Let’s dig into the relative performance of Ridgepost Capital (NYSE: RPC) and its peers as we unravel the now-completed Q4 custody bank earnings season.

Custody banks safeguard financial assets and provide services like settlement, accounting, and regulatory compliance for institutional investors. Growth opportunities stem from increasing global assets under custody, demand for data analytics, and blockchain technology adoption for settlement efficiency. Challenges include fee pressure from large clients, substantial technology investment requirements, and competition from both traditional players and fintech firms entering the space.

The 16 custody bank stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 2.4%.

While some custody bank stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.2% since the latest earnings results.

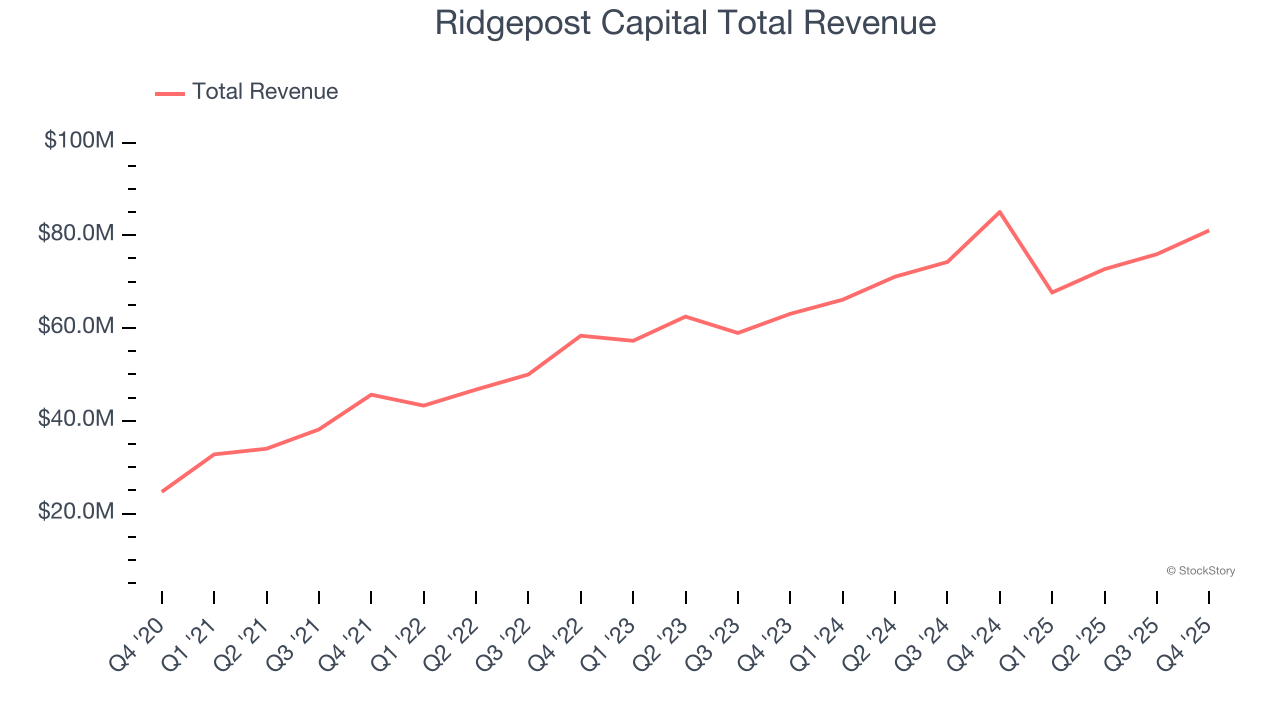

Ridgepost Capital (NYSE: RPC)

Operating as a bridge between institutional investors and hard-to-access private market opportunities, Ridgepost Capital (NYSE: RPC) is an alternative asset management firm that provides access to private equity, venture capital, impact investing, and private credit opportunities in the middle and lower middle markets.

Ridgepost Capital reported revenues of $81.05 million, down 4.7% year on year. This print exceeded analysts’ expectations by 0.5%. Overall, it was a strong quarter for the company with a beat of analysts’ EPS estimates and a narrow beat of analysts’ revenue estimates.

Ridgepost Capital delivered the slowest revenue growth of the whole group. Unsurprisingly, the stock is down 19.2% since reporting and currently trades at $8.55.

Is now the time to buy Ridgepost Capital? Access our full analysis of the earnings results here, it’s free.

