Shareholders of Wabash would probably like to forget the past six months even happened. The stock dropped 31% and now trades at $16.10. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Wabash, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Despite the more favorable entry price, we're swiping left on Wabash for now. Here are three reasons why we avoid WNC and a stock we'd rather own.

Why Do We Think Wabash Will Underperform?

With its first trailer reportedly built on two sawhorses, Wabash (NYSE: WNC) offers semi trailers, liquid transportation containers, truck bodies, and equipment for moving goods.

1. Backlog Declines as Orders Drop

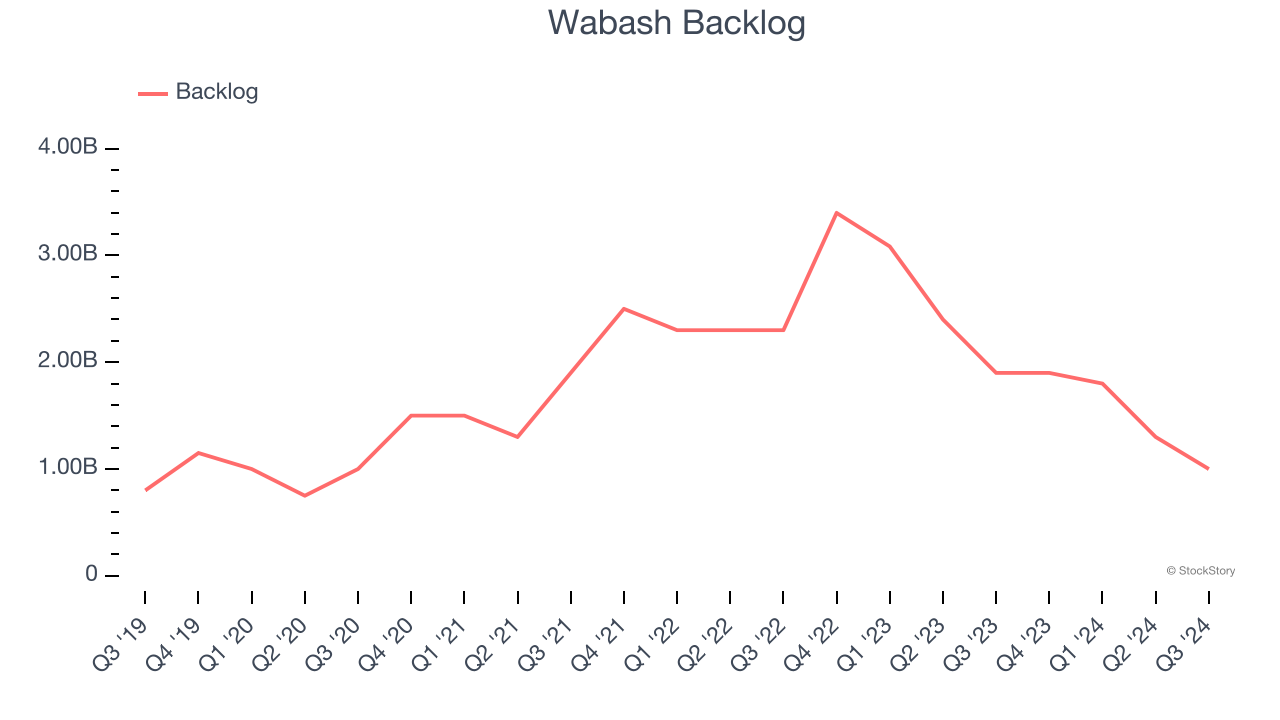

Investors interested in Heavy Transportation Equipment companies should track backlog in addition to reported revenue. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Wabash’s future revenue streams.

Wabash’s backlog came in at $1 billion in the latest quarter, and it averaged 15.2% year-on-year declines over the last two years. This performance was underwhelming and shows the company is not winning new orders. It also suggests there may be increasing competition or market saturation.

2. Low Gross Margin Reveals Weak Structural Profitability

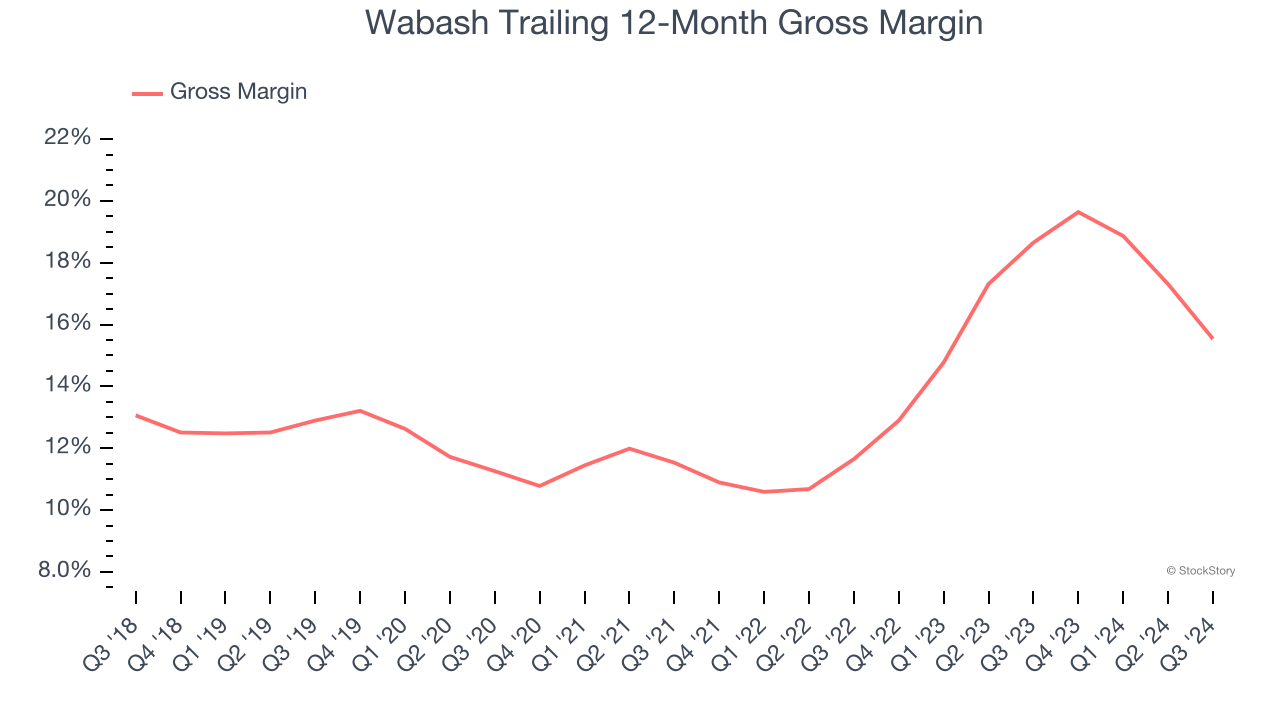

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Wabash has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 14.1% gross margin over the last five years. That means Wabash paid its suppliers a lot of money ($85.90 for every $100 in revenue) to run its business.

3. New Investments Fail to Bear Fruit as ROIC Declines

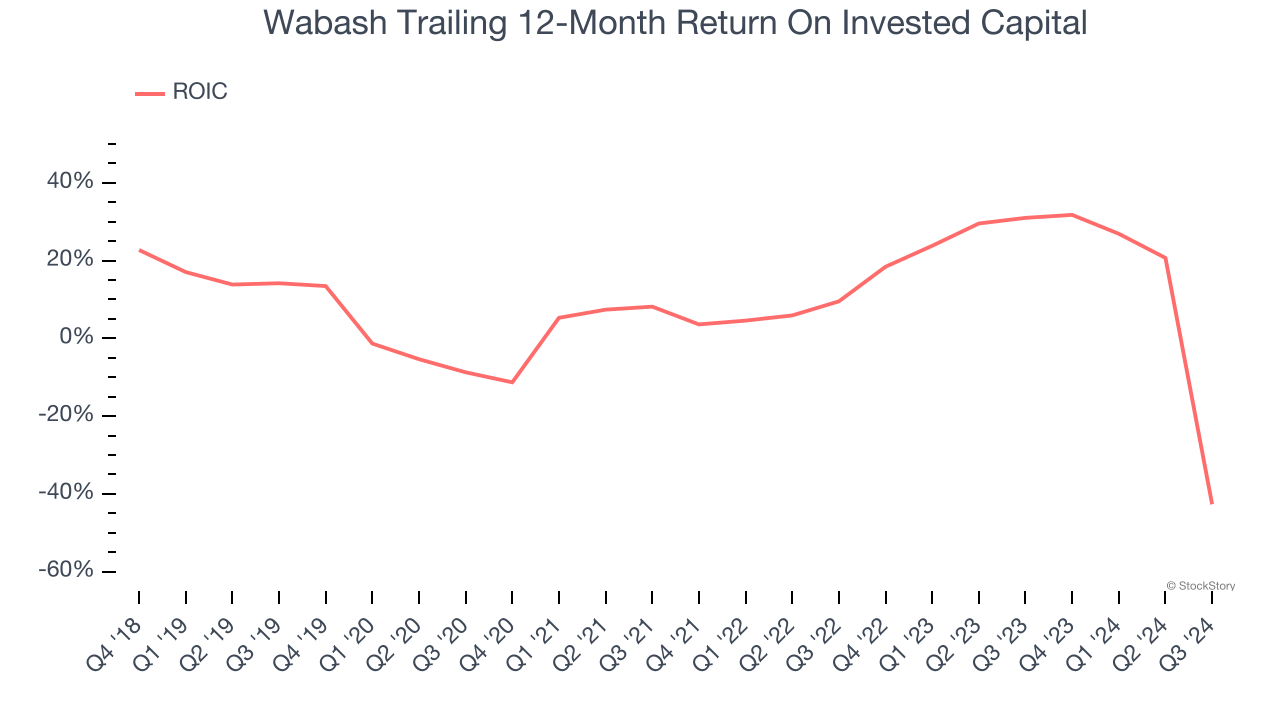

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Over the last few years, Wabash’s ROIC has decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

We see the value of companies helping their customers, but in the case of Wabash, we’re out. Following the recent decline, the stock trades at 11.4× forward price-to-earnings (or $16.10 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are better stocks to buy right now. Let us point you toward Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Wabash

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.