Single family construction feeling brunt of higher material prices

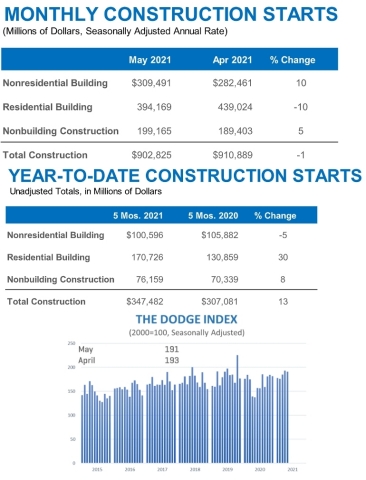

Total construction starts dropped 1% in May to a seasonally adjusted annual rate of $902.8 billion, according to Dodge Data & Analytics. The brunt of the decline was borne by residential starts, while nonresidential and nonbuilding starts continued their recovery from the COVID-19 pandemic.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210616005187/en/

May 2021 Construction Starts (Graphic: Business Wire)

“The weight of higher material prices and a lack of skilled labor are having a direct and notable influence on residential construction activity,” said Richard Branch, Chief Economist for Dodge Data & Analytics. “These negative factors are expected to continue to impact the sector over the remainder of the year and will result in a less positive influence from housing on overall levels of construction activity. While feeling similar effects, the nonresidential sector continues its modest recovery off the lows of last summer. There are enough projects in the planning pipeline to suggest this trend should continue into next year, but higher material prices will result in longer lead times to groundbreaking and more temperate improvements in nonresidential starts.”

Below is the full breakdown:

-

Nonbuilding construction starts rose 5% in May to a seasonally adjusted annual rate of $199.2 billion. The utility and gas plant category increased 22% due to the start of a large transmission line, while highway and bridge starts rose 9% and environmental public works moved 8% higher. The miscellaneous nonbuilding category lost 33% in May. Year-to-date through the first five months of 2021, total nonbuilding starts were 8% higher than in 2020. Environmental public works were up 37%, while utility/gas plant and miscellaneous nonbuilding starts were up 25% and 11%, respectively. Highway and bridge starts were down 10% through five months.

For the 12 months ending May 2021, total nonbuilding starts were 5% lower than the 12 months ending May 2020. Environmental public works starts were 18% higher, while utility and gas plant starts were down 23%. Highway and bridge starts were down less than one percentage point and miscellaneous nonbuilding starts were 14% lower through five months.

The largest nonbuilding projects to break ground in May were the $915 million Gateway South transmission project in Medicine Bow WY, the $795 million improvements to the West Davis Highway in Farmington UT, and a $528 million sewage reclamation project in Salt Lake City UT.

-

Nonresidential building starts jumped 10% in May to a seasonally adjusted annual rate of $309.5 billion. Manufacturing starts more than doubled over the month as a large refinery broke ground. Commercial starts gained 6%, with only the office category losing ground. Institutional starts were down 2% in May, despite a large increase in healthcare projects. Year-to-date, total nonresidential building starts were down 5% compared to the first five months of 2020. Institutional starts were 9% lower, while commercial starts were down 7%. Manufacturing starts were up 42% on a year-to-date basis.

For the 12 months ending May 2021, nonresidential building starts were 19% lower than the 12 months ending May 2020. Commercial starts were down 20%, while institutional starts fell 14%. Manufacturing starts dropped 43% in the 12 months ending May 2021.

The largest nonresidential building projects to break ground in May were the $1.5 billion Diamond Green Diesel refinery in Port Arthur TX, the $920 million Michigan Medicine Clinical Inpatient Tower in Ann Arbor MI, and the $475 million University of California Living and Learning dorm project in San Diego CA.

-

Residential building starts lost 10% in May to a seasonally adjusted annual rate of $394.2 billion. Single family starts were 12% lower, while multifamily starts dropped 7%. Year-to-date, total residential starts were 30% higher than the same period a year earlier. Single family starts were up 37%, while multifamily starts were 12% higher.

For the 12 months ending May 2021, total residential starts were 18% higher than the 12 months ending May 2020. Single family starts gained 27%, while multifamily starts were down 2% on a 12-month sum basis.

The largest multifamily structures to break ground in May were a $500 million mixed-use project in Brooklyn, N.Y, the $230 million Mather Senior Living Community in McLean VA, and the $160 million Alcove Tower in Nashville TN.

- Regionally, May’s starts rose in the Midwest, South Atlantic, and West regions but fell in the Northeast and South Central regions.

About Dodge Data & Analytics

Dodge Data & Analytics is North America’s leading provider of commercial construction project data, market forecasting & analytics services and workflow integration solutions for the construction industry. Building product manufacturers, architects, engineers, contractors, and service providers leverage Dodge to identify and pursue unseen growth opportunities that help them grow their business. On a local, regional or national level, Dodge empowers its customers to better understand their markets, uncover key relationships, seize growth opportunities, and pursue specific sales opportunities with success. The company’s construction project information is the most comprehensive and verified in the industry.

As of April 15th, Dodge Data & Analytics and The Blue Book -- the largest, most active network in the U.S. commercial construction industry -- combined their businesses in a merger. The Blue Book Network delivers three unparalleled databases of companies, projects, and people.

Dodge and The Blue Book offer 10+ billion data elements and 14+ million project and document searches. Together, they provide a unified approach for new business generation, business planning, research, and marketing services users can leverage to find the best partners to complete projects and to engage with customers and prospects to promote projects, products, and services. To learn more, visit: construction.com and thebluebook.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210616005187/en/

Contacts

Media:

Nicole Sullivan | Gregory FCA | +1-212-398-9680, nsullivan@gregoryfca.com