Over the past six months, Badger Meter’s shares (currently trading at $159.25) have posted a disappointing 14.7% loss, well below the S&P 500’s 6% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Following the drawdown, is this a buying opportunity for BMI? Find out in our full research report, it’s free.

Why Are We Positive On Badger Meter?

The developer of the world’s first frost-proof water meter in 1905, Badger Meter (NYSE: BMI) provides water control and measure equipment to various industries.

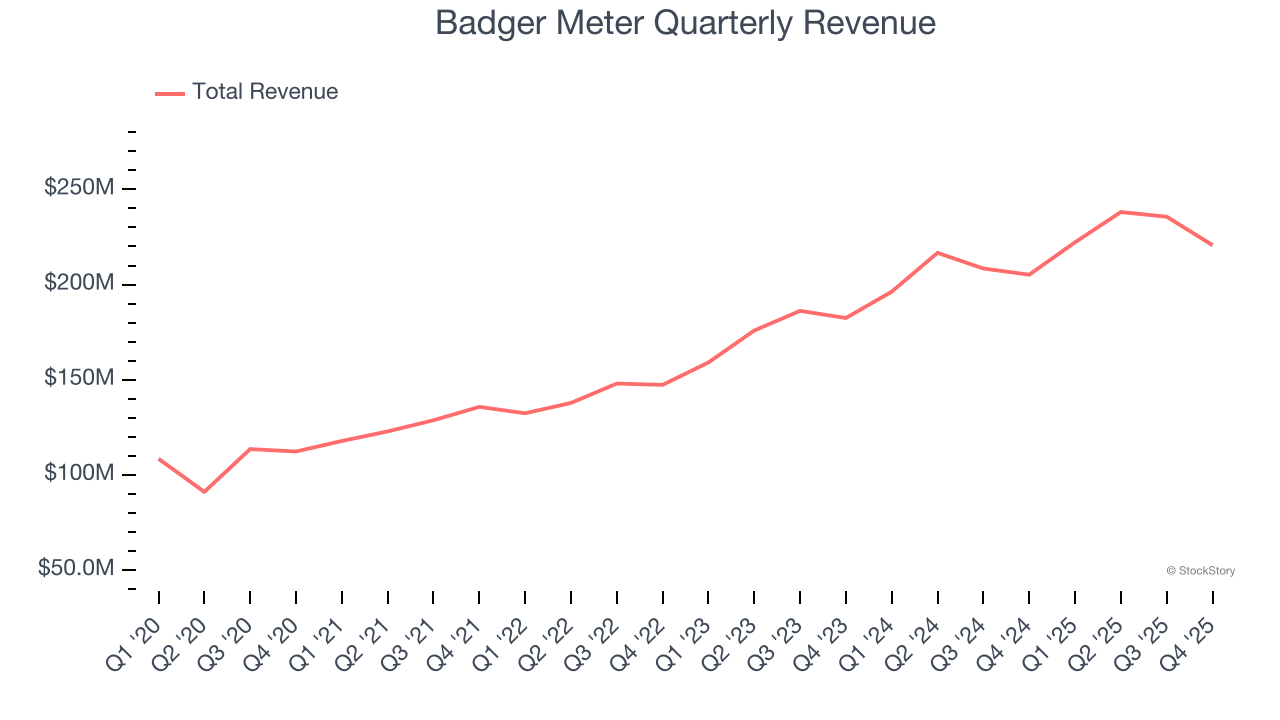

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Badger Meter’s 16.6% annualized revenue growth over the last five years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers.

