The artificial intelligence (AI) boom has brought with it dazzling innovation and a hefty electricity bill. As data centers multiply across the U.S. to power everything from cloud computing to generative AI, local communities have grown increasingly concerned about strained power grids and rising utility costs. In the middle of this tension between tech progress and consumer pain, Microsoft (MSFT) has stepped forward with a notable promise that aims to shift the narrative.

Earlier this week, Microsoft committed not only to cover the cost of its data center energy needs but also to replenish more water than it uses and boost local tax revenues. Microsoft President Brad Smith emphasized that the tech giant will strike deals with utilities in advance so they can upgrade infrastructure without passing electricity costs onto consumers. Even U.S. President Donald Trump hailed Microsoft as the first tech company to make such a commitment.

So, does this consumer-first strategy make Microsoft’s investment case even more attractive now?

About Microsoft Stock

Founded in 1975 by Bill Gates and Paul Allen, Microsoft has grown from a modest software company into a global technology leader. Headquartered in Redmond, Washington, the company has significantly influenced modern computing through widely used products like Windows, Office, Teams, and Xbox, which have become integral to how people work, connect, and entertain themselves.

Over time, Microsoft broadened its focus by investing heavily in cloud computing through Azure, helping businesses operate more digitally and efficiently. Now, the company is accelerating its push into artificial intelligence, embedding AI-powered tools across its platforms to improve productivity and reshape how users interact with technology.

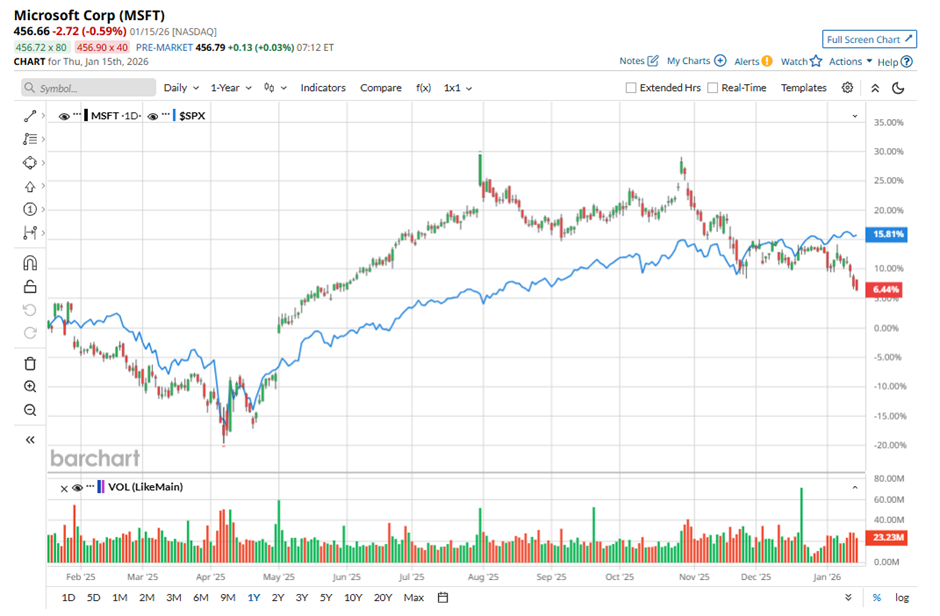

That said, while Microsoft’s leadership and rapid innovations in cloud and AI are unquestionable, MSFT stock hasn’t been getting the same love from investors lately. Even as one of the world’s most valuable companies with a market capitalization of around $3.4 trillion, MSFT shares have been under pressure. After ending 2025 with a modest 7% rise, the stock stumbled into 2026, down by 5% year-to-date (YTD) so far.

By contrast, the broader S&P 500 Index ($SPX) has painted a much brighter picture, surging about 17% in 2025 and still managing to post a 1.4% gain so far this year. MSFT stock’s lagging price action reflects a combination of broader weakness in the software sector, investors locking in profits after a lengthy rally, and growing concerns over Microsoft’s hefty spending as it ramps up its aggressive AI investments.

Inside Microsoft’s Q1 Earnings Report

Microsoft began fiscal 2026 with impressive momentum, reporting its first-quarter earnings on Oct. 29 that comfortably exceeded Wall Street’s forecasts for both sales and profits. The company generated $77.7 billion in revenue, marking an 18% increase from the prior year and surpassing analyst expectations of $74.96 billion. This robust performance was fueled by strong and persistent demand for Azure cloud services, along with growing adoption of AI-powered tools like Microsoft Copilot across enterprises worldwide.

The standout performer once again was the Intelligent Cloud division, which houses Azure and recorded $30.9 billion in revenue, a 28% year-over-year (YOY) increase. Azure itself surged by 40%, reflecting the rapid shift of businesses toward cloud computing and AI solutions. At the same time, the Productivity and Business Processes segment posted healthy growth, with revenue rising 17% YOY to $33 billion, driven by continued strength in Microsoft 365 Commercial and Dynamics 365.

