AT&T has been treading water for the past six months, recording a small loss of 0.8% while holding steady at $28.68. The stock also fell short of the S&P 500’s 6% gain during that period.

Is now the time to buy AT&T, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think AT&T Will Underperform?

We're sitting this one out for now. Here are three reasons why T doesn't excite us and a stock we'd rather own.

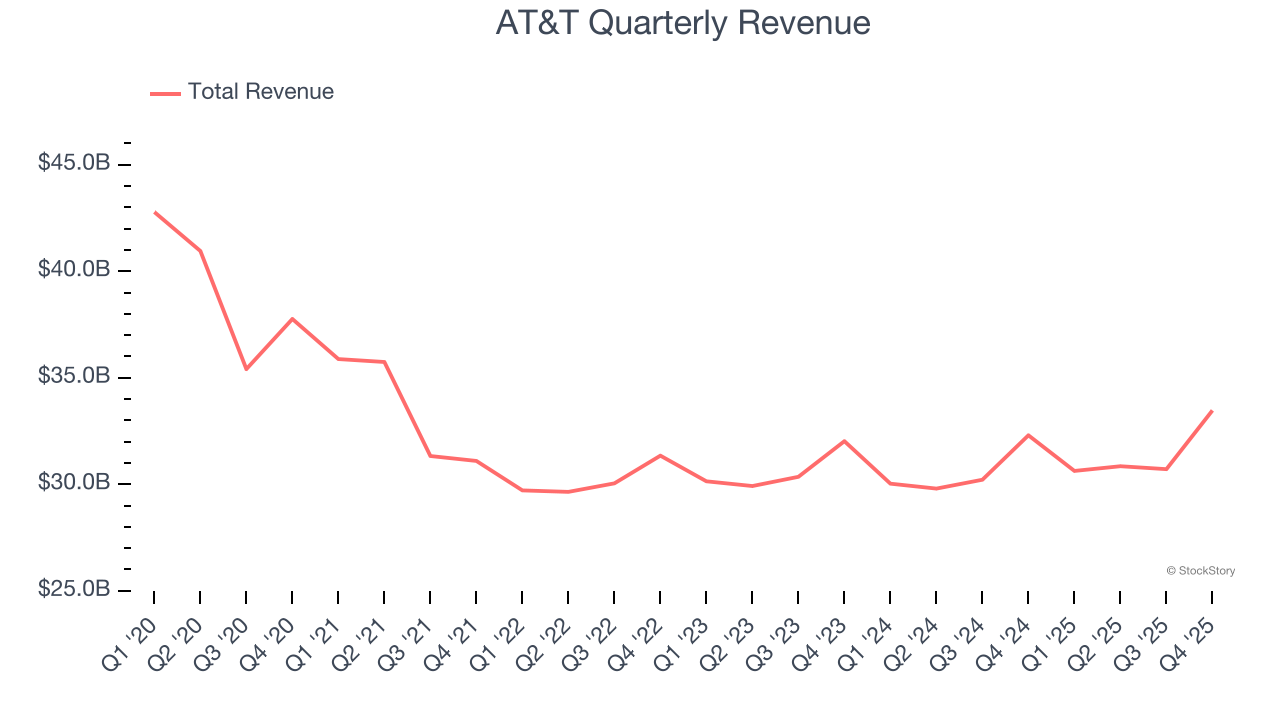

1. Revenue Spiraling Downwards

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. AT&T struggled to consistently generate demand over the last five years as its sales dropped at a 4.3% annual rate. This was below our standards and is a sign of poor business quality.

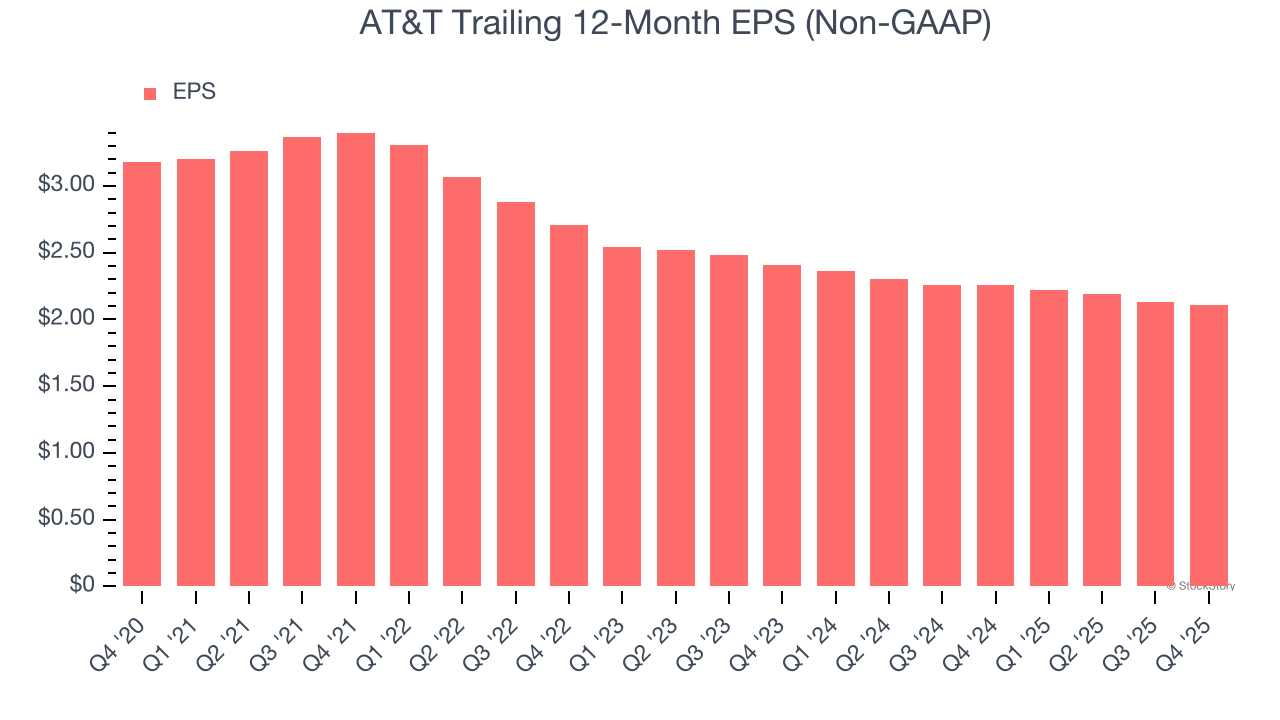

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for AT&T, its EPS declined by 7.9% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

3. Cash Flow Margin Set to Decline

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the next year, analysts predict AT&T’s cash conversion will slightly fall. Their consensus estimates imply its free cash flow margin of 15.5% for the last 12 months will decrease to 14.1%.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of AT&T, we’ll be cheering from the sidelines. With its shares underperforming the market lately, the stock trades at 12.5× forward P/E (or $28.68 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are better investments elsewhere. Let us point you toward one of our top digital advertising picks.

Stocks We Would Buy Instead of AT&T

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.