Fifth Third Bancorp has had an impressive run over the past six months as its shares have beaten the S&P 500 by 18.6%. The stock now trades at $53.30, marking a 24.6% gain. This run-up might have investors contemplating their next move.

Is now the time to buy Fifth Third Bancorp, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think Fifth Third Bancorp Will Underperform?

We’re glad investors have benefited from the price increase, but we're cautious about Fifth Third Bancorp. Here are three reasons we avoid FITB and a stock we'd rather own.

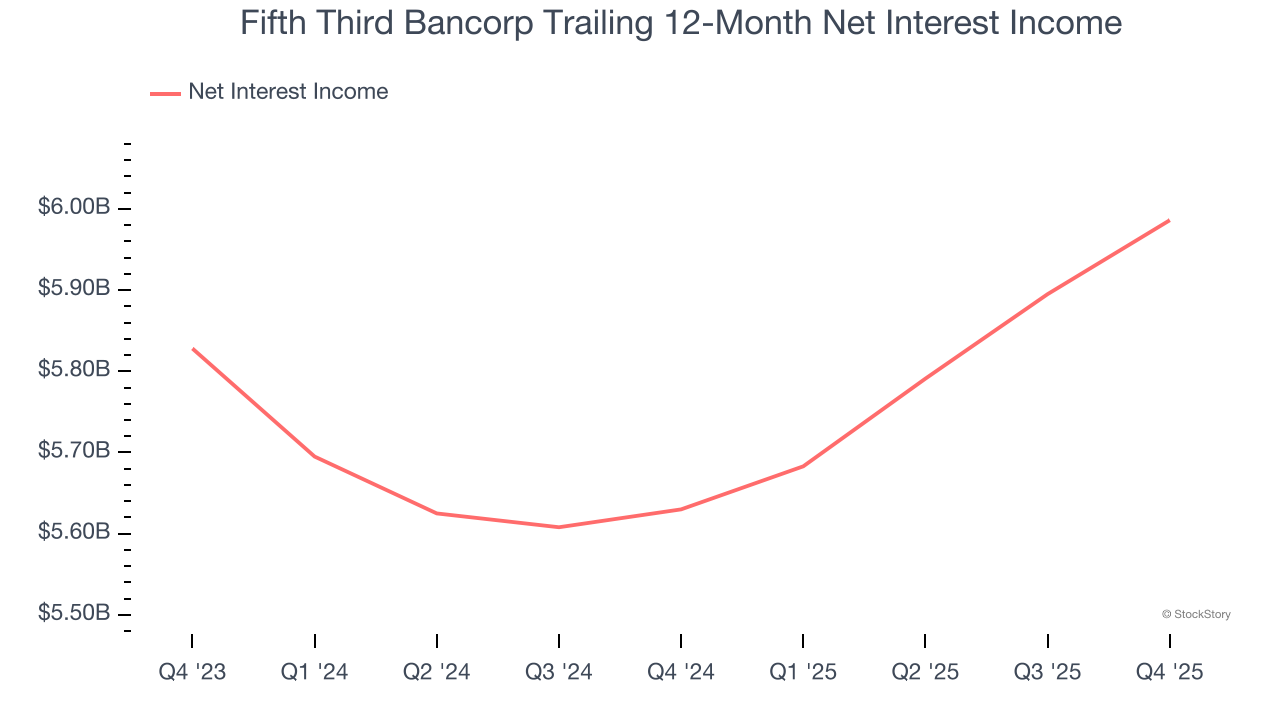

1. Net Interest Income Points to Soft Demand

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

Fifth Third Bancorp’s net interest income has grown at a 4.6% annualized rate over the last five years, much worse than the broader banking industry. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

