Pet food company Freshpet (NASDAQ: FRPT) fell short of the market’s revenue expectations in Q4 CY2024, but sales rose 22% year on year to $262.7 million. The company’s full-year revenue guidance of $1.20 billion at the midpoint came in 1.7% below analysts’ estimates. Its GAAP profit of $0.36 per share was 5.3% below analysts’ consensus estimates.

Is now the time to buy Freshpet? Find out by accessing our full research report, it’s free.

Freshpet (FRPT) Q4 CY2024 Highlights:

- Revenue: $262.7 million vs analyst estimates of $264.4 million (22% year-on-year growth, 0.6% miss)

- EPS (GAAP): $0.36 vs analyst expectations of $0.38 (5.3% miss)

- Adjusted EBITDA: $52.63 million vs analyst estimates of $47.84 million (20% margin, 10% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.20 billion at the midpoint, missing analyst estimates by 1.7% and implying 22.5% growth (vs 27.5% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $210 million at the midpoint, above analyst estimates of $206.9 million

- Operating Margin: 7.4%, in line with the same quarter last year

- Free Cash Flow was -$7.90 million compared to -$40.48 million in the same quarter last year

- Sales Volumes were up 20.7% year on year

- Market Capitalization: $6.34 billion

"Fiscal year 2024 was a breakout year for Freshpet. We continued to deliver the exceptional net sales growth investors have come to expect from Freshpet but also delivered very strong profit improvements - and even exceeded some of the fiscal year 2027 targets we set two years ago. We also delivered full-year positive net income for the first time. The strength of this sustained performance, coupled with our operating cash flow improvements, gives us confidence we will be free cash flow positive in 2026 and able to self-fund our growth going forward," commented Billy Cyr, Freshpet’s Chief Executive Officer.

Company Overview

Standing out from typical processed pet foods, Freshpet (NASDAQ: FRPT) is a pet food company whose product portfolio includes natural meals and treats for dogs and cats.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $975.2 million in revenue over the past 12 months, Freshpet is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the other hand, it can grow faster because it’s working from a smaller revenue base and has a longer runway of untapped store chains to sell into.

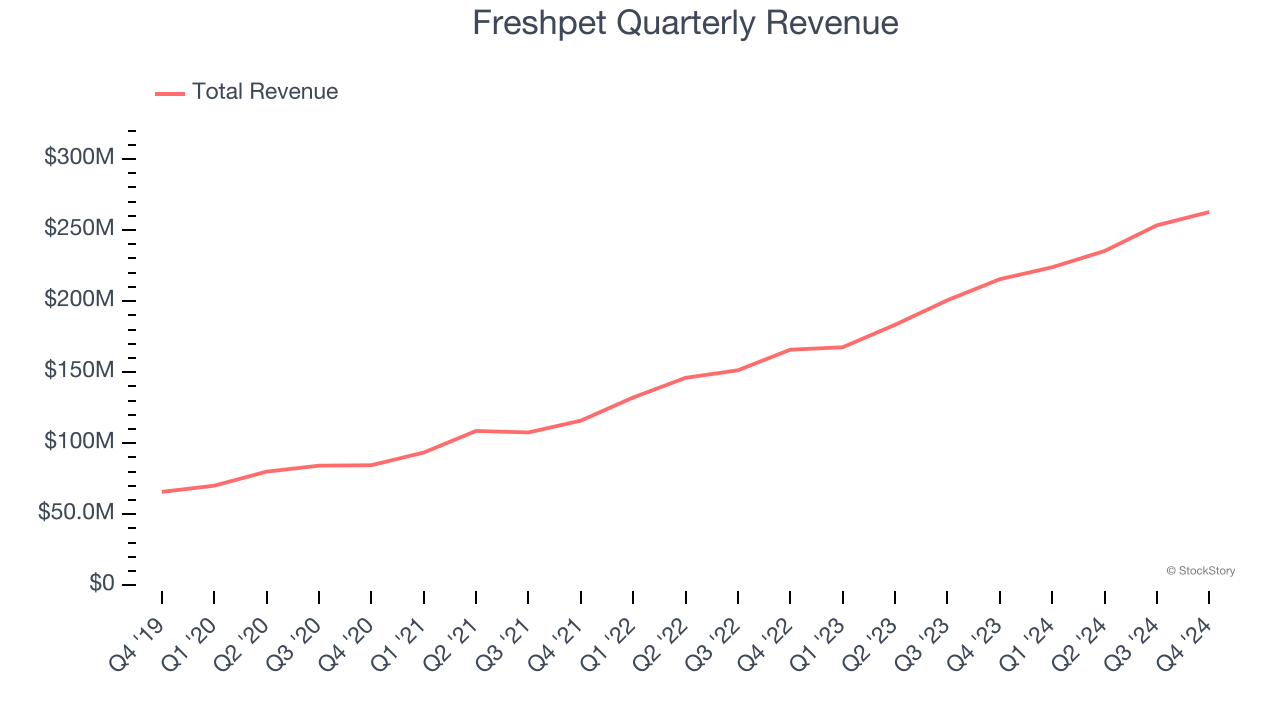

As you can see below, Freshpet’s sales grew at an incredible 31.8% compounded annual growth rate over the last three years as consumers bought more of its products.

This quarter, Freshpet generated an excellent 22% year-on-year revenue growth rate, but its $262.7 million of revenue fell short of Wall Street’s high expectations.

Looking ahead, sell-side analysts expect revenue to grow 24.7% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is commendable and implies the market is factoring in success for its products.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

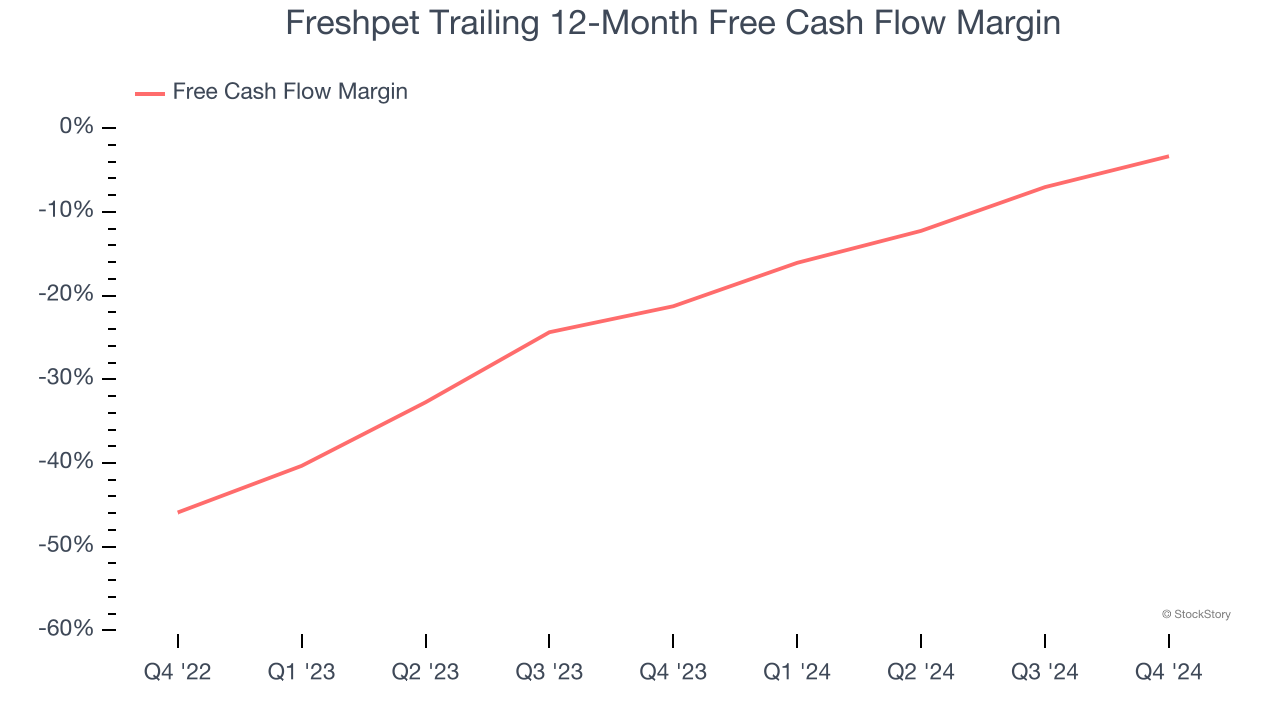

Freshpet’s demanding reinvestments have drained its resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 11.2%, meaning it lit $11.25 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Freshpet’s margin expanded by 17.9 percentage points over the last year. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

Freshpet burned through $7.90 million of cash in Q4, equivalent to a negative 3% margin. The company’s cash burn slowed from $40.48 million of lost cash in the same quarter last year.

Key Takeaways from Freshpet’s Q4 Results

We were impressed by how significantly Freshpet blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance was higher than Wall Street’s estimates. On the other hand, its gross margin missed significantly and its full-year revenue guidance fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 3.6% to $126 immediately following the results.

So should you invest in Freshpet right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.