Real estate services firm Cushman & Wakefield (NYSE: CWK) missed Wall Street’s revenue expectations in Q4 CY2024 as sales rose 3% year on year to $2.63 billion. Its non-GAAP profit of $0.48 per share was in line with analysts’ consensus estimates.

Is now the time to buy Cushman & Wakefield? Find out by accessing our full research report, it’s free.

Cushman & Wakefield (CWK) Q4 CY2024 Highlights:

- Revenue: $2.63 billion vs analyst estimates of $2.65 billion (3% year-on-year growth, 0.9% miss)

- Adjusted EPS: $0.48 vs analyst estimates of $0.48 (in line)

- Adjusted EBITDA: $222.3 million vs analyst estimates of $219.9 million (8.5% margin, 1.1% beat)

- Operating Margin: 6.6%, up from 4.3% in the same quarter last year

- Free Cash Flow Margin: 4%, down from 7.8% in the same quarter last year

- Market Capitalization: $2.99 billion

“We closed out 2024 with strong momentum in our business, reporting another quarter of solid Leasing revenue, our strongest Capital markets growth since the first quarter of 2022 and robust year-over-year improvement in free cash flow,” said Michelle MacKay, Chief Executive Officer of Cushman & Wakefield.

Company Overview

With expertise in the commercial real estate sector, Cushman & Wakefield (NYSE: CWK) is a global Chicago-based real estate firm offering a comprehensive range of services to clients.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Sales Growth

