Shares of Qualcomm (QCOM) have struggled so far this year, with the stock down more than 18% year-to-date (YTD) and nearly 32% below its 52-week high. Despite the significant pullback, unfavorable industry dynamics around memory supply could weigh on QCOM’s earnings. With sentiment already negative, the possibility of the stock revisiting its two-year low of $120.80 cannot be ruled out.

Qualcomm’s Q1 Surpasses Street’s Forecast

Qualcomm delivered better-than-expected Q1 financial numbers. Revenue of $12.3 billion rose 5% YoY and slightly exceeded consensus expectations, reflecting steady demand across key end markets. The Qualcomm Technology Licensing (QTL) segment delivered $1.6 billion in revenue with a strong EBT margin, supported by higher unit volumes and a favorable product mix.

The core Qualcomm CDMA Technologies (QCT) business posted revenue of $10.6 billion, driven by demand across smartphones, automotive, and IoT markets. Handset revenues within QCT climbed to a record $7.8 billion, benefiting from the launch cycle of premium flagship devices. IoT revenue grew 9% YoY to $1.7 billion, driven by consumer and networking applications, while automotive revenue reached $1.1 billion, up 15%, as adoption of Snapdragon Digital Chassis platforms accelerated.

Its adjusted EPS of $3.50 rose 3% YoY and surpassed expectations.

Guidance Delivers the Real Blow to QCOM Stock

The market’s negative reaction to QCOM stock reflects management’s weak guidance. Management guided for second-quarter revenue of $10.2 billion to $11 billion and adjusted EPS of $2.45 to $2.65, both below Wall Street expectations. This raised concerns that near-term headwinds will likely weigh on its growth.

The most significant challenge impacting Qualcomm's growth is the uncertainty in global memory markets. Surging demand for memory solutions, led by AI data centers, has diverted supply away from smartphones, driving higher prices for handset manufacturers. This has been especially disruptive in China, where OEMs are responding by scaling back production plans and tightening inventory management.

While Qualcomm maintains that the fundamental demand environment for handsets remains intact, highlighting better-than-expected global shipments in the December quarter and a strong Snapdragon design win pipeline, the near-term outlook remains cautious. OEMs are adjusting build plans downward to manage cost pressures, and Qualcomm is seeing reduced chipset orders as a result.

For the second quarter, Qualcomm forecasts QCT handset revenues of $6 billion, reflecting a sharp sequential decline. While management expects QCT handset revenues to return to their prior growth trajectory once memory supply and pricing normalize. However, until visibility into memory availability improves and OEM production plans stabilize, Qualcomm’s earnings may remain under pressure. That uncertainty helps explain why the shares have continued to slide despite solid underlying execution.

Growth Engines Emerge Beyond Handset Revenues

While the company’s handset revenues could continue to face near-term pressure, management has pointed to meaningful strength in other businesses.

Qualcomm’s QCT IoT revenue is projected to grow by a low teens percentage YoY. That growth will likely be driven by expanding demand across both industrial and consumer IoT applications. Further, the momentum in the QCT automotive business will be sustained. Qualcomm anticipates YoY revenue growth accelerating to more than 35% in the second fiscal quarter.

The Bottom Line on QCOM

From a valuation standpoint, QCOM stock appears inexpensive at 16.3 times forward earnings. However, that multiple fails to attract. Analysts expect QCOM’s earnings to decline 14.7% in fiscal 2026, and there is still limited visibility into a meaningful reacceleration in fiscal 2027. With handset revenues under pressure and earnings momentum weakening, Qualcomm's stock could still remain under pressure.

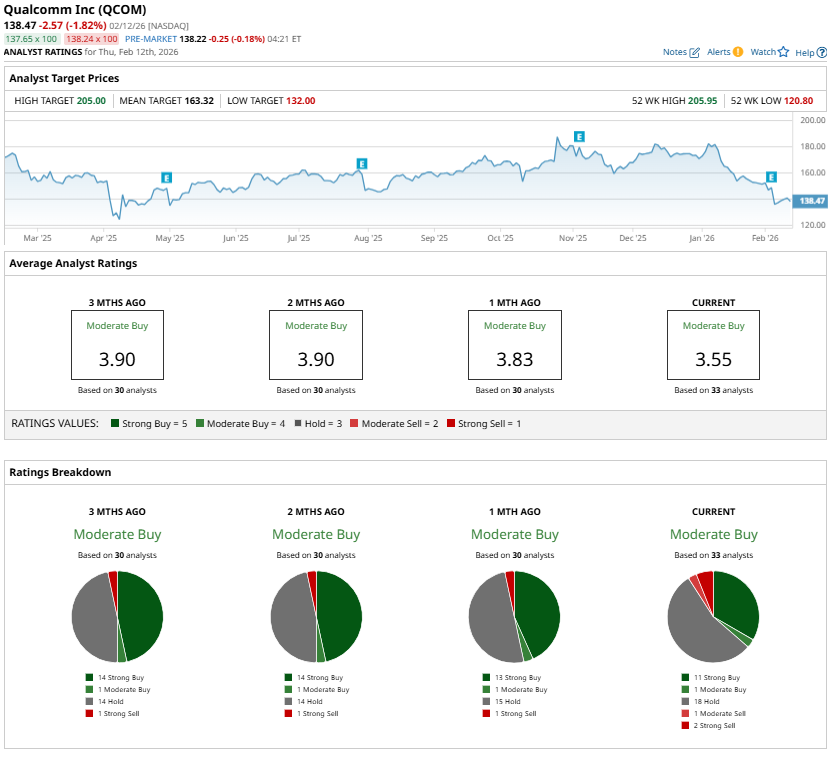

Analysts maintain a “Moderate Buy” consensus rating on QCOM stock. However, if memory constraints persist longer than expected, the risk of Qualcomm shares drifting toward their two-year low increases.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart