What a brutal six months it’s been for Baldwin Insurance Group. The stock has dropped 46.2% and now trades at $17.59, rattling many shareholders. This may have investors wondering how to approach the situation.

Following the pullback, is now an opportune time to buy BWIN? Find out in our full research report, it’s free.

Why Is BWIN a Good Business?

Rebranded from BRP Group in May 2024, Baldwin Insurance Group (NASDAQ: BWIN) is an independent insurance distribution company that provides tailored insurance, risk management, and employee benefits solutions to businesses and individuals.

1. Core Business Firing on All Cylinders

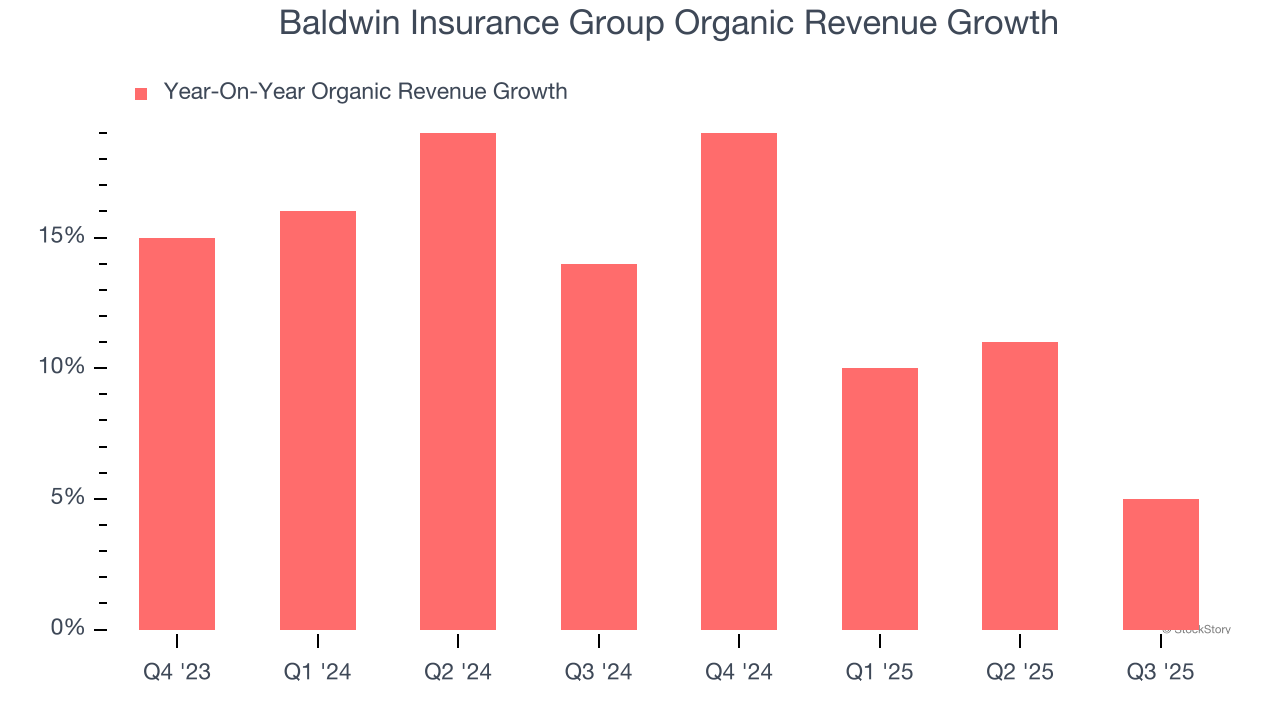

In addition to reported revenue, organic revenue is a useful data point for analyzing Insurance Brokers companies. This metric gives visibility into Baldwin Insurance Group’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Baldwin Insurance Group’s organic revenue averaged 13.6% year-on-year growth. This performance was fantastic and shows it can expand quickly without relying on expensive (and risky) acquisitions.