The More Personal Computing segment — which includes Windows, search advertising, devices, and gaming — also delivered steady results, climbing 4% to $13.8 billion, demonstrating resilience in a category that typically sees slower growth. On the profitability front, Microsoft reported adjusted EPS of $4.13, up 23% YOY and well above the consensus estimate of $3.65, after accounting for costs related to its OpenAI investments.

In addition to its strong financial results, Microsoft returned $10.7 billion to shareholders through dividends and stock repurchases during the quarter. However, despite the solid performance, MSFT stock dropped around 3% on Oct. 30 as investors focused on the company’s rising spending. CFO Amy Hood disclosed that capital expenditures reached $34.9 billion in Q1 — a sharp 74% increase from a year earlier — and indicated that capex growth in fiscal 2026 would outpace that of 2025.

As Microsoft accelerates its investments to build the AI infrastructure needed to meet soaring demand, some investors expressed concern over how much further spending could rise. Still, the company remains optimistic about its trajectory. For fiscal Q2, set to be reported on Jan. 28, Microsoft projects revenue between $79.5 billion and $80.6 billion. That signals that, despite cost concerns, its cloud and AI businesses continue to gain strength.

How Are Analysts Viewing Microsoft Stock?

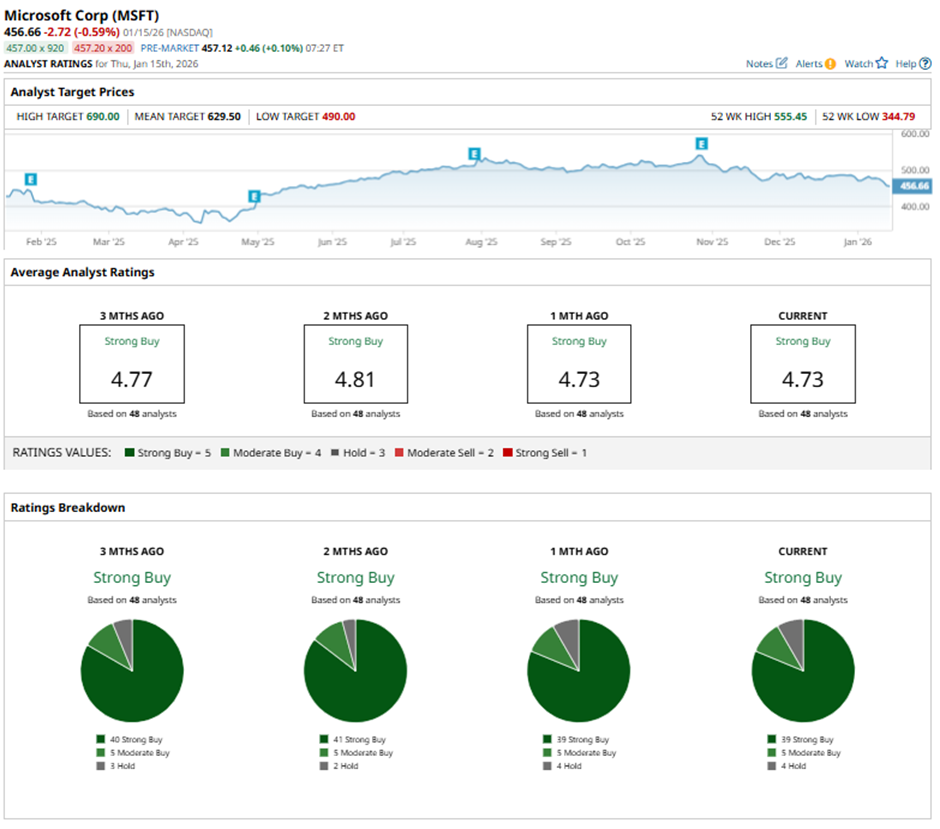

Even though Microsoft may not be as popular with investors now, Wall Street’s confidence in the company remains remarkably strong. The stock currently boasts a “Strong Buy” consensus rating, reflecting broad optimism among analysts who closely follow the firm. Out of 48 analysts covering MSFT stock, an overwhelming 39 recommend “Strong Buy,” five lean toward a “Moderate Buy” rating, and only four suggest a “Hold." That's a strikingly bullish split.

The optimism becomes even more evident when looking at price targets. Analysts foresee significant room to run, with an average target of $629.50 pointing to roughly 37% potential upside. Meanwhile, the most bullish estimate sits at $690, implying that MSFT could surge as much as 50% from current levels — a powerful signal that many on Wall Street still believe Microsoft’s best days lie ahead.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After Rigetti Announced a Quantum Computing Delay, How Should You Play RGTI Stock in January 2026?

- Wells Fargo Says You Should Buy the Dip in Broadcom Stock

- Taiwan Semi Crushed Q4 Earnings. That Makes This 1 AI Chip Stock a Top Buy.

- As Trump Hits AMD MI325X Chips with a 25% Tariff, How Should You Play AMD Stock?