The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how consumer discretionary - media stocks fared in Q4, starting with The New York Times (NYSE: NYT).

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare. Media companies create, aggregate, and distribute content—including news, entertainment, and advertising—across television, print, digital, and out-of-home channels. Tailwinds include growing digital advertising budgets, content licensing opportunities, and global audience expansion through streaming and social platforms. Headwinds are substantial: traditional advertising revenue from print and linear TV continues its structural decline as audiences migrate to digital alternatives. Content creation costs are escalating amid intense competition for talent and intellectual property. Media fragmentation makes it difficult to build sustainable audience scale, while AI-generated content threatens to commoditize production and disrupt established business models.

The 6 consumer discretionary - media stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 47.8%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.3% since the latest earnings results.

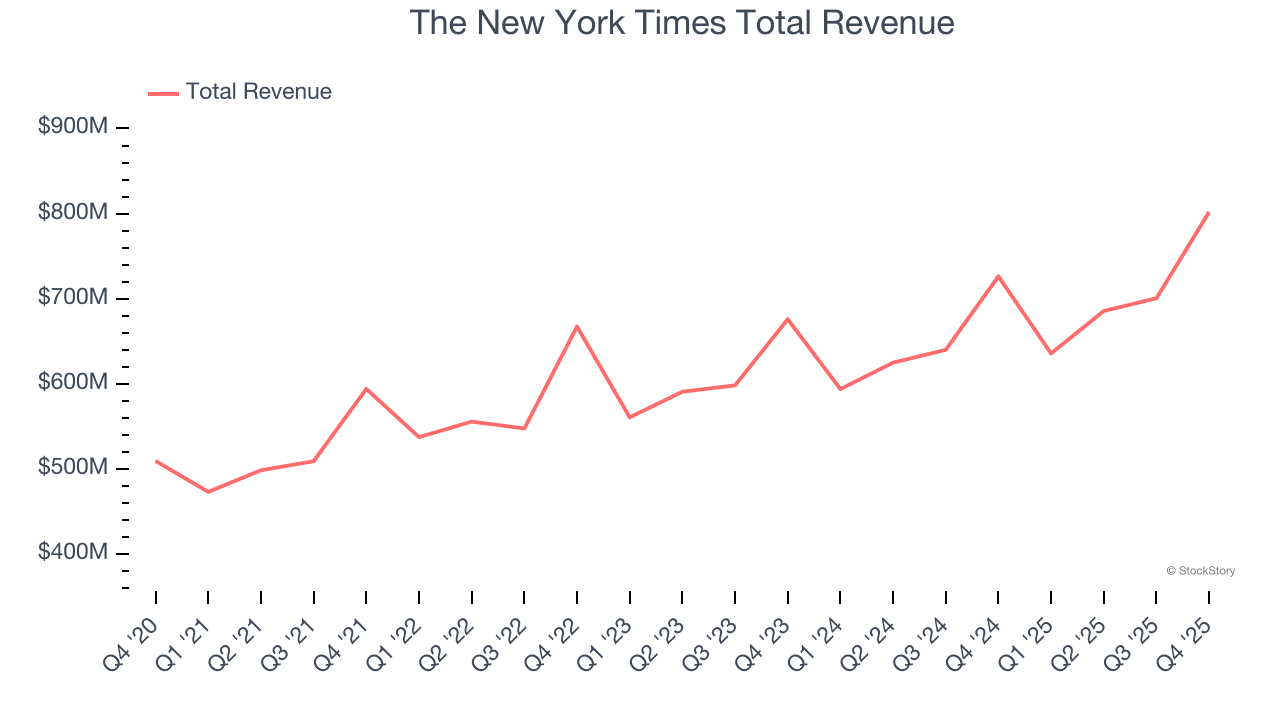

Weakest Q4: The New York Times (NYSE: NYT)

Founded in 1851, The New York Times (NYSE: NYT) is an American media organization known for its influential newspaper and expansive digital journalism platforms.

The New York Times reported revenues of $802.3 million, up 10.4% year on year. This print exceeded analysts’ expectations by 1.4%. Despite the top-line beat, it was still a mixed quarter for the company with a narrow beat of analysts’ revenue estimates but a miss of analysts’ EBITDA estimates.

Interestingly, the stock is up 1% since reporting and currently trades at $72.94.

Is now the time to buy The New York Times? Access our full analysis of the earnings results here, it’s free.

