GE Aerospace (GE) is a leading aerospace manufacturer specializing in the design, production, and servicing of commercial and military aircraft engines, integrated propulsion systems, and related aviation technologies. Headquartered in Evendale, Ohio, the company serves global commercial airlines, defense customers, and general aviation markets. GE Aerospace has a market cap of around $326.9 billion, making it one of the largest industrial and aerospace firms.

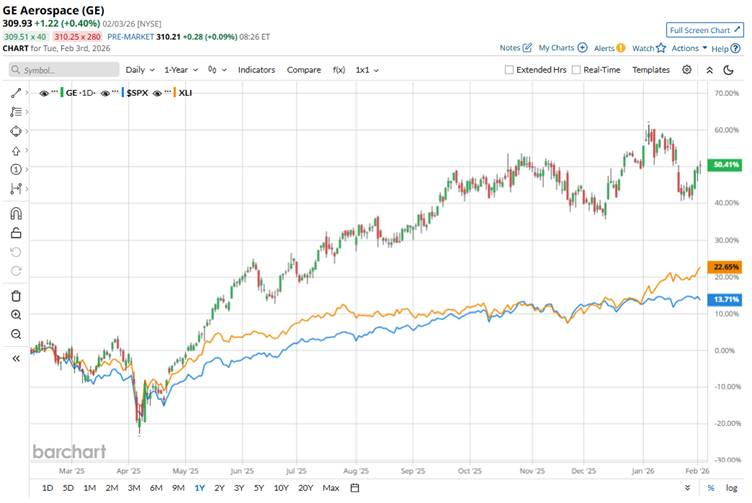

The aerospace and defense giant has notably outperformed the broader market over the past year. The stock has soared 51.8% over the past 52 weeks and marginally on a YTD basis, compared to the S&P 500 Index’s ($SPX) 15.4% gains over the past year and 1.1% returns on a YTD basis.

Narrowing the focus, GE Aerospace stock has also outperformed over the past year but lagged behind in terms of YTD performance, compared to the State Street Industrial Select Sector SPDR ETF’s (XLI) 23.3% surge over the past 52 weeks and 8.9% gains in 2026.

GE Aerospace’s stock has climbed due to strong financial performance and robust demand in the aerospace sector. The company has consistently beaten earnings expectations, driven by surging orders and a record backlog.

In Q4 2025, GE Aerospace reported total orders of $27 billion, a 74% year-over-year surge, reflecting very strong demand across its segments. This robust order intake helped propel the company’s total year-end backlog to roughly $190 billion.

For the full fiscal 2026, analysts expect GE to report an EPS of $7.45, up 17% year-over-year. Further, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

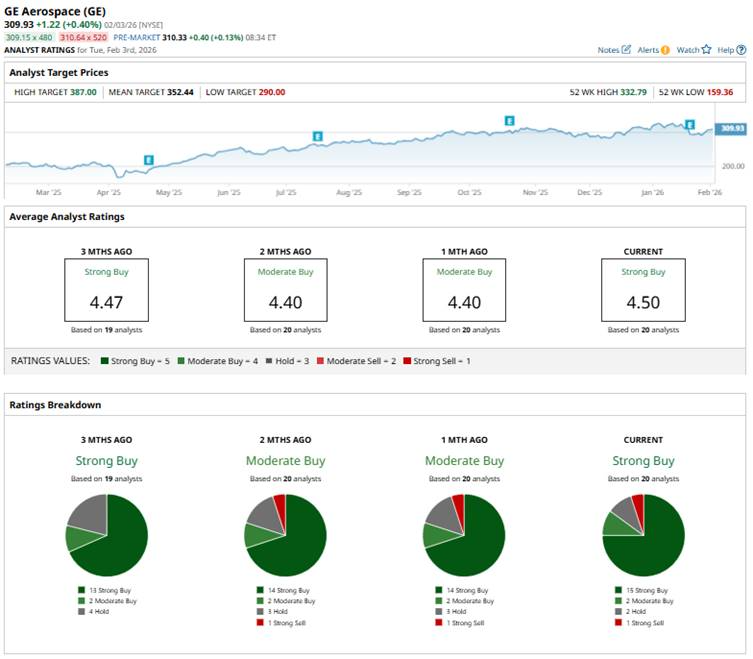

The stock has a consensus “Strong Buy” rating overall. Of the 20 analysts covering the stock, opinions include 15 “Strong Buy” ratings, two “Moderate Buys,” two “Holds,” and one “Strong Sell.”

The configuration is more bullish than two months ago, when there were 14 “Strong Buy” ratings and an overall “Moderate Buy.”

Last month, UBS raised its price target on GE Aerospace to $374 from $368 while maintaining a “Buy” rating, citing solid underlying fundamentals.

GE’s mean price target of $352.44 represents a 13.7% premium. Meanwhile, the Street-high target of $387 suggests a notable 24.9% upside potential from current price levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Qualcomm Stock Fans, Mark Your Calendars for February 4

- Palantir CEO Alex Karp Says ‘Inexplicable Growth in Revenue, but Not Inexplicable Growth in Customers’ Is Ahead. What Does That Mean for PLTR Stock?

- FuboTV Stock Plunges Deep Into Oversold Territory on Reverse Stock Split News. Should You Buy the Dip?

- Even More Layoffs Are Coming at Amazon. What Does That Mean for AMZN Stock?