Beauty supply retailer Sally Beauty (NYSE: SBH) met Wall Street’s revenue expectations in Q4 CY2024, but sales were flat year on year at $937.9 million. On the other hand, next quarter’s revenue guidance of $899.3 million was less impressive, coming in 2.3% below analysts’ estimates. Its non-GAAP profit of $0.43 per share was in line with analysts’ consensus estimates.

Is now the time to buy Sally Beauty? Find out by accessing our full research report, it’s free.

Sally Beauty (SBH) Q4 CY2024 Highlights:

- Revenue: $937.9 million vs analyst estimates of $941.8 million (flat year on year, in line)

- Adjusted EPS: $0.43 vs analyst estimates of $0.43 (in line)

- Adjusted EBITDA: $110.2 million vs analyst estimates of $109.5 million (11.7% margin, 0.6% beat)

- Revenue Guidance for Q1 CY2025 is $899.3 million at the midpoint, below analyst estimates of $920.2 million

- Operating Margin: 10.7%, up from 7.4% in the same quarter last year

- Free Cash Flow Margin: 6.1%, up from 2.2% in the same quarter last year

- Locations: 4,453 at quarter end, down from 4,475 in the same quarter last year

- Same-Store Sales rose 1.6% year on year (-0.8% in the same quarter last year)

- Market Capitalization: $940.7 million

“We are pleased to start fiscal 2025 with solid first quarter results, reflecting continued momentum across both our Sally Beauty and Beauty Systems Group segments,” said Denise Paulonis, president and chief executive officer.

Company Overview

Catering to both everyday consumers as well as salon professionals, Sally Beauty (NYSE: SBH) is a retailer that sells salon-quality beauty products such as makeup and haircare products.

Beauty and Cosmetics Retailer

Beauty and cosmetics retailers understand that beauty is in the eye of the beholder, but a little lipstick, nail polish, and glowing skin also help the cause. These stores—which mostly cater to consumers but can also garner the attention of salon pros—aim to be a one-stop personal care and beauty products shop with many brands across many categories. E-commerce is changing how consumers buy cosmetics, so these retailers are constantly evolving to meet the customer where and how they want to shop.

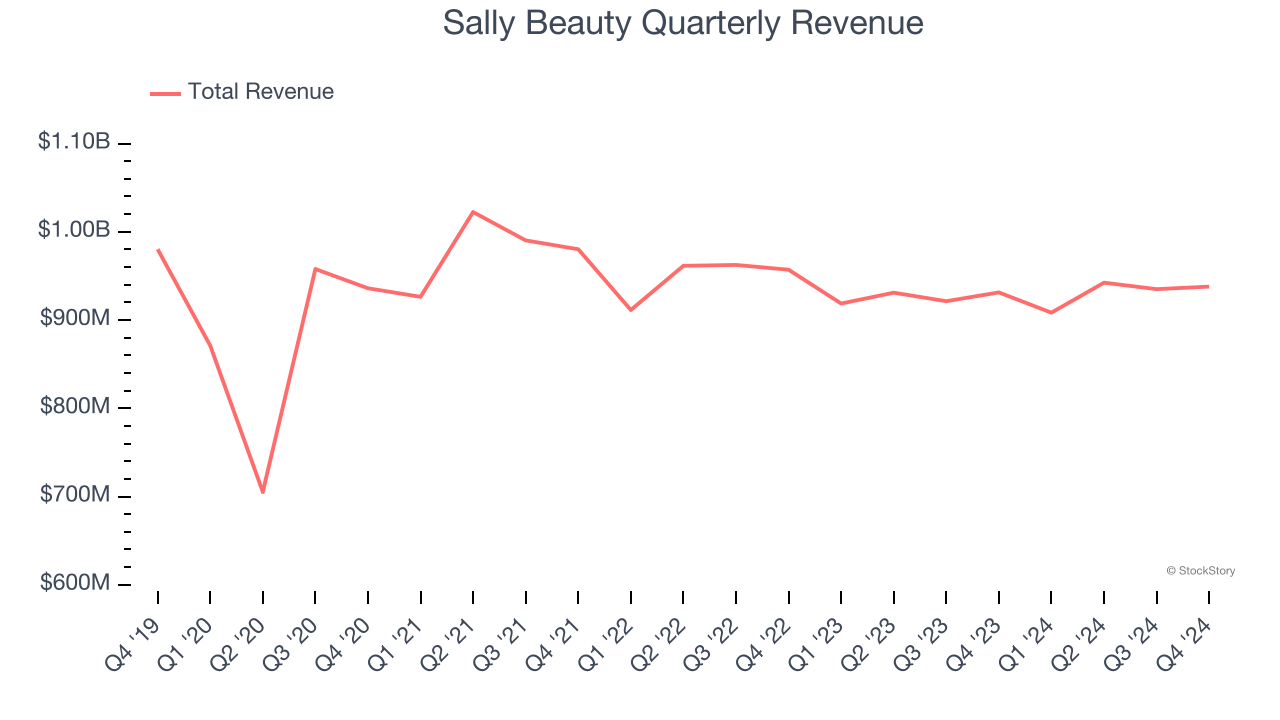

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $3.72 billion in revenue over the past 12 months, Sally Beauty is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

As you can see below, Sally Beauty struggled to increase demand as its $3.72 billion of sales for the trailing 12 months was close to its revenue five years ago (we compare to 2019 to normalize for COVID-19 impacts). This was mainly because it closed stores.

This quarter, Sally Beauty’s $937.9 million of revenue was flat year on year and in line with Wall Street’s estimates. Company management is currently guiding for a 1% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.1% over the next 12 months. Although this projection suggests its newer products will spur better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Store Performance

