Credit rating agency Moody's (NYSE: MCO) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 13% year on year to $1.89 billion. Its non-GAAP profit of $3.64 per share was 6.1% above analysts’ consensus estimates.

Is now the time to buy Moody's? Find out by accessing our full research report, it’s free.

Moody's (MCO) Q4 CY2025 Highlights:

- Revenue: $1.89 billion vs analyst estimates of $1.86 billion (13% year-on-year growth, 1.6% beat)

- Pre-tax Profit: $687 million (36.4% margin)

- Adjusted EPS: $3.64 vs analyst estimates of $3.44 (6.1% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $16.70 at the midpoint, beating analyst estimates by 1.5%

- Market Capitalization: $75.5 billion

Company Overview

Founded in 1900 during America's railroad boom when investors needed reliable information on bond risks, Moody's (NYSE: MCO) provides credit ratings, risk assessment tools, and analytical solutions that help organizations evaluate financial risks and make informed investment decisions.

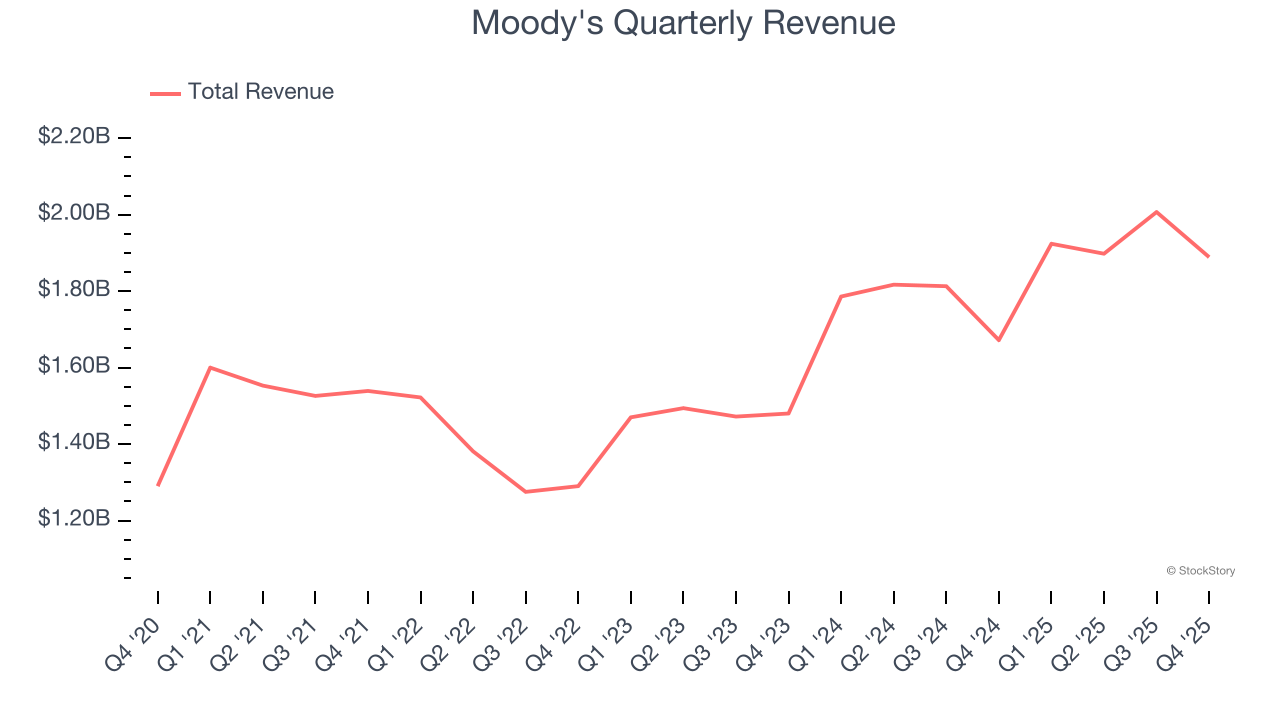

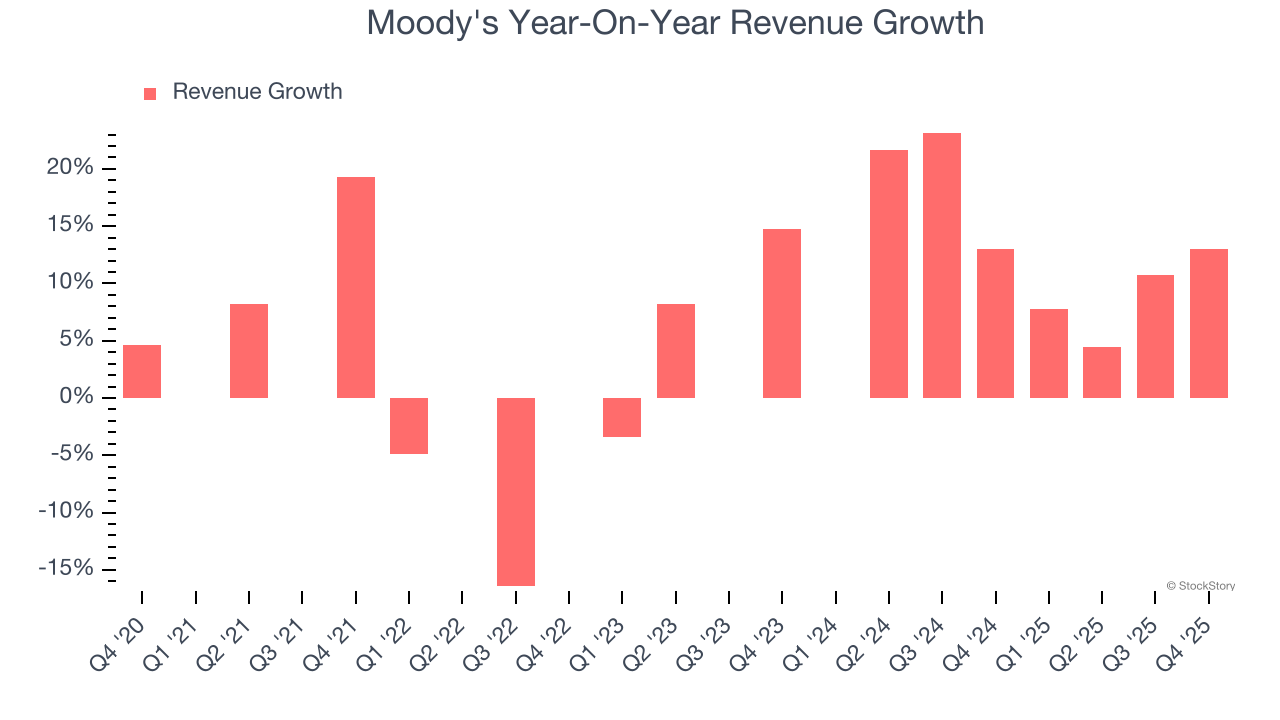

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Moody’s revenue grew at a decent 7.5% compounded annual growth rate over the last five years. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Moody’s annualized revenue growth of 14.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Moody's reported year-on-year revenue growth of 13%, and its $1.89 billion of revenue exceeded Wall Street’s estimates by 1.6%.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Key Takeaways from Moody’s Q4 Results

It was good to see Moody's beat analysts’ EPS expectations this quarter. We were also glad its full-year EPS guidance slightly exceeded Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 3% to $436 immediately following the results.

Moody's put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).