Apple (AAPL) has never been just a hardware story. From iPhones to AirPods to a steadily expanding Services engine, the company has built an ecosystem designed to keep users engaged and paying over the long haul. As hardware growth matures, investors are increasingly looking to Services for the next lever that could matter to AAPL stock in 2026.

That puts Apple Fitness+ in sharper focus. Launched in 2020 and now spanning dozens of markets, the platform has grown quietly alongside Apple’s broader Services push, even as subscriber figures remain undisclosed. Recently, Apple added intrigue by teasing an upcoming Fitness+ update, hinting that something bigger is in the works for the new year. In an Apple Fitness+ Instagram post, trainers held mock newspapers with suggestive headlines, while the caption teased “big plans for 2026."

With Services revenue already hitting record highs, will these hinted-at Fitness+ upgrades meaningfully deepen user engagement, and ultimately move the needle for AAPL stock in 2026?

About Apple Stock

Apple, the $4 trillion tech giant born in Cupertino, California, has spent decades reshaping how the world works, creates, and connects. From the iPhone that redefined mobility to the Mac and iPad that blurred the line between work and creativity, Apple built its reputation on products that feel personal yet powerful.

Today, its story has evolved beyond devices. The company’s growing services business has become a quiet force, anchored by more than 1 billion paid subscriptions. High-margin offerings like iCloud, Apple Music, and the App Store now form a steady backbone, helping Apple navigate global uncertainty while deepening user loyalty.

Apple may wear the crown of innovation, but AAPL stock has not had a smooth coronation through 2025. Regulatory pressure, louder competition, and an intensifying artificial intelligence (AI) arms race rattled confidence for much of the year. Even so, AAPL stock is still up about 11% over the past 52 weeks, a reminder that Apple rarely stays down for long.

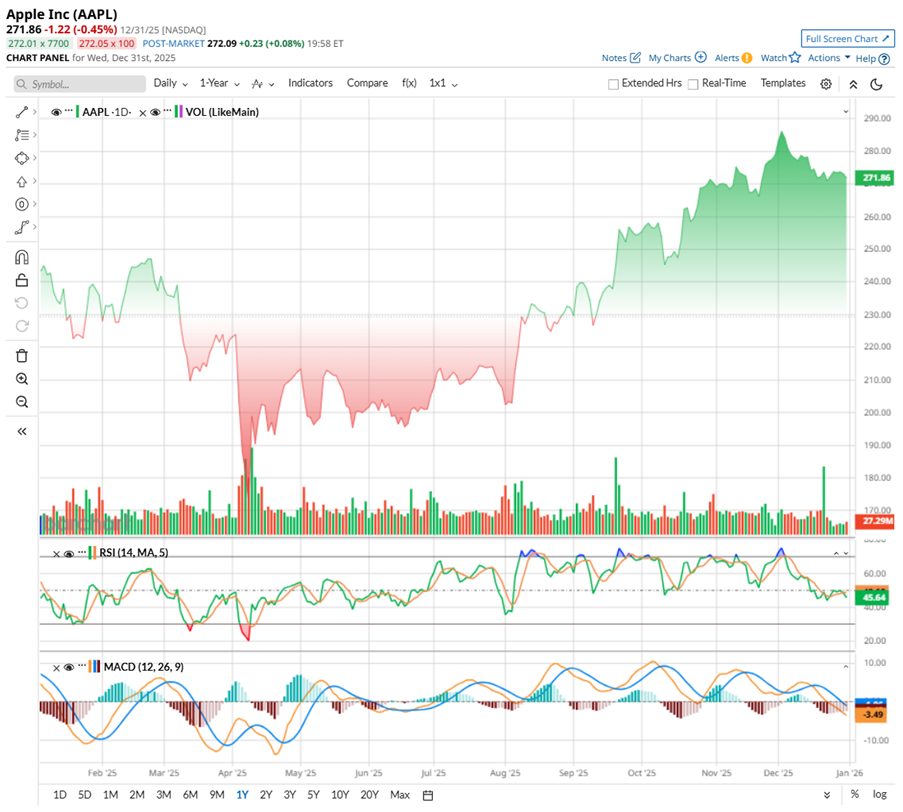

The chart tells a story of recovery forged through volatility. After sliding into the $200 zone in early August, AAPL found a firm footing and began a disciplined climb. Momentum carried the stock past $280 in December, peaking at $288.62 on Dec. 3 before profit-taking dragged it back toward the $270 range. Over the past month, shares have declined roughly 3% with volume thinning, suggesting hesitation rather than panic.

