( click to enlarge )

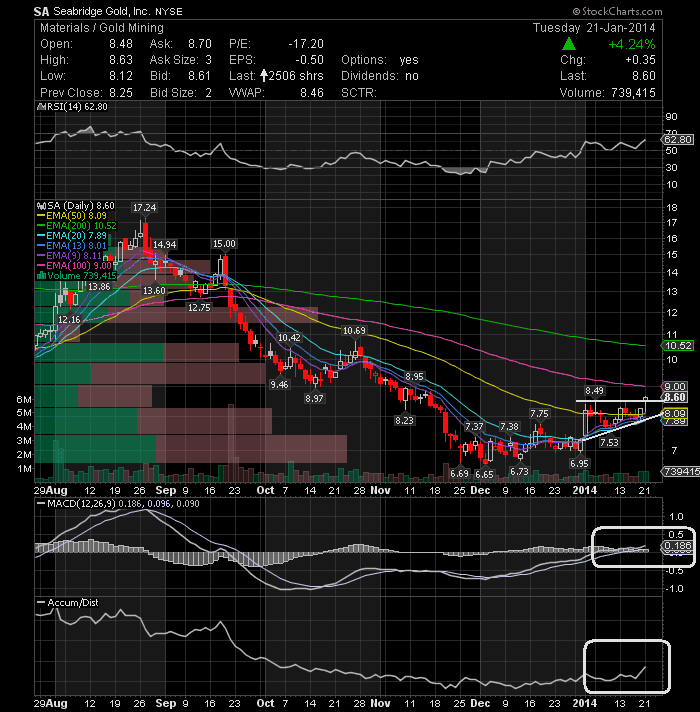

( click to enlarge )Seabridge Gold, Inc. (NYSE:SA) The stock price brokeout from an ascending triangle with solid volume. Target price is at 9.60. Watch out for the resistance at $9 (100EMA) if this level is breached with high volume, then the stock price would be heading towards its target at 9.60. From a technical standpoint, the MACD is rising in positive territory indicating that the uptrend is intact and the AC/DT line is now signalling an upwards trend. The Parabolic SAR indicator continues with its buy signal. Long Setup.

( click to enlarge )

( click to enlarge )Allied Nevada Gold Corp. (NYSEMKT:ANV) Watch Wednesday's action for a possible breakout over $5.10

( click to enlarge )

( click to enlarge )Altisource Residential Corp (NYSE:RESI) is still coiling just under $35 and appears about ready to make a new breakout soon. Hold the stock with a stop at $32.55 (EMA9)

( click to enlarge )

( click to enlarge )Southwestern Energy Company (NYSE:SWN) is threatening to break through the 40.39 resistance level which would be a very bullish sign. The stock price has been strong over the past weeks, so watch it closely the next few trading sessions.

( click to enlarge )

( click to enlarge )Zuoan Fashion Ltd (NYSE:ZA) Daily chart is suggesting the stock should continue its run higher. Trading volumes have increased in the last three sessions, indicating sustainability of the up move. In addition, the MACD is above its signal line but in the negative terriroy, however is almost at the verge of turning upwards, indicating that the stock price might be bottoming out. Upside targets are 2.09, 2.34 and 3.62 which are the October spike highs. ZA is a solid China stock with a strong cash flow. Long setup.

( click to enlarge )

( click to enlarge )Gogo Inc (NASDAQ:GOGO) could be in the early stages of a technical breakout. If the stock can break through 25.20, expect to see heavy volume drive the stock higher. Plus, the MACD is crossing up through the signal line.

( click to enlarge )

( click to enlarge )Facebook Inc (NASDAQ:FB) may be close to breaking to new highs. At this stage, it is definitely a wait and see, if the resistance will be easily taken out by the bulls. Fresh exposures may be considered on a move past $59, with a stop-loss at $56.15 (20EMA).

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC