Cerulean Pharma Inc. (Nasdaq: CERU) stock has shifted gears over the past two trading sessions, posting a 46.5% gain, after falling gradually since mid-June. This should be a wake-up call for biotech's naysayers.

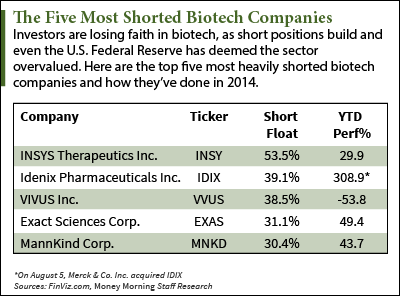

The two-day ascent comes at a time when short sellers betting on biotech's downfall are adding to their positions, and when even the country's head central banker has little faith in the sector. Biotech has been on a rally over the last year, a rally that a lot of traders feel has run its course.

And it's true biotech was on a remarkable, if not overly optimistic, tear over the last two years - the iShares Nasdaq Biotechnology Index (Nasdaq: IBB) gained 32.1% in 2012 and 65.5% in 2013. It has notched another 10.6% so far this year.

But the sector has already corrected itself from its overstated gains and shook out the bad money.

"I think everybody this year kind of expects an adjustment to take place, which did take place," Money Morning's BioScience Investment Specialist Ernie Tremblay said. The correction was most evident when the IBB closed at its yearly high of 272.81 on Feb. 25, and then dove 21.2% to 215.04 in April.

Even after this downdraft, U.S. Federal Reserve Chairwoman Janet Yellen offered her take on the sector, writing in a July report that "valuation metrics in some sectors do appear substantially stretched - particularly those for smaller firms in the social media and biotechnology industries..."

What Yellen's comments did, far short of offering substantial market analysis, was add an unneeded voice to a chorus of biotech doubters that are not looking at the actual strength of the industry, but are crying "bubble" in hopes of making money off short trading.

What Yellen's comments did, far short of offering substantial market analysis, was add an unneeded voice to a chorus of biotech doubters that are not looking at the actual strength of the industry, but are crying "bubble" in hopes of making money off short trading.

That could explain why biotech is so heavily shorted and those shorts only continue to grow. Short selling data is reported every few weeks, and at the time of Yellen's remarks short float on the flagship biotech exchange-traded fund, IBB, was already at a heavy 44.7%. Since then, it has reached 49.4%. Short sellers see these dramatic increases in biotech company shares and are waiting for some kind of correction to pocket gains on the downside.

But investors who listen to Yellen and the short-selling doubters are missing out on huge profit opportunities...

Why a 30% Gain Is Far Short of Biotech's PotentialCERU stock advanced 30.5% yesterday (Wednesday), the day after the biopharma company reported earnings and reaffirmed that it was making progress on phase 2 clinical trials for an ovarian cancer relapse treatment. It added another 12.2% today.

But even those impressive, quick gains are miniscule compared to some of biotech's big winners. Some biotech stocks have the potential to shoot up 50%, 60%, and even 300% overnight, Tremblay said.

That's what critics like Yellen fail to understand - biotech is a sector like no other. You can't take standard valuation metrics across the sector and paint a full picture of each individual company.

As Tremblay said, in the development stages of marketable treatments, biotech firms are "cash-burners," and deriving true value is difficult because "all the numbers you put into that equation are guesswork, it's all imagination." Using the standard price-to-earnings calculations fall well short of giving a company value.

"[The Fed is] looking at averaged numbers derived through standard technical analysis. And it's all nonsense. Remember, the majority of small-cap biotech companies are pre-profit. There is no way to valuate them using a standard formula," Tremblay said. "The only approach that really makes sense is...take a look at each company on its own terms, evaluate its pipeline, look at potential market size, research the competition, make a reasonable judgment about market penetration, then derive an estimate for peak profits going forward."

The case of Puma Biotech drives this point home...

Puma Biotech's Value Derived from Cutting Edge Drugs, Not Shaky Investor MathPuma Biotechnology Inc. (NYSE: PBYI) stock surged 290% on July 23 after announcing that it would soon be marketing a new cancer treatment. And after a slight pullback, its shares have gained another 13.2% by the close of market today (Thursday).

Even before this huge gain, biotech's detractors could have told you the firm's record of red ink threw its PE ratios out of whack and made it overvalued at $59. It's now trading at close to $250.

Continuously operating at losses since the company's inception in 2007, the pharmaceutical firm didn't catch a break until August 2011 when it got the exclusive rights to make, use, lease, and sell neratinib, a potential treatment for more aggressive forms of breast cancer. However, the exhaustive regulatory hurdles of the FDA and the lengthy clinical trials for drugs ensured that PBYI wouldn't be churning out profits any time soon.

PBYI's SEC filings say it all: "We have a history of operating losses and no meaningful operations upon which to evaluate our business. We expect to incur substantial losses and negative operating cash flow for the foreseeable future as we continue development of our drug candidates, which we do not expect will be commercially available for a number of years, if at all."

But once PBYI announced the positive results of its phase 3 clinical trial in late July, the last phase before a drug or treatment can be made marketable, investors saw the value of the company based on the need it was delivering and not valuation metrics, and the stock soared to almost 300% gains.

Biotech stocks may look overvalued because the profits aren't there, but when they are past the development stage they position themselves to market solutions for cancers, Alzheimer's, and several other much needed therapies.

"I think there's real value behind these companies," Tremblay said. "They're delivering real products for real value and they're delivering a real need."

More from Ernie Tremblay: As people get older, they need more medical help, and with the elderly population set to double by 2030, there's about to be a huge boom in healthcare and pharma spending......

Tags: biotech stocks, CERU stock, Cerulean Pharma stock, pharmaceutical stocks, Puma Biotechnology stock, short selling, short selling stocksThe post Cerulean Pharma Inc. (Nasdaq: CERU) Stock Shows the Staggering Gains Biotech Has to Offer appeared first on Money Morning - Only the News You Can Profit From.