On Bubbles … And Why it Will All be Fine

June 22, 2011 at 09:50 AM EDT

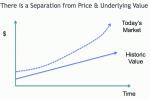

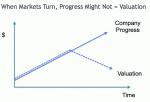

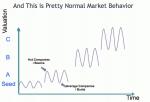

Editor’s Note: This is a guest post by ( @msuster ) Mark Suster, a 2x entrepreneur, now VC at GRP Partners . Read more about Suster at Bothsidesofthetable Bubble. There, I said it. We're definitely in some stage of it - whether early in the cycle or the end of it nobody can say. And it will all be fine. People get too worked up over the word. I'm no great scholar on bubbles - I have more interesting things to spend my time worrying about than the exact definition, but having been around a few I have at least given them intellectual consideration. I know that most people who are close to them tend to deny their existence, as we saw in the great housing bubble of 2002-2007 and the dot com bubble of 1997-2000. I believe a bubble occurs when a market is willing to pay greater than intrinsic value for an asset class. That asset class need not represent the broader market. As any historian of bubbles will tell you - there were periods of bubbles in assets as arcane as tulips, South American trading companies, dot-com bubbles & housing bubbles. They are often bound by geographies and asset classes. But they also often have a rippling effect on broader markets as all of our economies seem to be intertwined these days. The fact that today's Internet bubble does not represent all companies does not disprove its existence. The following post goes through a graphical analysis of the current market conditions and what to expect in the road ahead ...