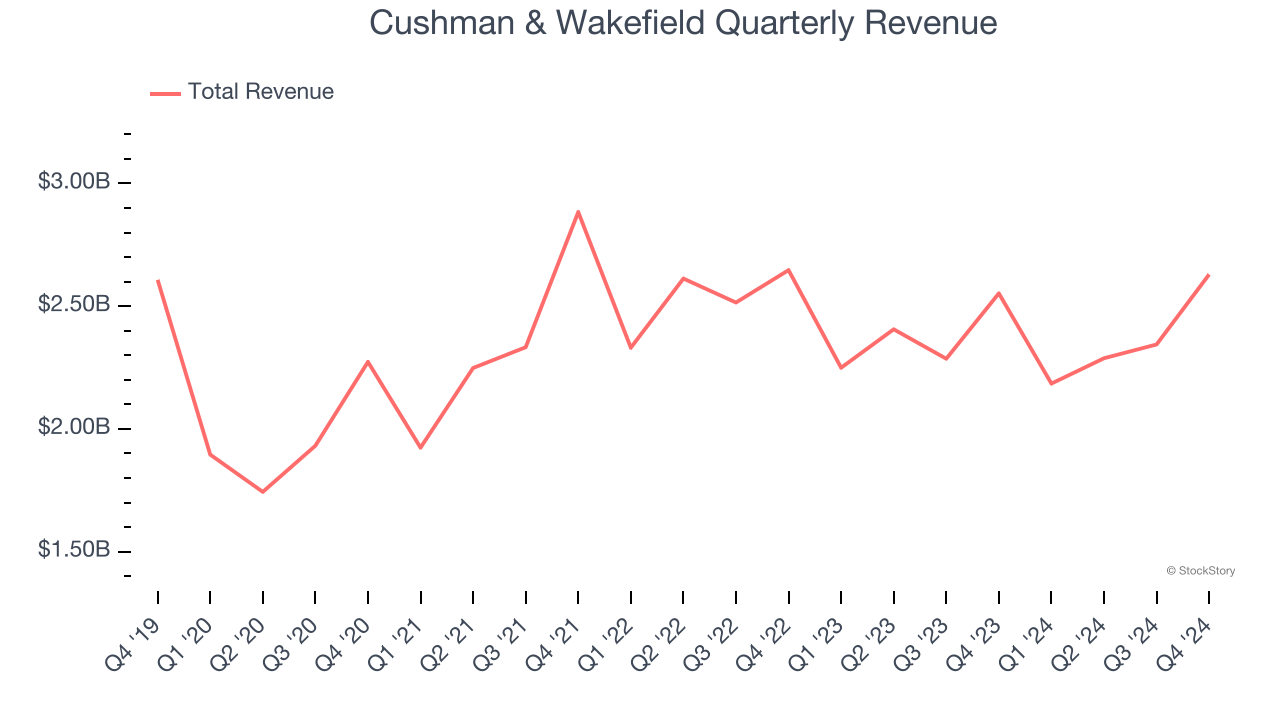

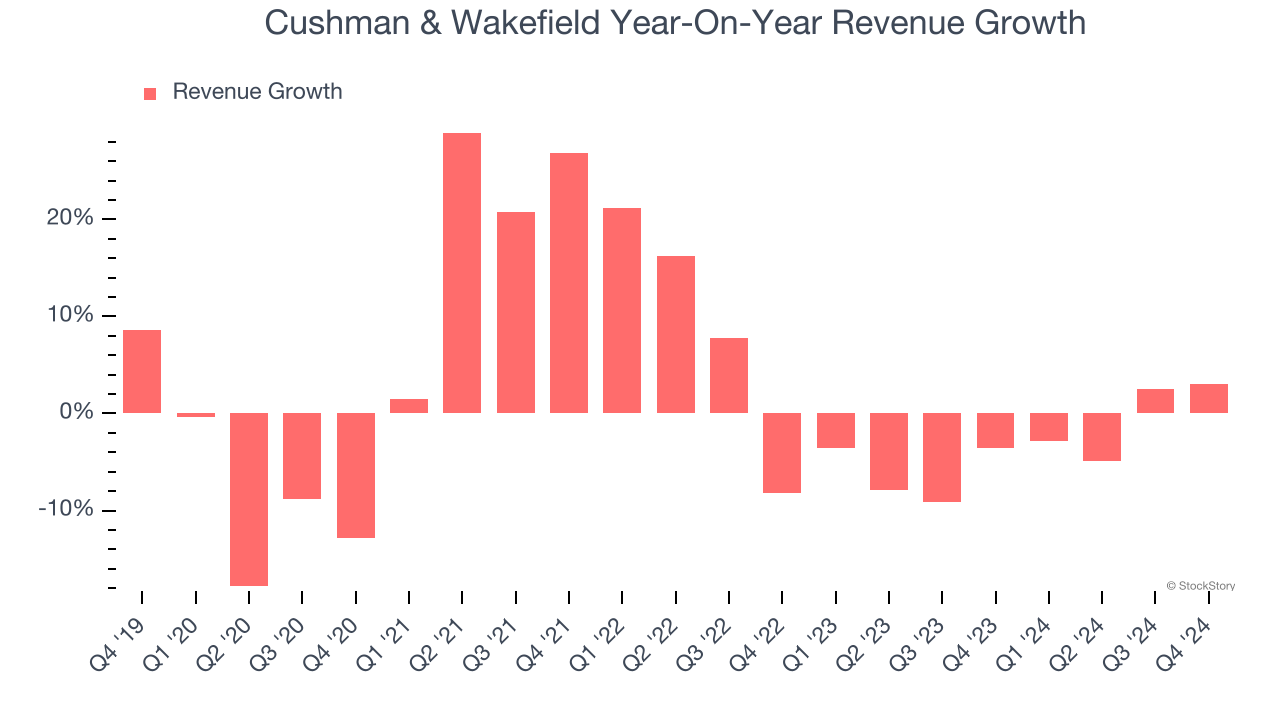

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Regrettably, Cushman & Wakefield’s sales grew at a weak 1.5% compounded annual growth rate over the last five years. This was below our standards and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Cushman & Wakefield’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.3% annually.

