Looking back on regional banks stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including Commerce Bancshares (NASDAQ: CBSH) and its peers.

Regional banks, financial institutions operating within specific geographic areas, serve as intermediaries between local depositors and borrowers. They benefit from rising interest rates that improve net interest margins (the difference between loan yields and deposit costs), digital transformation reducing operational expenses, and local economic growth driving loan demand. However, these banks face headwinds from fintech competition, deposit outflows to higher-yielding alternatives, credit deterioration (increasing loan defaults) during economic slowdowns, and regulatory compliance costs. Recent concerns about regional bank stability following high-profile failures and significant commercial real estate exposure present additional challenges.

The 95 regional banks stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.5%.

In light of this news, share prices of the companies have held steady as they are up 4.5% on average since the latest earnings results.

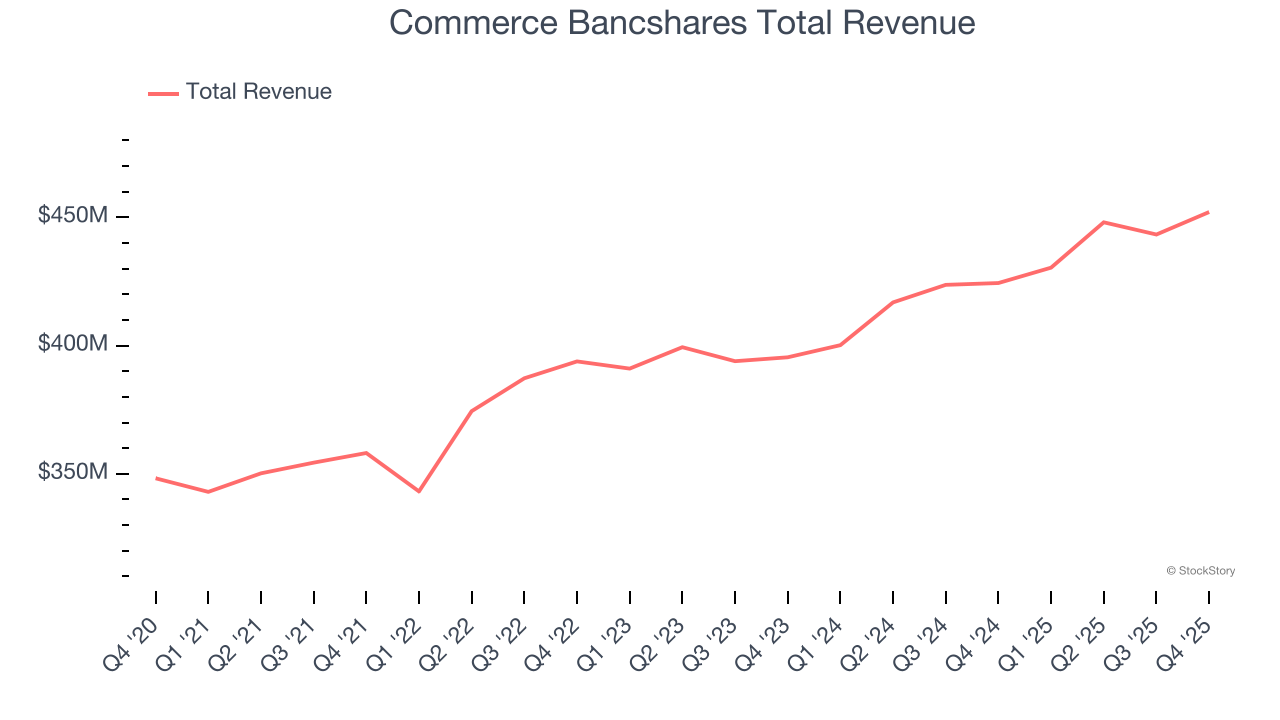

Commerce Bancshares (NASDAQ: CBSH)

Founded in 1865 during the post-Civil War economic boom, Commerce Bancshares (NASDAQGS:CBSH) is a Midwest-focused bank holding company that provides retail, commercial, and wealth management services to individuals and businesses.

Commerce Bancshares reported revenues of $452 million, up 6.5% year on year. This print exceeded analysts’ expectations by 2.2%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ revenue estimates but a narrow beat of analysts’ EPS estimates.

“Commerce delivered record revenues in the fourth quarter, driven by strong performance across both net interest income and non-interest income. Our overall results for the quarter and the full year are a reflection of the strength and diversity of our businesses and the dedication of our team members in serving our customers, communities and shareholders,” said John Kemper, President and Chief Executive Officer.

Unsurprisingly, the stock is down 3.8% since reporting and currently trades at $53.01.

Is now the time to buy Commerce Bancshares? Access our full analysis of the earnings results here, it’s free.

