Higher education company Laureate Education (NASDAQ: LAUR) announced better-than-expected revenue in Q4 CY2024, with sales up 3.4% year on year to $423.4 million. On the other hand, the company’s full-year revenue guidance of $1.56 billion at the midpoint came in 3% below analysts’ estimates. Its GAAP profit of $0.62 per share was 47.6% above analysts’ consensus estimates.

Is now the time to buy Laureate Education? Find out by accessing our full research report, it’s free.

Laureate Education (LAUR) Q4 CY2024 Highlights:

- Revenue: $423.4 million vs analyst estimates of $414.1 million (3.4% year-on-year growth, 2.2% beat)

- EPS (GAAP): $0.62 vs analyst estimates of $0.42 (47.6% beat)

- Adjusted EBITDA: $141.1 million vs analyst estimates of $140.7 million (33.3% margin, in line)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.56 billion at the midpoint, missing analyst estimates by 3% and implying -0.6% growth (vs 5.8% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $472 million at the midpoint, below analyst estimates of $476.2 million

- Operating Margin: 22%, down from 26.9% in the same quarter last year

- Free Cash Flow Margin: 0.8%, down from 8.2% in the same quarter last year

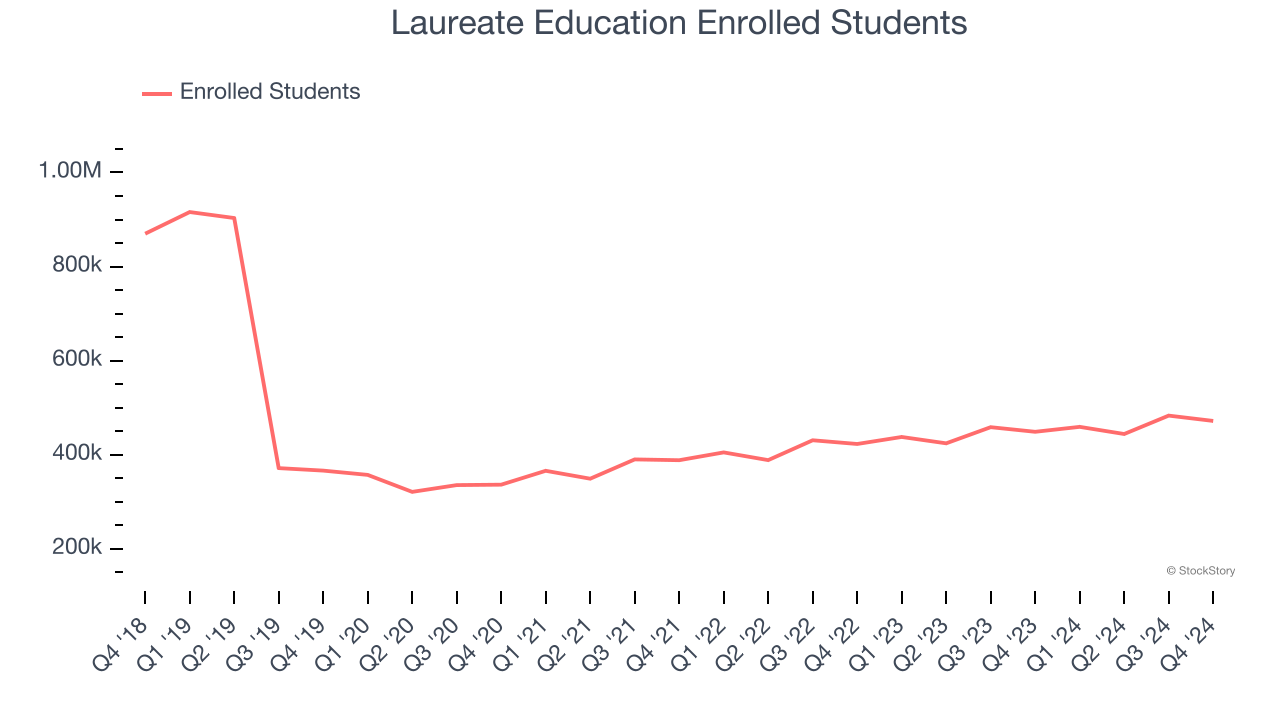

- Enrolled Students: 472,000, up 23,100 year on year

- Market Capitalization: $3.03 billion

Eilif Serck-Hanssen, President and Chief Executive Officer, said, “We delivered strong performance in 2024, with continued revenue growth and margin expansion. Our strong balance sheet and high free cash flow generation allowed us to execute on our growth strategy while also returning excess capital to shareholders. We see continued growth opportunities for 2025 in our local markets. The recent weakening of the Mexican Peso is expected to create foreign currency translation headwinds for us this year. However, based on current exchange rates, we still expect to deliver U.S. dollar-reported growth in both Adjusted EBITDA and unlevered free cash flow in 2025 due to robust momentum in local currency revenue growth and our continued margin expansion efforts. Returning excess capital to shareholders this year will remain a priority for us.”

Company Overview

Founded in 1998 by Douglas L. Becker and based in Miami, Laureate Education (NASDAQ: LAUR) is a global network of higher education institutions.

