In its most recent quarter, Snowflake Inc. (SNOW) surpassed earnings and revenue expectations, signaling a growing demand for cloud data warehousing services.

For the quarter ending on October 31, the company reported a year-over-year revenue increase of 31.8%, reaching $734.17 million, higher than analyst projections set at $713.54 million. Nevertheless, it faced a net loss of $214.25 million, compared to the prior-year quarter net loss of $200.94 million.

In terms of adjusted EPS, the company marked a significant rise of 127.3%, coming in at 25 cents - beating analysts’ estimations of 16 cents.

Despite demonstrating its potential to bolster its gross income and emerge as a key player within the cloud data sector, Snowflake is still wrestling with major competition from other dominant businesses in this space. Moreover, despite laudable strides in revenue growth, the company has yet to achieve profitability.

Although the company’s pioneering approach towards cloud data solutions puts it in favorable stead for expansion, its path to profitability remains uncertain. SNOW has experienced a notable deceleration in growth in the past year.

Considering these variables, the current juncture may not be the opportune moment to invest in the company’s stock. A thorough analysis of key financial metrics will provide greater insight into the matter.

Examining SNOW’s Financial Trajectory: A Tale of Growth & Challenges

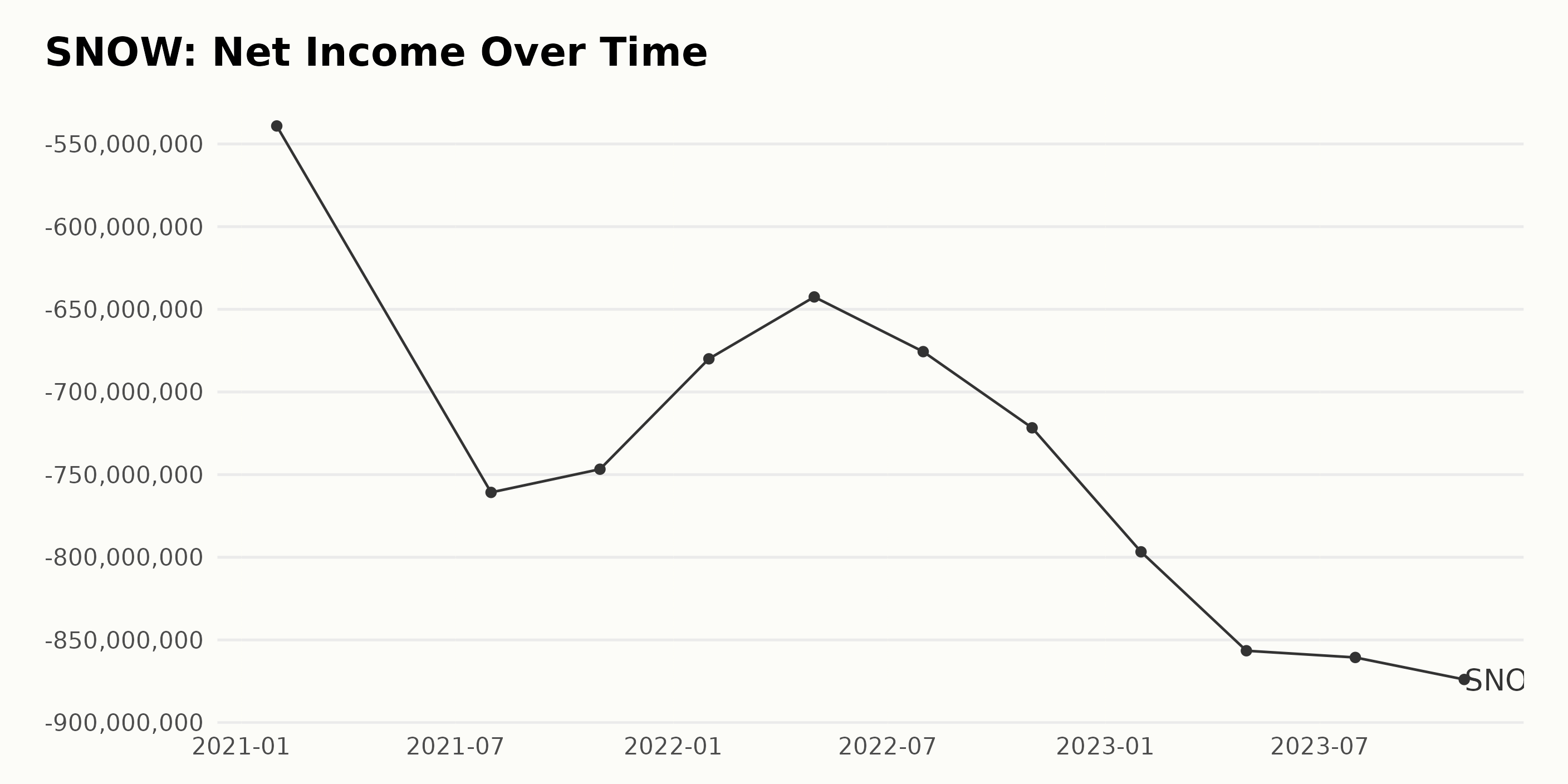

The trend for trailing-12-month Net Income for the given time series shows a consistent downward trajectory, implying increasing net losses. Here are some key details:

- At the beginning of the recorded timeframe, in January 2021, the Net Income stood at -$539.10 million.

- As of July 2021, the Net Income increased to losses of -$760.76 million, representing a clear increase in the company’s financial deficit.

- Contrary to the previous upward trend, the Net Income decreased slightly to -$746.73 million in October 2021, followed by a steady decline towards -$642.52 million in April 2022

- However, the following months showed a resurgence in net losses, with -$721.69 million in October 2022, escalating to -$856.53 million in April 2023.

- The most recent data point as of October 2023 shows the Net Income standing at -$873.91 million, marking the highest level of net losses during the observed period.

Overall, SNOW’s Net Income has grown from -$539.10 million to -$873.91 million, showing a significant growth rate in its losses. The most recent loss value reached its peak, suggesting an ongoing financial challenge for the company. The company’s financial performance seems to face consistent issues as signified by a negative trend and fluctuating Net Income.

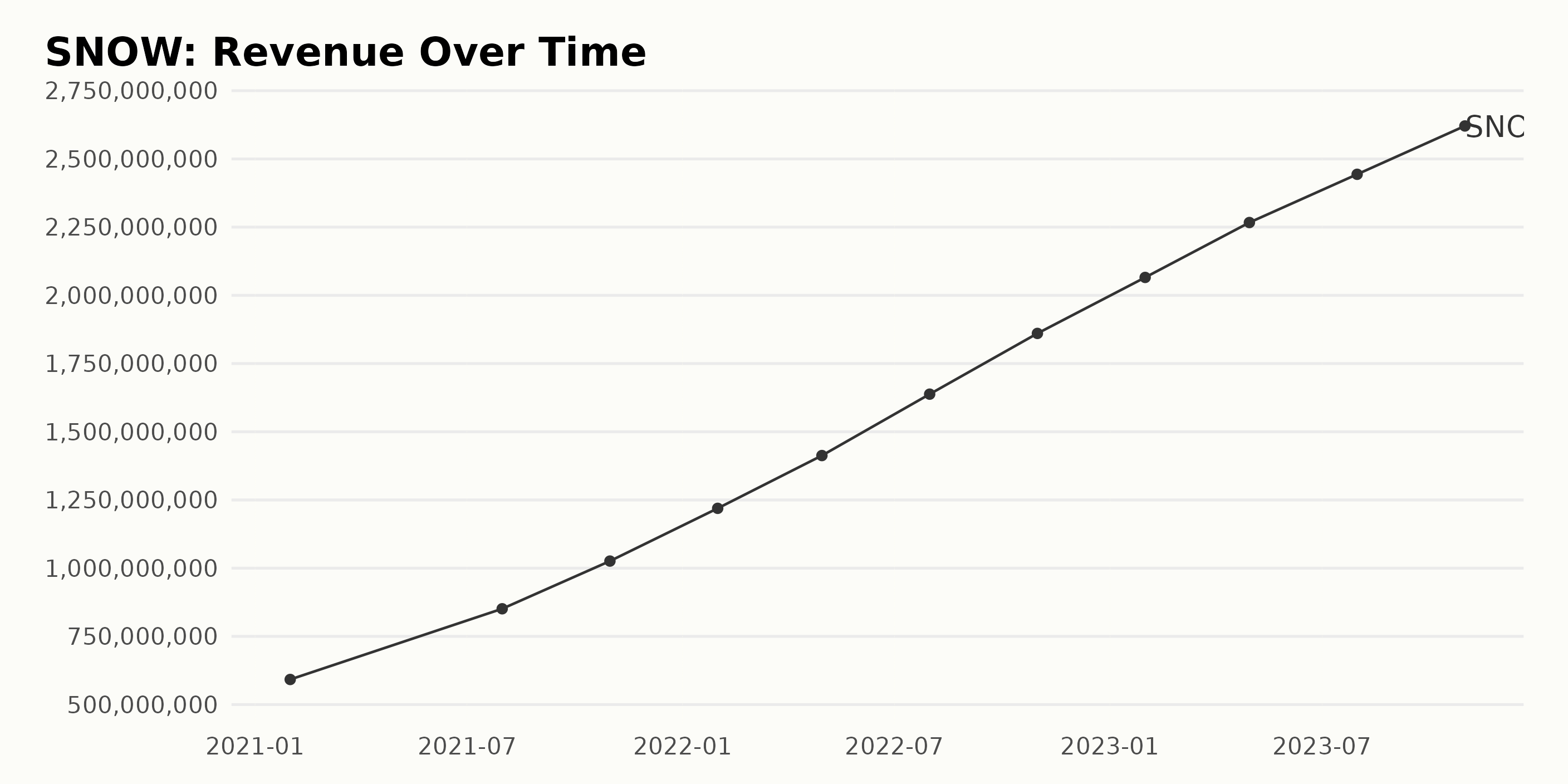

The trailing-12-month revenue trends of SNOW show consistent growth over time, with fluctuations becoming more pronounced in the latter part of the data series. Here are key points concerning the Revenue trends and fluctuations of SNOW:

- In January 2021, the Revenue was $592.05 million.

- By July 2021, there was a significant rise in Revenue to $851.20 million, indicating a strong mid-year performance.

- The Revenue continued to grow steadily throughout 2021 and into 2022, reaching $1.41 billion by April 2022 and $1.64 billion by July 2022.

- The upward trend continued through October 2022 when the reported Revenue was $1.86 billion

- In January 2023, the Revenue exceeded the $2 billion mark, reaching $2.07 billion.

- The latest data point from October 2023, shows the company’s Revenue at its highest at $2.62 billion.

From the first recorded value in January 2021 to the last one in October 2023, SNOW’s Revenue grew by approximately 342.68%. This highlights consistent and impressive growth over this period. Emphasis on the more recent data suggests that this growth trend is continuing.

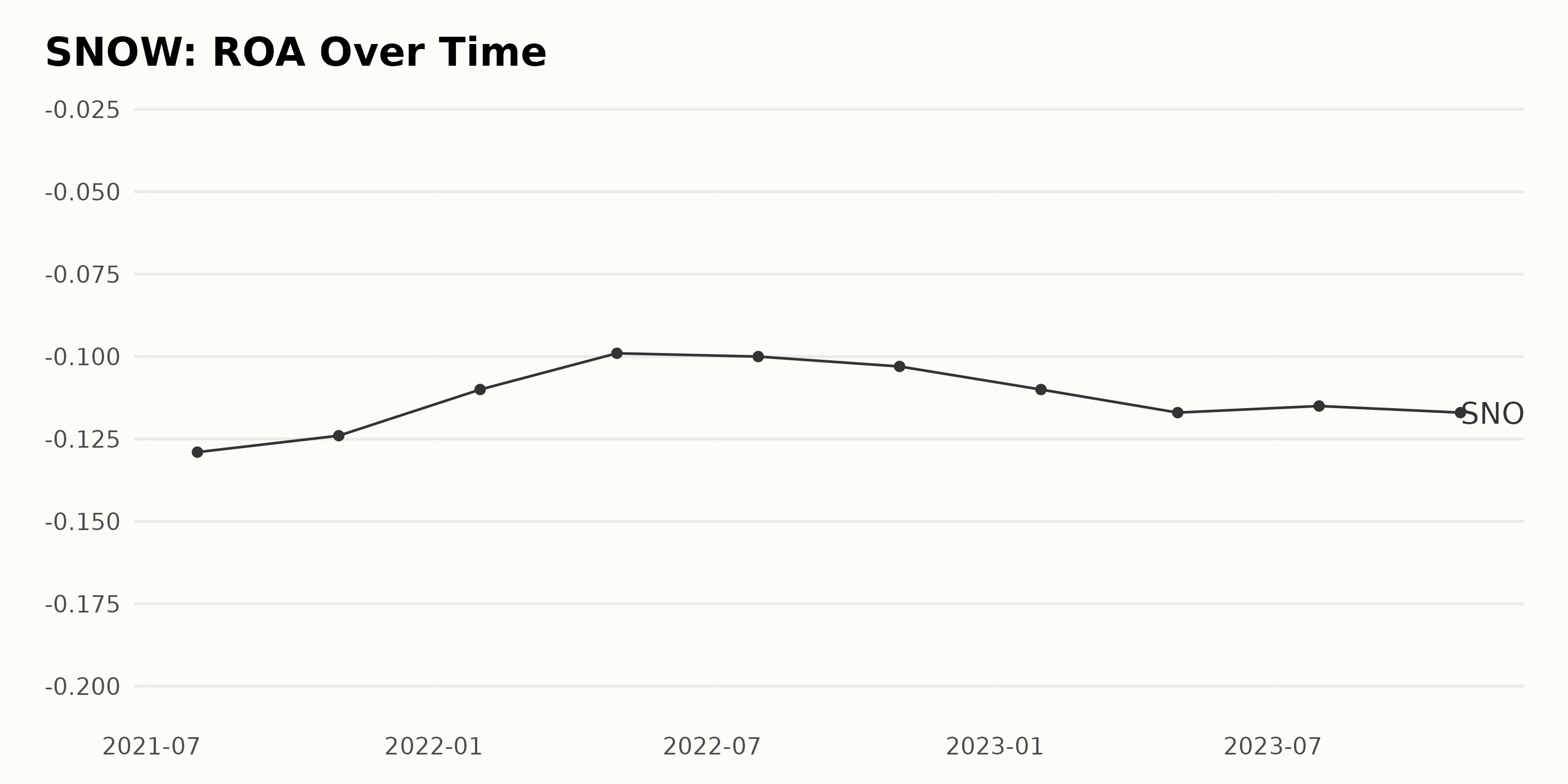

The Return on Assets (ROA) for SNOW shows a fluctuating pattern from July 2021 to October 2023. However, there seems to be an overall increase in the negative trend over the reported period. Here are the significant points of interest:

- Beginning at -0.13 in July 2021, the ROA improved marginally to -0.124 by October 2021.

- Consistency was observed in these figures until January 2022, as the ROA further decreased to -0.11.

- The ROA showed a continuing improving trend in April 2022 (-0.099) and then slightly dipped to -0.10 in July of the same year. However, this improvement was not sustained; the ROA ended up slightly worse by October 2022, at -0.103.

- In subsequent months, the ROA remained largely negative. By January 2023, it was -0.11, deteriorating further to -0.117 in April 2023 and maintaining roughly this status quo to end at -0.117 in October 2023.

Overall, while there were slight improvements noted in 2022, the ROA of SNOW presented a generally worsening (more negative) trend over the analysis period. Calculating growth from the first to the last value, there is an approximate decrease in ROA by 7.69%.