Cushman & Wakefield also breaks out the revenue for its three most important segments: Management, Leasing, and Capital Markets, which are 33.5%, 23.7%, and 9.4% of revenue. Over the last two years, Cushman & Wakefield’s Management revenue (property management) was flat, but its Leasing (sourcing tenants) and Capital Markets (financial advisory) revenues averaged 3.1% and 18.5% year-on-year declines.

This quarter, Cushman & Wakefield’s revenue grew by 3% year on year to $2.63 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.2% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

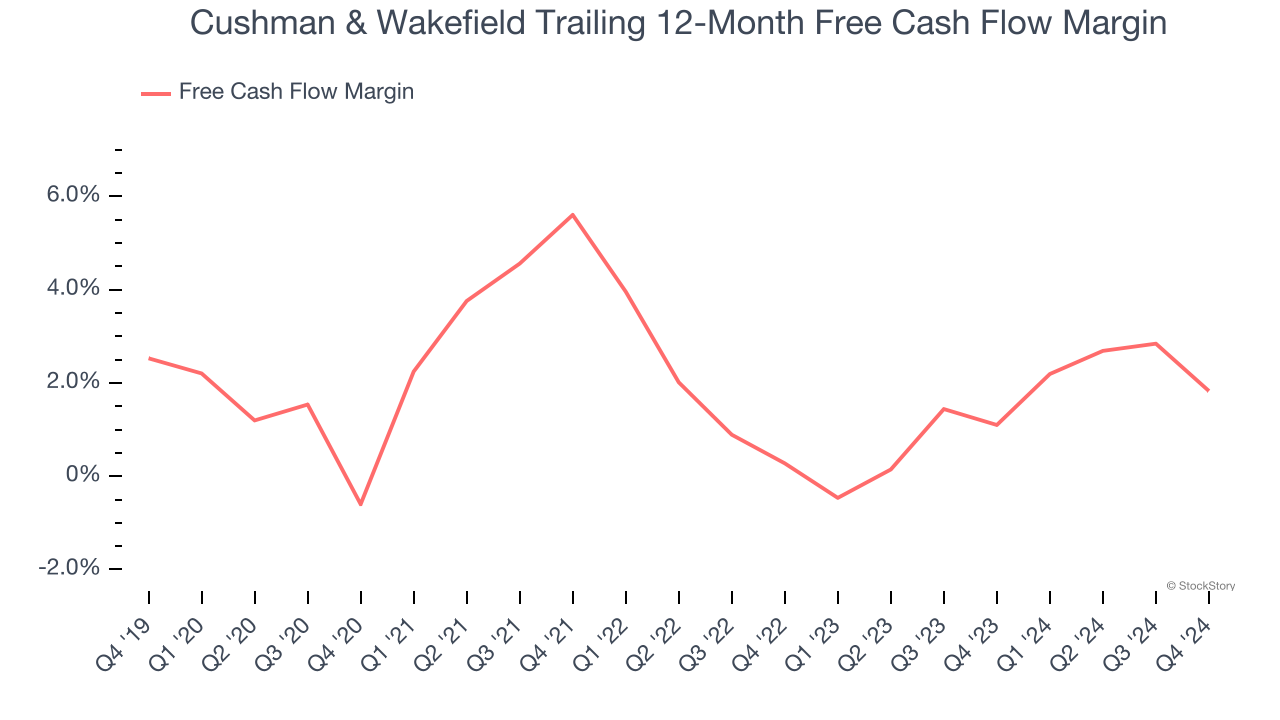

Cushman & Wakefield has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.5%, lousy for a consumer discretionary business.

Cushman & Wakefield’s free cash flow clocked in at $105.9 million in Q4, equivalent to a 4% margin. The company’s cash profitability regressed as it was 3.8 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends carry greater meaning.

Key Takeaways from Cushman & Wakefield’s Q4 Results

We struggled to find many positives in these results. Its revenue slightly missed and its Capital Markets revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 7.1% to $12.09 immediately following the results.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.