What a brutal six months it’s been for Tradeweb Markets. The stock has dropped 25.7% and now trades at $103.84, rattling many shareholders. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Given the weaker price action, is now the time to buy TW? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On TW?

Founded in 1996 as one of the pioneers in electronic bond trading, Tradeweb Markets (NASDAQ: TW) builds and operates electronic marketplaces that connect financial institutions for trading across rates, credit, equities, and money markets.

1. Skyrocketing Revenue Shows Strong Momentum

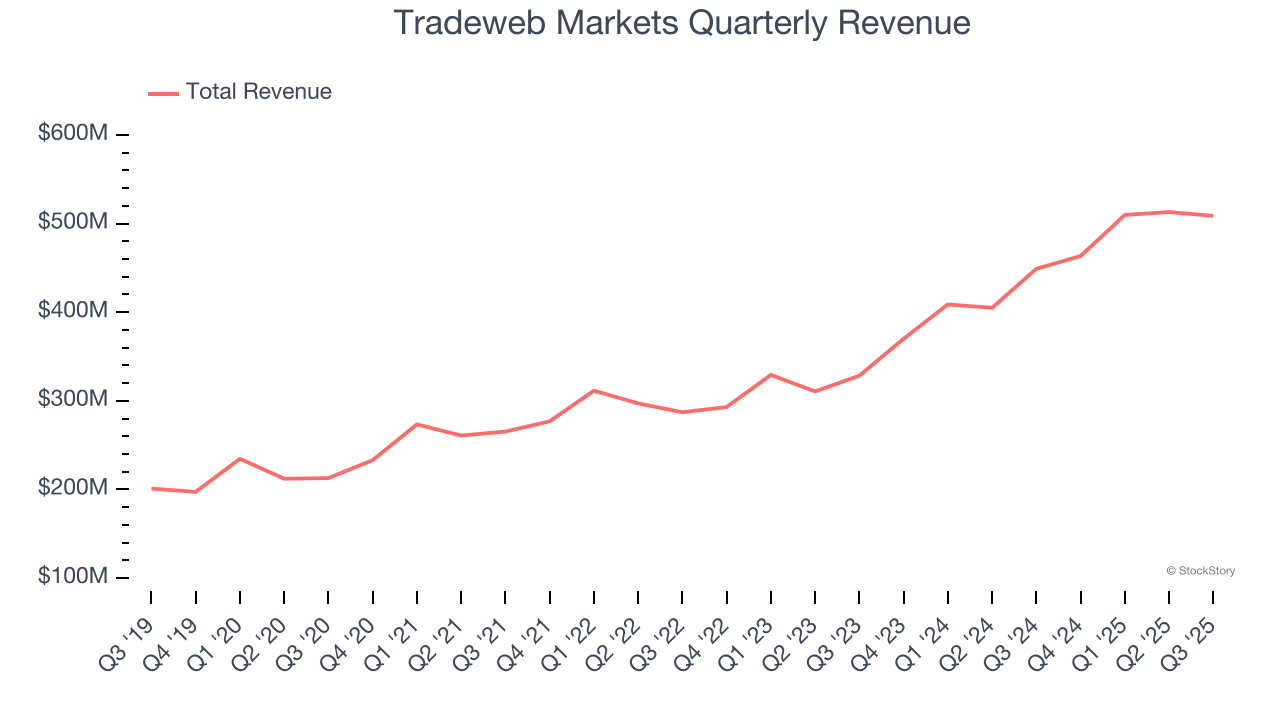

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

Over the last five years, Tradeweb Markets grew its revenue at an excellent 18.4% compounded annual growth rate. Its growth beat the average financials company and shows its offerings resonate with customers.

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Tradeweb Markets’s EPS grew at a spectacular 25% compounded annual growth rate over the last five years, higher than its 18.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why we think Tradeweb Markets is one of the best financials companies out there. After the recent drawdown, the stock trades at 28.2× forward P/E (or $103.84 per share). Is now the right time to buy? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than Tradeweb Markets

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.