Palantir (PLTR) stock delivered a solid gain of more than 130% in 2025, far outpacing the S&P 500’s ($SPX) roughly 16% return. The enterprise artificial intelligence (AI) software company has been reporting strong revenue growth alongside meaningful operating leverage. Higher revenue and profitability have significantly lifted investor confidence and pushed PLTR stock higher. However, the elevated valuation of Palantir could pose some challenges.

Let's take a closer look.

AI Platform Momentum Powers Growth

The key to Palantir's strong financials is the momentum of its AI Platform (AIP). Demand for the platform has been accelerating as enterprises and government clients increasingly turn to AI-driven tools to manage complex data and improve decision-making. This rising adoption has fueled faster revenue expansion and strengthened the company’s competitive position in the fast-evolving AI software landscape.

Palantir’s top-line growth has been accompanied by improving profitability. It reported a solid adjusted operating margin in the third quarter, highlighting stellar top-line growth, effective cost management, and a growing base of high-value customers. This margin expansion suggests that the business is scaling profitably.

Palantir’s growth story remains compelling for 2026. The company is likely to deliver strong growth led by high demand for AIP and its growing customer base. That said, its high valuation could pose challenges. PLTR stock is up 990% over the past two years, and much of the optimism around future growth may already be reflected in the share price.

Palantir Enters 2026 With Solid Momentum

Palantir has entered 2026 with accelerating demand across both its commercial and government segments and a sharp expansion in profitability.

Notably, its commercial revenue rose 73% year-over-year (YOY) in Q3 to $548 million, marking the fourth consecutive quarter in which commercial sales exceeded revenue from U.S. government customers. This shift is strategically important because it reduces Palantir’s historical dependence on government contracts and positions the company to scale more rapidly as enterprises adopt AI-driven decision platforms.

The momentum in the company's commercial business is being driven by AIP, which is driving new customer acquisition and expansion within existing clients. U.S. commercial revenue soared 121% YOY to $397 million, reflecting strong demand for AIP in the domestic market.

The strength of this demand is also visible in bookings. Palantir’s commercial total contract value (TCV) reached $1.4 billion for the quarter, up 132% from the prior year and 32% sequentially, reflecting a robust and expanding sales pipeline. Overall, Palantir’s total TCV bookings came at $2.8 billion, a 151% YOY increase. These bookings provide improved revenue visibility heading into 2026 and suggest that current growth will likely be sustained.

While commercial growth is leading, Palantir’s government business remains a meaningful and stable contributor. Government revenue grew 55% YOY to $633 million in Q3, with U.S. government revenue rising 52% to $486 million. This growth was driven by continued execution on existing programs and new contract awards tied to rising demand for AI-enabled software across defense and public-sector agencies. The combination of a fast-growing commercial segment and a resilient government base gives Palantir a balanced revenue mix that can support long-term expansion.

Customer metrics remain solid and indicate solid growth ahead. The company’s customer base increased 45% YOY to 911 clients, while the top 20 customers generated an average of $83 million each over the trailing 12 months, up 38% from a year earlier, highlighting strong upselling and cross-selling dynamics. Net dollar retention improved to 134%, reflecting both high customer stickiness and expanding usage across the platform.

With accelerating commercial adoption of AIP, strong booking momentum, expanding margins, and improving customer economics, the company is likely to deliver significant growth in 2026.

Valuation Remains the Key Risk

Despite the compelling operational momentum, valuation remains a significant consideration for investors. Even after recent pullbacks, Palantir trades at a price-to-sales multiple of 109.9, well above most peers.

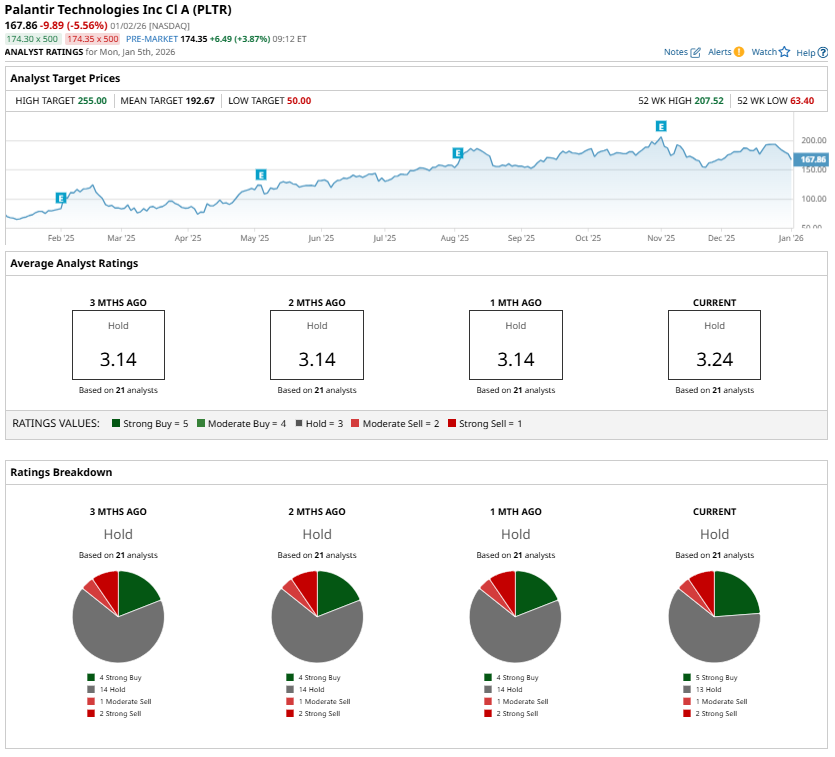

As a result, analysts remain cautious and maintain a consensus “Hold” rating on PLTR stock. That said, the Street’s highest price target of $255 implies roughly 47% potential upside over the next 12 months, suggesting that Palantir could still outperform the broader market if execution remains strong.

The Bottom Line

Palantir has entered 2026 with solid tailwinds and is likely to deliver strong growth. However, the elevated valuation means that future returns will depend heavily on the firm's ability to sustain its momentum and exceed already high expectations.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Warren Buffett’s Legacy Includes an Emphasis on Industrials. This ETF Reminds Us Why.

- 2025 Wasn’t an Easy Year for Tesla Stock, but Baird Says It’s a ‘Core Holding’ for 2026 Anyways

- ‘I Was Probably the First CEO to Jump Behind That’: Nvidia’s Jensen Huang Says He Is Pushing Partners to Build In America

- As the EV Price War Heats Up in China, Can Nio Stock Survive 2026?