Semiconductor designer Power Integrations (NASDAQ: POWI) met Wall Streets revenue expectations in Q3 CY2025, with sales up 2.7% year on year to $118.9 million. On the other hand, next quarter’s revenue guidance of $102.5 million was less impressive, coming in 11.5% below analysts’ estimates. Its non-GAAP profit of $0.36 per share was 4% above analysts’ consensus estimates.

Is now the time to buy Power Integrations? Find out by accessing our full research report, it’s free for active Edge members.

Power Integrations (POWI) Q3 CY2025 Highlights:

- Revenue: $118.9 million vs analyst estimates of $118.4 million (2.7% year-on-year growth, in line)

- Adjusted EPS: $0.36 vs analyst estimates of $0.35 (4% beat)

- Adjusted Operating Income: $18.12 million vs analyst estimates of $17.8 million (15.2% margin, 1.8% beat)

- Revenue Guidance for Q4 CY2025 is $102.5 million at the midpoint, below analyst estimates of $115.9 million

- Operating Margin: -3.3%, down from 10% in the same quarter last year

- Free Cash Flow Margin: 20.3%, down from 23.5% in the same quarter last year

- Inventory Days Outstanding: 277, down from 295 in the previous quarter

- Market Capitalization: $2.19 billion

Power Integrations CEO Jennifer Lloyd commented: “Our industrial business remains on track for strong growth in 2025 after a 20 percent year-over-year increase in the third quarter, while orders for consumer appliances continue to be soft after accelerated shipments earlier in the year ahead of U.S. tariffs. Overall, we are on course for solid growth in 2025 despite the challenging economic backdrop, and remain focused on secular growth opportunities in high voltage, including GaN, grid modernization, electric transportation and data center. Last month we detailed the capabilities of our 1250- and 1700-volt PowiGaN™ technologies for next-gen AI data centers, including our collaboration with NVIDIA on 800 VDC power architecture.”

Company Overview

A leading supplier of parts for electronics such as home appliances, Power Integrations (NASDAQ: POWI) is a semiconductor designer and developer specializing in products used for high-voltage power conversion.

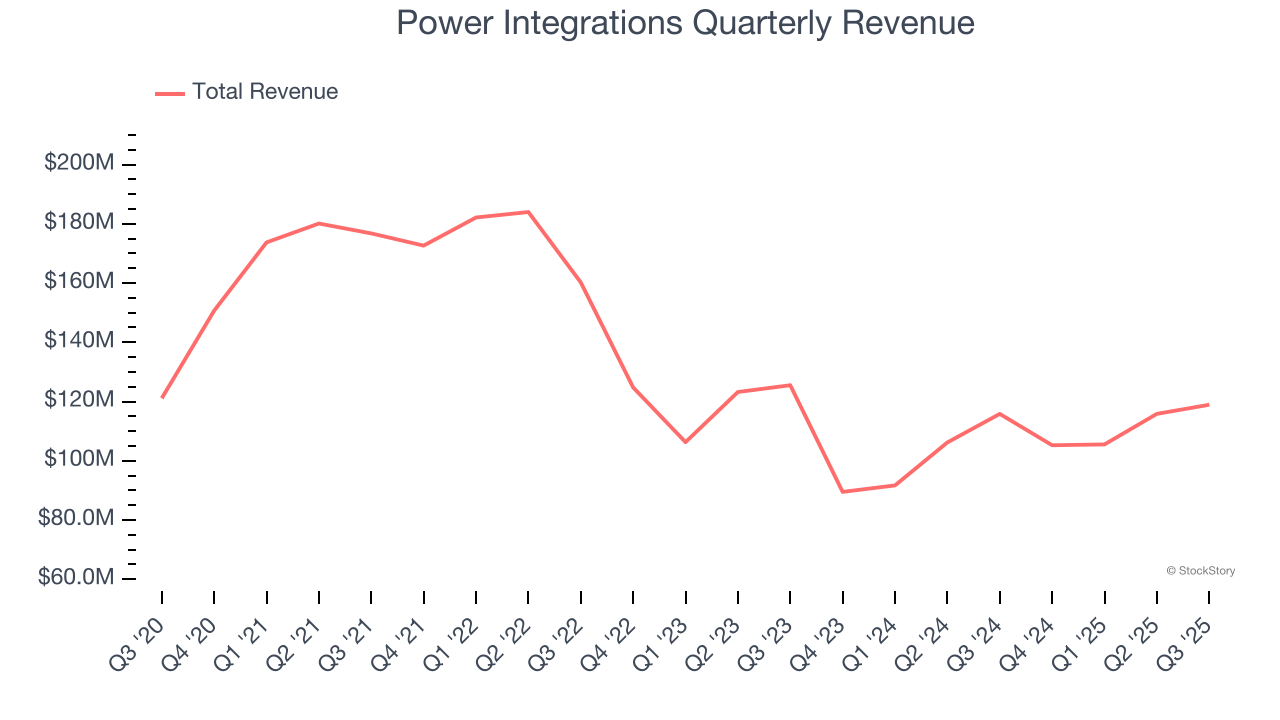

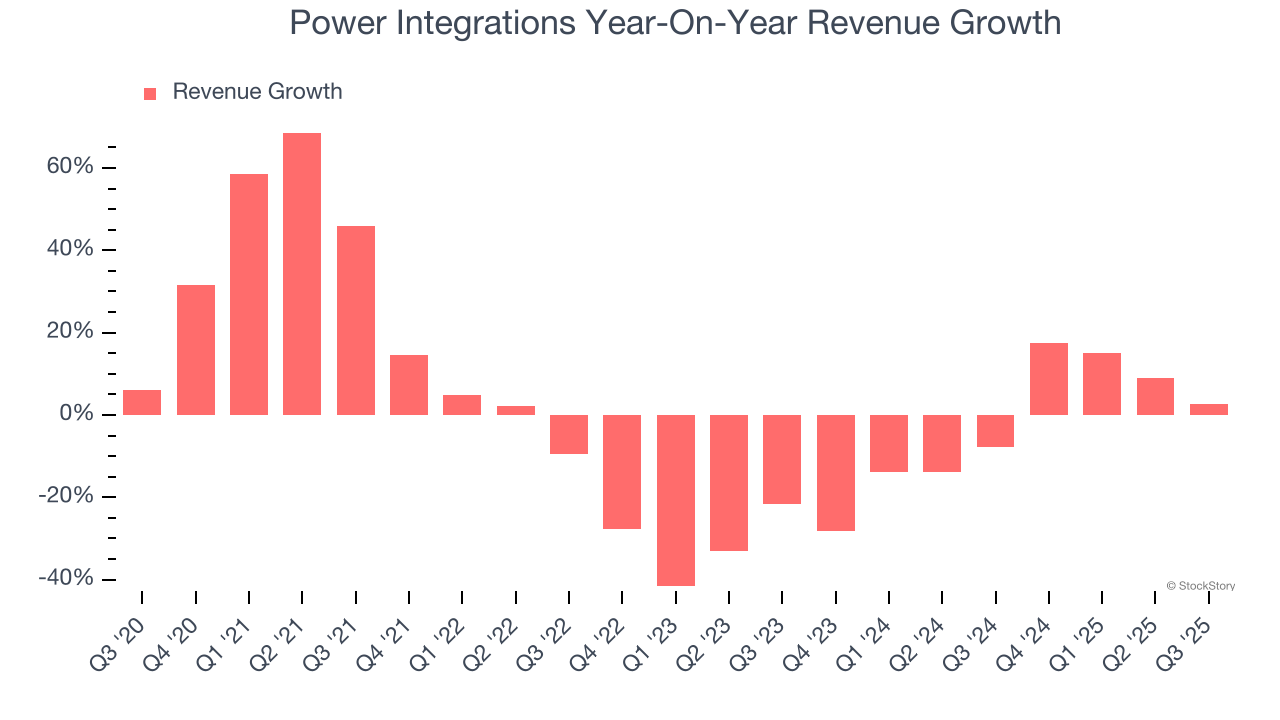

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Power Integrations struggled to consistently increase demand as its $445.6 million of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of lacking business quality. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Power Integrations’s recent performance shows its demand remained suppressed as its revenue has declined by 3.6% annually over the last two years.

This quarter, Power Integrations grew its revenue by 2.7% year on year, and its $118.9 million of revenue was in line with Wall Street’s estimates. Although the company met estimates, this was its third consecutive quarter of decelerating growth, indicating a potential cyclical downturn. Company management is currently guiding for a 2.6% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.6% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and implies its newer products and services will spur better top-line performance.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

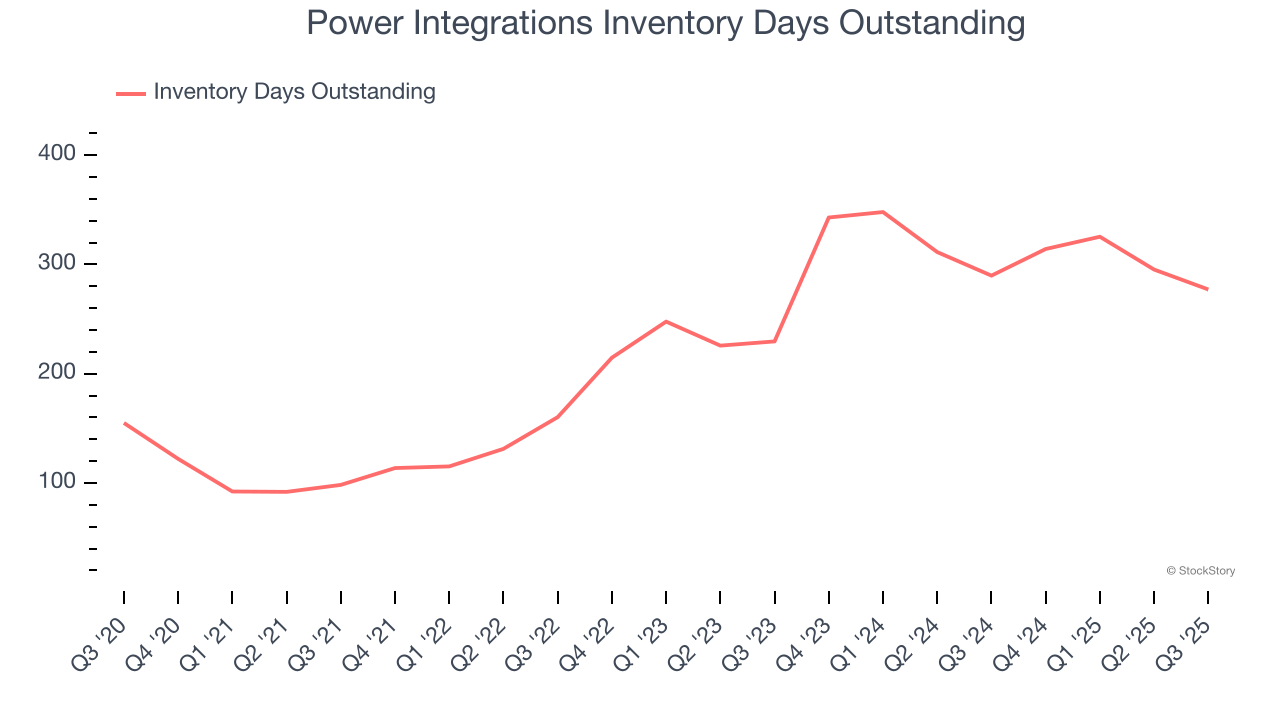

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Power Integrations’s DIO came in at 277, which is 60 days above its five-year average. These numbers suggest that despite the recent decrease, the company’s inventory levels are higher than what we’ve seen in the past.

Key Takeaways from Power Integrations’s Q3 Results

It was great to see a material improvement in Power Integrations’s inventory levels. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed. Zooming out, we think this was a mixed quarter. Investors were likely hoping for more, and shares traded down 2.9% to $37.81 immediately following the results.

So do we think Power Integrations is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.