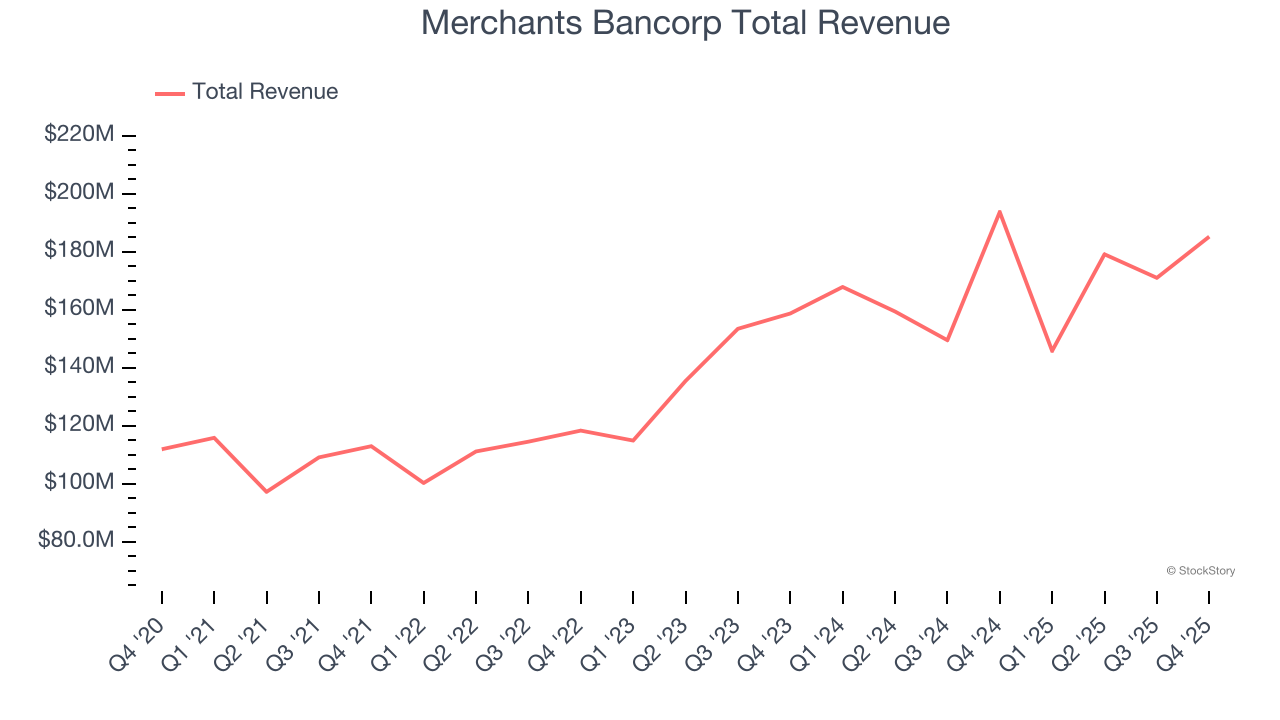

Best Q4: Merchants Bancorp (NASDAQ: MBIN)

With a strategic focus on low-risk, government-backed lending programs, Merchants Bancorp (NASDAQCM:MBIN) is an Indiana-based bank holding company specializing in multi-family mortgage banking, mortgage warehousing, and traditional banking services.

Merchants Bancorp reported revenues of $185.3 million, down 4.4% year on year, outperforming analysts’ expectations by 7.8%. The business had a stunning quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ net interest income estimates.

The market seems happy with the results as the stock is up 35.2% since reporting. It currently trades at $47.24.

Is now the time to buy Merchants Bancorp? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: The Bancorp (NASDAQ: TBBK)

Operating behind the scenes of many popular fintech apps and prepaid cards you might use daily, The Bancorp (NASDAQ: TBBK) is a bank holding company that specializes in providing banking services to fintech companies and offering specialty lending products.

The Bancorp reported revenues of $172.7 million, up 8.2% year on year, falling short of analysts’ expectations by 11%. It was a disappointing quarter as it posted a significant miss of analysts’ tangible book value per share estimates and a significant miss of analysts’ revenue estimates.

As expected, the stock is down 15.5% since the results and currently trades at $59.60.

Read our full analysis of The Bancorp’s results here.

Zions Bancorporation (NASDAQ: ZION)

Founded in 1873 during Utah's pioneer era and named after Mount Zion in the Bible, Zions Bancorporation (NASDAQ: ZION) operates seven regional banks across the Western United States, providing commercial, retail, and wealth management services to over a million customers.

Zions Bancorporation reported revenues of $879 million, up 7.1% year on year. This print surpassed analysts’ expectations by 1%. More broadly, it was a mixed quarter as it also produced a narrow beat of analysts’ tangible book value per share estimates but net interest income in line with analysts’ estimates.

The stock is up 4.1% since reporting and currently trades at $61.53.

Read our full, actionable report on Zions Bancorporation here, it’s free.

BOK Financial (NASDAQ: BOKF)

Tracing its roots back to 1910 when Oklahoma was still a young state, BOK Financial (NASDAQ: BOKF) is a regional bank holding company that provides commercial banking, consumer banking, and wealth management services across eight states in the central and southwestern US.

BOK Financial reported revenues of $592.1 million, up 12.7% year on year. This number beat analysts’ expectations by 7.6%. It was a very strong quarter as it also put up a solid beat of analysts’ revenue estimates and a beat of analysts’ EPS estimates.

The stock is up 4.2% since reporting and currently trades at $133.61.

Read our full, actionable report on BOK Financial here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.