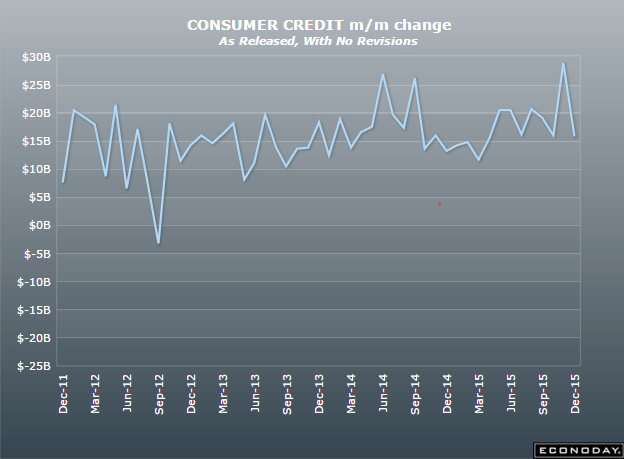

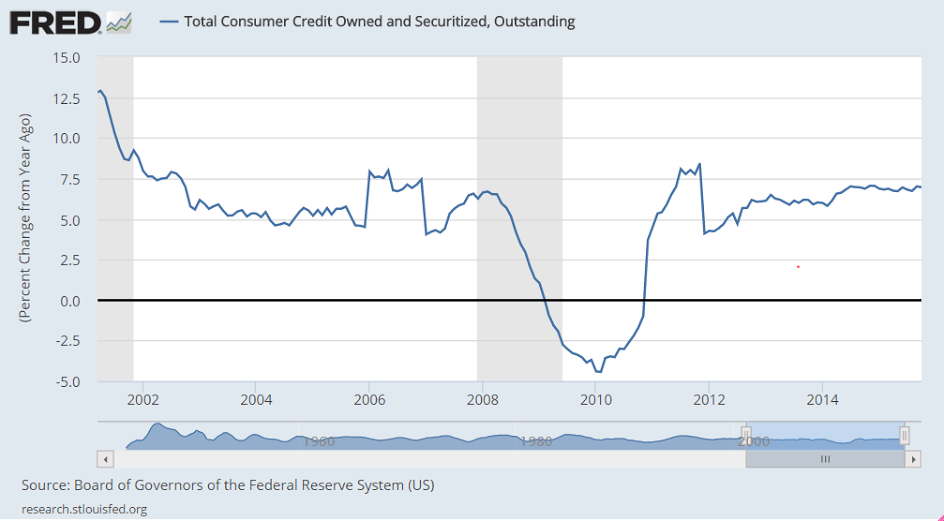

Looks like the last blip up just got reversed so it continues to go nowhere and it’s at levels higher than before the last recession:

Consumer Credit

Highlights

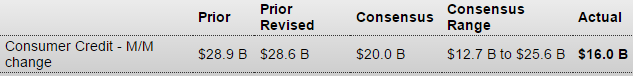

Revolving credit barely made it into the plus column in October, up $0.2 billion for what is, however, an eighth straight gain. Non-revolving credit, which in contrast to revolving credit hasn’t posted a decline since April 2010, rose an intrend $15.8 billion, once again boosted by vehicle financing and also by student loans which are tracked in this component. But the gain on the non-revolving side couldn’t offset the flat result for revolving credit as total consumer credit rose a lower-than-expected $16.0 billion in October. The slowing in the revolving component may not be pointing entirely to consumer caution but may reflect a lack borrowing demand given the strength in the jobs market and the savings rate and also of course low gas prices which are leaving more money in consumer pockets. Still, the pause for revolving credit won’t be lifting expectations for holiday spending.

No telling how low prices will go before Saudi sells their entire output capacity estimated at 12 million bpd. Right now they are at 10 million bpd and prices have to go low enough for other suppliers to cut back or demand to increase. And here comes Iran:

“It is going to be 12 to 18 months before they see any relief,” David Fyfe, from the oil trading group Gunvor, said.

“We think oil stocks will continue to build in the first half of next year and we don’t think they will draw down to normal levels until well into 2017.”

Mr Fyfe said Iran has 40m to 50m barrels floating on tankers offshore that will flood onto the market as soon as sanctions are lifted. It will then crank up extra output to 500,000 b/d by the end of next year.

The post Consumer Credit, Oil comment appeared first on The Center of the Universe.