Savvy investors often eye the biotech sector for growth stocks with the potential for enormous gains. Artificial intelligence (AI) has significantly boosted the odds of medical breakthroughs in gene therapy, cancer, rare disease therapeutics, and RNA-based medications. Clinical-stage biotech companies, in particular, have one or more drugs in clinical trials, which, when successful, has the potential to cause the company’s stock to skyrocket.

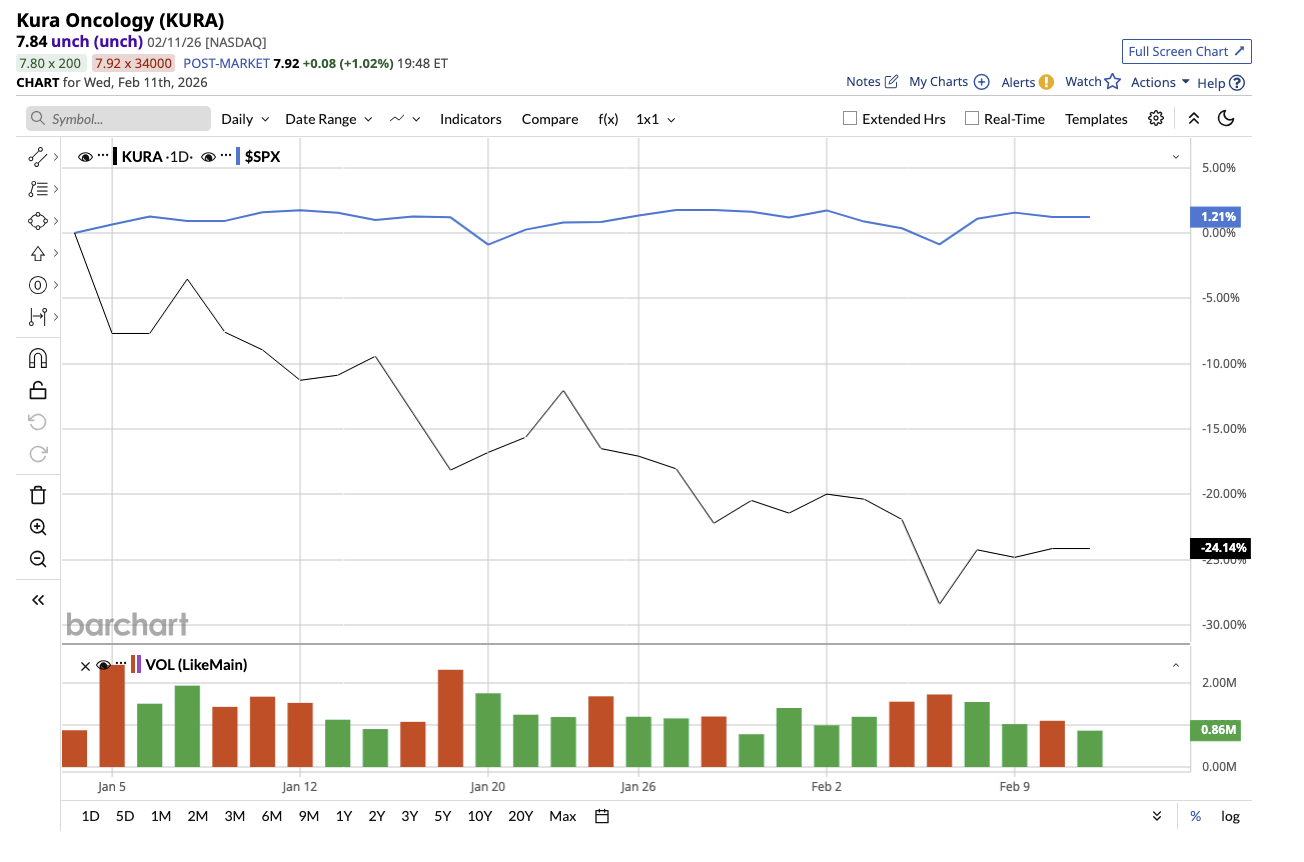

One such company is Kura Oncology (KURA), which has transitioned recently from a clinical-stage to a commercial-stage biotech company now that the U.S. Food and Drug Administration (FDA) has approved one of its cancer drugs. While the stock is down 24% year-to-date (YTD), Wall Street believes Kura stock has the potential to surge as high as 850% in 2026.

What is The Target Price for Kura Stock?

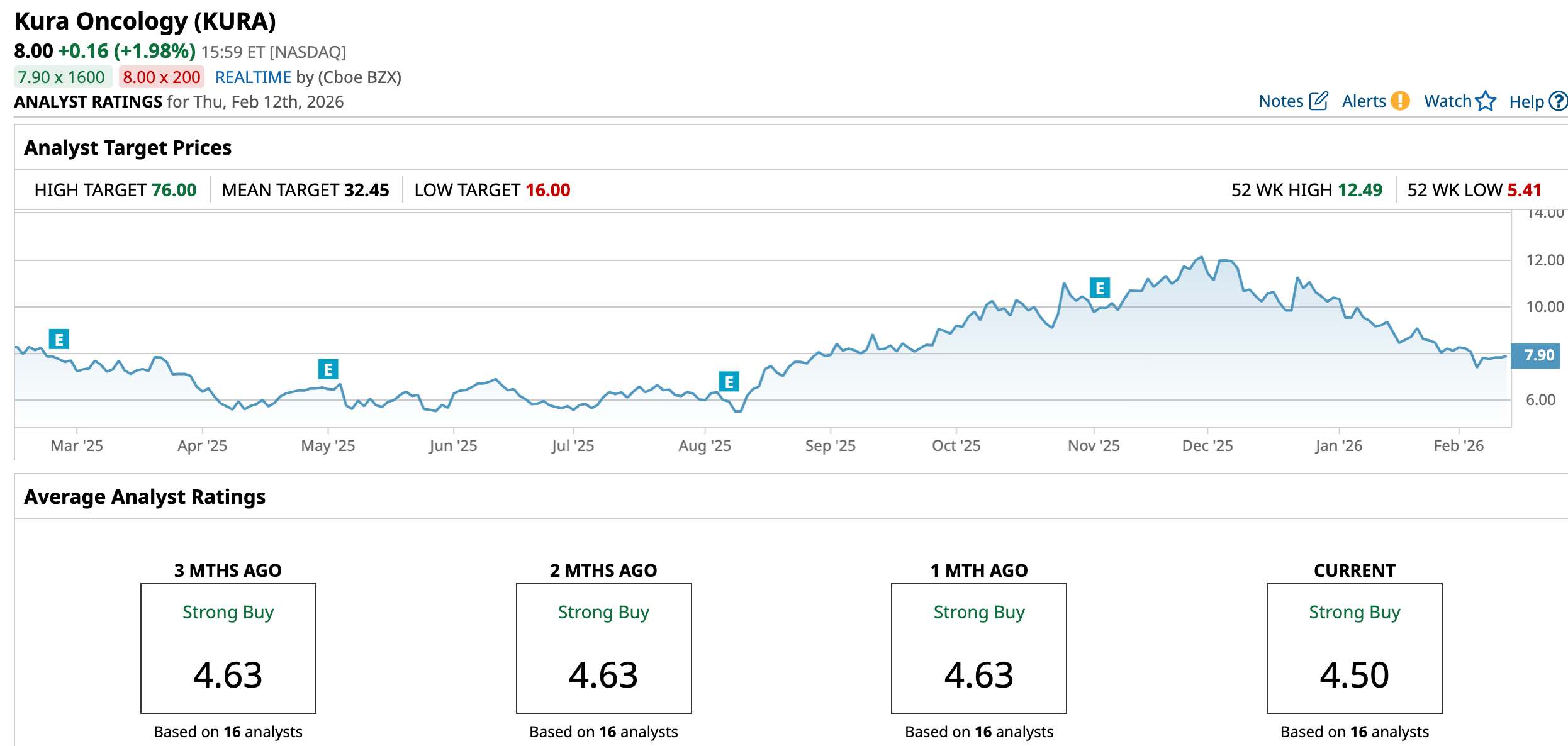

Analysts have assigned $32.45 as the average target price for Kura stock. This suggests that the stock has the potential to surge by more than 311% from current levels. Furthermore, its Street-high estimate of $76 implies that the stock has a potential upside of 864% in the next 12 months.

While these gains seem unattainable, several biotech stocks have given such returns to investors when their drugs hit the market. Even a single drug can make the company a commercially successful company. One classic example of that is Moderna (MRNA), whose COVID-19 vaccine made its stock surge 1,227% between 2020 and 2022.

A Recent Approval That Changed The Story For This Clinical-Stage Biotech

Valued at $682.2 billion, Kura Oncology develops new targeted small-molecule drugs designed to treat cancer by blocking specific genetic or molecular pathways that help cancer grow. On Nov. 13, 2025, the FDA granted full approval to Kura’s lead candidate, KOMZIFTI (ziftomenib). The drug is used to treat adult patients with relapsed or refractory acute myeloid leukemia (AML) who have a susceptible NPM1 mutation and no other treatment choices.

According to the company, NPM1 mutations occur in around 30% of AML cases, and statistics show that many patients reverted despite responding to frontline therapies. As a result, this drug will address an important unmet need. This approval also marks Kura’s successful transformation from a clinical-stage biotech to a commercial-stage oncology company.

Soon after the approval, Kura initiated the U.S. commercial launch of the drug, which brought in a $135 million milestone payment under the company’s collaboration agreement with Kyowa Kirin. Initial sales results have been modest yet meaningful. During the five-week period from Nov. 21 to Dec. 31, 2025, Kura reported $2.1 million in net product revenue. The company expects collaboration revenue between $15 million and $17 million in the fourth quarter. This modest revenue will turn into recurring revenue quarter by quarter, eliminating the need for external funding, a critical milestone for a newly commercialized biotech company.

Why Wall Street Expects Such Huge Upside

Wall Street's optimism is not just based on KOMZIFTI's success. Much of the predicted upside stems from continued expansion potential, which could open up new markets for KOMZIFTI. Kura is conducting a Phase 3 KOMET-017 trial to assess ziftomenib in conjunction with intense and non-intensive chemotherapy in newly diagnosed AML patients, which represents more than half of all AML cases.