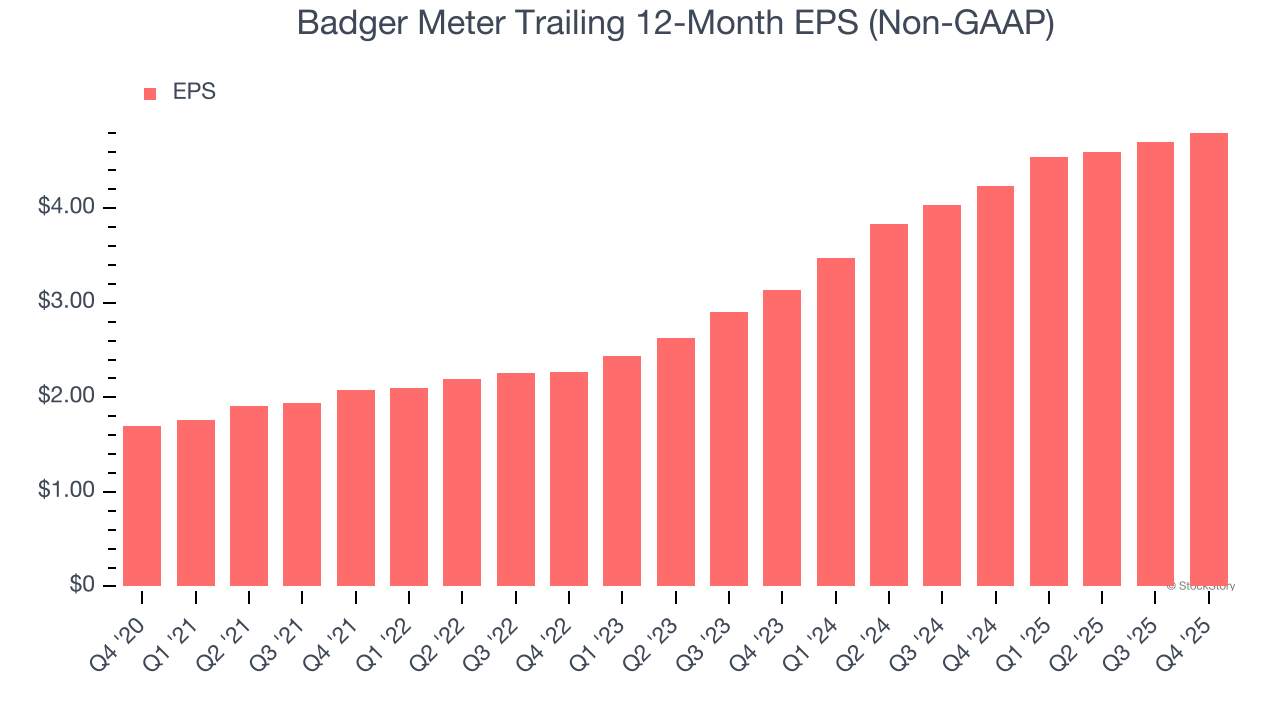

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Badger Meter’s EPS grew at an astounding 23.1% compounded annual growth rate over the last five years, higher than its 16.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

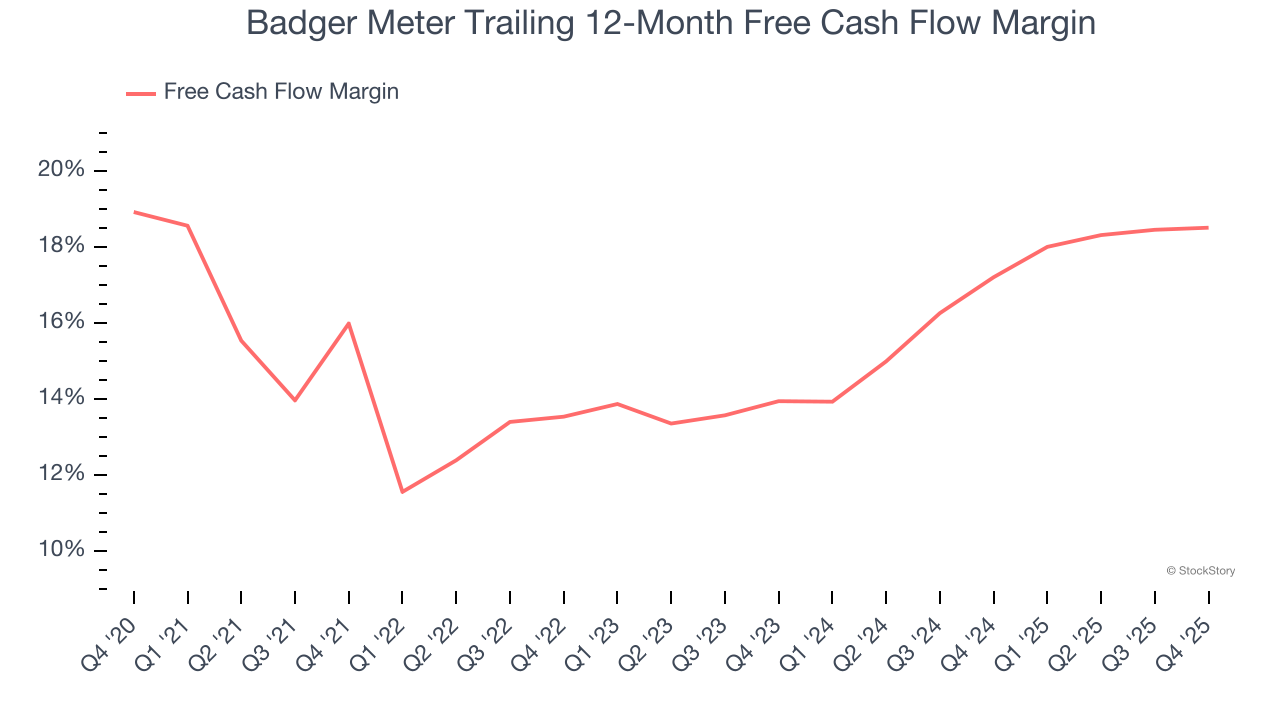

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Badger Meter has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 16.1% over the last five years.

Final Judgment

These are just a few reasons why we're bullish on Badger Meter. After the recent drawdown, the stock trades at 30.3× forward P/E (or $159.25 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.