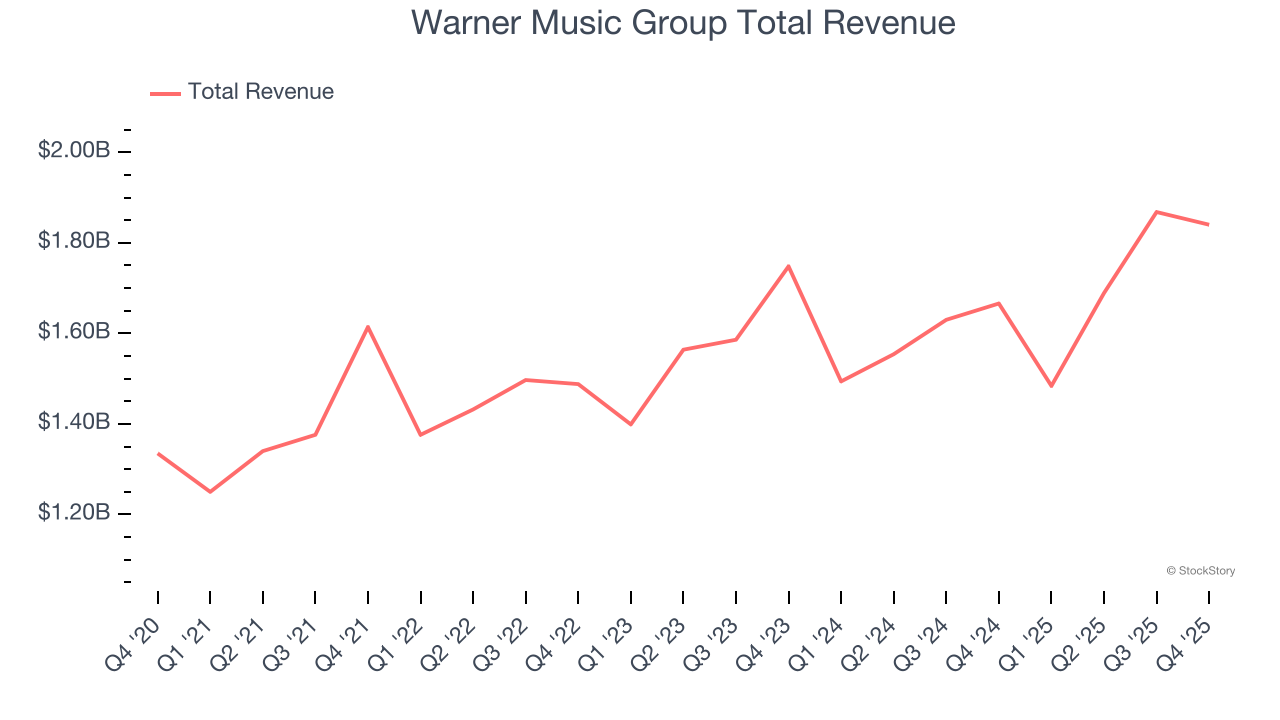

Best Q4: Warner Music Group (NASDAQ: WMG)

Launching the careers of legendary artists like Frank Sinatra, Warner Music Group (NASDAQ: WMG) is a music company managing a diverse portfolio of artists, recordings, and music publishing services worldwide.

Warner Music Group reported revenues of $1.84 billion, up 10.4% year on year, outperforming analysts’ expectations by 4.1%. The business had a very strong quarter with an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ EBITDA estimates.

The market seems content with the results as the stock is up 4.5% since reporting. It currently trades at $29.45.

Is now the time to buy Warner Music Group? Access our full analysis of the earnings results here, it’s free.

Scholastic (NASDAQ: SCHL)

Creator of the legendary Scholastic Book Fair, Scholastic (NASDAQ: SCHL) is an international company specializing in children's publishing, education, and media services.

Scholastic reported revenues of $551.1 million, up 1.2% year on year, falling short of analysts’ expectations by 1%. It was a mixed quarter as it posted a beat of analysts’ EPS estimates but full-year EBITDA guidance missing analysts’ expectations.

Scholastic delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 16.5% since the results and currently trades at $33.51.

Read our full analysis of Scholastic’s results here.

fuboTV (NYSE: FUBO)

Originally launched as a soccer streaming platform, fuboTV (NYSE: FUBO) is a video streaming service specializing in live sports, news, and entertainment content.

fuboTV reported revenues of $1.55 billion, up 249% year on year. This number topped analysts’ expectations by 279%. Aside from that, it was a satisfactory quarter as it also recorded an impressive beat of analysts’ revenue estimates but a significant miss of analysts’ EPS estimates.

fuboTV scored the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is down 41% since reporting and currently trades at $1.34.

Read our full, actionable report on fuboTV here, it’s free.

Disney (NYSE: DIS)

Founded by brothers Walt and Roy, Disney (NYSE: DIS) is a multinational entertainment conglomerate, renowned for its theme parks, movies, television networks, and merchandise.

Disney reported revenues of $25.98 billion, up 5.2% year on year. This result beat analysts’ expectations by 0.8%. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ adjusted operating income estimates and a beat of analysts’ EPS estimates.

The stock is down 6.6% since reporting and currently trades at $105.30.

Read our full, actionable report on Disney here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.