Electricity storage and software provider Fluence (NASDAQ: FLNC) fell short of the market’s revenue expectations in Q4 CY2024, with sales falling 48.7% year on year to $186.8 million. The company’s full-year revenue guidance of $3.4 billion at the midpoint came in 13% below analysts’ estimates. Its GAAP loss of $0.32 per share was 76.9% below analysts’ consensus estimates.

Is now the time to buy Fluence Energy? Find out by accessing our full research report, it’s free.

Fluence Energy (FLNC) Q4 CY2024 Highlights:

- Revenue: $186.8 million vs analyst estimates of $377.6 million (48.7% year-on-year decline, 50.5% miss)

- EPS (GAAP): -$0.32 vs analyst expectations of -$0.18 (76.9% miss)

- Adjusted EBITDA: -$49.68 million vs analyst estimates of -$30.31 million (-26.6% margin, 63.9% miss)

- The company dropped its revenue guidance for the full year to $3.4 billion at the midpoint from $4 billion, a 15% decrease

- EBITDA guidance for the full year is $85 million at the midpoint, below analyst estimates of $177.7 million

- Operating Margin: -31%, down from -8.2% in the same quarter last year

- Free Cash Flow was -$216.4 million, down from $16.77 million in the same quarter last year

- Backlog: $5.1 billion at quarter end, up 37.8% year on year

- Market Capitalization: $1.63 billion

"We have experienced customer-driven delays in signing certain contracts that, coupled with competitive pressures, result in the need to lower our fiscal year 2025 outlook. While these delays are disappointing, we continue to see a very robust utility scale battery storage market globally and strong interest in our U.S. domestic content product offering in particular, as evidenced by our record $5.1 billion backlog. Importantly, we are executing plans to maintain our leadership position, differentiate our product, and optimize our cost structure, which we expect will drive improved financial performance in fiscal year 2026 and beyond," said Julian Nebreda, Fluence's Chief Executive Officer.

Company Overview

Pioneering the use of lithium-ion batteries for grid storage, Fluence (NASDAQ: FLNC) helps store renewable energy sources with battery systems.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

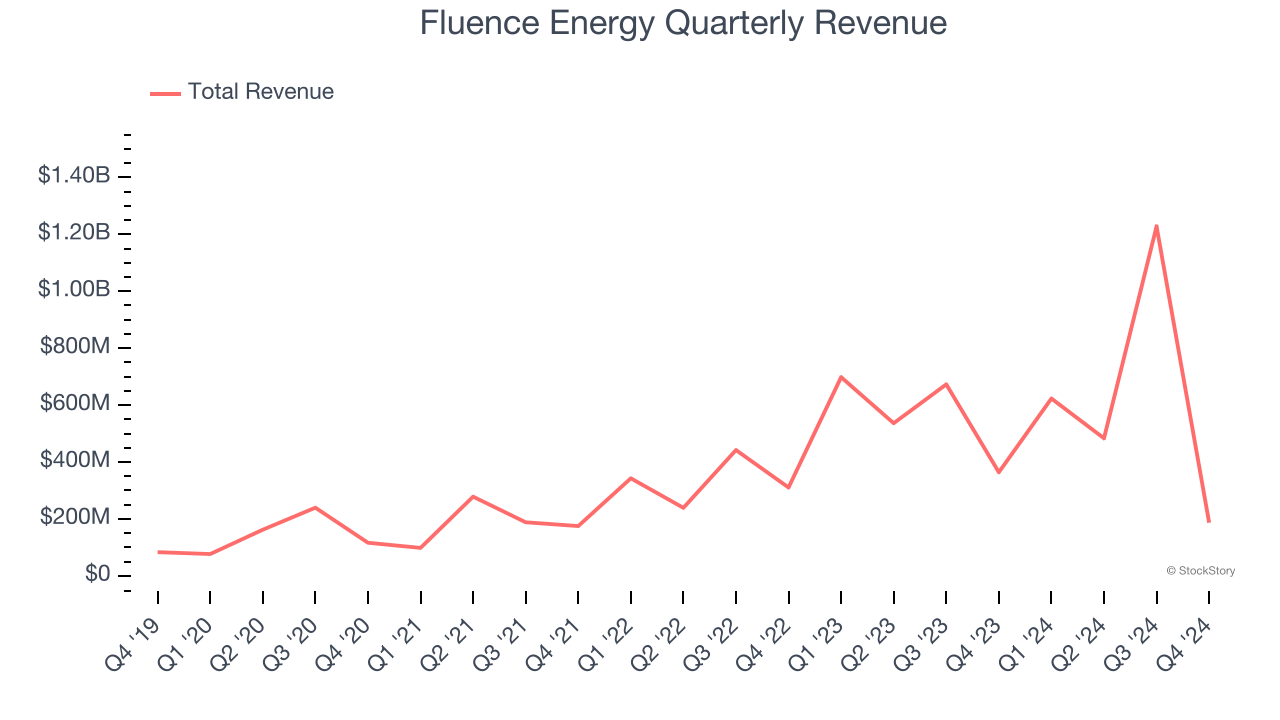

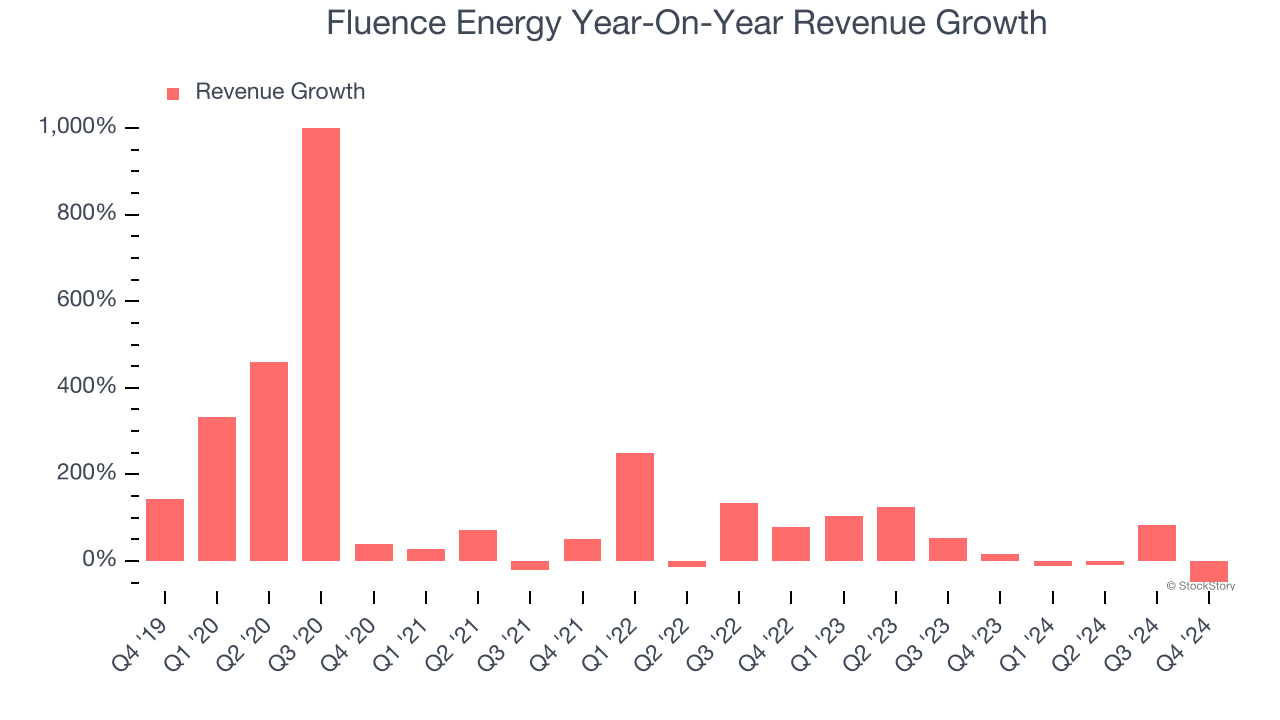

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Luckily, Fluence Energy’s sales grew at an incredible 78% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Fluence Energy’s annualized revenue growth of 37.5% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Fluence Energy missed Wall Street’s estimates and reported a rather uninspiring 48.7% year-on-year revenue decline, generating $186.8 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 67.7% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and indicates its newer products and services will fuel better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