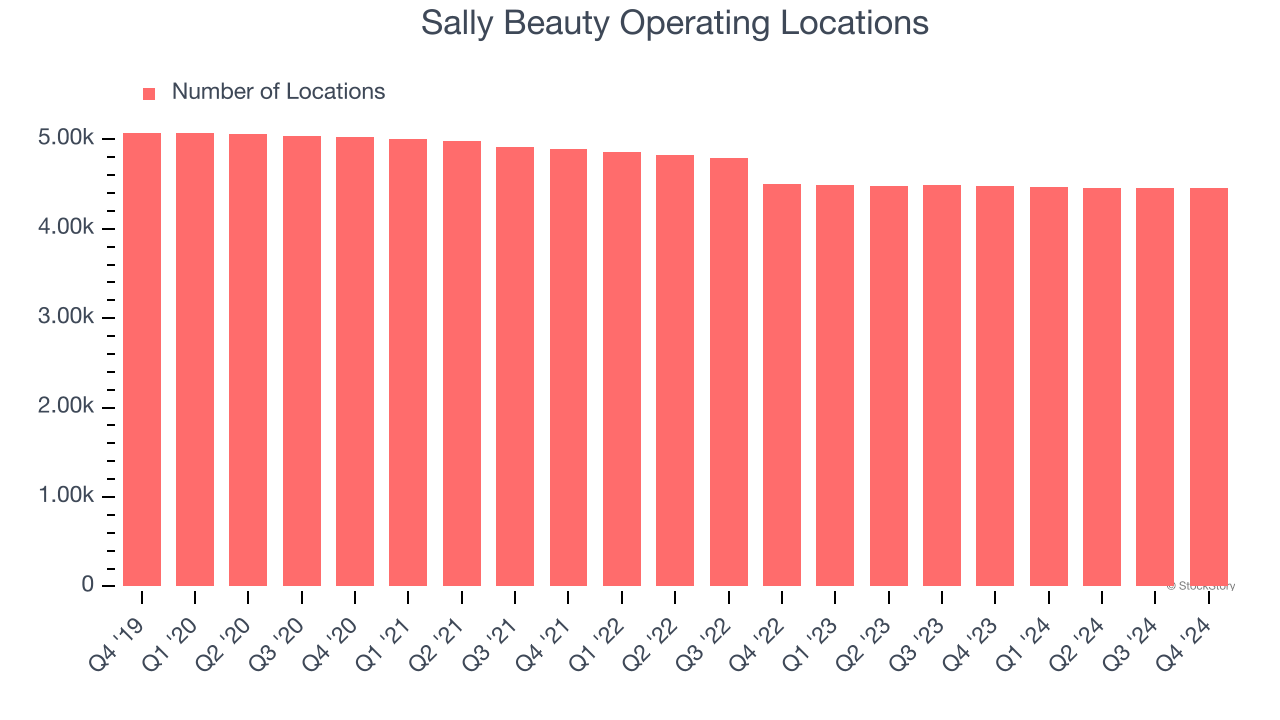

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Sally Beauty listed 4,453 locations in the latest quarter and has generally closed its stores over the last two years, averaging 3% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

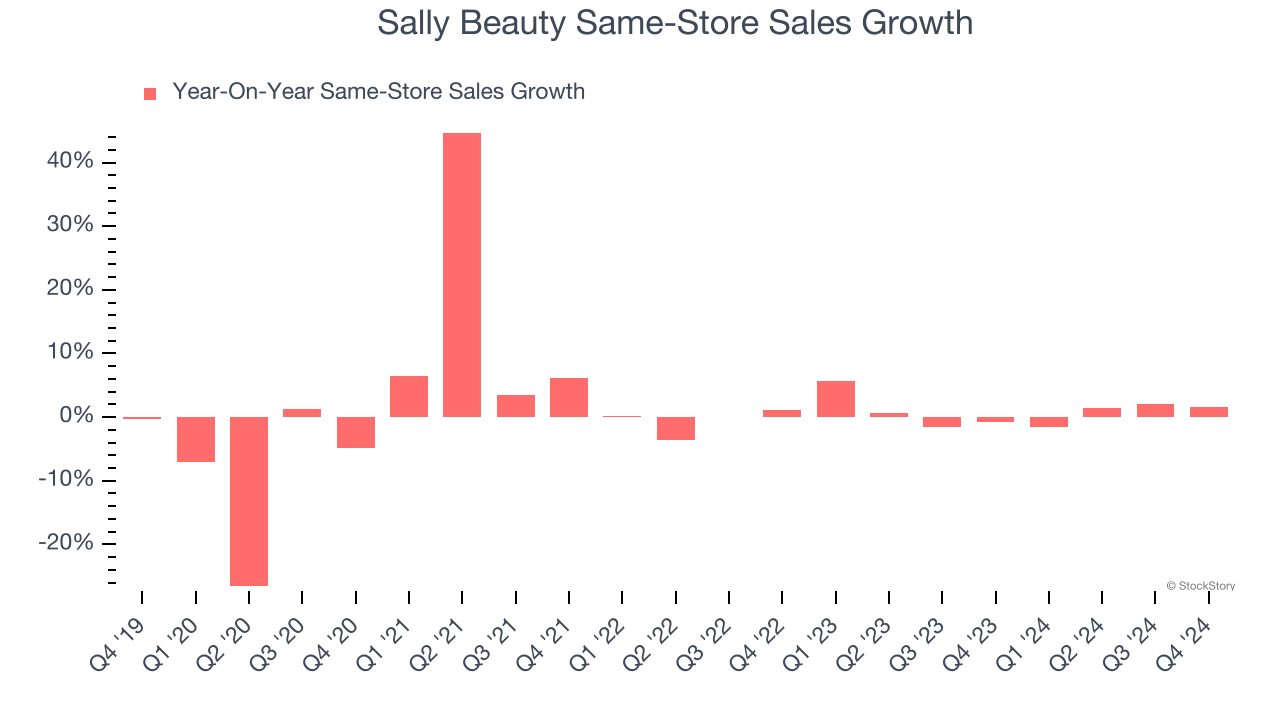

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Sally Beauty’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and Sally Beauty is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Sally Beauty’s same-store sales rose 1.6% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Sally Beauty’s Q4 Results

Revenue and EPS were in line. One negative was that the company's revenue guidance for next quarter missed. Overall, this was a muted quarter. It seems expectations were low, though, and the stock traded up 5.4% to $9.60 immediately after reporting.

Is Sally Beauty an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.