MSA Safety has had an impressive run over the past six months as its shares have beaten the S&P 500 by 12.5%. The stock now trades at $201.94, marking a 18.5% gain. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy MSA Safety, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is MSA Safety Not Exciting?

We’re glad investors have benefited from the price increase, but we don't have much confidence in MSA Safety. Here are two reasons you should be careful with MSA and a stock we'd rather own.

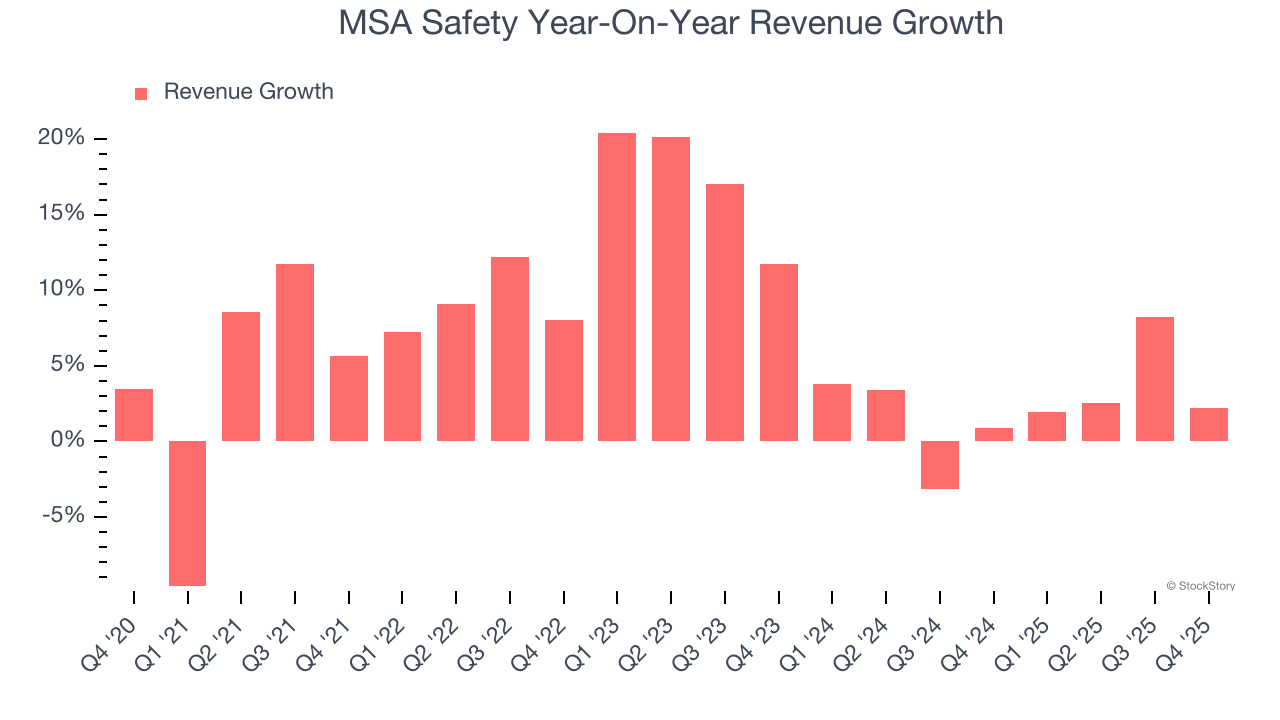

1. Lackluster Revenue Growth

Long-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. MSA Safety’s recent performance shows its demand has slowed as its annualized revenue growth of 2.4% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

2. Recent EPS Growth Below Our Standards

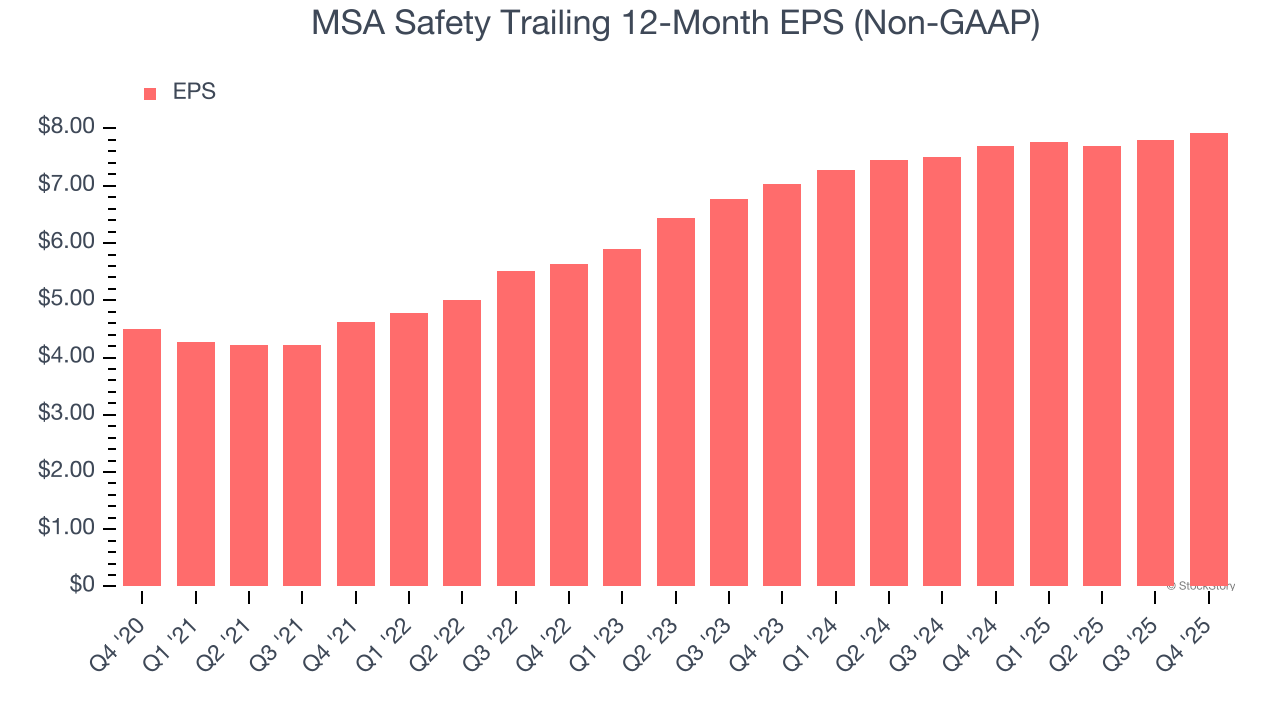

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

MSA Safety’s EPS grew at an unimpressive 6.2% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 2.4% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

MSA Safety isn’t a terrible business, but it doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 23× forward P/E (or $201.94 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.