Technically, the tone has cooled. The 14-day RSI has retreated from December’s overbought territory and now hovers near the mid-40s, signaling fading momentum but not outright weakness. Meanwhile, the MACD oscillator signals caution. The yellow MACD line has slipped below the blue signal line, pointing to waning upside momentum after December’s sharp run. The histogram has dipped into negative territory, hinting at short-term consolidation rather than a decisive trend break.

Apple’s valuation is not cheap. Trading at roughly 33 times forward earnings and about 9.6 times sales, AAPL clearly wears a premium label. But in Apple’s case, that premium reflects durability, not excess. Investors are paying for an ecosystem that locks users in, a brand that commands global loyalty, and a business that delivers consistency at massive scale.

That confidence trickles down to shareholders, too. Apple has raised dividends for 13 consecutive years, and with just 13.6% of profits distributed as dividends, the firm retains substantial reserves. That low payout ratio hints at future increases, reminding investors that the company’s premium valuation is not only about what it is today, but about the firepower and consistency still ahead.

A Snapshot of Apple’s Q4 Results

Apple’s fourth-quarter earnings report, released on Oct. 30, was impressive. The company posted $102.5 billion in quarterly revenue, up 8% year-over-year (YOY), while adjusted EPS climbed to $1.85, comfortably ahead of expectations. Zooming out, Apple wrapped up the full year with $416.2 billion in revenue, marking a solid 6% annual increase in an environment that has not been kind to Big Tech optimism.

Digging into the mix, products still carried the weight, accounting for nearly 72% of sales and rising 5.4% YOY to $73.7 billion in Q4. But the real momentum came from Services. That segment jumped 15% annually to a record $28.75 billion, now making up more than 28% of total revenue — a steady reminder that Apple’s ecosystem is doing more heavy lifting with each passing quarter.

The iPhone remained the centerpiece, generating roughly $49 billion in revenue, up 6.1% and representing almost half of quarterly sales. Mac revenue surprised on the upside, climbing nearly 13% to $8.7 billion, while iPad and Wearables, Home & Accessories stayed largely flat, each hovering around $7 billion and $9 billion, respectively.

Apple’s balance sheet remains resilient. As of Sept. 27, 2025, the company held $132.4 billion in cash and marketable securities against total debt of about $98.7 billion. Shareholders were not forgotten either, with nearly $24 billion returned during the quarter through dividends and aggressive buybacks.

Looking ahead, Apple is striking a confident tone. Management expects 10% to 12% revenue growth in the holiday quarter (December quarter), driven by a projected double-digit jump in iPhone sales and what it calls its “best ever” December for the device. Gross margins are forecast between 47% and 48%, even as Apple continues investing heavily in AI and product development.

Analysts monitoring the company remain optimistic, predicting EPS to be around $8.11 for fiscal 2026, up 8.7% YOY, before surging another 12.5% annually to $9.12 in fiscal 2027.

What Do Analysts Expect for Apple Stock?

Raymond James has stepped back into coverage of AAPL stock with a “Market Perform” rating, striking a balanced and measured tone. The brokerage firm credits Apple’s rock-solid fundamentals, improving product cycles, and unmatched ecosystem, but argues that AAPL stock’s current valuation already prices in those strengths, leaving limited room for near-term upside.

Apple’s leadership in consumer hardware and services, and its famously sticky ecosystem, is not in question. Rather, it is well understood and broadly owned.

Raymond James also highlighted Apple’s perfect Piotroski Score of 9, a metric that gauges financial strength using profitability, leverage, liquidity, and operating efficiency, essentially acting as a clean bill of financial health. Still, with an installed base of roughly 2.4 billion active devices, the firm notes that incremental growth is becoming harder to move the needle at scale.

While the iPhone 17 refresh is being seen as relatively successful, with 2025 iPhone revenue estimated at $217 billion, Apple trades several turns above its five-year average earnings multiple. Services remains a bright spot, projected to grow at a 13% compound annual growth rate (CAGR) and approach 29% of revenue by 2027, but hardware cycles — especially the iPhone — still dominate performance. Add in tariff and supply-chain risks, and Raymond James sees no clear catalyst for sustained outperformance, justifying its neutral stance.

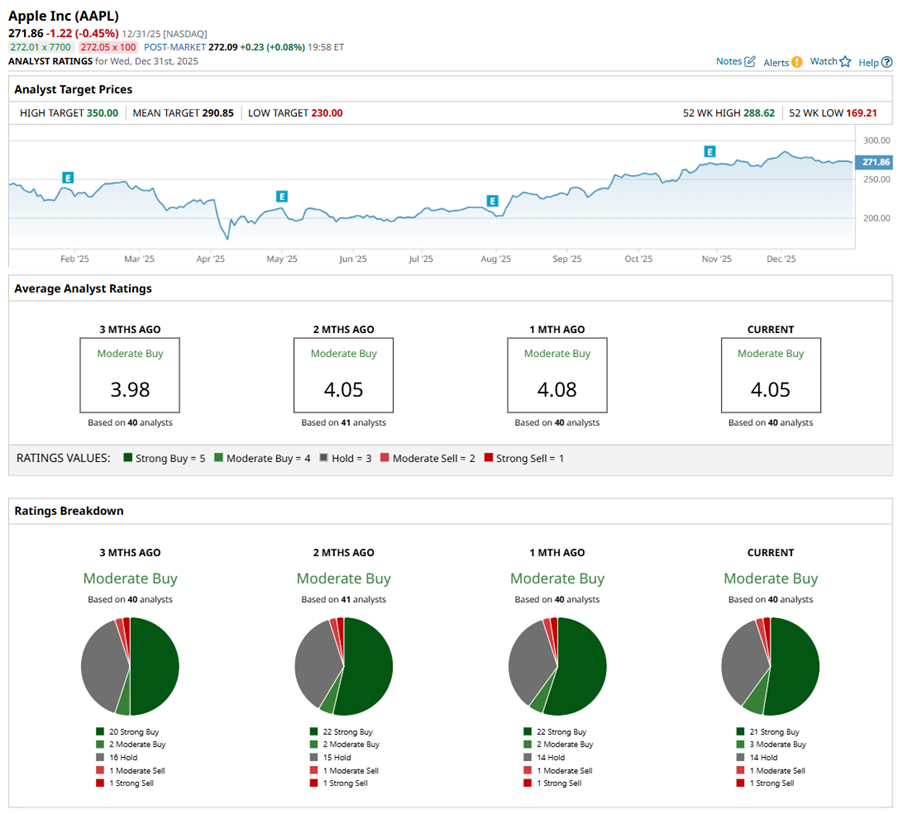

AAPL stock has a consensus “Moderate Buy” rating overall. Out of 41 analysts covering the tech stock, 21 recommend a “Strong Buy,” three give a “Moderate Buy,” 15 analysts stay cautious with a “Hold” rating, one has a “Moderate Sell” rating, and one analyst has a “Strong Sell” rating.

The average analyst price target for AAPL is $290.85, indicating potential upside of around 8% from here. However, the Street-high target price of $350 suggests that the stock could rally as much as 30%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Tesla’s Deliveries Have Fallen for 2 Years: Should TSLA Investors Even Care Amid the AI Pivot?

- Analysts Love Salesforce Stock and Are Raising Their Price Targets - How to Play CRM

- Why 1 Top Analyst Expects Apple Stock to Stagnate in 2026

- An Alzheimer’s Drug Could Supercharge This High-Risk Stock. Is It Worth a Buy Here?