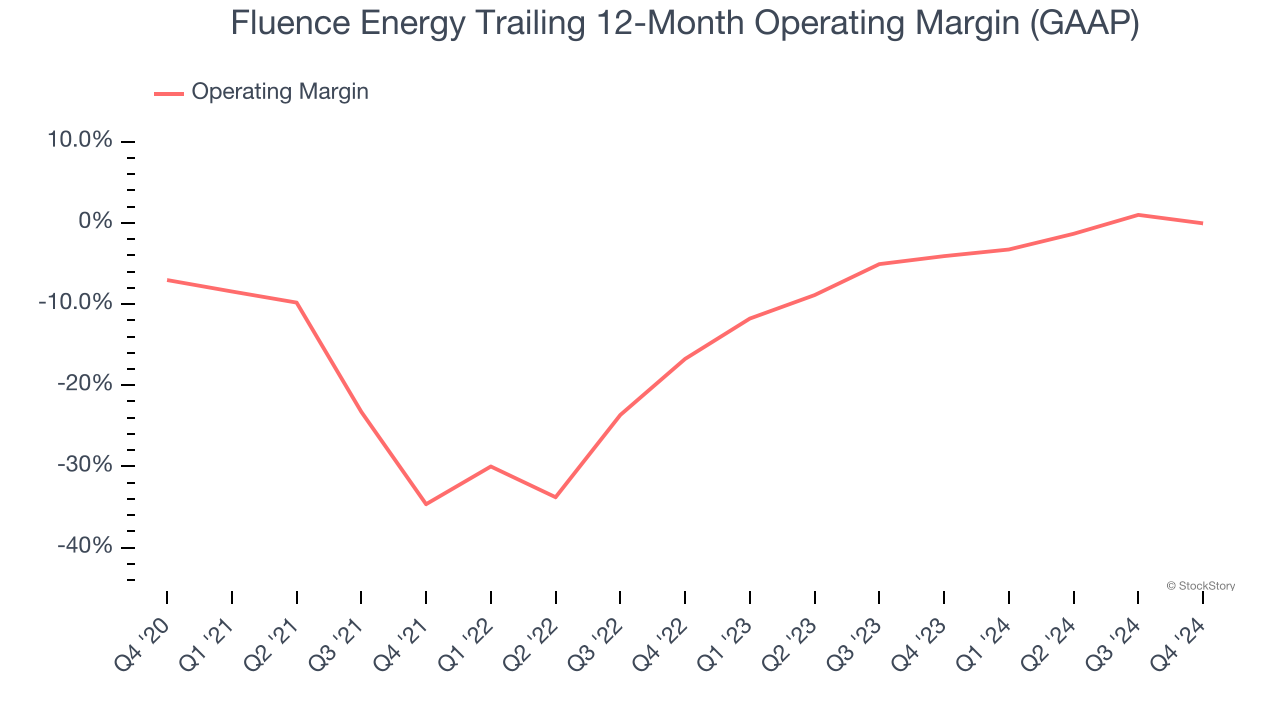

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Fluence Energy’s high expenses have contributed to an average operating margin of negative 8.3% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Fluence Energy’s operating margin rose by 7 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q4, Fluence Energy generated a negative 31% operating margin.