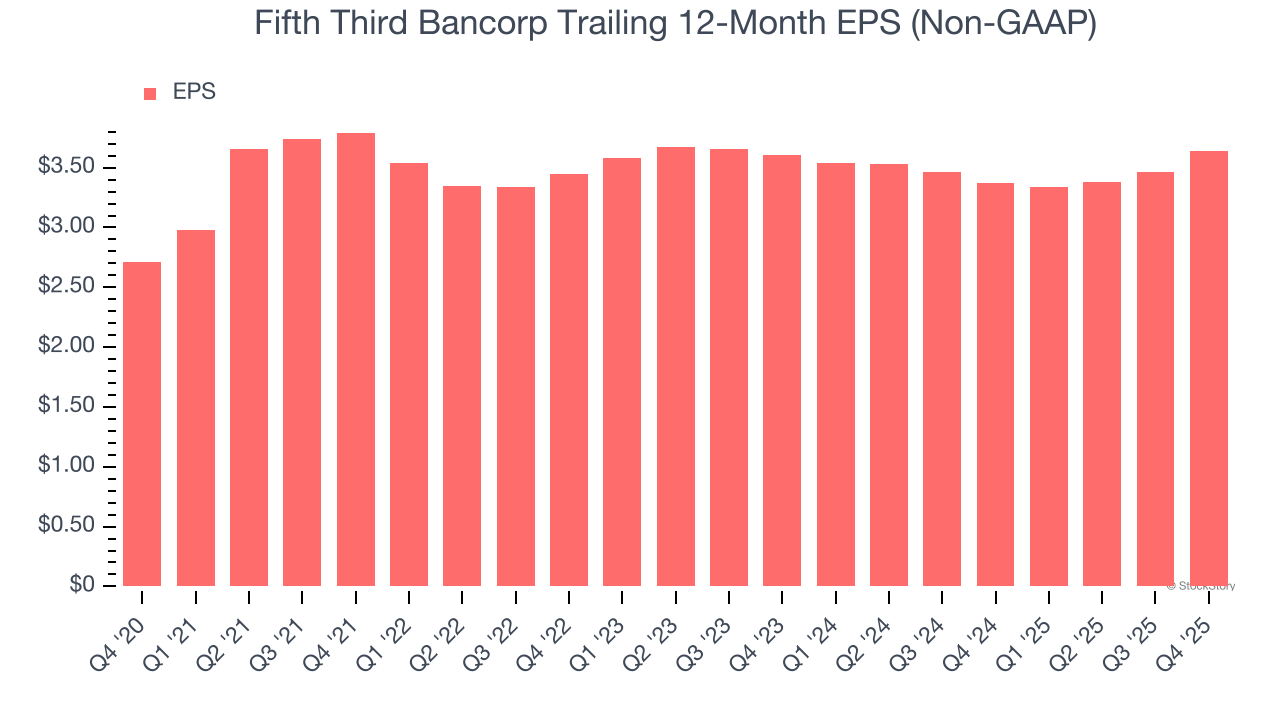

2. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Fifth Third Bancorp’s EPS grew at a weak 6.1% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 3.3% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

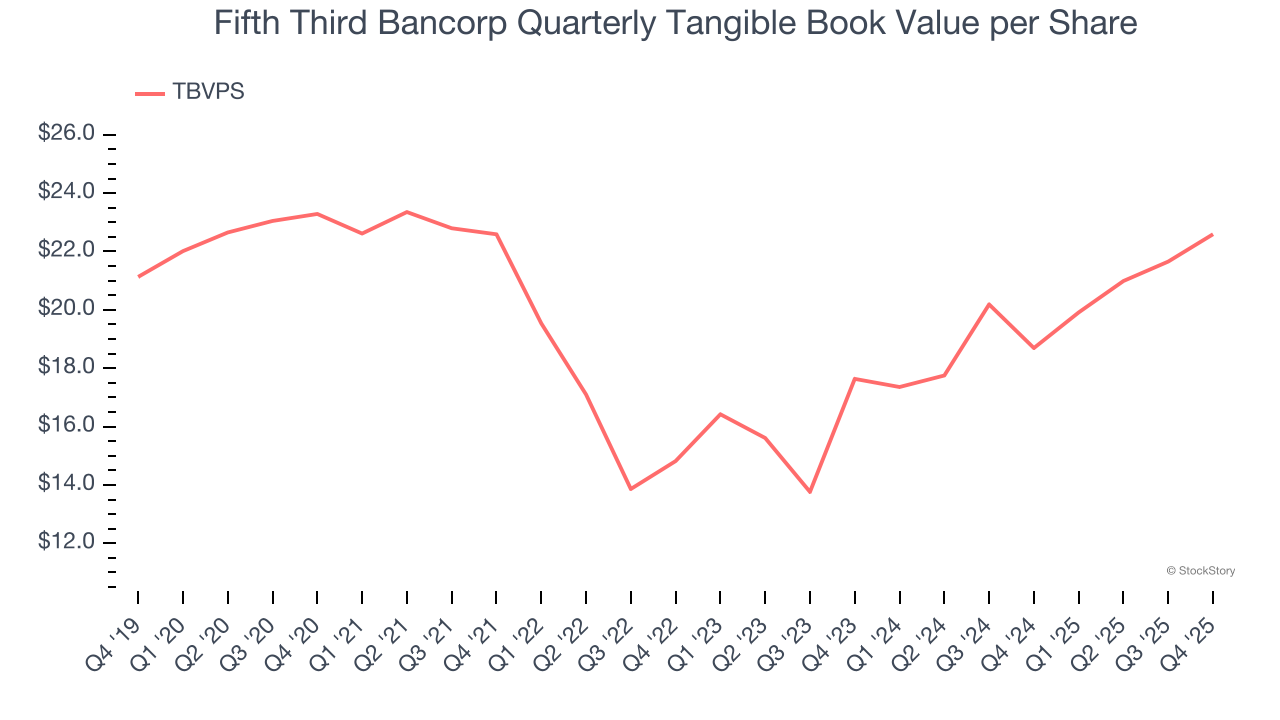

3. Steady Increase in TBVPS Highlights Solid Asset Growth

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

Although Fifth Third Bancorp’s TBVPS was flat over the last five years. the good news is that its growth has recently accelerated as TBVPS grew at a solid 13.2% annual clip over the past two years (from $17.64 to $22.59 per share).

Final Judgment

Fifth Third Bancorp falls short of our quality standards. With its shares topping the market in recent months, the stock trades at 1.5× forward P/B (or $53.30 per share). At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment. We’d suggest looking at the Amazon and PayPal of Latin America.

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.