( click to enlarge )

( click to enlarge )FORM Holdings Corp. (NASDAQ:FH) Daily technical chart is starting to heat up again, along with all the recent positive developments in their press releases. In addition, the bullish insiders (On Monday, Director Richard Abbe purchased 152,005 shares at $2.11) should indicate the stock is really worth buying. The stock is currently within a rising channel and this new wave could send the stock up into the 2.80 range. Daily MACD also flashed today a buy signal above zero. On watch.

( click to enlarge )

( click to enlarge )aTyr Pharma Inc (NASDAQ:LIFE) Bullish breakout of a bottoming base confirmed on expanding volume. Momentum picking up with MACD rising and RSI climbing. Look for a quick run to $3.52 then to $3.75

( click to enlarge )

( click to enlarge )I have Gigamon Inc (NYSE:GIMO) on my watchlist for Thursday. The stock broke out of a bullish consolidation with high volume, creating a significant amount of bullish potential. I will be watching the stock on Thursday for a continuation move through Wednesday’s highs of $49.34

( click to enlarge )

( click to enlarge )Wynn Resorts, Limited (NASDAQ:WYNN) has witnessed a major break above the horizontal resistance at 105.16 on closing basis, which confirms my previous outlook. Go long on the break of Wednesday’s high or wait for a retracement entry.

( click to enlarge )

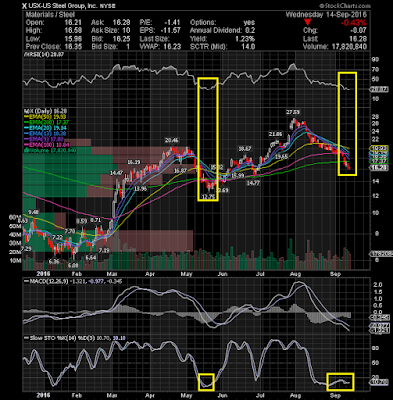

( click to enlarge )United States Steel Corporation (NYSE:X) is very close to bottoming, jmho. Whether its a short term bottom or something more, open long positions at current levels could be a good option for a swing trade. Looking at the daily over the last couple months, I notice that every time the RSI hit extreme oversold conditions it recovers significantly.

( click to enlarge )

( click to enlarge )GNC Holdings Inc (NYSE:GNC) closed the day well positioned to break an important area. So, tomorrow keep an eye on the stock for apossible breakout over $21.39 on a close basis.

( click to enlarge )

( click to enlarge )Acasti Pharma Inc (NASDAQ:ACST) Crazy action and volume into the close. On the long-time frame, traders should watch for a potential breakout over 3.20

If you want to contact me for advertising opportunities on blog or twitter, then get in touch via email

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC