Online freelance marketplace Fiverr (NYSE: FVRR) fell short of the market’s revenue expectations in Q4 CY2025 as sales rose 3.4% year on year to $107.2 million. Next quarter’s revenue guidance of $104 million underwhelmed, coming in 7.5% below analysts’ estimates. Its non-GAAP profit of $0.86 per share was 16.2% above analysts’ consensus estimates.

Is now the time to buy Fiverr? Find out by accessing our full research report, it’s free.

Fiverr (FVRR) Q4 CY2025 Highlights:

- Revenue: $107.2 million vs analyst estimates of $109 million (3.4% year-on-year growth, 1.7% miss)

- Adjusted EPS: $0.86 vs analyst estimates of $0.74 (16.2% beat)

- Adjusted EBITDA: $26.51 million vs analyst estimates of $26.24 million (24.7% margin, 1.1% beat)

- Revenue Guidance for Q1 CY2026 is $104 million at the midpoint, below analyst estimates of $112.4 million

- EBITDA guidance for the upcoming financial year 2026 is $70 million at the midpoint, below analyst estimates of $111.6 million

- Operating Margin: 5.5%, up from -5.7% in the same quarter last year

- Free Cash Flow Margin: 20.3%, down from 27% in the previous quarter

- Active Buyers: 3.1 million, down 500,000 year on year

- Market Capitalization: $483.8 million

“As we close 2025, a year of disciplined execution for us, it is clear that we are living through a significant shift in AI adoption. We are seeing a profound migration on our marketplace where humans are becoming more essential, not less. By moving toward an agentic economy, where AI helps navigate complexity, we are ensuring that we remain the bridge between businesses and the most exceptional human talent. With our expansive global talent network, outcome based hiring model, and depth of proprietary data, Fiverr has a unique right to win in this new age of AI,” said Micha Kaufman, founder and CEO of Fiverr.

Company Overview

Based in Tel Aviv, Fiverr (NYSE: FVRR) operates a fixed price global freelance marketplace for digital services.

Revenue Growth

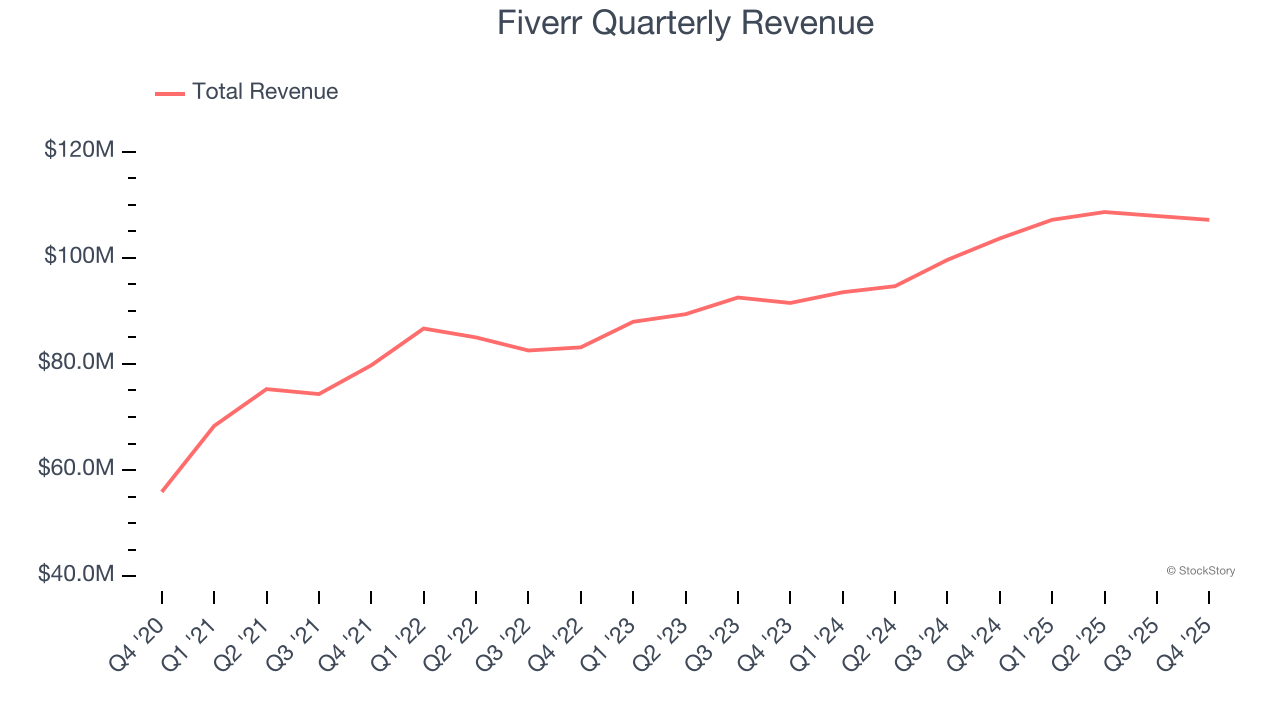

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Fiverr’s 8.5% annualized revenue growth over the last three years was mediocre. This was below our standard for the consumer internet sector and is a poor baseline for our analysis.

This quarter, Fiverr’s revenue grew by 3.4% year on year to $107.2 million, falling short of Wall Street’s estimates. Company management is currently guiding for a 3% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.4% over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and implies its products and services will see some demand headwinds.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Active Buyers

Buyer Growth

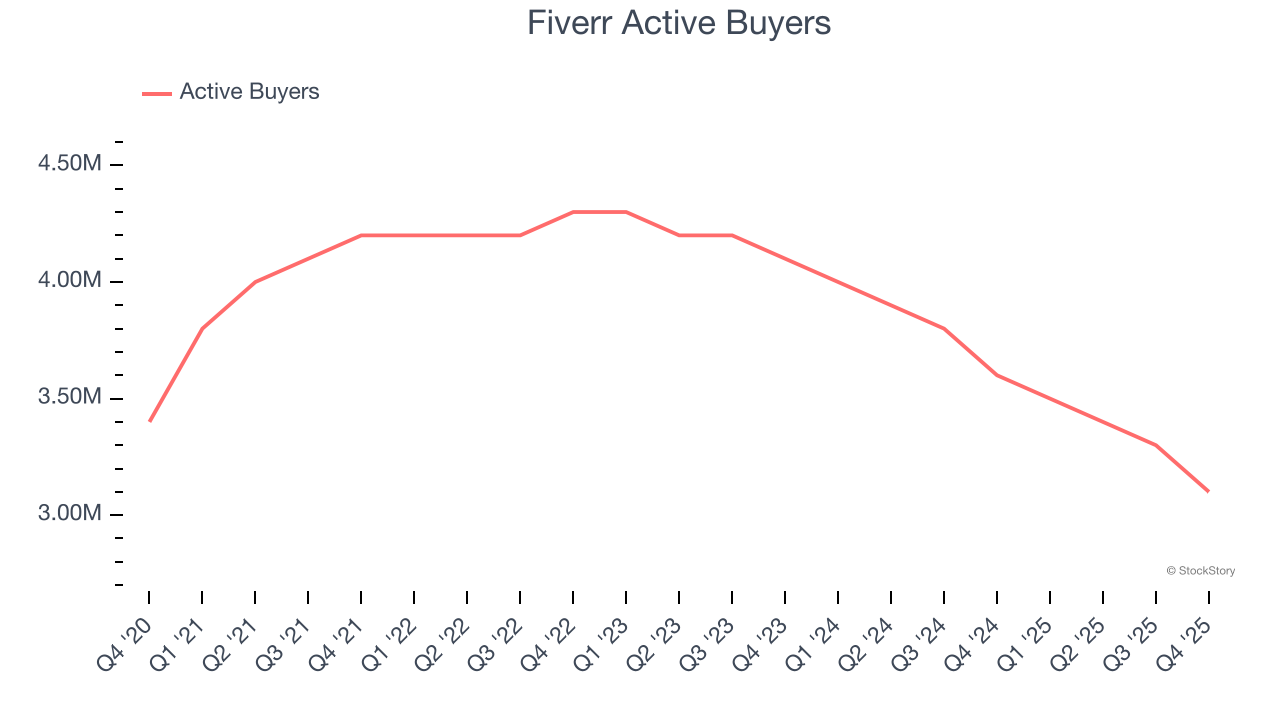

As a gig economy marketplace, Fiverr generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

Fiverr struggled with new customer acquisition over the last two years as its active buyers have declined by 11% annually to 3.1 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Fiverr wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

In Q4, Fiverr’s active buyers once again decreased by 500,000, a 13.9% drop since last year. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t moving the needle for buyers yet.