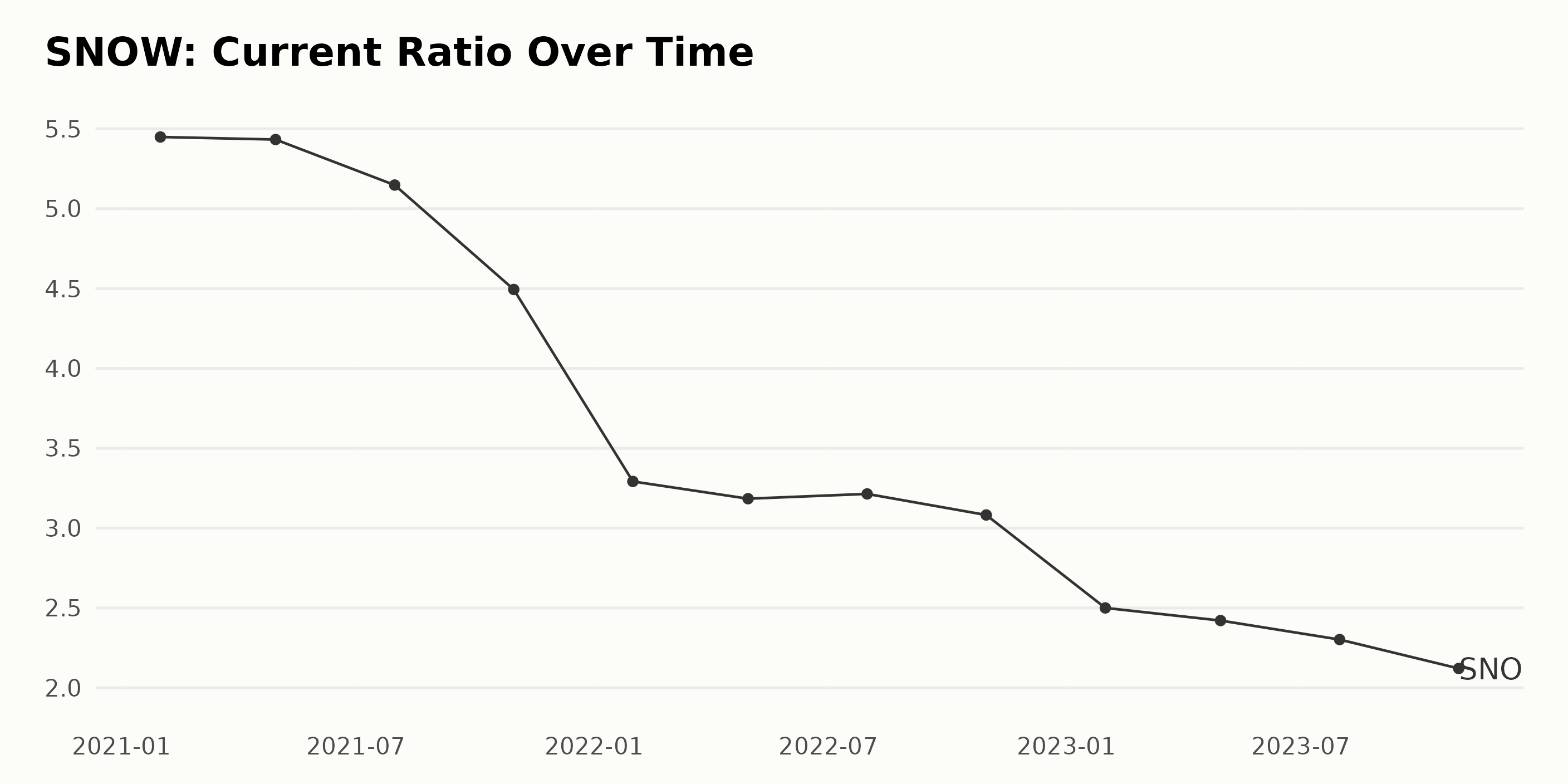

SNOW experienced a declining trend in its Current Ratio from January 2021 to October 2023.

- The Current Ratio began at 5.45 as of January 2021, dropping down slightly to 5.43 by April 2021.

- Throughout 2021 to 2022, SNOW’s Current Ratio continued a steady decline, reaching 3.082 by October 2022.

- From the start of 2023 to October 2023, the Current Ratio made a further decrease, ending at 2.121.

Highlighted by these figures, the downward trend shows fluctuations with the most marked decrease happening between July 2021 and January 2022 where the Current Ratio declined from 5.148 to 3.292. In terms of growth rate calculated by measuring the last value from the first value, there was a significant negative growth rate of -61% over this period from January 2021 to October 2023. This summary emphasizes recent data and indicates the current financial stability of SNOW compared to previous years, showing a concerning steady decrease in their liquidity position as reflected by the Current Ratio.

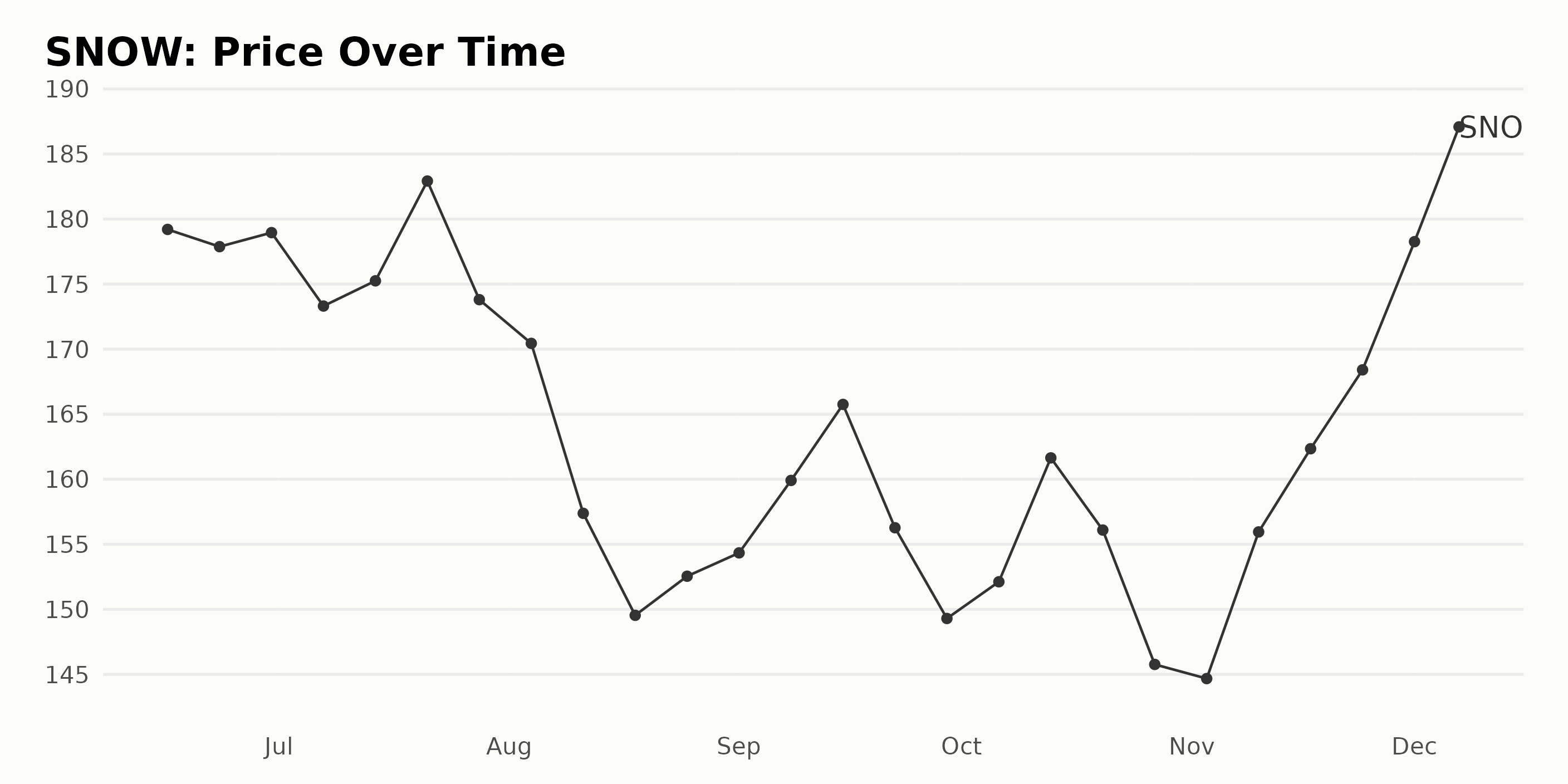

Analyzing SNOW’s Six-Month Fluctuating Stock Performance

The share prices for SNOW can be seen following a slightly fluctuating trend over the period from June to December 2023:

- Starting on June 16, 2023, the price was at $179.20. Over the next two weeks, there was a minor drop and then a slight rise: reaching $177.88 on June 23, 2023, and $178.96 on June 30, 2023.

- During July, there was a mix of ups and downs, beginning with a significant drop to $173.31 on July 7, 2023. By the week of July 21, the price had ascended to its peak for the period at $182.92 before settling down to approximately $173.80 by the end of that month.

- The initial weeks of August signalled a decelerating trend. The price decreased from $170.44 on August 4, 2023, to a substantial fall to $149.54 on August 18, 2023.

- Towards the end of August and into early September, the prices showed an upward trend again; rising from $152.55 on August 25, 2023, to reach $165.75 on September 15, 2023. However, it fell again to $149.30 by the end of September.

- In October 2023, despite a slight rise in the middle, the general trend was downwards with the prices falling from $152.12 at the start of the month to $145.77 towards the end.

- A revival was observed in November 2023. The prices exhibited an accelerating upward trend beginning with $144.68 on November 3, 2023, ultimately reaching $168.41 by November 24, 2023.

- In early December 2023, the share prices climbed further, reaching $178.26 on December 1, 2023, before finally ending at $187.09 on December 7, 2023.

In summary, while there’s a degree of fluctuation in the data, the overall growth rate shows a slight upward trend over this six-month period. Despite periods of deceleration, particularly in August and October, the prices picked up again in the following months, concluding the period at a higher price than it started. Here is a chart of SNOW’s price over the past 180 days.

