In a market still captivated by the promise of artificial intelligence (AI), trade is broadening beyond mega-cap tech. While giants like Nvidia (NVDA) , Microsoft (MSFT) , and Alphabet (GOOGL) still anchor markets, investors are rotating into the next wave of AI beneficiaries.

Amid this evolving landscape, ServiceNow (NOW) stands out. As a backbone for automated digital workflows and enterprise AI tools from IT operations to HR and customer service, ServiceNow is positioning itself not just as a software vendor but as a platform enabling AI adoption at scale.

Despite near-term caution, investors believe the AI software story remains intact, with names like NOW stock viewed as compelling long-term opportunities. Notably, software stocks lagged the broader market in 2025, making valuations more attractive.

About ServiceNow Stock

ServiceNow is a leading enterprise software company that provides a cloud-based platform for automating and managing digital workflows across IT service management, customer service, human resources, security, and other business functions. The company is headquartered in Santa Clara, California and has a market capitalization of $153 billion, reflecting its position as one of the most valuable enterprise software providers globally with strong recurring revenue and broad adoption among large organizations.

ServiceNow’s share price has underperformed in 2025, with NOW stock down by around 30% over the past year, lagging the broader S&P 500 Index’s ($SPX) 17% gains and indicating notable investor caution. The stock is currently down 39% from its 52-week high of $239.62, reached in late January 2025, reflecting shifting sentiment.

Macroeconomic headwinds like tariff-related uncertainty and cautious enterprise IT spending have also dampened enthusiasm. Additionally, competitive pressures in AI workflows from larger rivals have amplified the selloff. More recently, share prices fell amid market reactions to ServiceNow’s reported large acquisition plan (the Armis cybersecurity deal) and resulting investor worry about strategic direction and capital allocation.

NOW stock is trading at 65 times forward earnings, which is higher than the sector median but below its own historical average.

ServiceNow Is Advancing Its AI Story

In 2025, ServiceNow has significantly accelerated its AI strategy by turning its workflow platform into a truly AI-driven enterprise engine, expanding both the depth and reach of its capabilities across customers and partners. A central pillar of this growth has been the rollout of a reimagined ServiceNow AI Platform, which unifies data, intelligence, and orchestration to help companies scale AI beyond pilots into real business value, including the introduction of centralized tools like AI Control Tower to manage and govern AI agents and models on a single platform.

ServiceNow has also embraced agentic AI as a differentiator, embedding thousands of pre-configured AI agents across workflows, enabling automation of complex tasks with minimal human intervention and boosting operational productivity. It extended this vision further with agentic workforce management, allowing employees and AI agents to work together seamlessly, expanding the practical impact of AI on everyday business execution.

Strategic partnerships and ecosystem expansion are additional growth drivers. ServiceNow deepened collaboration with companies like NTT DATA to co-develop and deploy AI-powered enterprise solutions globally, positioning the ServiceNow AI Platform as a cornerstone for large-scale AI transformation. Furthermore, the company has introduced AI incentives within its partner programs to accelerate adoption and broaden its market footprint.

Steady Q3 Results

In the third quarter 2025, ServiceNow reported robust financial results that reflected continued demand for its cloud-based and AI-enhanced workflow platform. The company released its third-quarter earnings on Oct. 29. Subscription revenues climbed to $3.3 billion, up 21.5% year-over-year (YOY), while total revenues reached $3.4 billion, marking a 22% increase compared with the same quarter in 2024.

Current remaining performance obligations (cRPO), a key indicator of future revenue, were $11.4 billion, up 21% YOY. Total RPO grew by around 24%, signaling strong backlog and contract strength. Adjusted EPS came in at $4.82, a 30% rise YOY, beating consensus estimates and highlighting strong profitability expansion.

ServiceNow raised its full-year 2025 guidance, increasing its subscription revenue outlook to $12.835 billion to $12.845 billion and forecasting margin expansion, including a targeted 31% non-GAAP operating margin and 34% free cash flow margin, reflecting confidence in continued growth and operational leverage. Q4 guidance called for subscription revenues in the $3.42 billion to $3.43 billion range with sustained YOY growth.

Analysts tracking NOW stock project the company’s EPS to rise 36% YOY to $1.96 in fiscal 2025, then grow another 21% to $2.37 in fiscal 2026.

What Do Analysts Expect for ServiceNow Stock?

Last month, Bernstein SocGen reiterated its “Outperform” rating on ServiceNow stock, despite volatility tied to potential acquisition concerns. Citizens also reiterated its “Market Outperform” rating on ServiceNow.

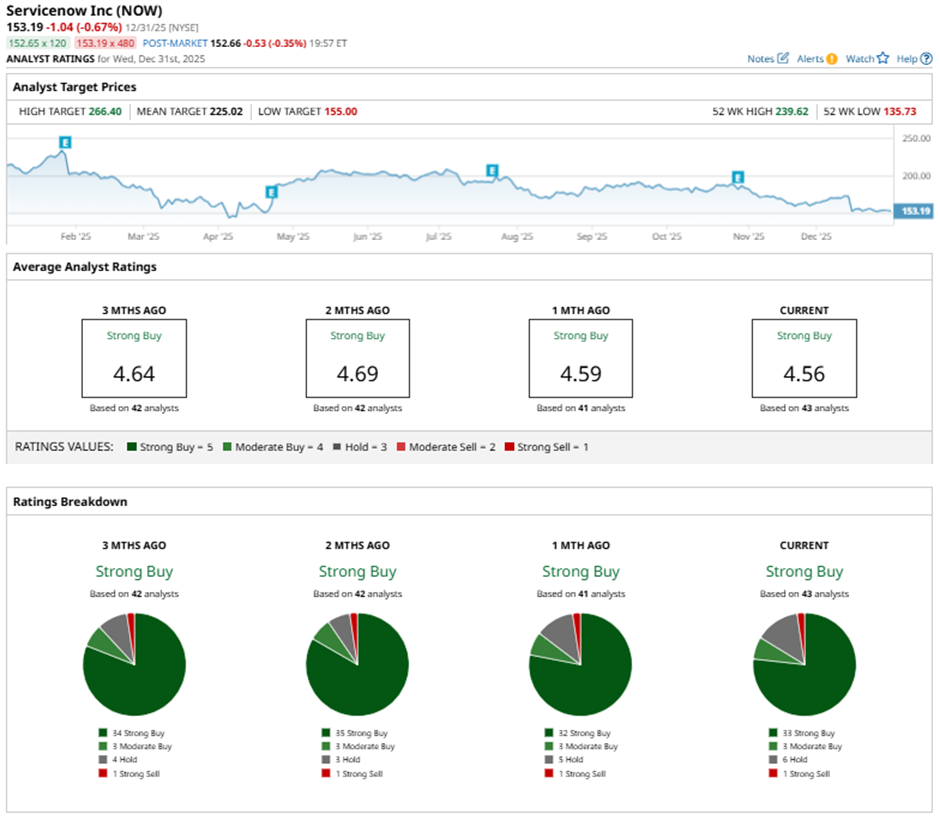

NOW stock has a consensus rating of a “Strong Buy” overall. Of the 43 analysts covering the stock, 33 advise a “Strong Buy,” three suggest a “Moderate Buy,” six analysts give it a “Hold” rating and one has a “Strong Sell.”

While NOW stock’s average price target of $225.02 suggests potential upside of 53%, the Street-high target of $266.40 signals that the stock could rise as much as 81% from current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart