Balloon payment car loans

Balloon payment car loans

MELBOURNE, Australia - July 8, 2021 - (Newswire.com)

According to leading finance broker National Loans, most borrowers refinance a car loan in order to pay less monthly interest, which can potentially save thousands of dollars over the life of the loan. Other common reasons to refinance a car loan include to repay the debt faster, to provide cashflow by extending the loan to a longer term or to remove or add a co-signer.

Essentially, refinancing a car loan involves borrowing money from a new lender to pay off the current car loan lender, says National Loans.

If market rates have dropped since commencing the loan, it's a good idea to shop around to find a lower interest rate, says National Loans, which offers caravan finance and boat finance as well as car loans.

Getting the right car loan is just as important as getting the best deal on the car itself. National Loans explains that many people who haven't properly planned ahead end up taking out a high-cost car loan at the dealership.

To get the most out of the car loan, National Loans says it's important for people to fully understand the different types of car loans. One of the main things to consider is the car loan term, which is the agreed period for the loan.

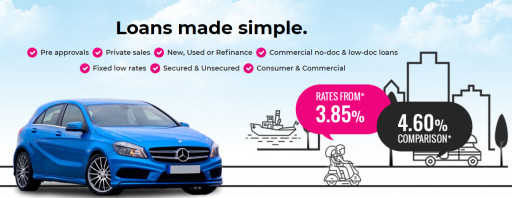

Additionally, National Loans explains that fixed loans have a fixed interest rate locked in for the term of the loan. Variable car loans come with a variable interest rate, which can go up and down at the discretion of the lender. Rates are normally adjusted in response to the Reserve Bank changing the official cash rate and, as a result, repayments can move up and down.

A secured car loan involves putting the car or another asset up as security against the loan, while an unsecured loan generally involves a higher interest rate and creditworthiness.

Balloon payment car loans feature lower monthly repayments, followed by a large lump sum to be paid out at the end of the loan term. The vehicle can be traded in at the end of the loan to repay the outstanding amount.

Whether looking for a car loan, caravan loan or boat loan, National Loans provides all the resources needed to make an informed decision.

Press Release Service by Newswire.com

Original Source: The Key Benefits of Refinancing a Car Loan