Banking software provider Q2 (NYSE: QTWO) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 12.9% year on year to $183 million. Guidance for next quarter’s revenue was better than expected at $186 million at the midpoint, 0.8% above analysts’ estimates. Its GAAP loss of $0 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Q2 Holdings? Find out by accessing our full research report, it’s free.

Q2 Holdings (QTWO) Q4 CY2024 Highlights:

- Revenue: $183 million vs analyst estimates of $179.9 million (12.9% year-on-year growth, 1.7% beat)

- EPS (GAAP): $0 vs analyst estimates of -$0.10 (significant beat)

- Adjusted Operating Income: $29.58 million vs analyst estimates of $28.47 million (16.2% margin, 3.9% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $775.5 million at the midpoint, in line with analyst expectations and implying 11.3% growth (vs 11.4% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $167.5 million at the midpoint, above analyst estimates of $159.8 million

- Operating Margin: -0.9%, up from -11.1% in the same quarter last year

- Free Cash Flow Margin: 20.1%, similar to the previous quarter

- Market Capitalization: $5.53 billion

“We delivered strong fourth-quarter results to cap off a great year,” said Matt Flake, chairman and CEO, Q2.

Company Overview

Founded in 2004 by Hank Seale, Q2 (NYSE: QTWO) offers software-as-a-service that enables small banks to provide online banking and consumer lending services to their clients.

Banking Software

Consumers these days are accustomed to frictionless digital experiences from online shopping to ordering food or hailing a cab. Financial services firms are notoriously risk averse in adopting modern software, often lacking the resources or competency to develop the digital solutions in-house. That drives demand for software as a service platforms that allows banks and other finance institutions to offer the digital services without having to run or maintain them.

Sales Growth

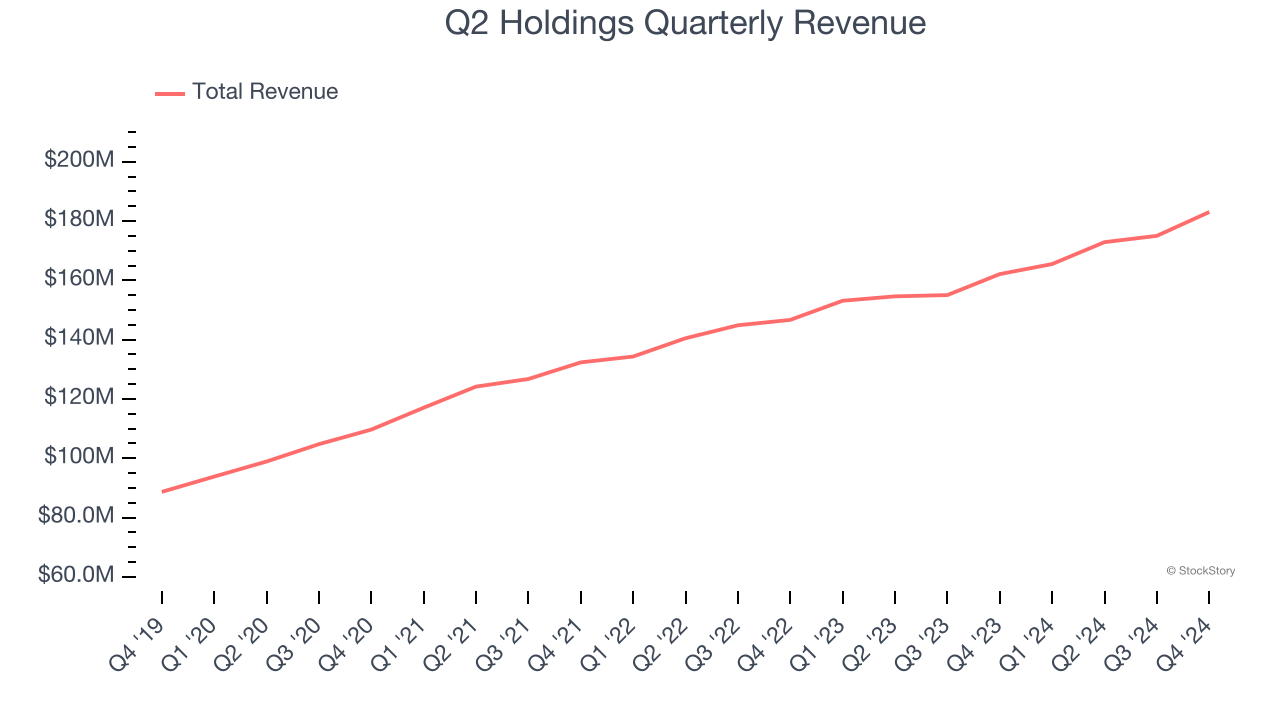

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Q2 Holdings grew its sales at a 11.7% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our benchmark for the software sector, which enjoys a number of secular tailwinds.

This quarter, Q2 Holdings reported year-on-year revenue growth of 12.9%, and its $183 million of revenue exceeded Wall Street’s estimates by 1.7%. Company management is currently guiding for a 12.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.9% over the next 12 months, similar to its three-year rate. This projection is above average for the sector and implies its newer products and services will help support its historical top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Q2 Holdings is efficient at acquiring new customers, and its CAC payback period checked in at 40.7 months this quarter. The company’s relatively fast recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Q2 Holdings’s Q4 Results

We were impressed by Q2 Holdings’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EBITDA guidance came in much higher than Wall Street’s estimates. Zooming out, we think this was a solid quarter. The stock traded up 7.5% to $99 immediately following the results.

Sure, Q2 Holdings had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.