Education Services

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

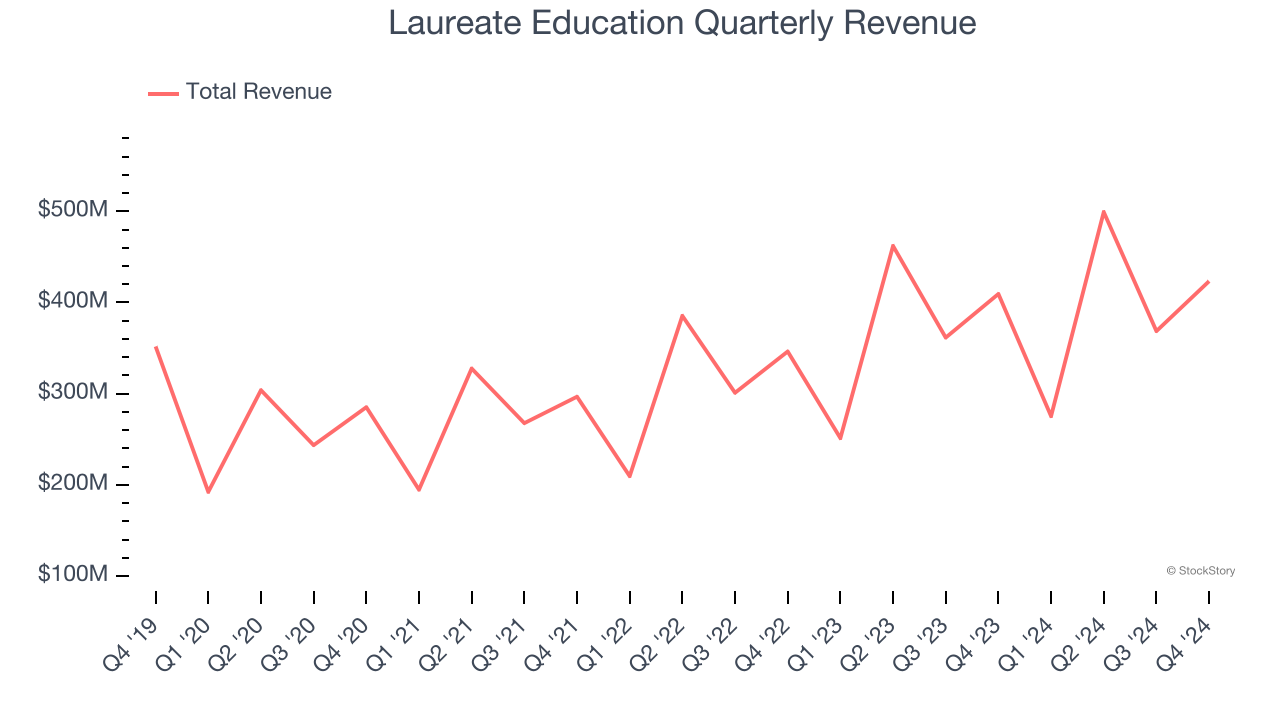

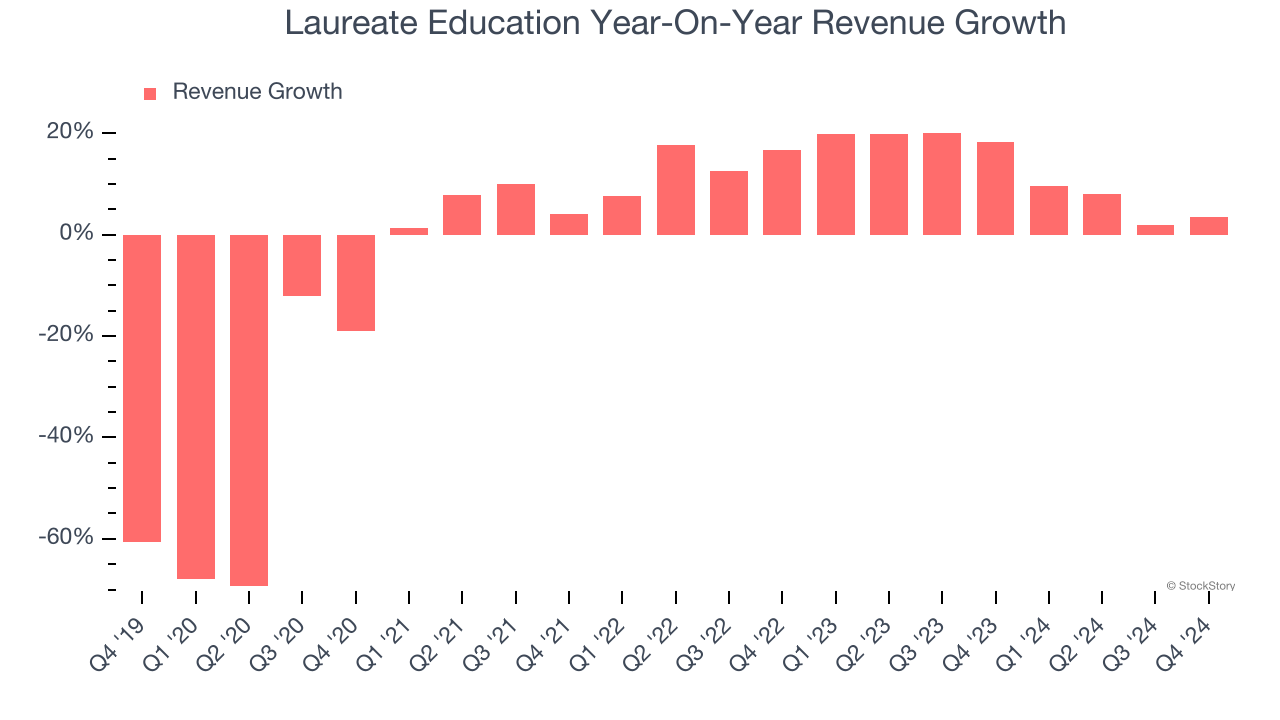

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Laureate Education struggled to consistently generate demand over the last five years as its sales dropped at a 6.8% annual rate. This was below our standards and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Laureate Education’s annualized revenue growth of 12.3% over the last two years is above its five-year trend, but we were still disappointed by the results.

Laureate Education also discloses its number of enrolled students, which reached 472,000 in the latest quarter. Over the last two years, Laureate Education’s enrolled students averaged 6.2% year-on-year growth. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Laureate Education reported modest year-on-year revenue growth of 3.4% but beat Wall Street’s estimates by 2.2%.

Looking ahead, sell-side analysts expect revenue to grow 2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

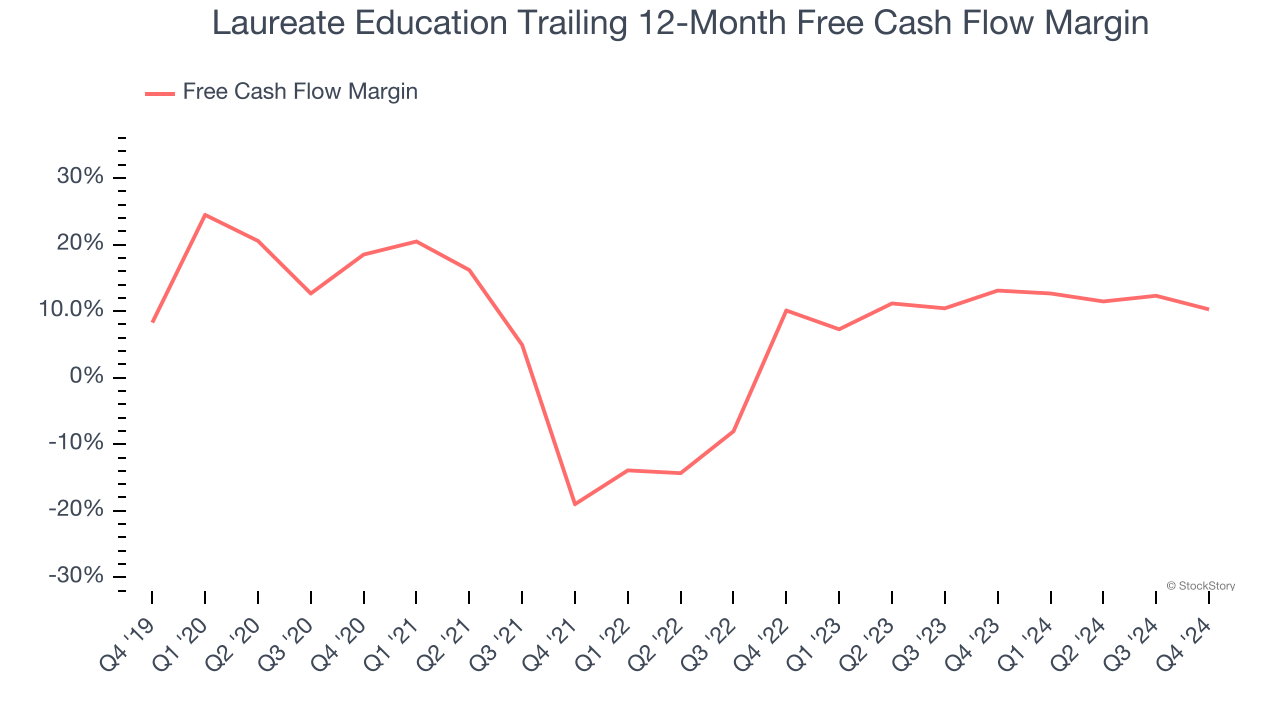

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Laureate Education has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.6% over the last two years, slightly better than the broader consumer discretionary sector.

Laureate Education broke even from a free cash flow perspective in Q4. The company’s cash profitability regressed as it was 7.4 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Laureate Education’s cash conversion will slightly improve. Their consensus estimates imply its free cash flow margin of 10.3% for the last 12 months will increase to 11.8%, giving it more flexibility for investments, share buybacks, and dividends.

Key Takeaways from Laureate Education’s Q4 Results

We were impressed by how significantly Laureate Education blew past analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed. Overall, this quarter was mixed. The stock traded up 2.7% to $20.69 immediately after reporting.

Should you buy the stock or not? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.