Over the past year, Cipher Mining (CIFR) has shifted its narrative from being seen as a volatile crypto miner to an emerging artificial intelligence (AI) and high-performance computing (HPC) infrastructure player. In a market obsessed with AI capacity and power-hungry data centers, that pivot has reshaped investor perception, and sentiment has turned increasingly bullish.

Even as cryptocurrencies face uneven momentum now, Cipher has continued to benefit from the broader AI infrastructure trade. And now, the attention shifts to its fiscal fourth-quarter and full-year 2025 results, due before the market opens on Tuesday, Feb. 24. The update could serve as a key catalyst, offering fresh clarity on whether Cipher’s AI-driven transformation still has momentum.

About Cipher Mining Stock

Founded in 2021, New York-based Cipher Mining started out as a large-scale Bitcoin miner, building high-powered facilities designed to secure the network and generate digital assets. Today, with a market capitalization of roughly $6.4 billion, the company still mines Bitcoin, but its ambitions have expanded far beyond crypto.

Cipher is rapidly evolving into a broader digital infrastructure player, developing and operating industrial-scale data centers that not only power its mining operations but also support high-performance computing workloads, including AI. In other words, what began as a pure-play crypto story is steadily transforming into an AI-driven infrastructure narrative. That evolution into an AI infrastructure story is exactly why Cipher has delivered such outsized returns.

The stock has surged 174.58% over the past year, massively outperforming the broader S&P 500 Index ($SPX), which is up just 11.79% in 2025. Momentum remains firmly on its side. Shares have gained 11.25% year-to-date (YTD), and a recent bullish call from Morgan Stanley has added fresh fuel to the rally. Over the last five trading days alone, Cipher has jumped an impressive 11.47%, once again leaving the broader market’s marginal advance in the rearview mirror.

Cipher Mining Q3 Earnings Snapshot

When Cipher Mining released its fiscal 2025 third-quarter earnings on Nov. 3, the numbers technically missed Wall Street expectations across the board. But the market’s reaction told a very different story. Instead of focusing on the shortfall, investors zeroed in on the bigger picture and sent the stock soaring 22% in a single session. Despite the earnings miss, the headline figures were hard to ignore.

The report underscored that Cipher has evolved beyond a pure-play Bitcoin miner into a scaled infrastructure provider serving AI HPC workloads. On the mining front, growth was explosive. Bitcoin mining revenue nearly tripled year-over-year (YOY), jumping from $24.1 million to $71.7 million. Production followed suit.

Cipher self-mined 689 bitcoins in the third quarter of 2025, a 35% increase from 509 bitcoins in the second quarter, fueled by the first full quarter of production at its Black Pearl site, which boosted both capacity and efficiency. Profitability was just as impressive. Adjusted EPS came in at $0.10, a sharp turnaround from a $0.01 per-share loss a year earlier. Meanwhile, the balance sheet strengthened dramatically. Cash and cash equivalents swelled to $1.2 billion as of Sept. 30, compared to just $62.7 million on June 30.

The true highlight of the report was the company’s execution of transformative hosting agreements with major tech giants. Cipher executed a landmark 15-year lease agreement with Amazon Web Services (AMZN) for 300 megawatts of capacity, a contract expected to generate roughly $5.5 billion in revenue.

That announcement was paired with the finalization of a 10-year, $3 billion hosting agreement with Fluidstack, notably backstopped by Alphabet (GOOG) (GOOGL). Now, with fourth-quarter results set to arrive later this month, investors will be watching closely to see what comes next, and whether this momentum story has another chapter ready to unfold.

How Are Analysts Viewing Cipher Mining Stock?

On Feb. 9, shares of Cipher Mining surged nearly 13.8% after Morgan Stanley initiated coverage with an “Overweight” rating and a $38 price target. Morgan Stanley isn’t viewing Bitcoin miners as speculative crypto bets. Instead, it’s analyzing them through an infrastructure asset lens, especially once they’ve built large-scale data centers backed by long-term leases with creditworthy counterparties.

In other words, once companies like Cipher lock in stable, multi-year contracts, they start to look less like volatile Bitcoin plays and more like infrastructure platforms capable of generating predictable cash flows. The bank argues that Bitcoin companies with established, contracted data centers should naturally attract infrastructure-focused investors, the kind who prioritize steady, long-term returns, rather than traditional crypto traders chasing price swings.

To illustrate the point, Morgan Stanley compares Cipher’s evolving model to data center REITs such as Equinix (EQIX) and Digital Realty (DLR), which trade at more than 20x forward EV/EBITDA. While it acknowledges that Bitcoin-linked data centers likely won’t command those same premium multiples due to somewhat lower growth visibility, the comparison signals a meaningful potential re-rating opportunity.

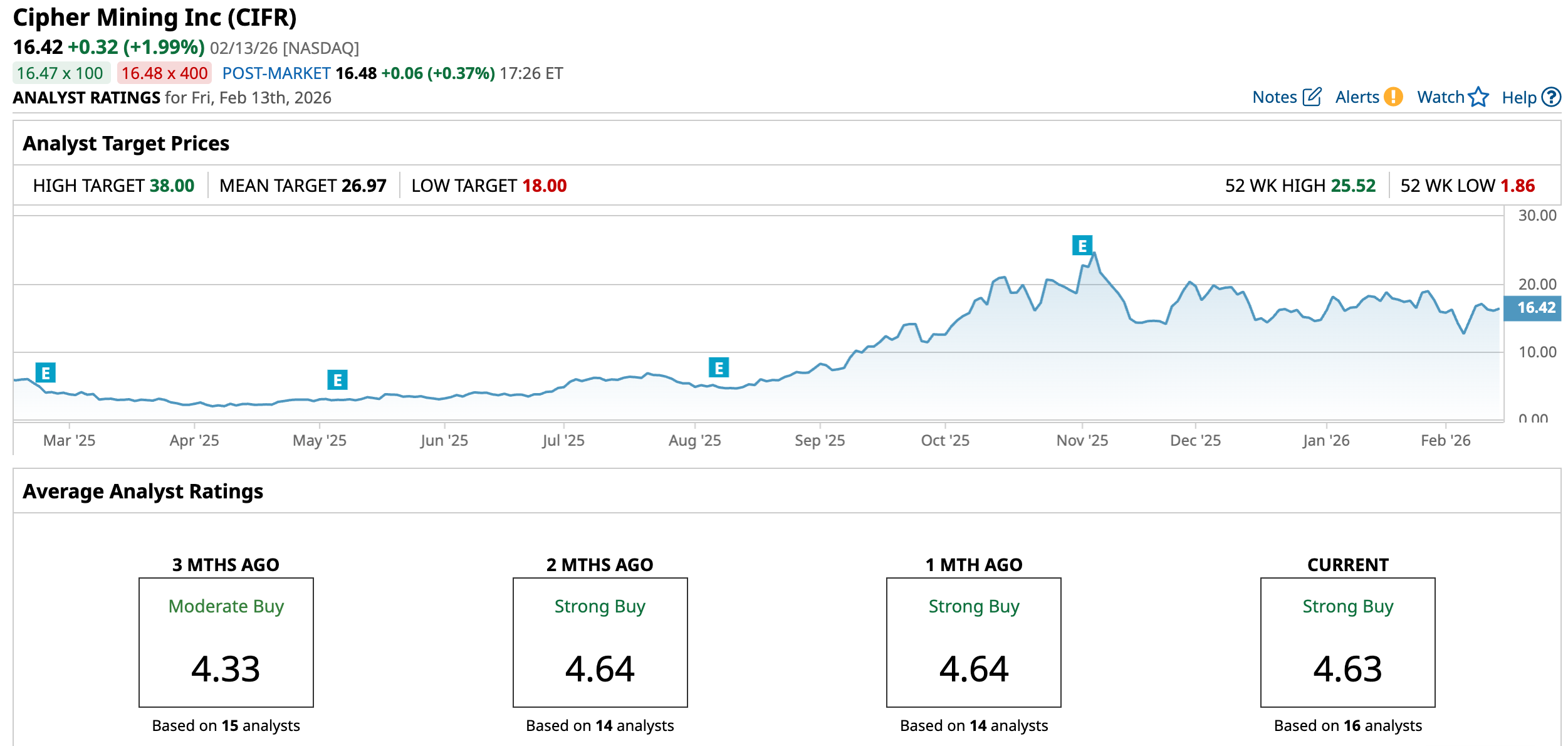

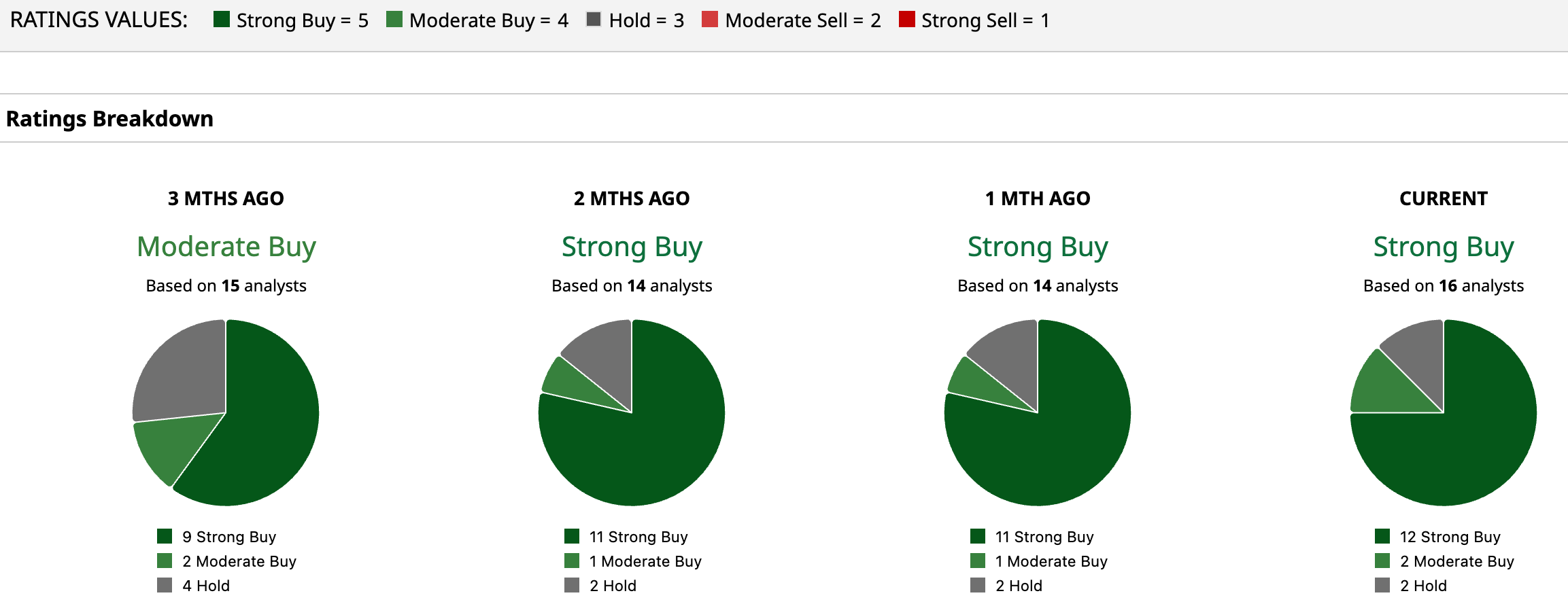

Ahead of the company’s upcoming report, Wall Street’s confidence in Cipher Mining remains firmly intact. The stock currently carries a consensus “Strong Buy” rating, a clear sign that analysts see further upside ahead. Out of 16 analysts covering the name, 12 rate it a “Strong Buy,” two recommend a “Moderate Buy,” and only two sit on the sidelines with a “Hold.”

The average price target of $26.97 implies roughly 64.25% upside from current levels. And then there’s Morgan Stanley, which set a far more ambitious $38 target, suggesting the stock could surge as much as 131.4% from here.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Cipher Mining Stock Fans, Mark Your Calendars for February 24

- Why Wedbush Thinks Norway Could Be Key for This Quantum Computing Stock -- and the Entire Industry

- The Saturday Spread: Maximizing First-Order Analytics to Help Even the Odds

- Is This Metal the Next Big Thing After a Record Silver Rally? 1 ETF to Buy Now.