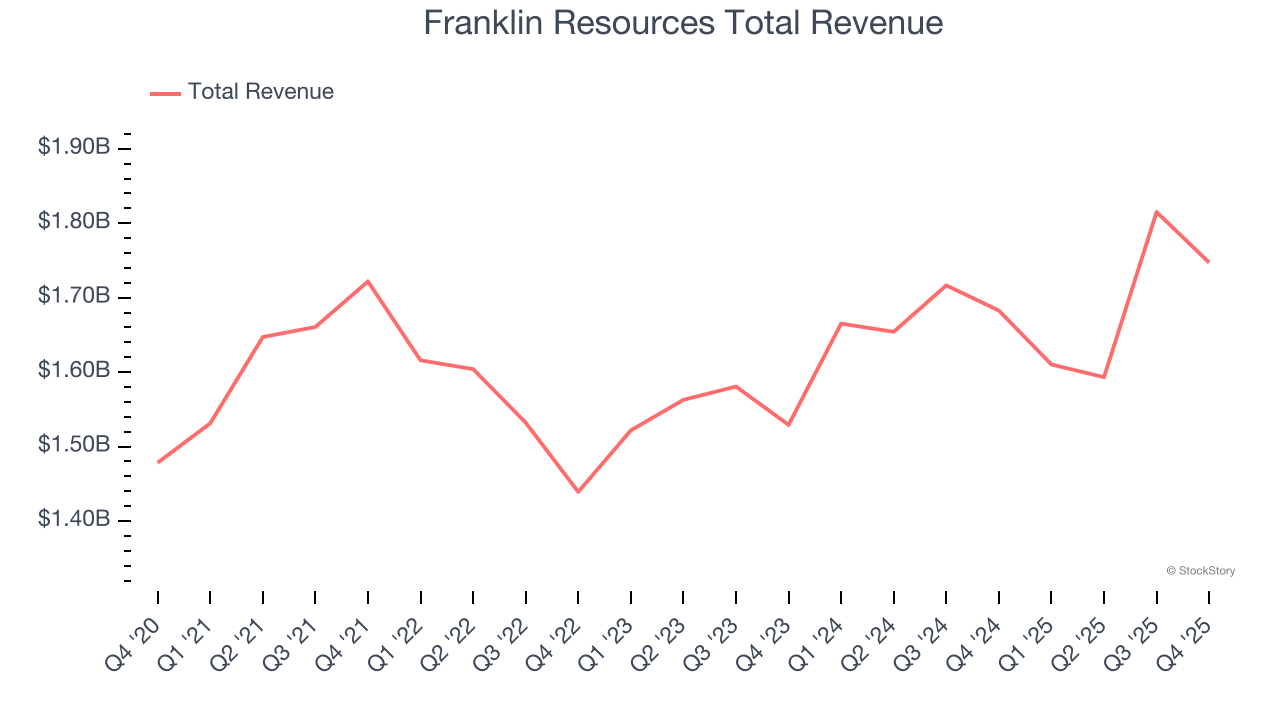

Best Q4: Franklin Resources (NYSE: BEN)

Operating under the widely recognized Franklin Templeton brand since 1947, Franklin Resources (NYSE: BEN) is a global investment management organization that offers financial services and solutions to individuals, institutions, and wealth advisors worldwide.

Franklin Resources reported revenues of $1.75 billion, up 3.8% year on year, outperforming analysts’ expectations by 1.9%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and a decent beat of analysts’ revenue estimates.

The market seems happy with the results as the stock is up 5.9% since reporting. It currently trades at $27.40.

Is now the time to buy Franklin Resources? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Voya Financial (NYSE: VOYA)

Originally spun off from Dutch financial giant ING in 2013 and rebranded with a name suggesting "voyage," Voya Financial (NYSE: VOYA) provides workplace benefits and savings solutions to U.S. employers, helping their employees achieve better financial outcomes through retirement plans and insurance products.

Voya Financial reported revenues of $2.01 billion, up 5.7% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ EPS estimates and revenue in line with analysts’ estimates.

As expected, the stock is down 1.5% since the results and currently trades at $74.42.

Read our full analysis of Voya Financial’s results here.

T. Rowe Price (NASDAQ: TROW)

Founded in 1937 by Thomas Rowe Price Jr., who pioneered the growth stock investing approach, T. Rowe Price (NASDAQ: TROW) is an investment management firm that offers mutual funds, advisory services, and retirement planning solutions to individuals and institutions.

T. Rowe Price reported revenues of $1.94 billion, up 5.4% year on year. This result was in line with analysts’ expectations. Aside from that, it was a mixed quarter as it produced a slight miss of analysts’ AUM estimates.

The stock is down 8.7% since reporting and currently trades at $93.76.

Read our full, actionable report on T. Rowe Price here, it’s free.

Federated Hermes (NYSE: FHI)

With roots dating back to 1955 and a pioneering role in money market funds, Federated Hermes (NYSE: FHI) is an investment management firm that offers a wide range of funds and strategies for institutional and individual investors.

Federated Hermes reported revenues of $482.8 million, up 13.7% year on year. This number surpassed analysts’ expectations by 2.2%. Overall, it was a very strong quarter as it also put up a beat of analysts’ EPS estimates and a decent beat of analysts’ revenue estimates.

The stock is up 3.7% since reporting and currently trades at $55.00.

Read our full, actionable report on Federated Hermes here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.