Pediatric healthcare provider Pediatrix Medical Group (NYSE: MD) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 1.2% year on year to $502.4 million. Its non-GAAP profit of $0.51 per share was 39.9% above analysts’ consensus estimates.

Is now the time to buy Pediatrix Medical Group? Find out by accessing our full research report, it’s free.

Pediatrix Medical Group (MD) Q4 CY2024 Highlights:

- Revenue: $502.4 million vs analyst estimates of $484.9 million (1.2% year-on-year growth, 3.6% beat)

- Adjusted EPS: $0.51 vs analyst estimates of $0.36 (39.9% beat)

- Adjusted EBITDA: $68.72 million vs analyst estimates of $55.37 million (13.7% margin, 24.1% beat)

- EBITDA guidance for the upcoming financial year 2025 is $225 million at the midpoint, below analyst estimates of $229.3 million

- Operating Margin: 7.8%, up from -22.5% in the same quarter last year

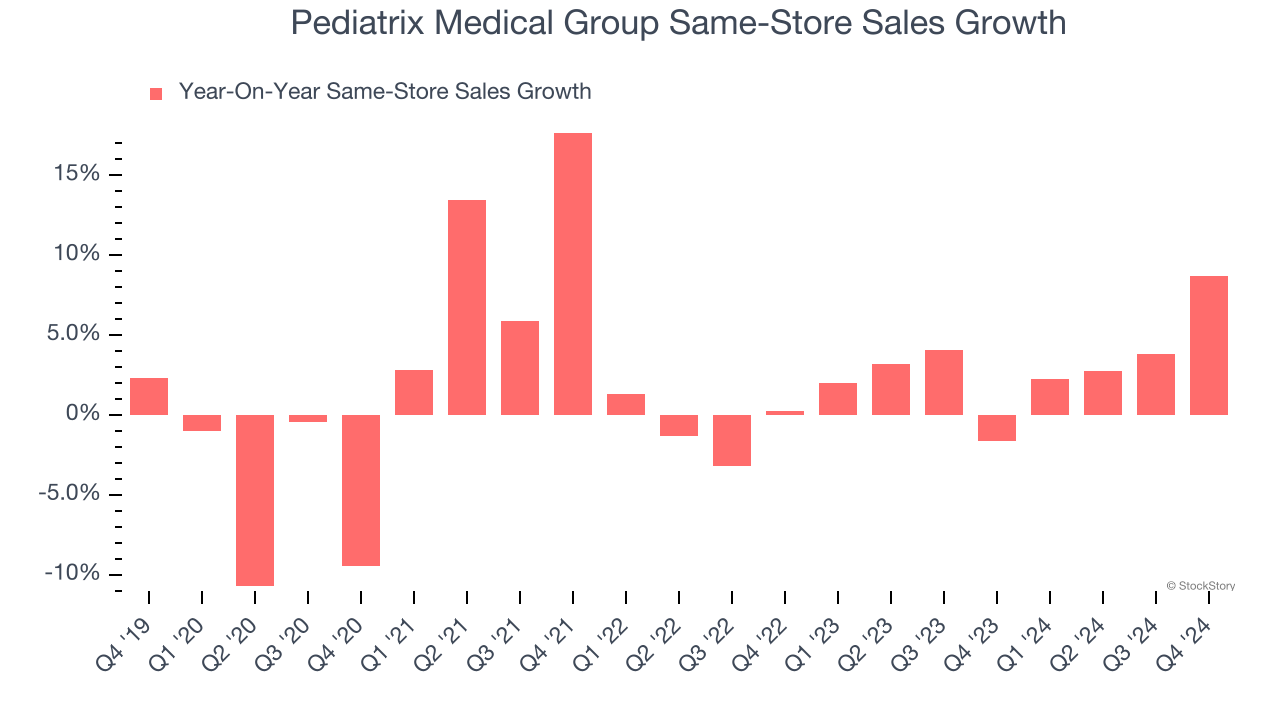

- Same-Store Sales rose 8.7% year on year (-1.6% in the same quarter last year)

- Market Capitalization: $1.19 billion

“Our strong fourth quarter results reflect continued top-line outperformance versus our expectations, the completion of our portfolio restructuring, and the related overhead expense reductions,” said Mark S. Ordan, Chief Executive Officer of Pediatrix Medical Group.

Company Overview

Founded in 1979, Pediatrix Medical Group (NYSE: MD) offers a wide range of pediatric care services, specializing in neonatal, pediatric, and maternal-fetal health.

Specialized Medical & Nursing Services

The skilled nursing services industry provides specialized care for patients requiring medical or rehabilitative support after hospital stays or for chronic conditions. These companies benefit from stable demand driven by an aging population and recurring revenue from Medicare, Medicaid, and private insurance. However, the industry faces challenges such as thin margins due to high labor costs and stringent regulatory requirements. Looking ahead, the industry is supported by tailwinds from an aging population, which means higher chronic disease prevalence. Advances in medical technology, including using AI to better predict, diagnose, and treat illnesses, may reduce hospital readmissions and improve outcomes. However, headwinds such as labor shortages, wage inflation, and potential government reimbursement cuts pose challenges. Adapting to value-based care models may further squeeze margins by requiring investments in training, technology, and compliance.

Sales Growth

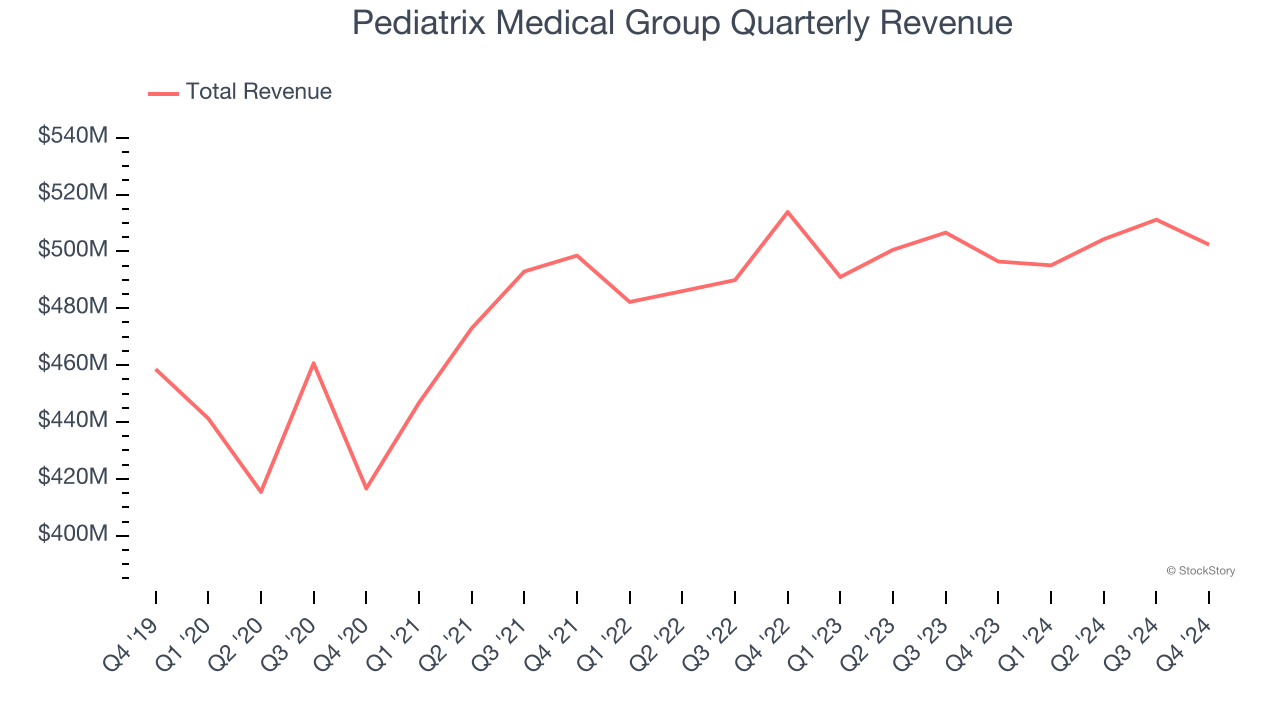

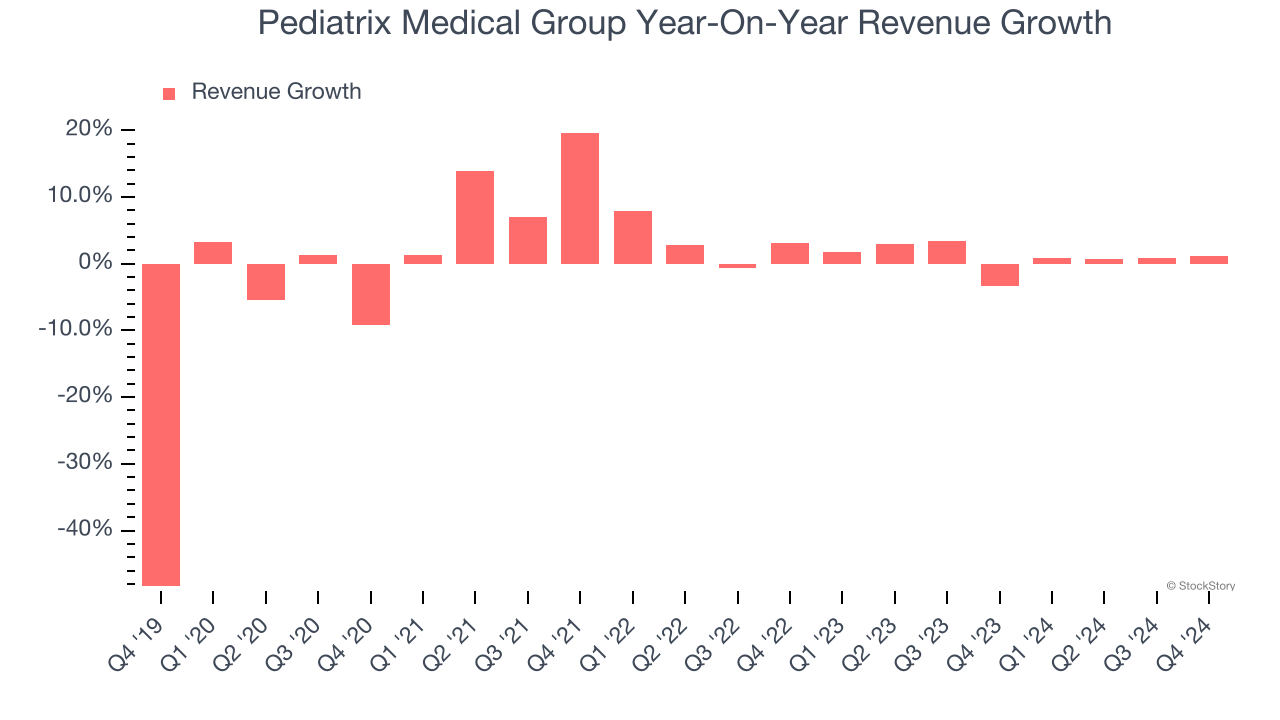

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Pediatrix Medical Group’s sales grew at a tepid 2.5% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a poor baseline for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Pediatrix Medical Group’s recent history shows its demand slowed as its annualized revenue growth of 1% over the last two years is below its five-year trend.

We can dig further into the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Pediatrix Medical Group’s same-store sales averaged 3.1% year-on-year growth. Because this number is better than its revenue growth, we can see its sales from existing locations are performing better than its sales from new locations.

This quarter, Pediatrix Medical Group reported modest year-on-year revenue growth of 1.2% but beat Wall Street’s estimates by 3.6%.

Looking ahead, sell-side analysts expect revenue to decline by 3% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

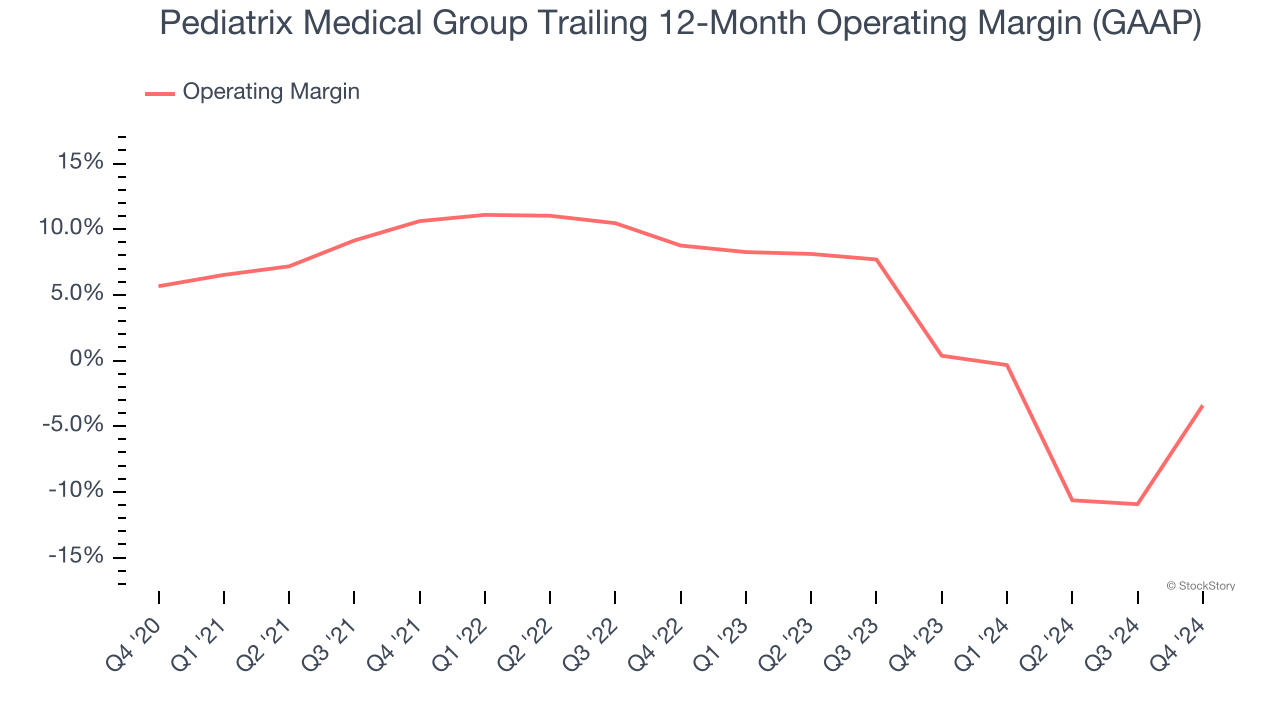

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Pediatrix Medical Group was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.3% was weak for a healthcare business.

Analyzing the trend in its profitability, Pediatrix Medical Group’s operating margin decreased by 9.1 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 12.2 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q4, Pediatrix Medical Group generated an operating profit margin of 7.8%, up 30.3 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

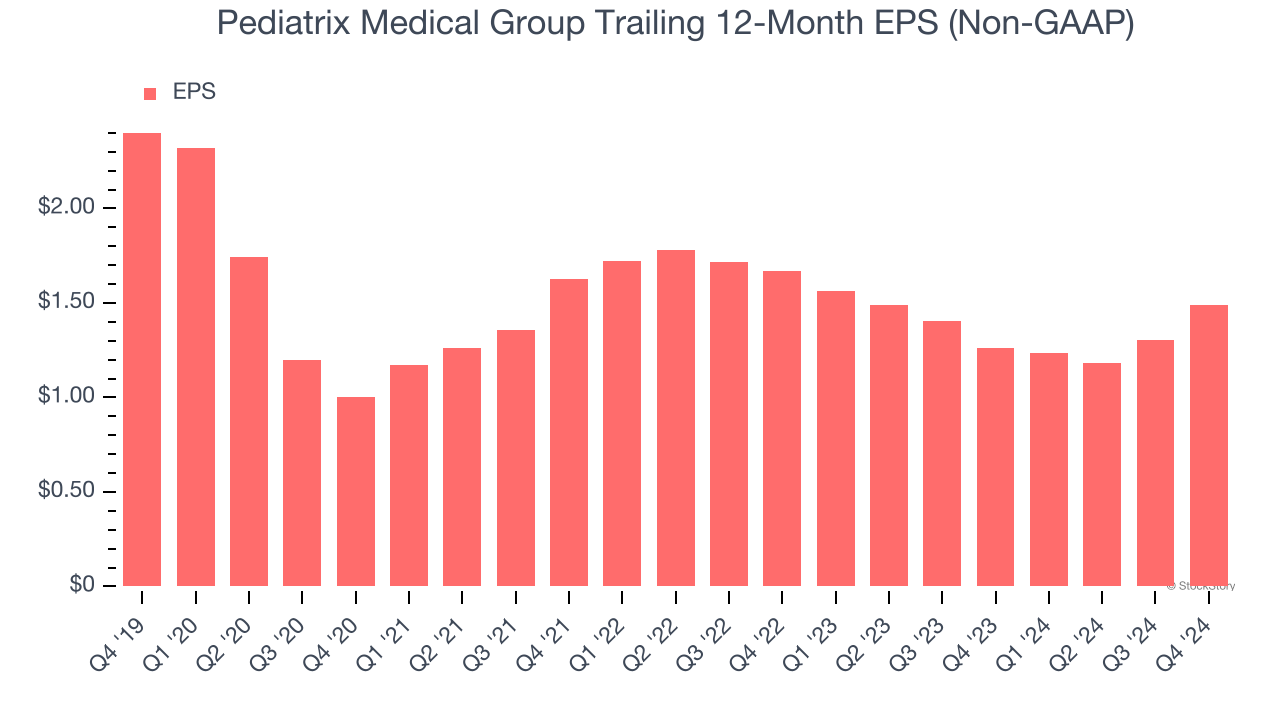

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

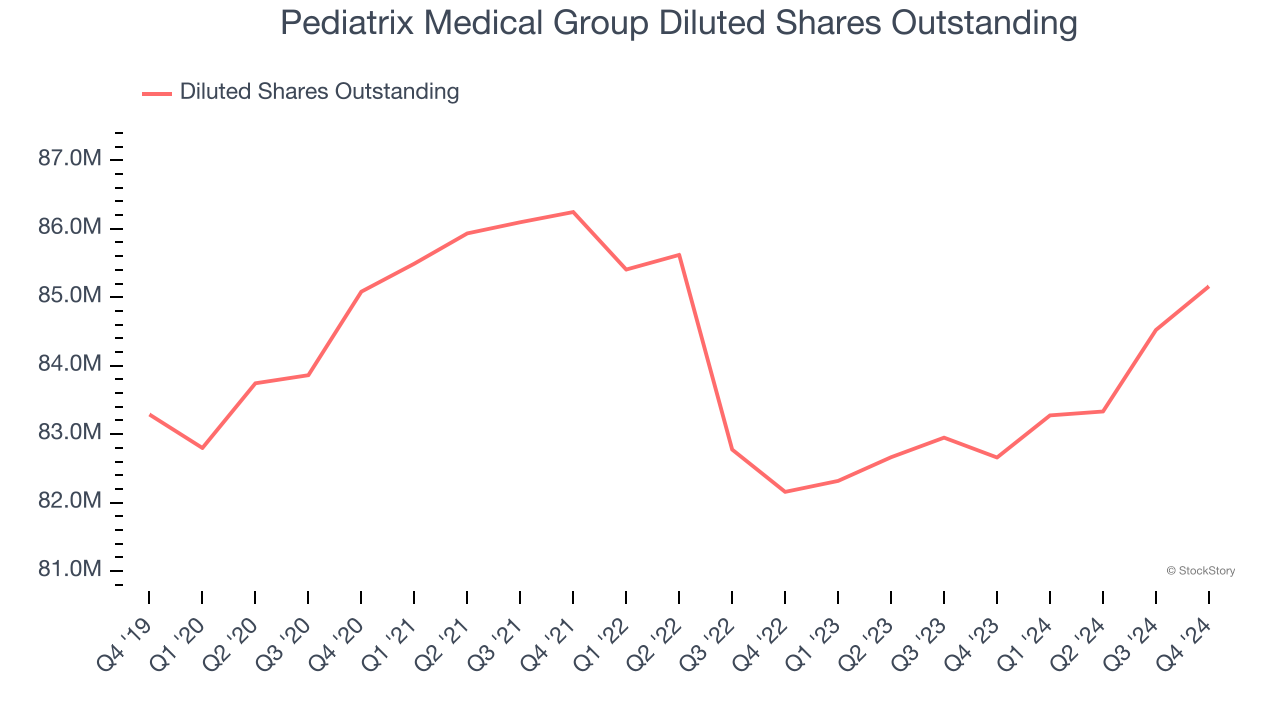

Sadly for Pediatrix Medical Group, its EPS declined by 9.1% annually over the last five years while its revenue grew by 2.5%. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Pediatrix Medical Group’s earnings to better understand the drivers of its performance. As we mentioned earlier, Pediatrix Medical Group’s operating margin improved this quarter but declined by 9.1 percentage points over the last five years. Its share count also grew by 2.2%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, Pediatrix Medical Group reported EPS at $0.51, up from $0.32 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Pediatrix Medical Group’s full-year EPS of $1.49 to grow 4.1%.

Key Takeaways from Pediatrix Medical Group’s Q4 Results

We were impressed by how significantly Pediatrix Medical Group blew past analysts’ same-store sales expectations this quarter, enabling it to beat on revenue, EPS, and EBITDA. On the other hand, its full-year EBITDA guidance missed. Zooming out, we think this quarter featured some positives. The stock remained flat at $14 immediately following the results.

So do we think Pediatrix Medical Group is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.