Travel technology company Sabre (NASDAQ: SABR) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 3.4% year on year to $666.5 million. Its non-GAAP loss of $0.01 per share was 80% above analysts’ consensus estimates.

Is now the time to buy Sabre? Find out by accessing our full research report, it’s free.

Sabre (SABR) Q4 CY2025 Highlights:

- Revenue: $666.5 million vs analyst estimates of $651.8 million (3.4% year-on-year growth, 2.3% beat)

- Adjusted EPS: -$0.01 vs analyst estimates of -$0.05 (80% beat)

- Adjusted EBITDA: $110.5 million vs analyst estimates of $113.2 million (16.6% margin, 2.4% miss)

- EBITDA guidance for the upcoming financial year 2026 is $585 million at the midpoint, in line with analyst expectations

- Operating Margin: 3.2%, down from 8.9% in the same quarter last year

- Free Cash Flow Margin: 17.4%, up from 10.3% in the same quarter last year

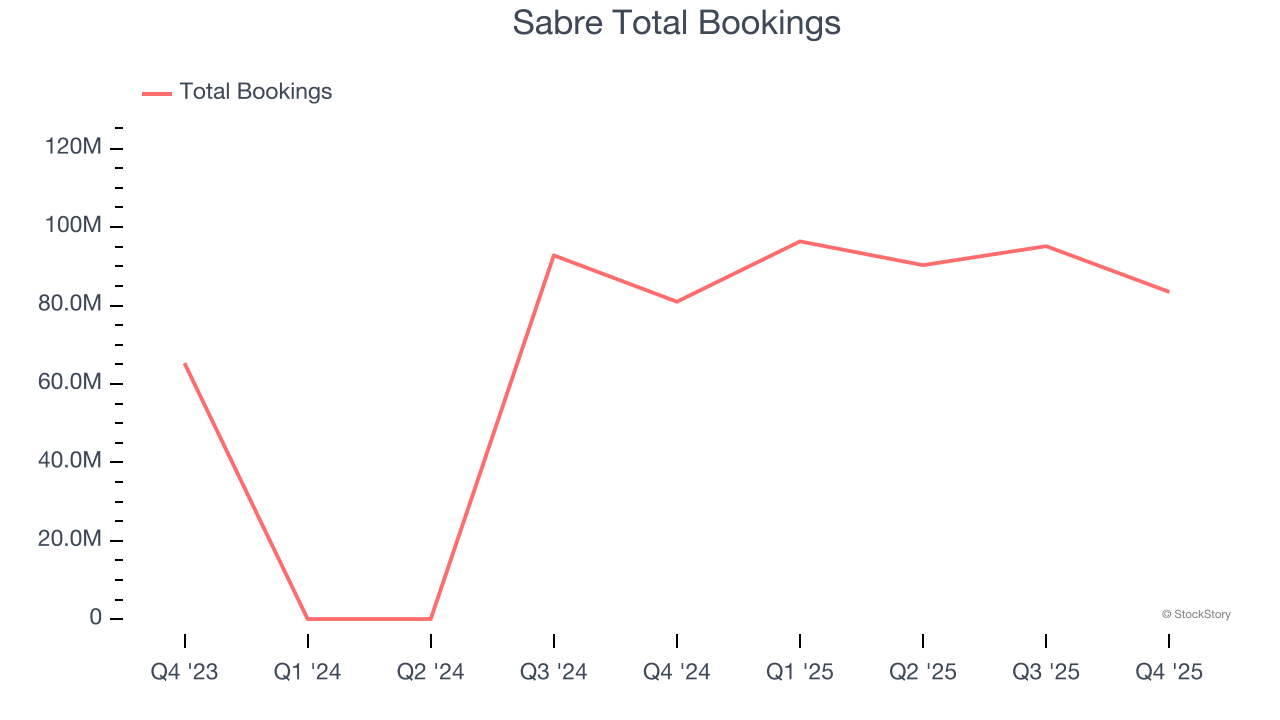

- Total Bookings: 83.47 million, up 2.49 million year on year

- Market Capitalization: $370.6 million

Company Overview

Originally a division of American Airlines, Sabre (NASDAQ: SABR) is a technology provider for the global travel and tourism industry.