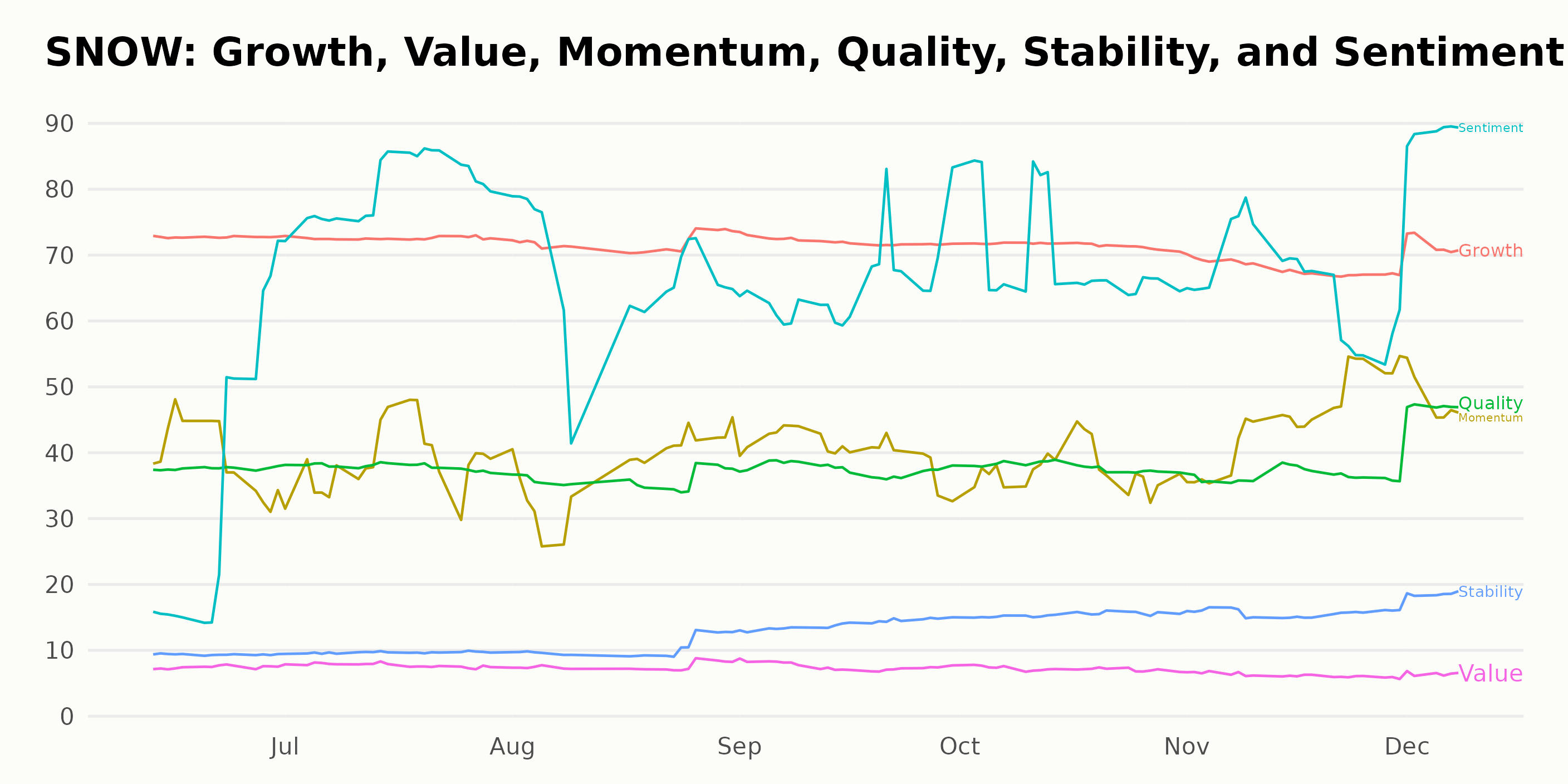

Analyzing SNOW’s Growth, Sentiment, and Momentum: A POWR Ratings Review

SNOW has an overall D rating, translating to a Sell in our POWR Ratings system. It is ranked #57 out of the 76 stocks in the Technology - Services category.

Based on the POWR Ratings data, the three most noteworthy dimensions for SNOW over the stated period are Growth, Sentiment, and Momentum. Here are significant observations for each dimension:

Growth

SNOW consistently maintained a high Growth rating throughout the period from June to December 2023. Beginning with a score of 73 in June 2023, there were minor fluctuations through the months, ending with an identical score of 72 in December 2023.

Sentiment

The Sentiment dimension showed a noticeable upward trend in this period. Starting with a score of 35 in June 2023, it increased significantly to 80 by July 2023. From there, it experienced some dips but ended with an impressive score of 89 at the close of the year in December 2023.

Momentum

The Momentum rating started at a moderate 40 in June 2023. It saw a slight decay to 38 by August 2023, then climbed upwards to reach 48 by the end of the period in December 2023, indicating a slow yet progressive upward trend.

How does Snowflake Inc. (SNOW) Stack Up Against its Peers?

Other stocks in the Technology - Services sector that may be worth considering are Teradata Corporation (TDC), LiveRamp Holdings, Inc. (RAMP), and PC Connection Inc. (CNXN) -- they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

SNOW shares were trading at $190.84 per share on Friday afternoon, up $3.53 (+1.88%). Year-to-date, SNOW has gained 32.95%, versus a 21.46% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Snowflake (SNOW) Post-Earnings Analysis – Time to Buy, Hold, or Sell? appeared first on StockNews.com