Shareholders of Acadia Healthcare would probably like to forget the past six months even happened. The stock dropped 43.2% and now trades at $41.25. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Acadia Healthcare, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even with the cheaper entry price, we don't have much confidence in Acadia Healthcare. Here are three reasons why ACHC doesn't excite us and a stock we'd rather own.

Why Is Acadia Healthcare Not Exciting?

Founded in 2005, Acadia Healthcare (NASDAQ: ACHC) is a provider of specialized behavioral healthcare services, operating inpatient psychiatric hospitals, residential treatment centers, and outpatient clinics.

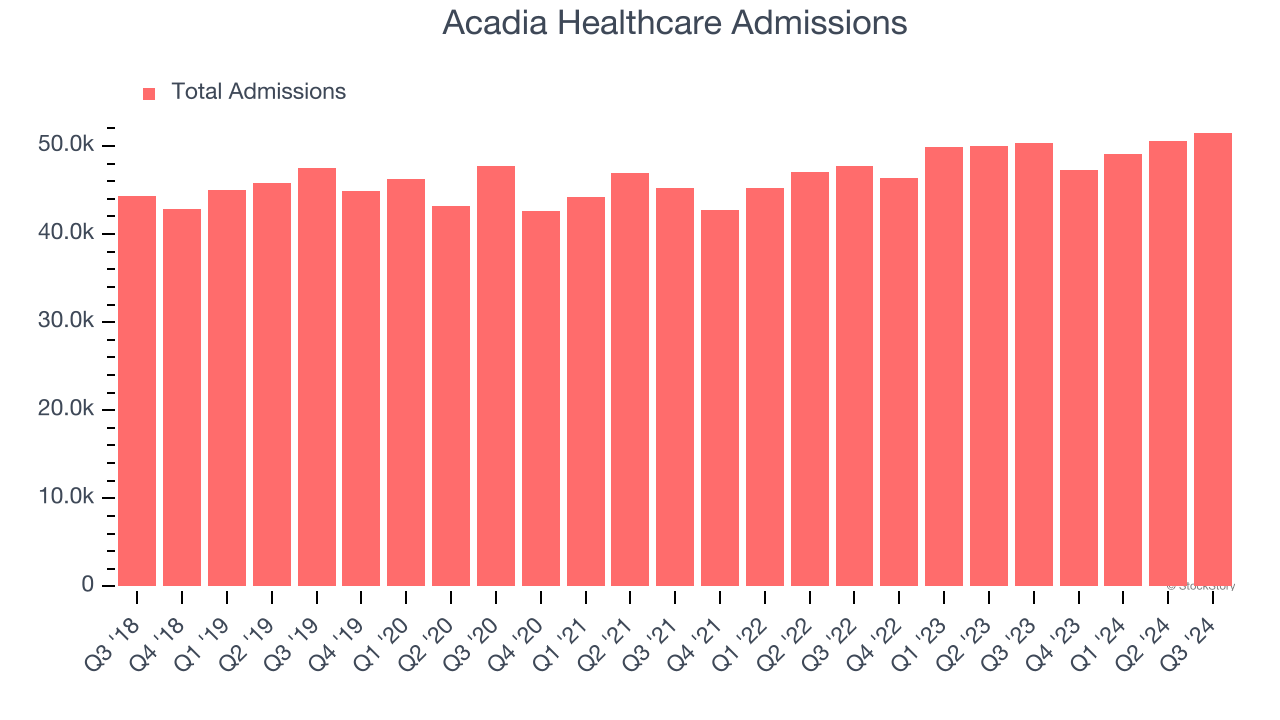

1. Weak Sales Volumes Indicate Waning Demand

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Hospital Chains company because there’s a ceiling to what customers will pay.

Acadia Healthcare’s admissions came in at 51,513 in the latest quarter, and over the last two years, averaged 4.3% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in service improvements to accelerate growth, factors that can hinder near-term profitability.

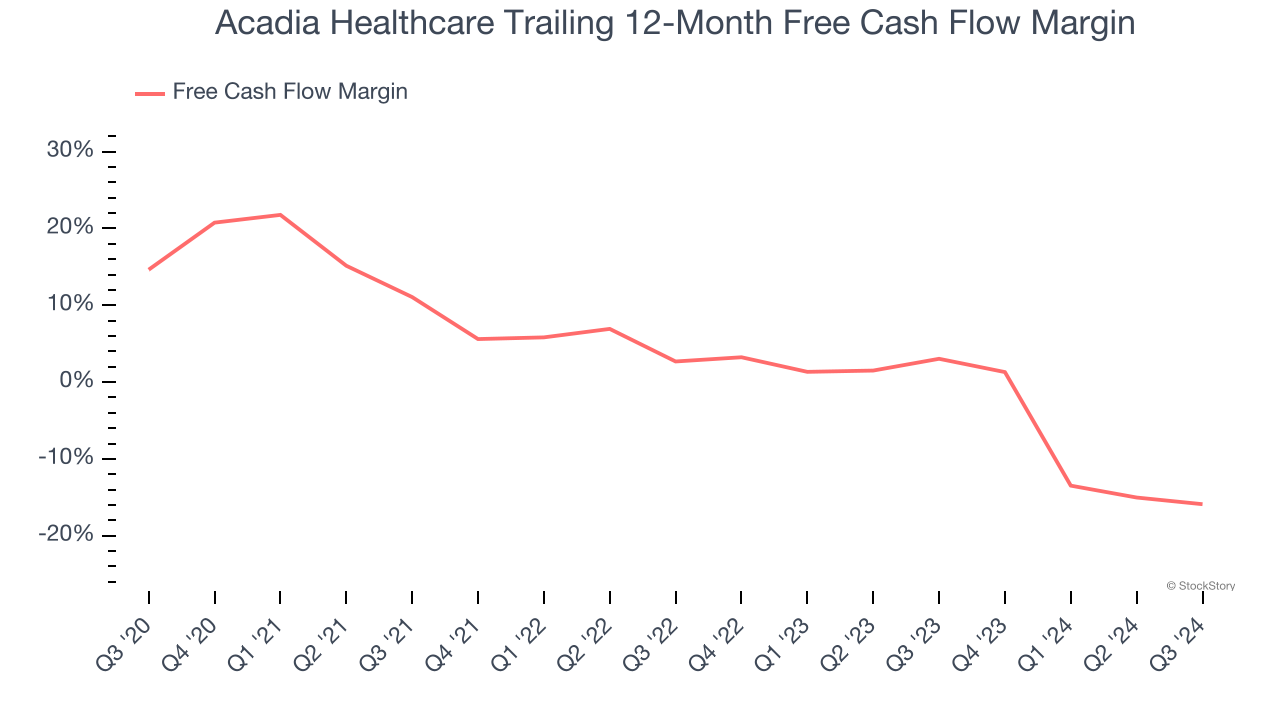

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Acadia Healthcare’s margin dropped by 30.5 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. Acadia Healthcare’s free cash flow margin for the trailing 12 months was negative 15.9%.

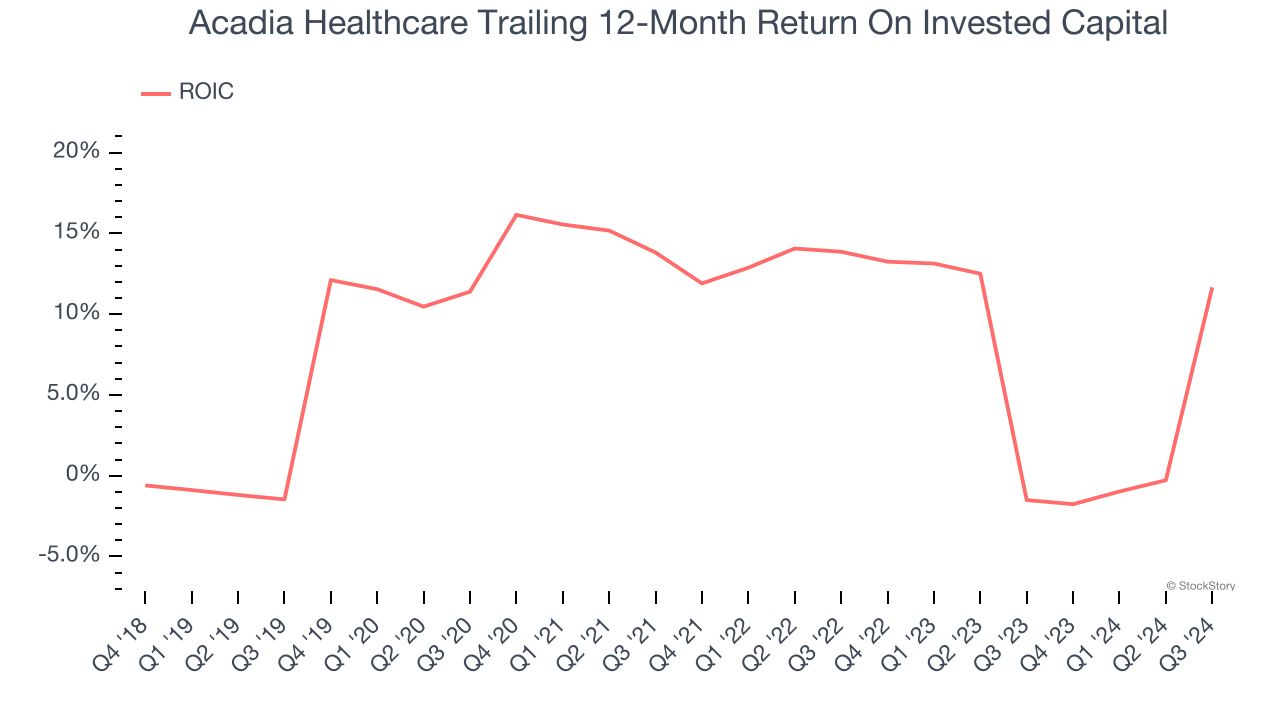

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Acadia Healthcare’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Acadia Healthcare isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 10.9× forward price-to-earnings (or $41.25 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. Let us point you toward one of our top software and edge computing picks.

Stocks We Would Buy Instead of Acadia Healthcare

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.