Revenue Per Buyer

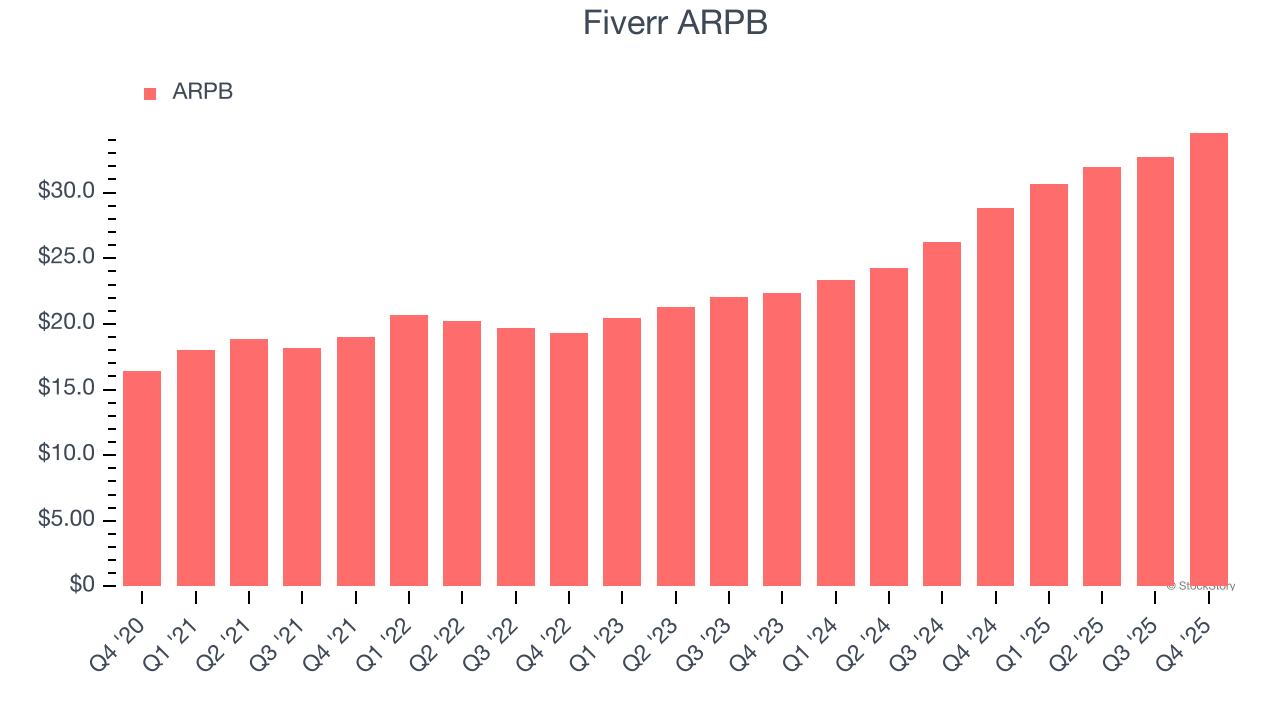

Average revenue per buyer (ARPB) is a critical metric to track because it measures how much the company earns in transaction fees from each buyer. This number also informs us about Fiverr’s take rate, which represents its pricing leverage over the ecosystem, or "cut" from each transaction.

Fiverr’s ARPB growth has been exceptional over the last two years, averaging 23%. Although its active buyers shrank during this time, the company’s ability to successfully increase monetization demonstrates its platform’s value for existing buyers.

This quarter, Fiverr’s ARPB clocked in at $34.57. It grew by 20.1% year on year, faster than its active buyers.

Key Takeaways from Fiverr’s Q4 Results

It was good to see Fiverr narrowly top analysts’ EBITDA expectations this quarter. On the other hand, its full-year revenue guidance missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a bad quarter, and the guidance miss is weighing heavily on the stock. The stock traded down 13% to $11.42 immediately after reporting.

Fiverr’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).