Intel (INTC) shares have pushed higher in recent sessions as investors await the company’s launch of new PC processors at the annual CES event set to officially kick off on Jan. 6.

The said rally has pushed INTC past two of its major moving averages (20-day and 50-day), which is often interpreted in technical analysis as a bullish signal.

Versus its April low, Intel stock is up a whopping 120% at the time of writing.

Is It Worth Buying Intel Stock Here?

INTC stock remains attractive at current levels amidst what analysts describe as a “semiconductor supercycle” driven by unprecedented AI investment, moving beyond cyclical pattern into sustained growth territory.

Meanwhile, the aforementioned technical setup transitions Intel from a defensive posture to a more aggressive growth trajectory, potentially attracting momentum-driven buying from algorithmic trading systems and technical experts.

Beyond moving averages, the semiconductor giant’s long-term relative strength index (RSI) also currently sits at about 57 only, indicating the broader bullish momentum isn’t running out of juice just yet.

According to Barchart, bullish option traders also seem to believe that Intel will be trading at more than $47 by the end of April.

INTC Shares Have Secured Strategic Validation

While Intel’s fundamental challenges, including its continued struggle in winning foundry customers, temper the technical optimism, the company has, nonetheless, secured strategic validation through significant external support.

This includes a $5 billion investment from Nvidia (NVDA) and $8.9 billion federal support, underscoring INTC’s importance in the government’s commitment to onshoring semiconductor manufacturing.

Additionally, the Nasdaq-listed firm stands to benefit from Taiwan Semi’s (TSM) capacity constraints as well as hyperscalers like Google (GOOGL) and Apple (AAPL) explore manufacturing alternatives for supply chain diversification.

All in all, Intel shares currently present an intriguing but complex opportunity for momentum-focused investors willing to accept sector volatility and the company’s execution risks.

Wall Street Remains Cautious on Intel

Despite an attractive technical setup and positive fundamental developments, Wall Street analysts continue to warrant caution in playing INTC shares in 2026.

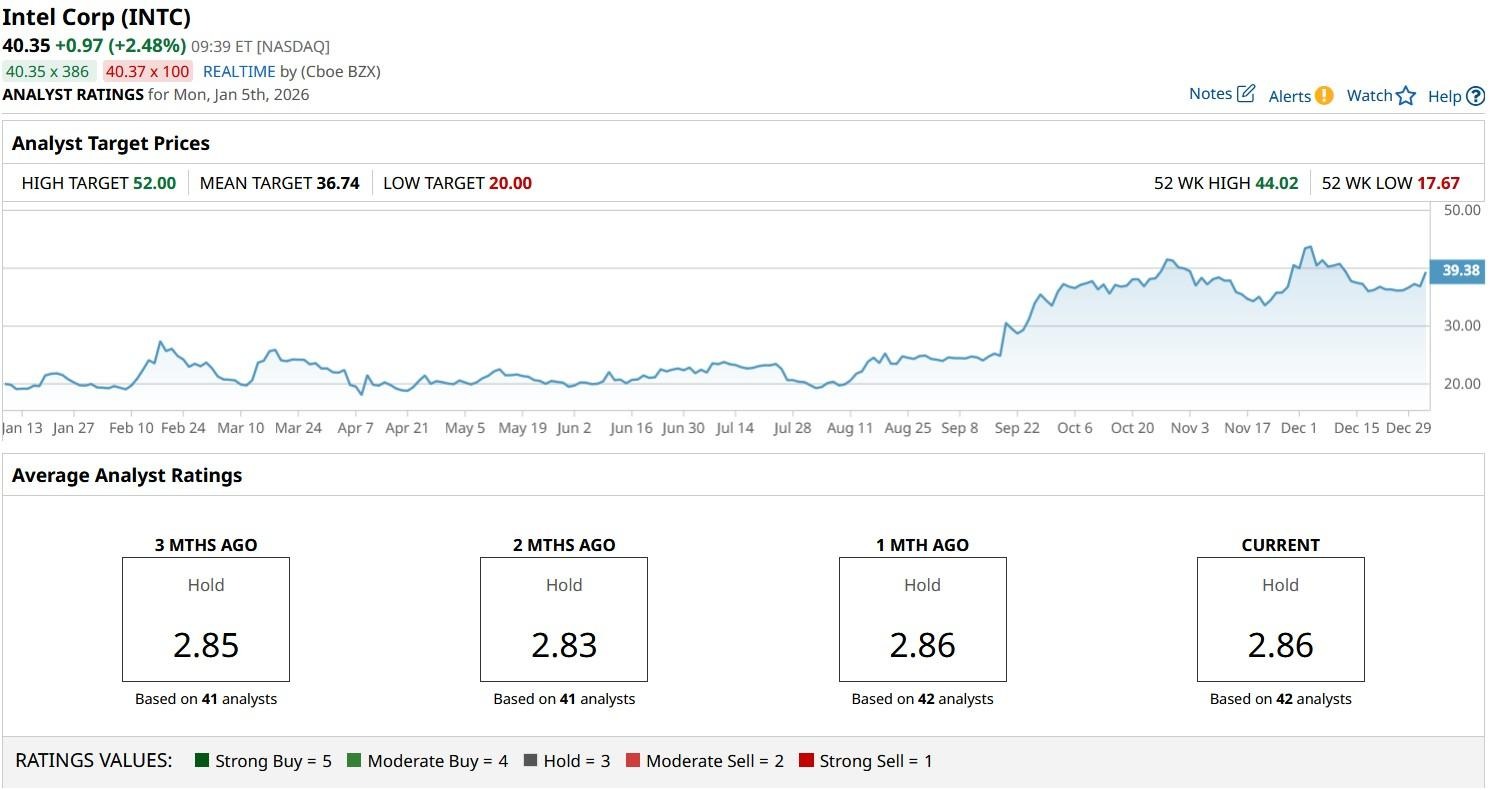

The consensus rating on Intel stock currently sits at “Hold” only with the mean target of about $37 indicating nearly 10% downside from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Halliburton Stock Just Pushed into Overbought Territory Amid Venezuela Tumult. Is There Still Time to Buy HAL?

- Betting on Popular 2025 ETFs Could Produce Wicked Results in 2026. Don’t Get Caught Chasing the Hype.

- Warren Buffett’s Legacy Includes an Emphasis on Industrials. This ETF Reminds Us Why.

- 2025 Wasn’t an Easy Year for Tesla Stock, but Baird Says It’s a ‘Core Holding’ for 2026 Anyways