Second, the KOMET-007 trial is currently investigating combinations of venetoclax and azacitidine chemotherapy in both newly diagnosed and recurrent patients. Additional trials are being conducted to assess combinations with FLT3 inhibitors such as quizartinib and gilteritinib. Any positive results from these trials could elevate KOMZIFTI from a novel drug to a larger standard-of-care alternative.

Aside from ziftomenib, Kura is developing other oncology initiatives, such as farnesyl transferase inhibitors and next-generation menin inhibitors, as well as investigating applications outside of oncology, such as possible cardiometabolic and diabetic indications.

Currently, Kura is in a healthy financial position, which may explain analysts' belief in tremendous upside potential. The partnership with Kyowa Kirin reduces commercialization risk outside the U.S. while providing milestone payments and shared development responsibilities. At the end of the third quarter, Kura had $667.3 million in cash, cash equivalents, and short-term investments. Management expects this capital, along with collaboration payments and anticipated product revenue, will support operations through key Phase 3 readouts and ongoing development programs.

The Bottom Line on Kura Stock

Kura has now transitioned to an emerging oncology growth story from a clinical-stage biotech. Importantly, Kura has multiple programs in its pipeline, indicating that the business is not reliant on a single product and that oncology treatments can continue to deliver blockbuster sales.

While the company has an approved drug on the market generating revenues, it could be a while before it starts generating real profits. It still has a clinical-stage pipeline that will necessitate ongoing investments, with the majority of its growth based on ongoing clinical trials and pipeline research. Therefore, it still remains a risky biotech stock best suited for investors with the stomach to bear the risks and a long-term investment horizon.

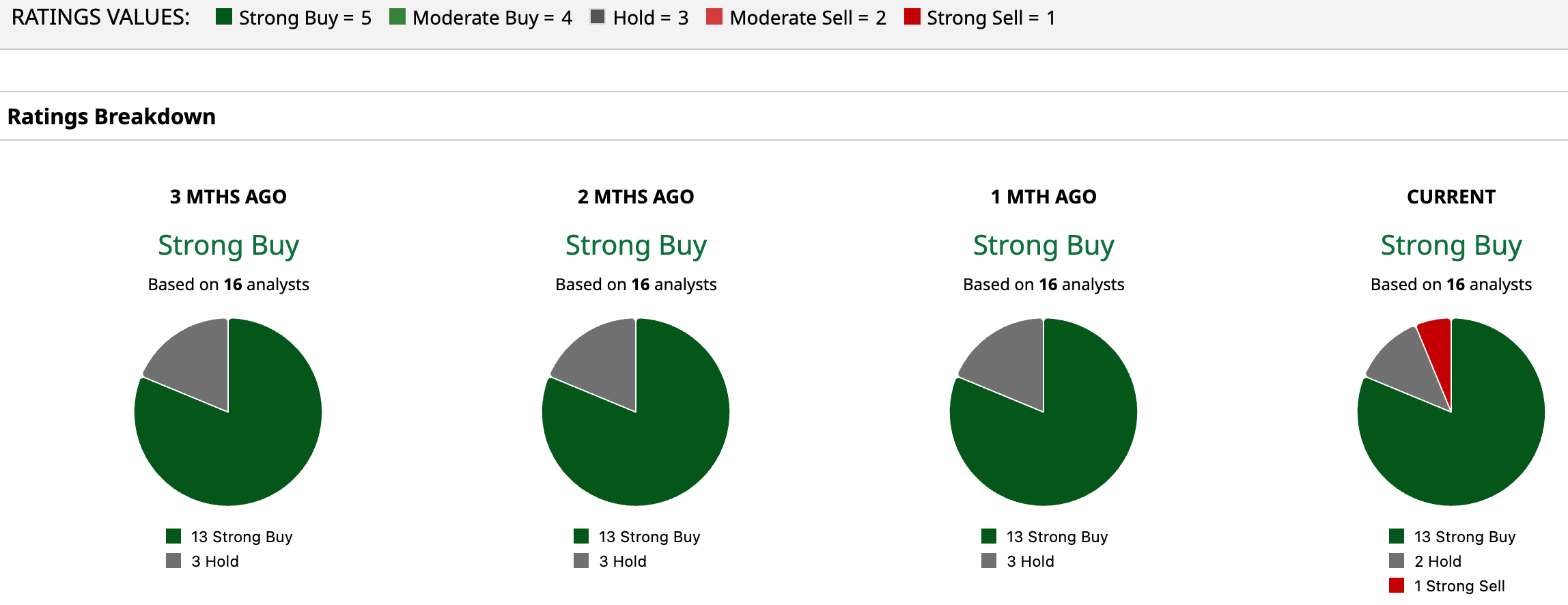

Overall, the consensus for KURA stock is a “Strong Buy.” Among the 16 analysts covering the company, 13 give it a “Strong Buy” rating, two recommend a “Hold,” and one suggests a “Strong Sell.” And with the Street high of $76, the stock can skyrocket 850% from here.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart