Over the last six months, Korn Ferry’s shares have sunk to $61.30, producing a disappointing 16.2% loss - a stark contrast to the S&P 500’s 6% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Korn Ferry, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Korn Ferry Not Exciting?

Even with the cheaper entry price, we're swiping left on Korn Ferry for now. Here are three reasons there are better opportunities than KFY and a stock we'd rather own.

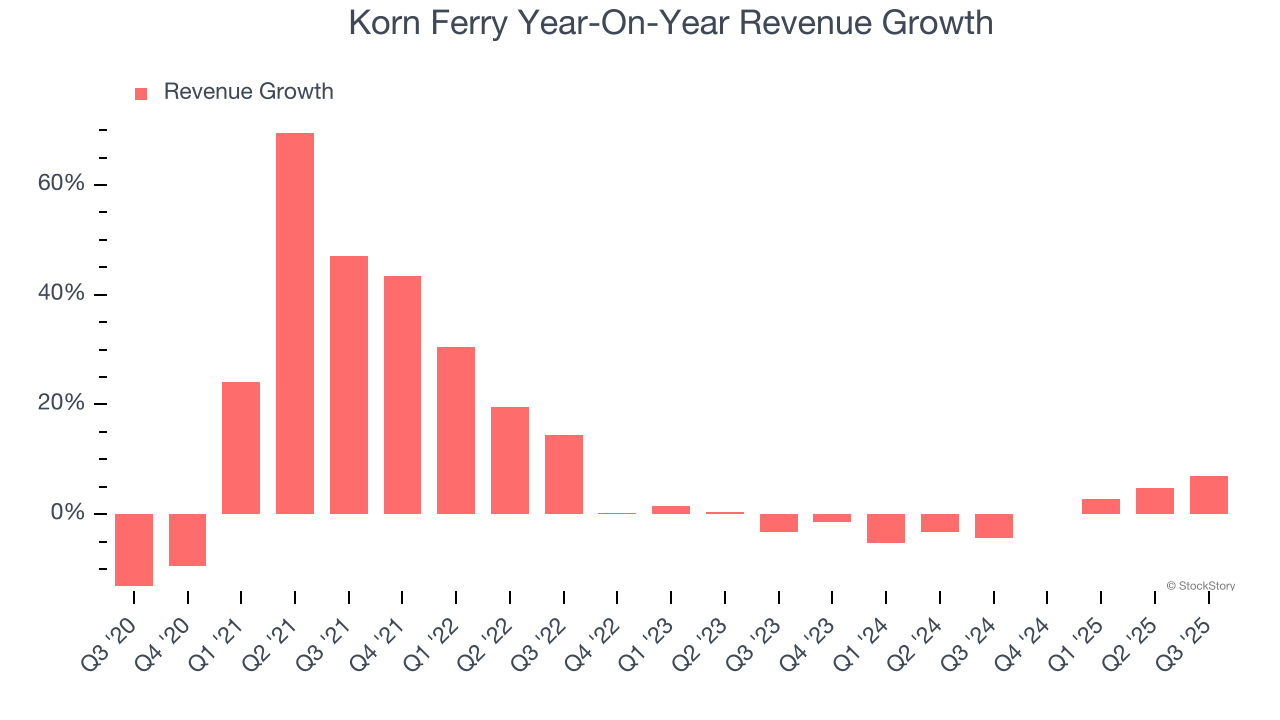

1. Revenue Growth Flatlining

Long-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. Korn Ferry’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years.

2. Shrinking Adjusted Operating Margin

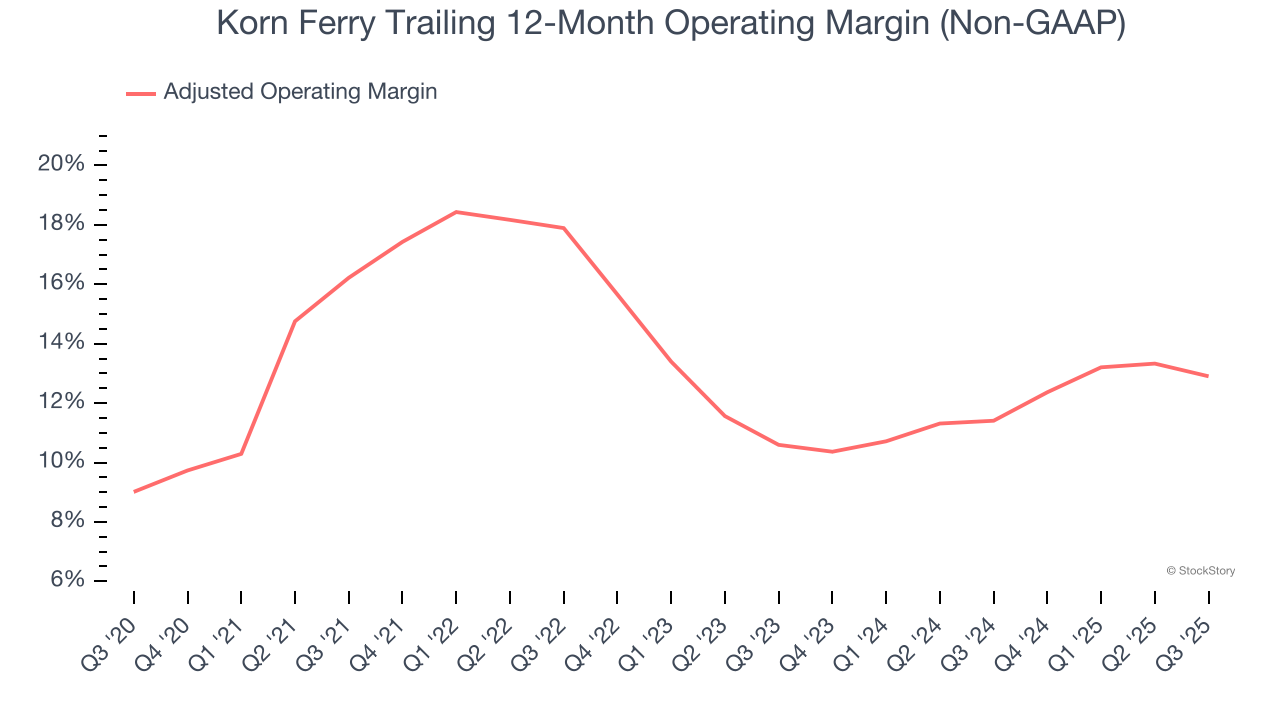

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

Looking at the trend in its profitability, Korn Ferry’s adjusted operating margin decreased by 3.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its adjusted operating margin for the trailing 12 months was 12.9%.

3. New Investments Fail to Bear Fruit as ROIC Declines

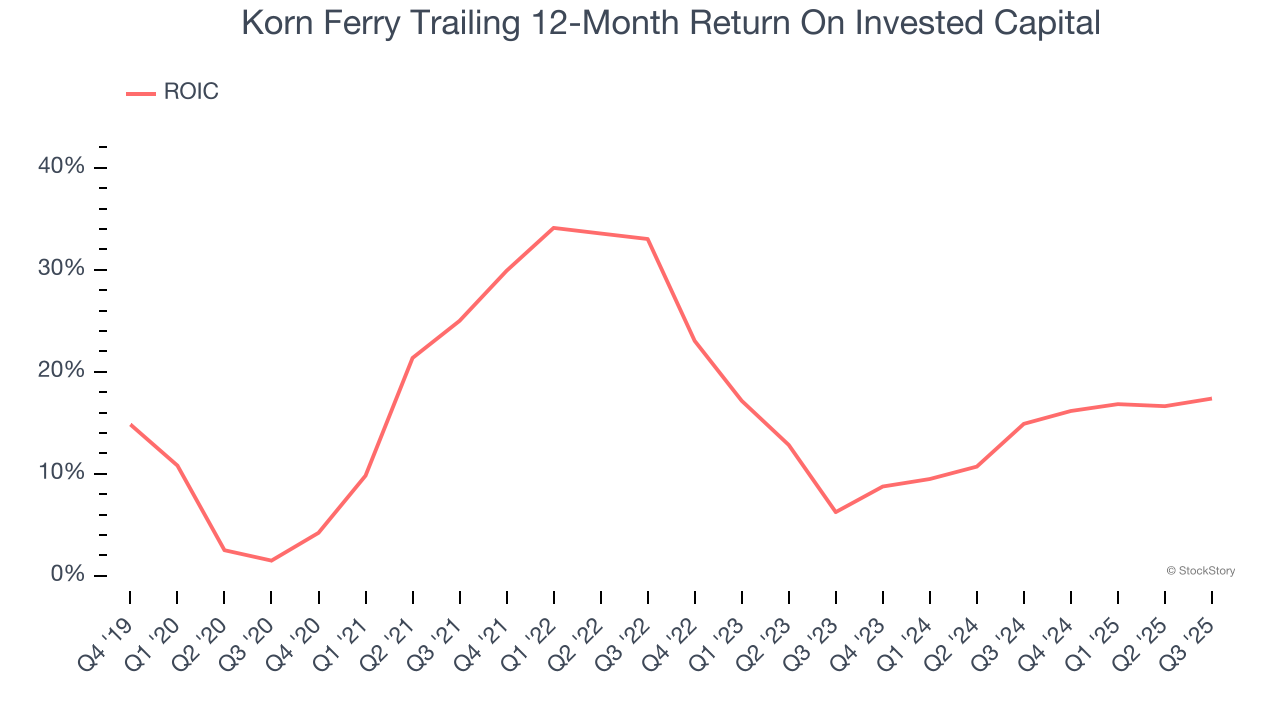

We like to invest in businesses with high returns, but the trend in a company’s ROIC can also be an early indicator of future business quality.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Korn Ferry’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Korn Ferry isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 11.3× forward P/E (or $61.30 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d suggest looking at the most dominant software business in the world.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.