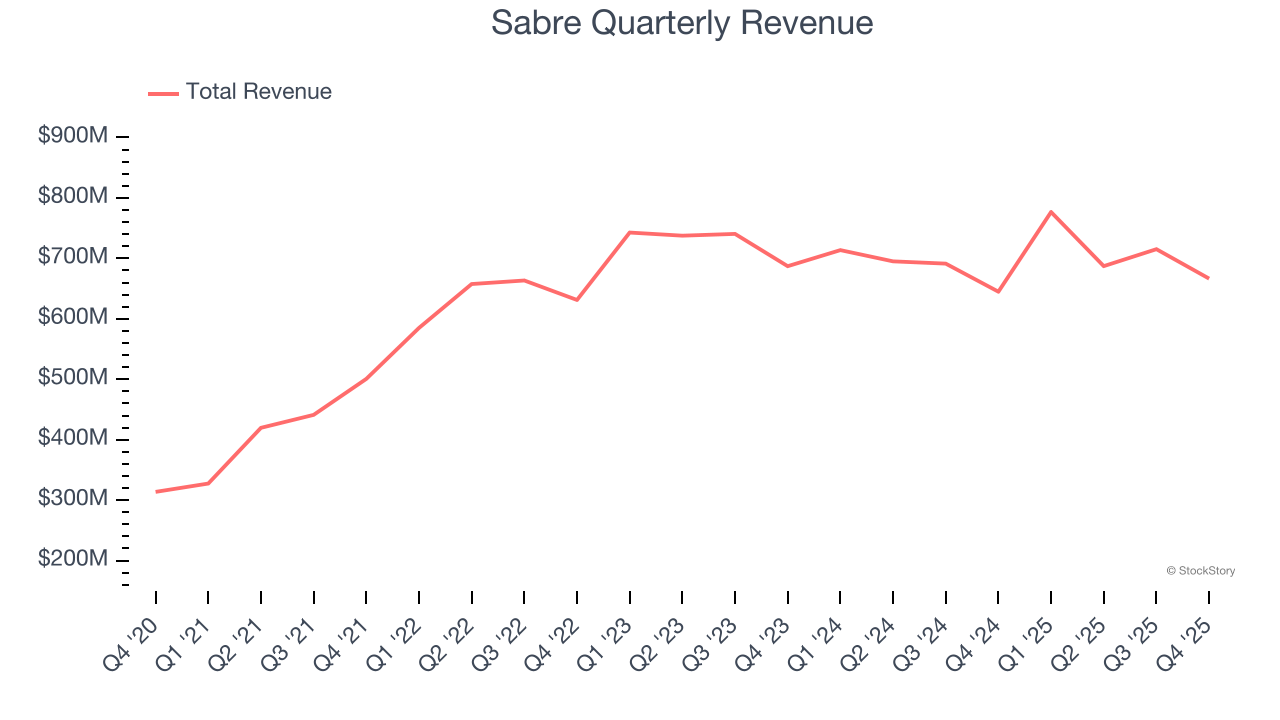

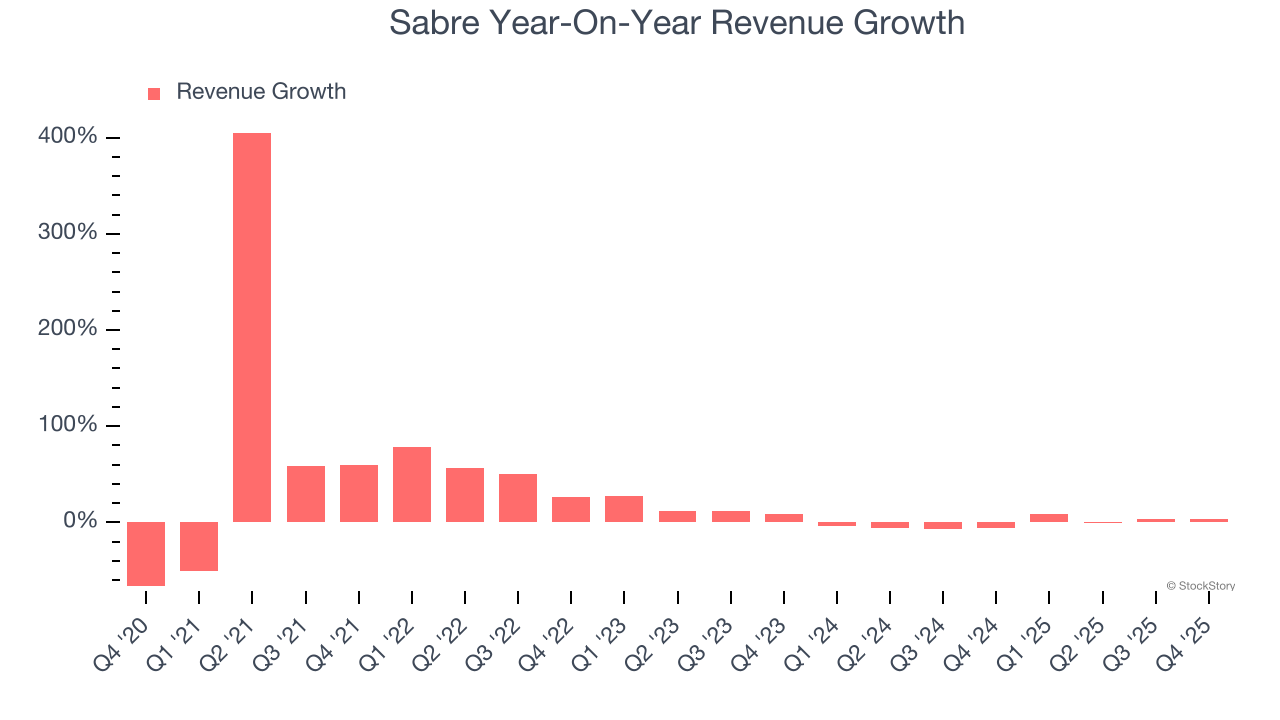

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Sabre grew its sales at a 16.4% compounded annual growth rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Sabre’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.1% annually.

Sabre also discloses its number of total bookings, which reached 83.47 million in the latest quarter. Over the last two years, Sabre’s total bookings grew massively as COVID impacted its base year numbers.

This quarter, Sabre reported modest year-on-year revenue growth of 3.4% but beat Wall Street’s estimates by 2.3%.

Looking ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

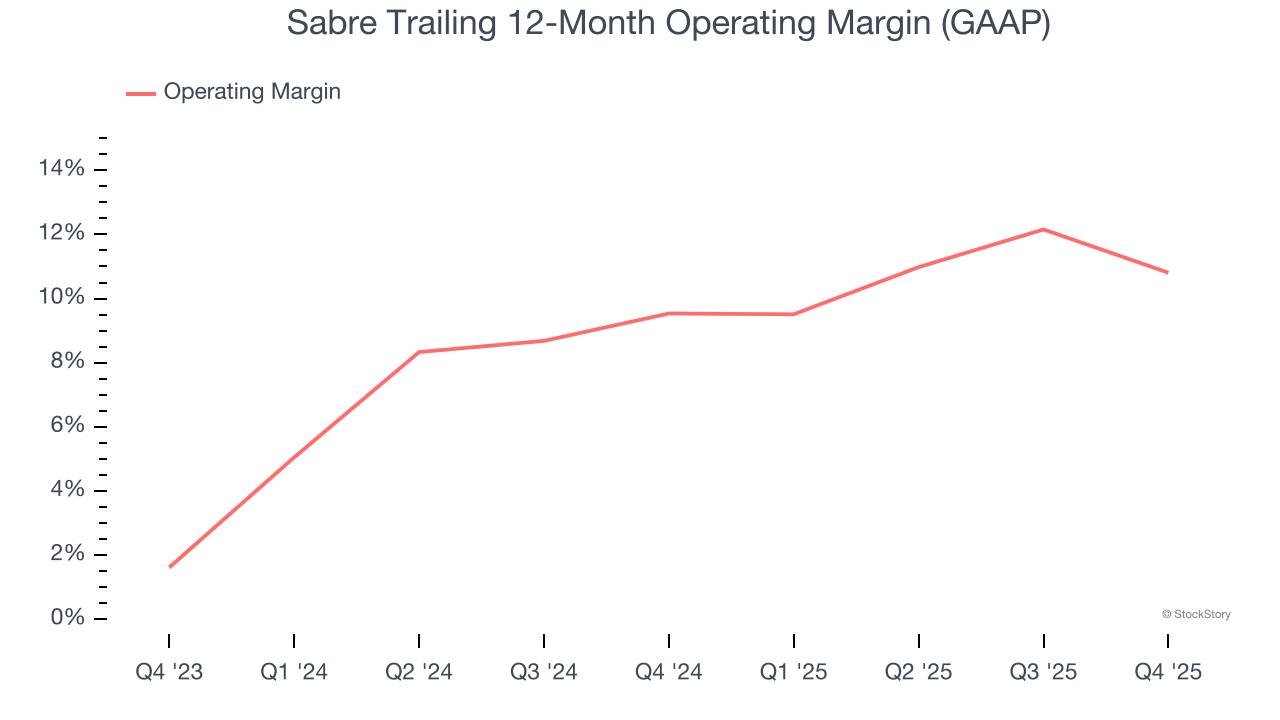

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Sabre’s operating margin has risen over the last 12 months and averaged 10.2% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

This quarter, Sabre generated an operating margin profit margin of 3.2%, down 5.7 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

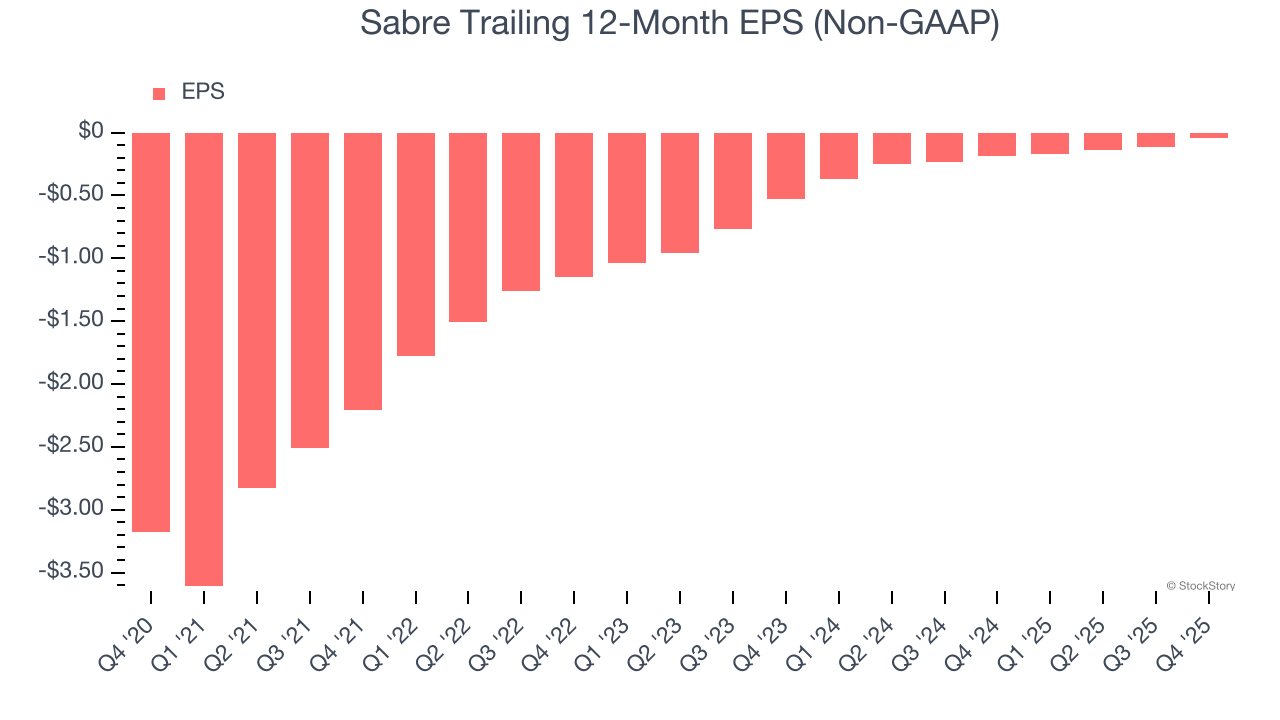

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Sabre’s full-year earnings are still negative, it reduced its losses and improved its EPS by 58% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q4, Sabre reported adjusted EPS of negative $0.01, up from negative $0.08 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast Sabre’s full-year EPS of negative $0.04 will flip to positive $0.13.

Key Takeaways from Sabre’s Q4 Results

It was good to see Sabre beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter missed. Zooming out, we think this was a mixed quarter. The stock traded up 12.8% to $1.08 immediately after reporting.

Is Sabre an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).