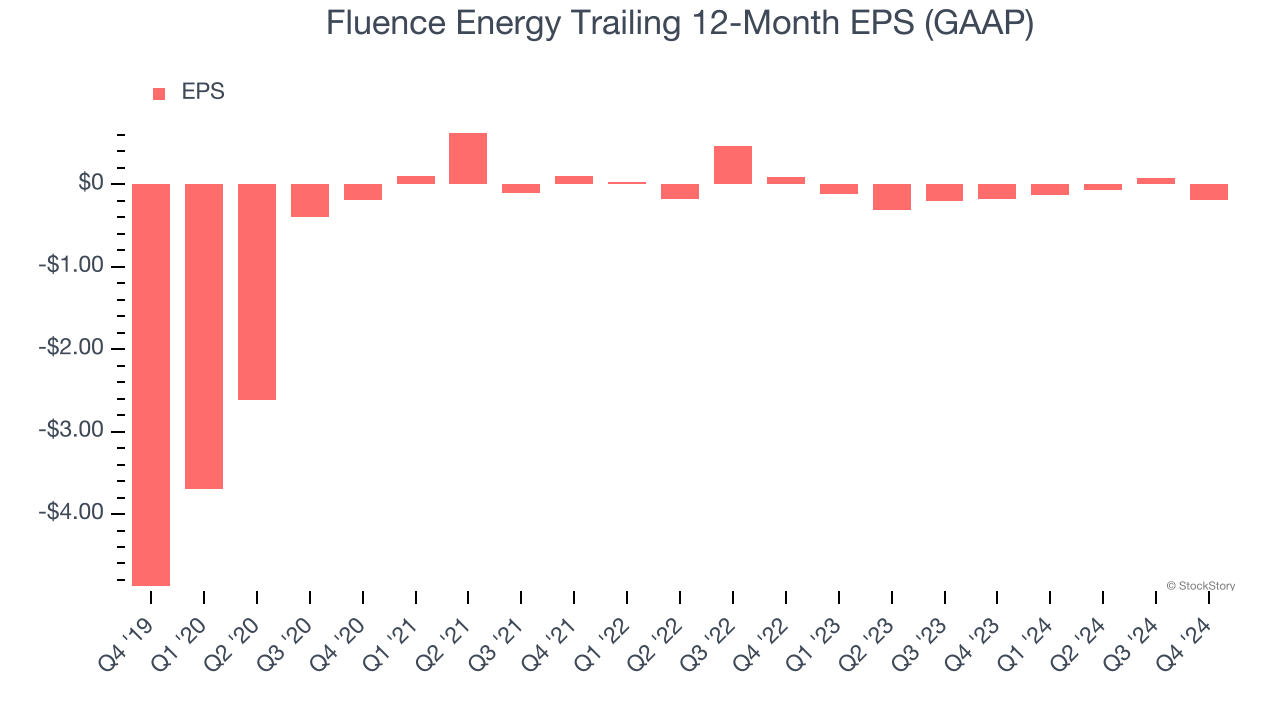

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Fluence Energy’s full-year earnings are still negative, it reduced its losses and improved its EPS by 47.6% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

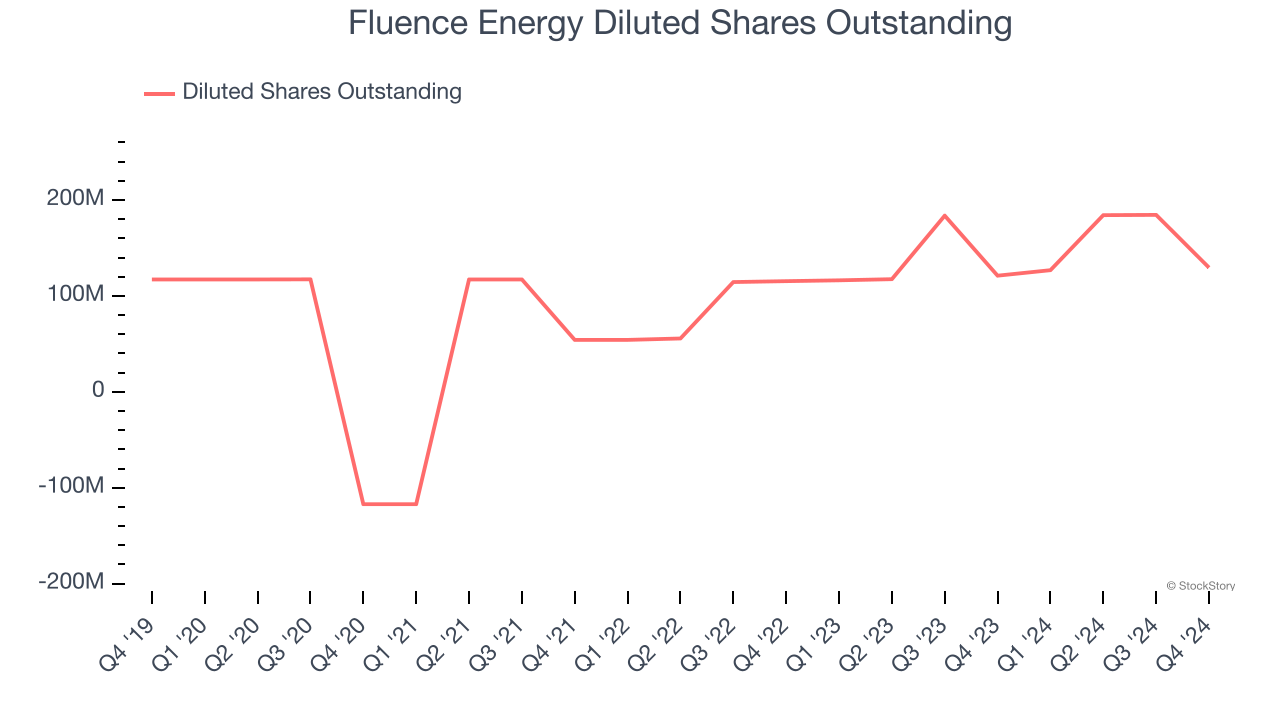

Sadly for Fluence Energy, its EPS declined by 107% annually over the last two years while its revenue grew by 37.5%. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Fluence Energy’s earnings to better understand the drivers of its performance. Fluence Energy’s operating margin has declined by 15.1 percentage points over the last two yearswhile its share count has grown 12.2%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, Fluence Energy reported EPS at negative $0.32, down from negative $0.04 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Fluence Energy’s full-year EPS of negative $0.19 will flip to positive $0.72.

Key Takeaways from Fluence Energy’s Q4 Results

We struggled to find many positives in these results. The company's revenue missed significantly due to "the pronounced backend nature of expected revenue for full year 2025 compared to the revenue distribution seen in full year 2024". Full-year revenue guidance was lowered and missed significantly, and EBITDA guidance didn't fare much better when compared to Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $13.07 immediately following the results.

The latest quarter from Fluence Energy’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.