Now we're getting some action! About 1/3 of the S&P 500 reports this week so there should be lots of opportunities for baragain hunting – unless, of course the earnings are not good and we finally begin to deflate this bubble market. This will be the first week in 4 years that there is likely to be more focus on the markets than the Government as the Government goes back to " normal " functions with a President who doesn't try to dominate the news cycle . That shifts the focus back to earnings but one might wonder how earnings can possibly justify the sky-high valuations we have been giving most stocks in the past few years. According to Jill Mislinsky at DShort : " The peak in 2000 marked an unprecedented 129% overshooting of the trend – substantially above the overshoot in 1929. At the beginning of December 2020, it is 154% above trend. The major troughs of the past saw declines in excess of 50% below the trend. If the current S&P 500 were sitting squarely on the regression, it would be at the 1457 level ." 154% above treand. That's a lot! While I don't see the S&P going all the way back to 1,457, I do see a 20% correction almost inevitable, back to about 3,000 and, while we may go higher, we'll still pull back at some point so 3,829 (this morning's open) is a very tough pill to swallow on the S&P 500. IN PROGRESS

Now we're getting some action!

Now we're getting some action!

About 1/3 of the S&P 500 reports this week so there should be lots of opportunities for baragain hunting – unless, of course the earnings are not good and we finally begin to deflate this bubble market. This will be the first week in 4 years that there is likely to be more focus on the markets than the Government as the Government goes back to "normal" functions with a President who doesn't try to dominate the news cycle.

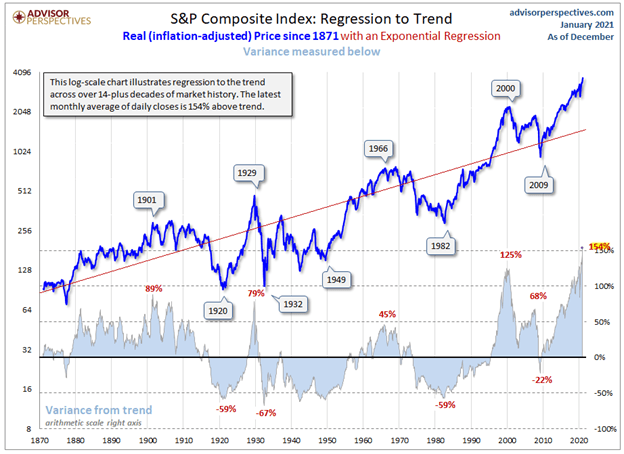

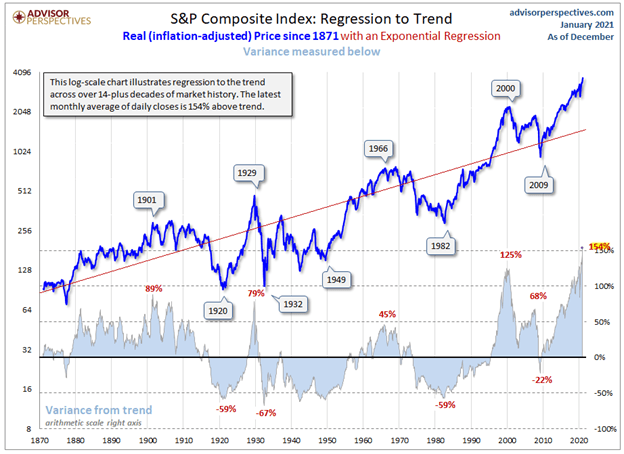

That shifts the focus back to earnings but one might wonder how earnings can possibly justify the sky-high valuations we have been giving most stocks in the past few years. According to Jill Mislinsky at DShort: "The peak in 2000 marked an unprecedented 129% overshooting of the trend – substantially above the overshoot in 1929. At the beginning of December 2020, it is 154% above trend. The major troughs of the past saw declines in excess of 50% below the trend. If the current S&P 500 were sitting squarely on the regression, it would be at the 1457 level."

154% above treand. That's a lot! While I don't see the S&P going all the way back to 1,457, I do see a 20% correction almost inevitable, back to about 3,000 and, while we may go higher, we'll still pull back at some point so 3,829 (this morning's open) is a very tough pill to swallow on the S&P 500.

IN PROGRESS