2. Adjusted Operating Margin Rising, Profits Up

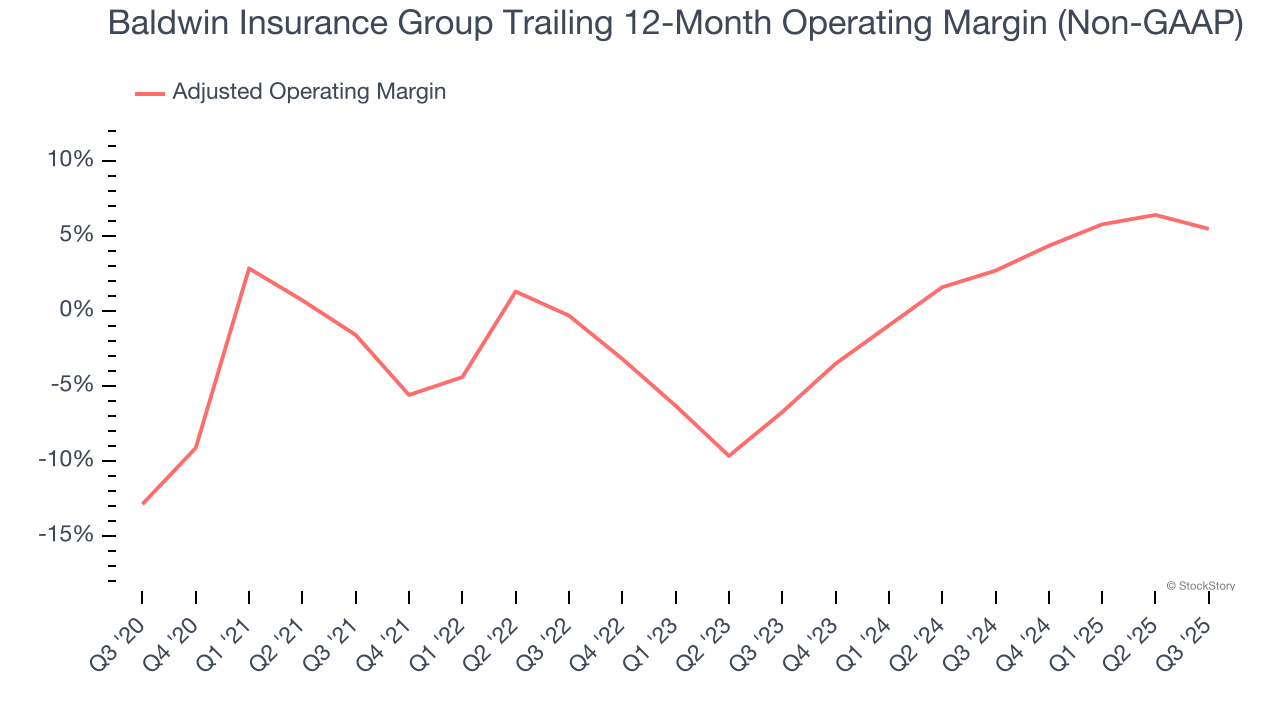

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Baldwin Insurance Group’s adjusted operating margin rose by 7.1 percentage points over the last five years, as its sales growth gave it immense operating leverage. Its adjusted operating margin for the trailing 12 months was 5.5%.

3. Outstanding Long-Term EPS Growth

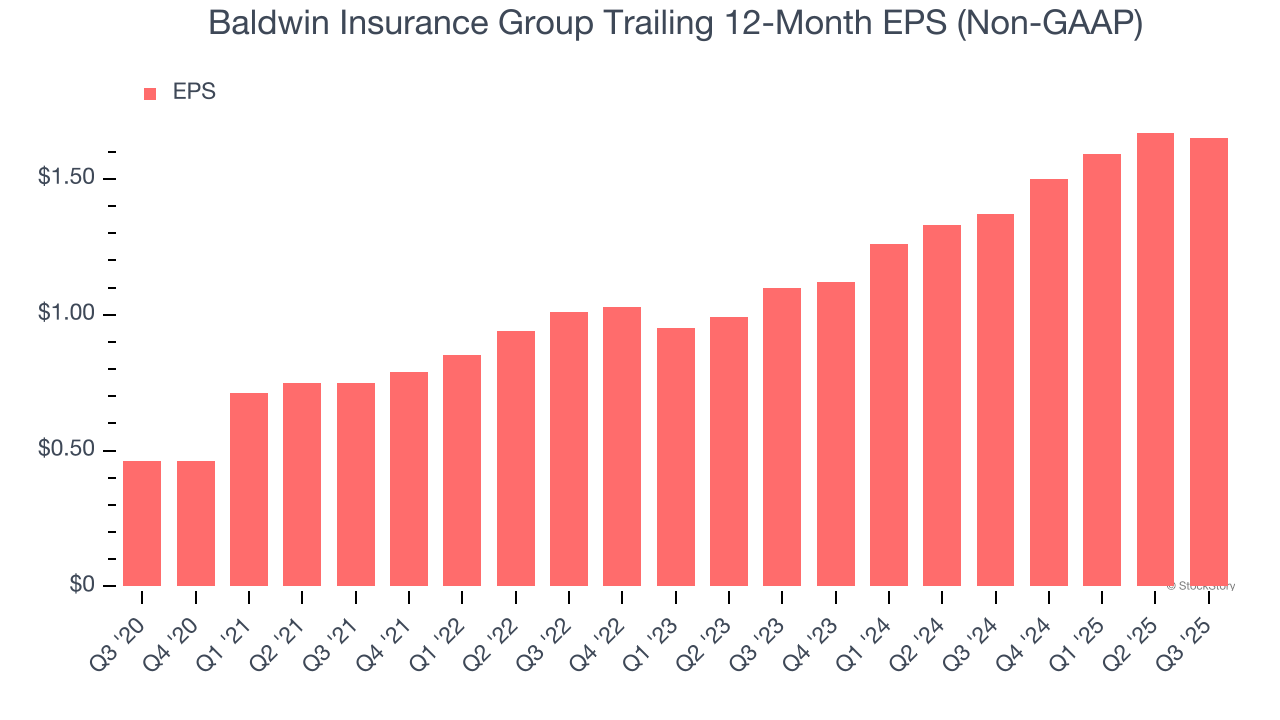

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Baldwin Insurance Group’s EPS grew at an astounding 29.1% compounded annual growth rate over the last five years. This performance was better than most business services businesses.

Final Judgment

These are just a few reasons why we're bullish on Baldwin Insurance Group. With the recent decline, the stock trades at 8.6× forward P/E (or $17.59 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.