( click to enlarge )

( click to enlarge )Juniper Networks, Inc. (NYSE:JNPR) broke the uptrend-line in place since April by a good amount of selling and MACD formed a lower low. Technicals are bearish. The near‐term risk for stock is a test down through the psychological level of 20, followed by the 200-day EMA at 19.44. On the other hand, resistance levels are seen at the 9-day EMA line at 20.99 and then at 21.20.

( click to enlarge )

( click to enlarge )Amarin Corporation plc (NASDAQ:AMRN) has been under a buying pressure in the last few days and overall the stock still looks healthy. The technicals look good, as seen in the daily chart above. The RSI indicator sloping up and crossing the 60% level and MACD about to cross above the zero line, which indicates a change in trend from the downswing. AMRN still has a chance to move higher from here. Next buy area is at 6.25.

( click to enlarge )

( click to enlarge )Himax Technologies, Inc. (NASDAQ:HIMX) remains inside of an ascending triangle pattern and may head higher or lower from here. Any break below the 5.90 is considered very bearish. Technical indicators are showing signs of weakness. The MACD is positive but below its signal line and RSI has moved below its 50% level.

( click to enlarge )

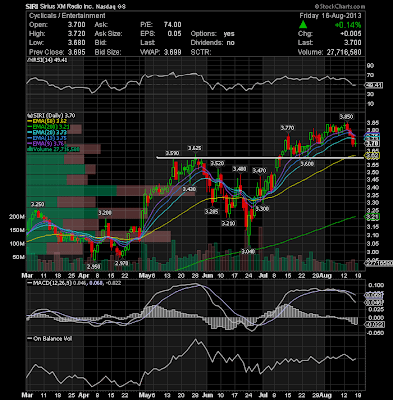

( click to enlarge )Sirius XM Radio Inc (NASDAQ:SIRI) should be watched closely here. The pullback below the short-term support level at 3.73 "EMA20" accompanied by a bearish MACD crossover, suggests that the selling pressure is increasing and the stock might test 3.6/3.62 levels in the short term.

( click to enlarge )

( click to enlarge )Albany Molecular Research, Inc. (NASDAQ:AMRI) Not a pretty picture. In downtrend mode. AD is decreasing, which means the stock price will probably go down ( stock is being distributed ).

( click to enlarge )

( click to enlarge )Chesapeake Energy Corporation (NYSE:CHK) attempted a move higher on Friday but was sent back into the bullish pennant. The stock still has a chance to move higher from here. Keep an eye on it for a possible breakout.

Monday kicks off Marketfy's Free Educational Series with the best and brightest in trading ! RESERVE YOUR SPOT

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC