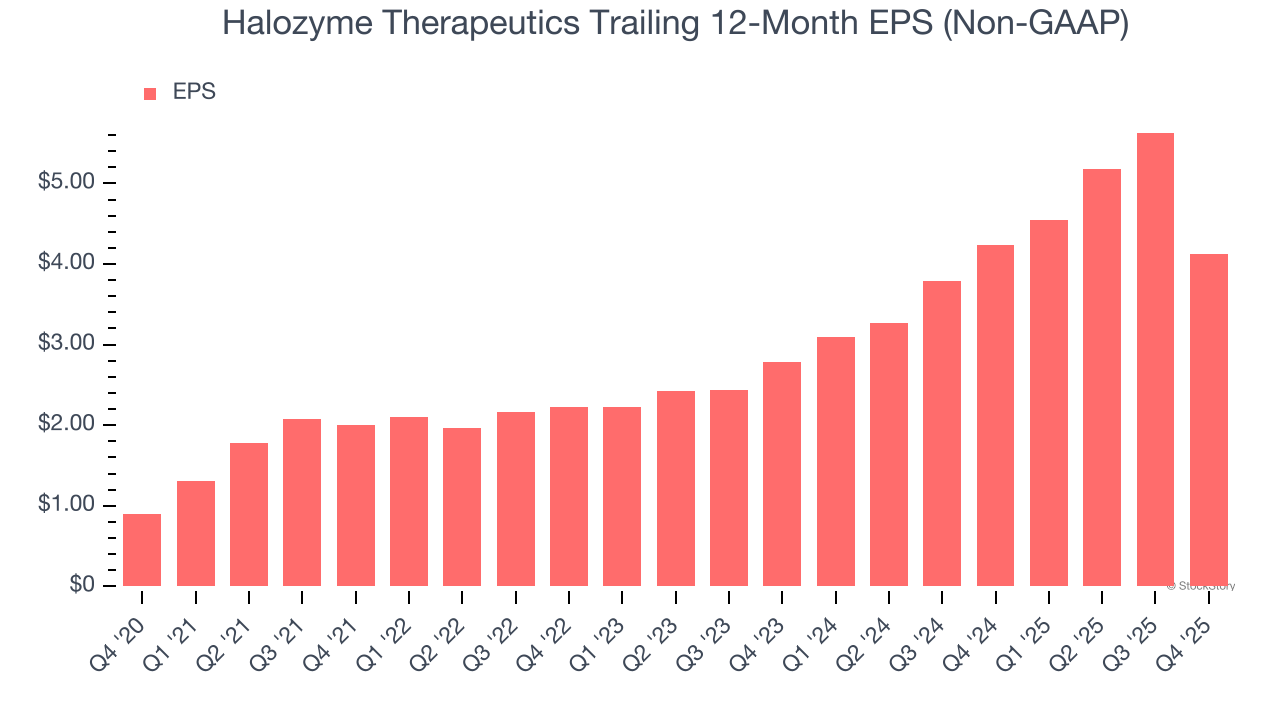

Halozyme Therapeutics’s EPS grew at an astounding 35.6% compounded annual growth rate over the last five years. However, this performance was lower than its 39.2% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into Halozyme Therapeutics’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Halozyme Therapeutics’s operating margin declined by 28.7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Halozyme Therapeutics reported adjusted EPS of negative $0.24, down from $1.26 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Halozyme Therapeutics’s full-year EPS of $4.13 to grow 97.8%.

Key Takeaways from Halozyme Therapeutics’s Q4 Results

It was good to see Halozyme Therapeutics narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS missed and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2.7% to $78.44 immediately following the results.

The latest quarter from Halozyme Therapeutics’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).