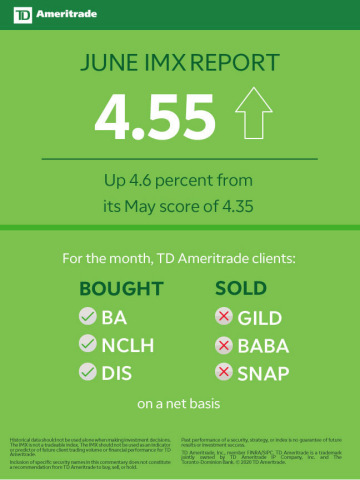

The Investor Movement Index® (IMXSM) increased to 4.55 in June, up 4.6 percent from its May score of 4.35. The IMX is TD Ameritrade’s proprietary, behavior-based index, aggregating Main Street investor positions and activity to measure what investors actually were doing and how they were positioned in the markets.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200706005045/en/

TD Ameritrade June 2020 Investor Movement Index (Graphic: TD Ameritrade)

The reading for the four-week period ending June 30, 2020, ranks “Moderate Low” compared to historic averages.

“In June, optimism waxed and waned as state economies took steps to reopen and spikes in cases of COVID-19 rippled across the country, contributing to continued volatility in the markets,” said JJ Kinahan, chief market strategist at TD Ameritrade. “Through their buys in the travel and hospitality sectors, our clients showed confidence in the uptick in economic activity to take advantage of the ripple effect they see coming to these sectors.”

Equity markets were mixed during the period. The S&P 500 and Dow Jones Industrial Average both declined, moving lower by 1.16 percent and 1.45 percent, respectively. The Nasdaq Composite registered a gain, moving higher by 2.82 percent. During the period, the S&P 500 traded above 3,200 for the first time since February, and the Nasdaq Composite topped 10,000 for the first time ever. During the middle of the period, the Dow fell more than 1,800 points, its worst day since March, over worries about spikes in U.S. coronavirus infections. Later, an uptick in economic activity in China and the U.S. suggested the initial stages of recovery from the pandemic. But stocks sold off as infection rates increased near the end of the period, with some regions pausing reopening plans. The Federal Reserve ordered banks to cap dividend payments and halt stock buybacks on worries that a prolonged economic downturn could saddle them with hundreds of billions of dollars in losses on soured loans, but did indicate the largest U.S. banks are likely strong enough to survive the crisis.

TD Ameritrade clients used the volatility during the June period to increase exposure to equity markets. Clients were net buyers overall, and net buyers of equities, with large buying among the Consumer Discretionary, Industrials, and Financials sectors. Some of the popular names that clients bought during the period included:

- Boeing Inc. (BA)

- Norwegian Cruise Line (NCLH)

- The Walt Disney Company (DIS)

- Slack Technologies Inc. (WORK)

- AT&T Inc. (T)

Some of the names that they net sold during the period included:

- Gilead Sciences (GILD)

- Alibaba Group Holding (BABA)

- Snapchat (SNAP)

- Kraft Heinz (KHC)

About the IMX

The IMX value is calculated based on a complex proprietary formula. Each month, TD Ameritrade pulls a sample from its client base of more than 12 million funded accounts, which includes all accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly IMX. For more information on the Investor Movement Index, including historical IMX data going back to January 2010; to view the full report from June 2020; or to sign up for future IMX news alerts, please visit www.tdameritrade.com/IMX. Additionally, TD Ameritrade clients can chart the IMX using the symbol $IMX in either the thinkorswim® or thinkorswim Mobile platforms.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold. All investments involve risk including the possible loss of principal. Please consider all risks and objectives before investing.

Past performance of a security, strategy, or index is no guarantee of future results or investment success. Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The IMX is not a tradable index. The IMX should not be used as an indicator or predictor of future client trading volume or financial performance for TD Ameritrade.

About TD Ameritrade Holding Corporation

TD Ameritrade provides investing services and education to approximately 12 million client accounts totaling approximately $1.2 trillion in assets, and custodial services to more than 7,000 registered investment advisors. We are a leader in U.S. retail trading, executing approximately 2 million daily average revenue trades per day for our clients, nearly one-third of which come from mobile devices. We have a proud history of innovation, dating back to our start in 1975, and today our team of nearly 10,000-strong is committed to carrying it forward. Together, we are leveraging the latest in cutting edge technologies and one-on-one client care to transform lives, and investing, for the better. Learn more by visiting TD Ameritrade’s newsroom at www.amtd.com, or read our stories at Fresh Accounts.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) / SIPC (www.SIPC.org)

Source: TD Ameritrade Holding Corporation

View source version on businesswire.com: https://www.businesswire.com/news/home/20200706005045/en/

Contacts:

Sr. Manager, Corporate Communications

(203) 434-2240

margaret.farrell@tdameritrade.com