Furniture company La-Z-Boy (NYSE: LZB) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 3.8% year on year to $541.6 million. On the other hand, next quarter’s revenue guidance of $570 million was less impressive, coming in 3.2% below analysts’ estimates. Its non-GAAP profit of $0.61 per share was 2.8% above analysts’ consensus estimates.

Is now the time to buy La-Z-Boy? Find out by accessing our full research report, it’s free.

La-Z-Boy (LZB) Q4 CY2025 Highlights:

- Revenue: $541.6 million vs analyst estimates of $535.6 million (3.8% year-on-year growth, 1.1% beat)

- Adjusted EPS: $0.61 vs analyst estimates of $0.59 (2.8% beat)

- Revenue Guidance for Q1 CY2026 is $570 million at the midpoint, below analyst estimates of $589.1 million

- Operating Margin: 5.5%, down from 6.7% in the same quarter last year

- Free Cash Flow Margin: 13.2%, up from 7.3% in the same quarter last year

- Market Capitalization: $1.58 billion

Melinda D. Whittington, Board Chair, President and Chief Executive Officer of La-Z-Boy Incorporated, said, “Our strong third quarter results are proof that we continue to strengthen our enterprise and increase the agility of our business. Amid the ongoing challenging consumer environment, we continue to create our own momentum, led by Retail expansion through both acquired and new stores, driving double-digit sales growth in our written and delivered business in the quarter. Over the last twelve months, we have added 29 net company-owned stores, reflecting 16 new, 17 acquired, and four closed. And our current proportion of company-owned stores is now at an all-time high of ~60% of total network. Growing our La-Z-Boy brand reach by expanding our direct-to-consumer business remains a key pillar of our Century Vision strategy.

Company Overview

The prized possession of every mancave, La-Z-Boy (NYSE: LZB) is a furniture company specializing in recliners, sofas, and seats.

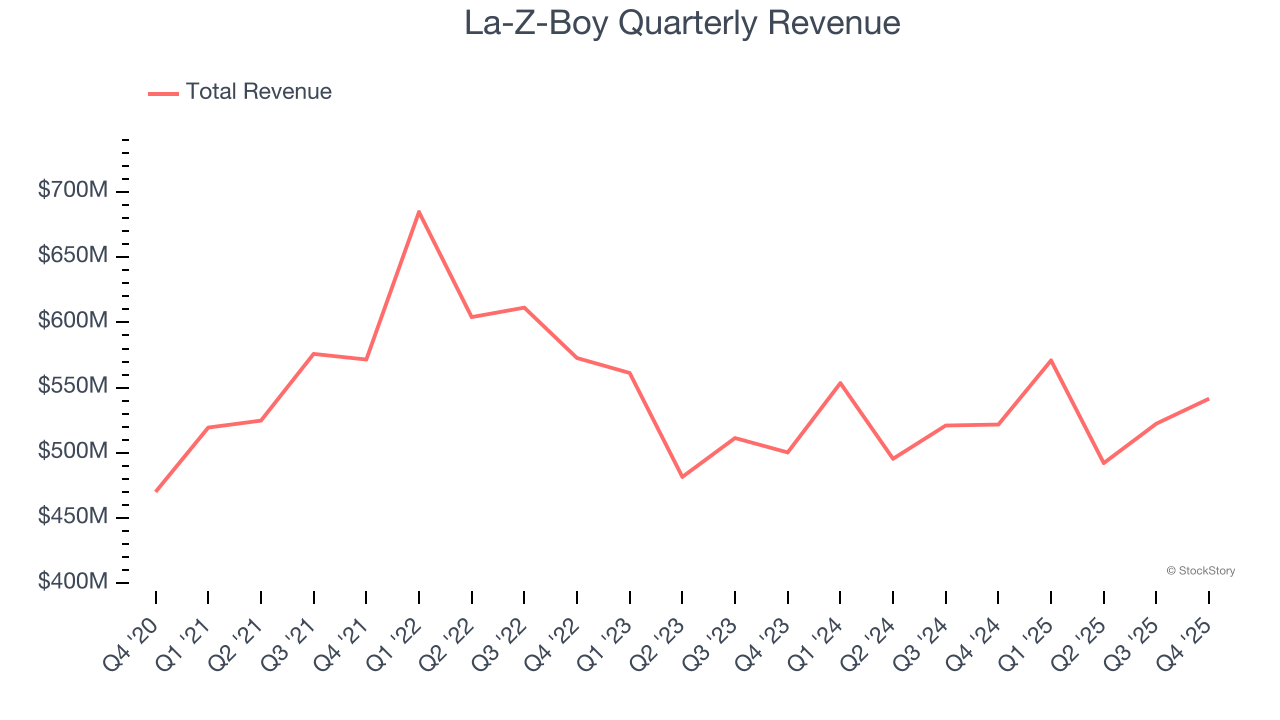

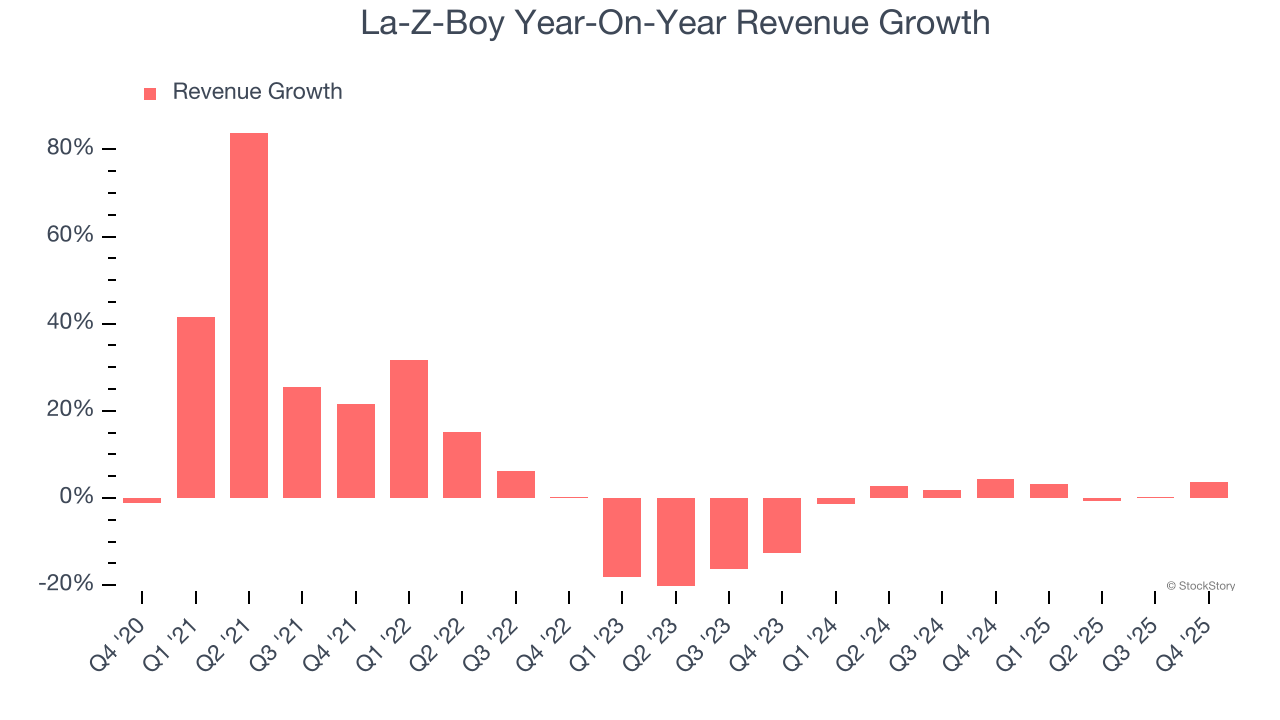

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, La-Z-Boy grew its sales at a weak 6.1% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. La-Z-Boy’s recent performance shows its demand has slowed as its annualized revenue growth of 1.7% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

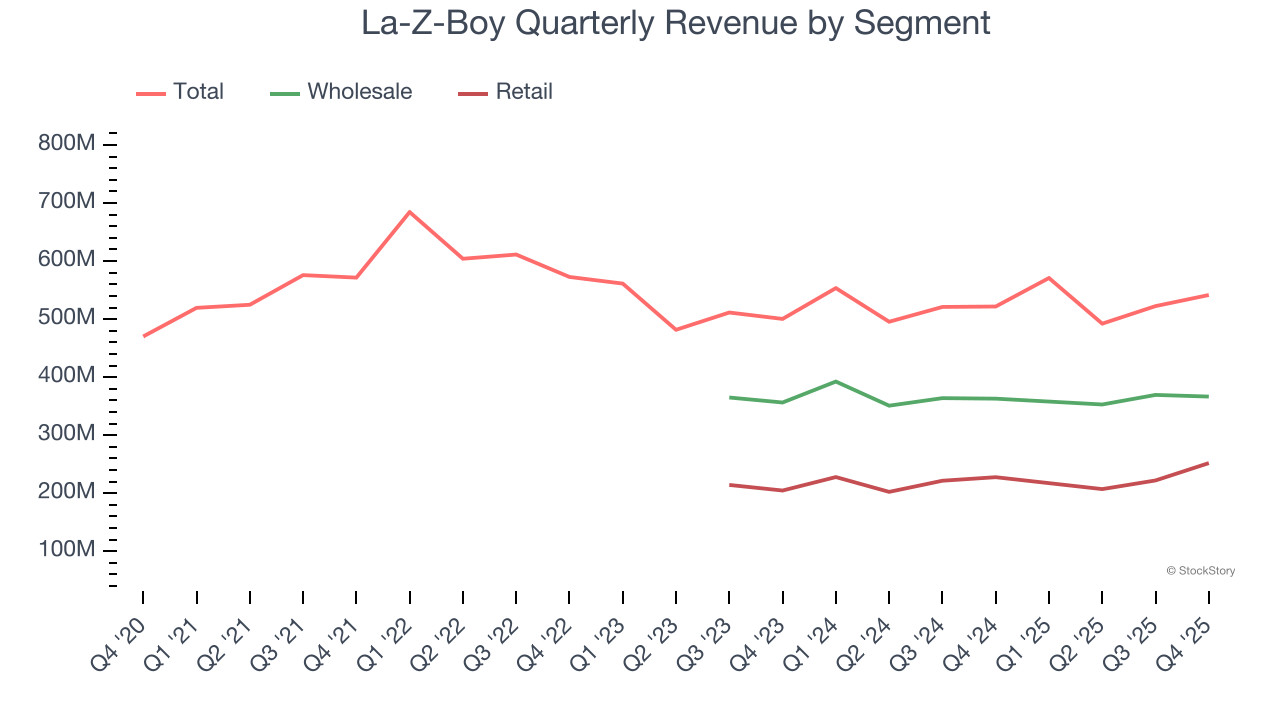

We can better understand the company’s revenue dynamics by analyzing its most important segments, Wholesale and Retail, which are 59.3% and 40.7% of core revenues. Over the last two years, La-Z-Boy’s Wholesale revenue (sales to retailers) was flat while its Retail revenue (direct sales to consumers) averaged 5.6% year-on-year growth.

This quarter, La-Z-Boy reported modest year-on-year revenue growth of 3.8% but beat Wall Street’s estimates by 1.1%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.1% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not accelerate its top-line performance yet.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

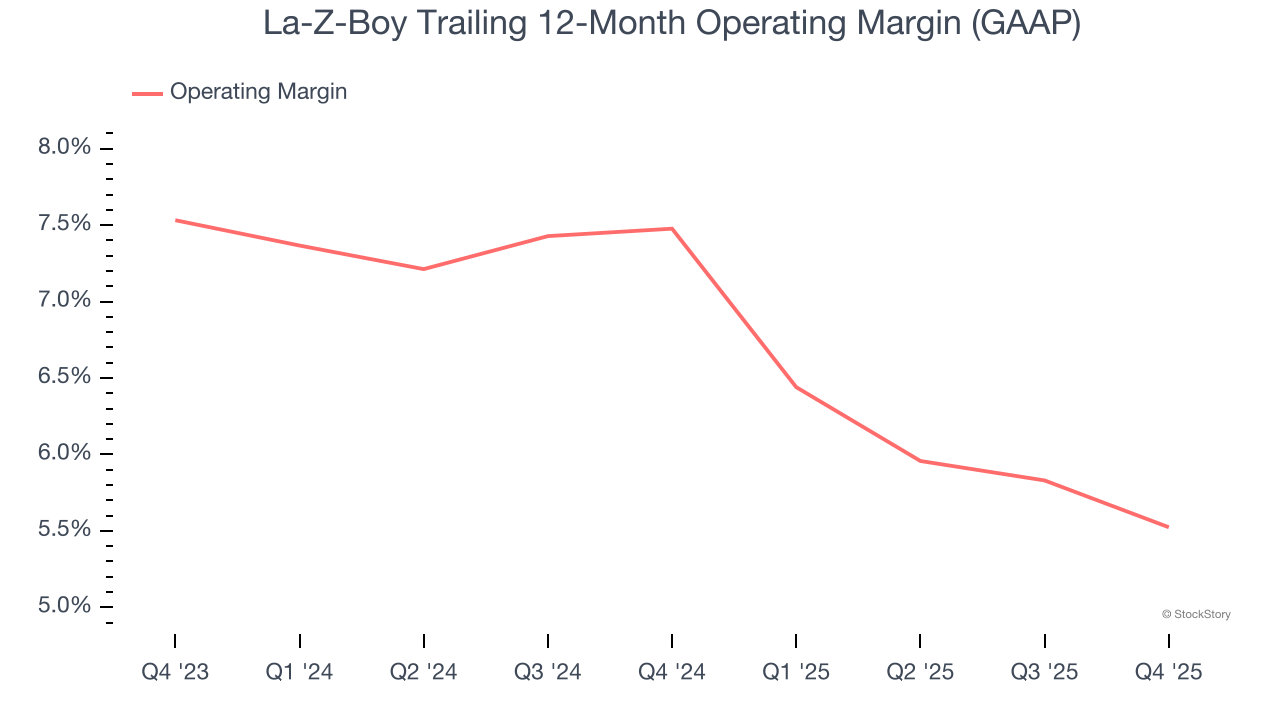

Operating Margin

La-Z-Boy’s operating margin has shrunk over the last 12 months and averaged 6.5% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, La-Z-Boy generated an operating margin profit margin of 5.5%, down 1.2 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

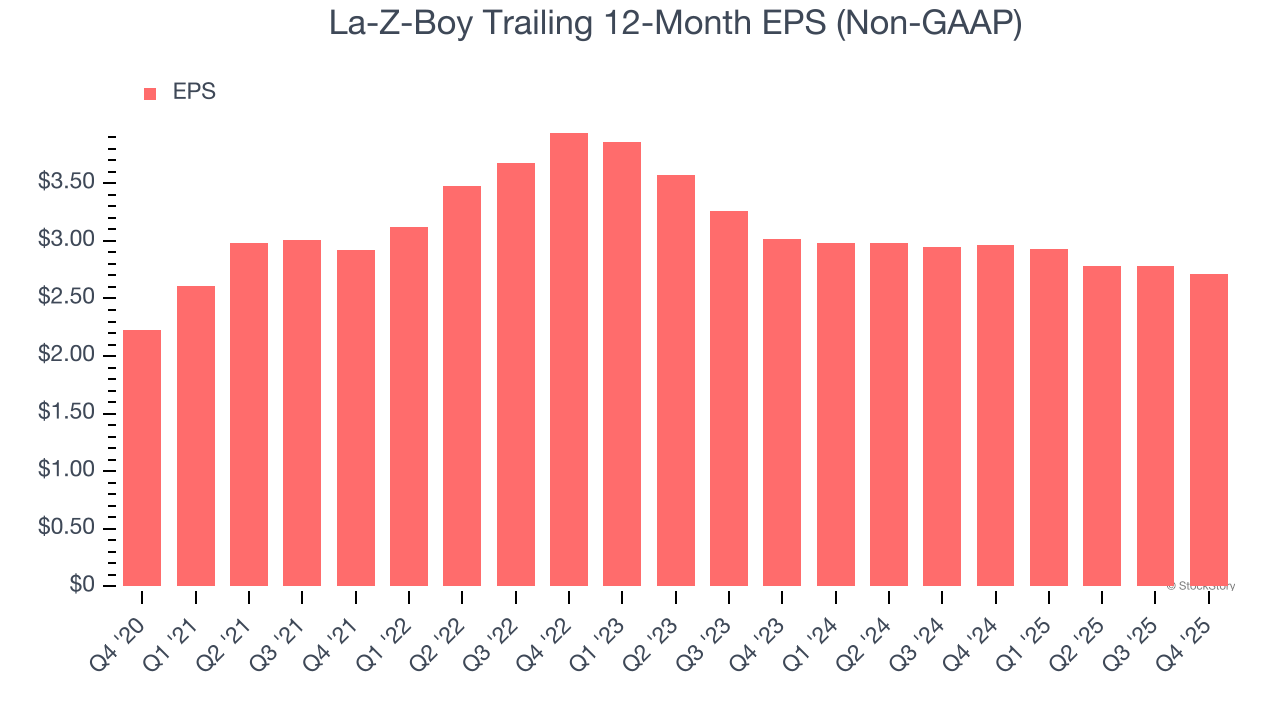

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

La-Z-Boy’s EPS grew at a weak 4% compounded annual growth rate over the last five years, lower than its 6.1% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q4, La-Z-Boy reported adjusted EPS of $0.61, down from $0.68 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 2.8%. Over the next 12 months, Wall Street expects La-Z-Boy’s full-year EPS of $2.71 to grow 7.4%.

Key Takeaways from La-Z-Boy’s Q4 Results

It was good to see La-Z-Boy narrowly top analysts’ revenue expectations this quarter. On the other hand, its revenue guidance for next quarter missed. Overall, this was a weaker quarter. The stock traded down 6% to $35.60 immediately after reporting.

Big picture, is La-Z-Boy a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).