Online used car dealer Carvana (NYSE: CVNA) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 46.3% year on year to $3.55 billion.

Is now the time to buy Carvana? Find out by accessing our full research report, it’s free.

Carvana (CVNA) Q4 CY2024 Highlights:

- Revenue: $3.55 billion vs analyst estimates of $3.34 billion (46.3% year-on-year growth, 6.2% beat)

- Adjusted EBITDA: $359 million vs analyst estimates of $332.3 million (10.1% margin, 8% beat)

- Retail Units Sold: 114,379

- Market Capitalization: $34.43 billion

Company Overview

Known for its glass tower car vending machines, Carvana (NYSE: CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Online Retail

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

Sales Growth

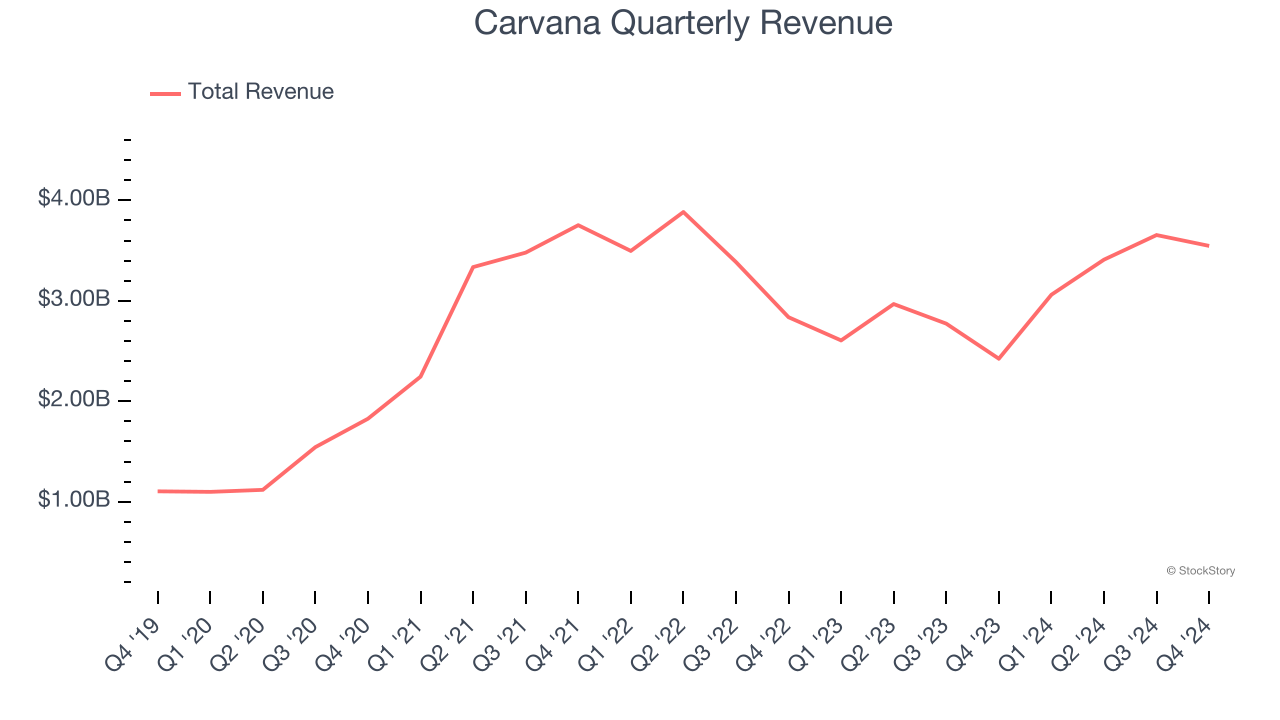

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Carvana grew its sales at a sluggish 2.2% compounded annual growth rate. This fell short of our benchmarks, but there are still things to like about Carvana.

This quarter, Carvana reported magnificent year-on-year revenue growth of 46.3%, and its $3.55 billion of revenue beat Wall Street’s estimates by 6.2%.

Looking ahead, sell-side analysts expect revenue to grow 15.3% over the next 12 months, an acceleration versus the last three years. This projection is particularly noteworthy for a company of its scale and implies its newer products and services will fuel better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Key Takeaways from Carvana’s Q4 Results

We were impressed by how significantly Carvana blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates as it sold more used vehicles than anticipated. Zooming out, we think this was a good quarter with some key areas of upside. The market seemed to be hoping for more, however, as shares were up 40%+ year-to-date going into the print. Because expectations were sky-high, the stock traded down 10.8% to $251.25 immediately after reporting.

So do we think Carvana is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.