Fresh produce company Fresh Del Monte (NYSE: FDP) reported Q4 CY2025 results beating Wall Street’s revenue expectations, but sales were flat year on year at $1.02 billion. Its non-GAAP profit of $0.70 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Fresh Del Monte Produce? Find out by accessing our full research report, it’s free.

Fresh Del Monte Produce (FDP) Q4 CY2025 Highlights:

- Revenue: $1.02 billion vs analyst estimates of $1.01 billion (flat year on year, 0.7% beat)

- Adjusted EPS: $0.70 vs analyst estimates of $0.28 (significant beat)

- Adjusted EBITDA: $67.1 million vs analyst estimates of $40.4 million (6.6% margin, 66.1% beat)

- Operating Margin: 4.5%, up from 2% in the same quarter last year

- Free Cash Flow was -$17.2 million compared to -$22.3 million in the same quarter last year

- Market Capitalization: $1.93 billion

"Fiscal 2025 reflected solid execution across the business, supported by pricing discipline, continued demand for our core categories, and a strong focus on cash flow," said Mohammad Abu-Ghazaleh, Fresh Del Monte’s Chairman and Chief Executive Officer.

Company Overview

Translating to "of the mountain" in Spanish, Fresh Del Monte (NYSE: FDP) is a leader in providing high-quality, sustainably grown fresh fruits and vegetables.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $4.32 billion in revenue over the past 12 months, Fresh Del Monte Produce carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

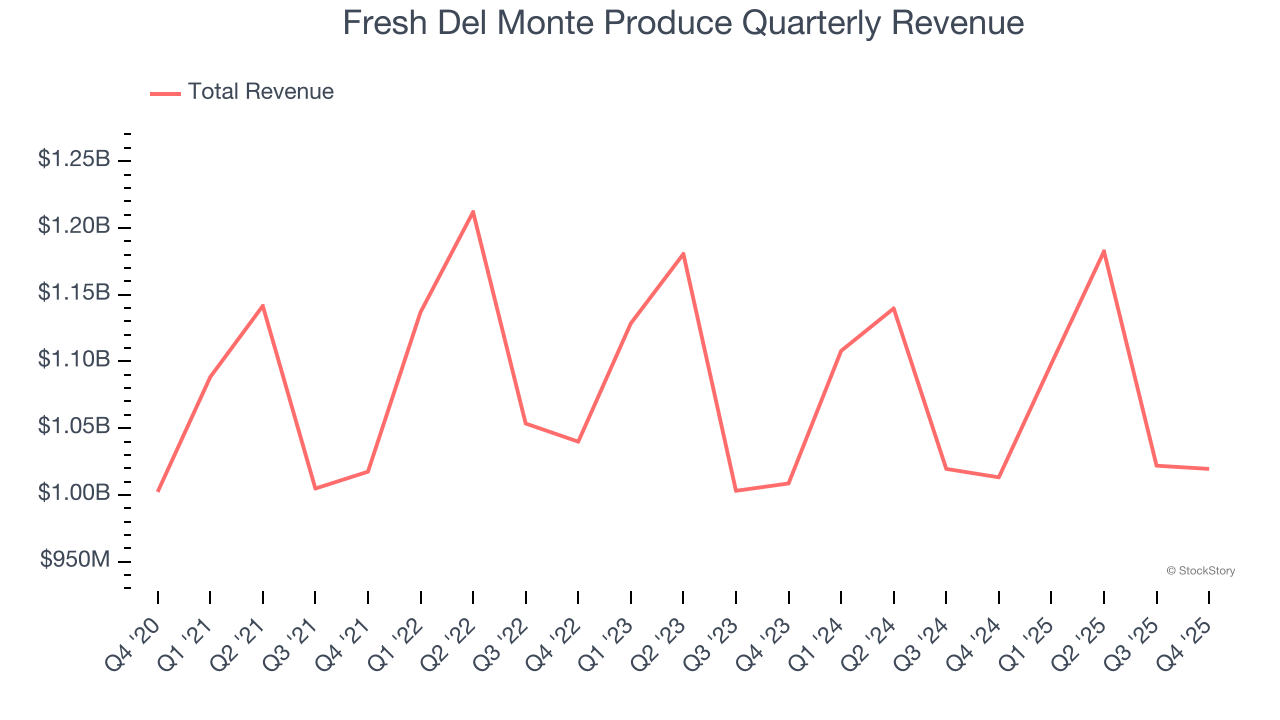

As you can see below, Fresh Del Monte Produce struggled to increase demand as its $4.32 billion of sales for the trailing 12 months was close to its revenue three years ago. This shows demand was soft, a rough starting point for our analysis.

This quarter, Fresh Del Monte Produce’s $1.02 billion of revenue was flat year on year but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to decline by 3.5% over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and implies its products will face some demand challenges.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

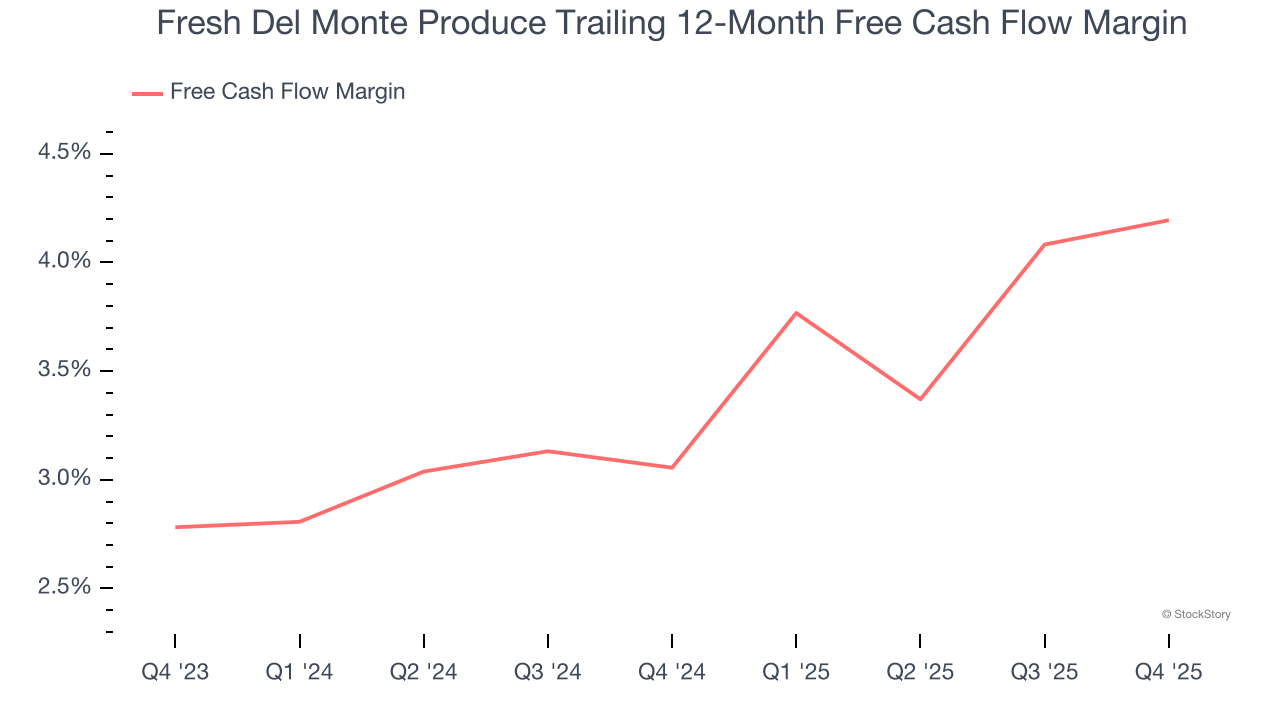

Fresh Del Monte Produce has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.6%, subpar for a consumer staples business.

Taking a step back, an encouraging sign is that Fresh Del Monte Produce’s margin expanded by 1.1 percentage points over the last year. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Fresh Del Monte Produce burned through $17.2 million of cash in Q4, equivalent to a negative 1.7% margin. The company’s cash burn was similar to its $22.3 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

Key Takeaways from Fresh Del Monte Produce’s Q4 Results

It was good to see Fresh Del Monte Produce beat analysts’ EPS expectations this quarter. We were also excited its gross margin outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 5.8% to $42.66 immediately following the results.

Fresh Del Monte Produce may have had a good quarter, but does that mean you should invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).