Biopharma manufacturing company Repligen Corporation (NASDAQ: RGEN) met Wall Street’s revenue expectations in Q4 CY2024, but sales were flat year on year at $167.5 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $697.5 million at the midpoint. Its non-GAAP profit of $0.44 per share was 7.9% above analysts’ consensus estimates.

Is now the time to buy Repligen? Find out by accessing our full research report, it’s free.

Repligen (RGEN) Q4 CY2024 Highlights:

- Revenue: $167.5 million vs analyst estimates of $167.7 million (flat year on year, in line)

- Adjusted EPS: $0.44 vs analyst estimates of $0.41 (7.9% beat)

- Adjusted EBITDA: $35.05 million vs analyst estimates of $33.13 million (20.9% margin, 5.8% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $697.5 million at the midpoint, in line with analyst expectations and implying 9.9% growth (vs 0.7% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $1.71 at the midpoint, in line with analyst estimates

- Adjusted EBITDA guidance for the upcoming financial year 2025 is $143 million at the midpoint (20.5% margin), above analyst estimates of $134.1 million

- Operating Margin: -21.8%, down from 5.9% in the same quarter last year

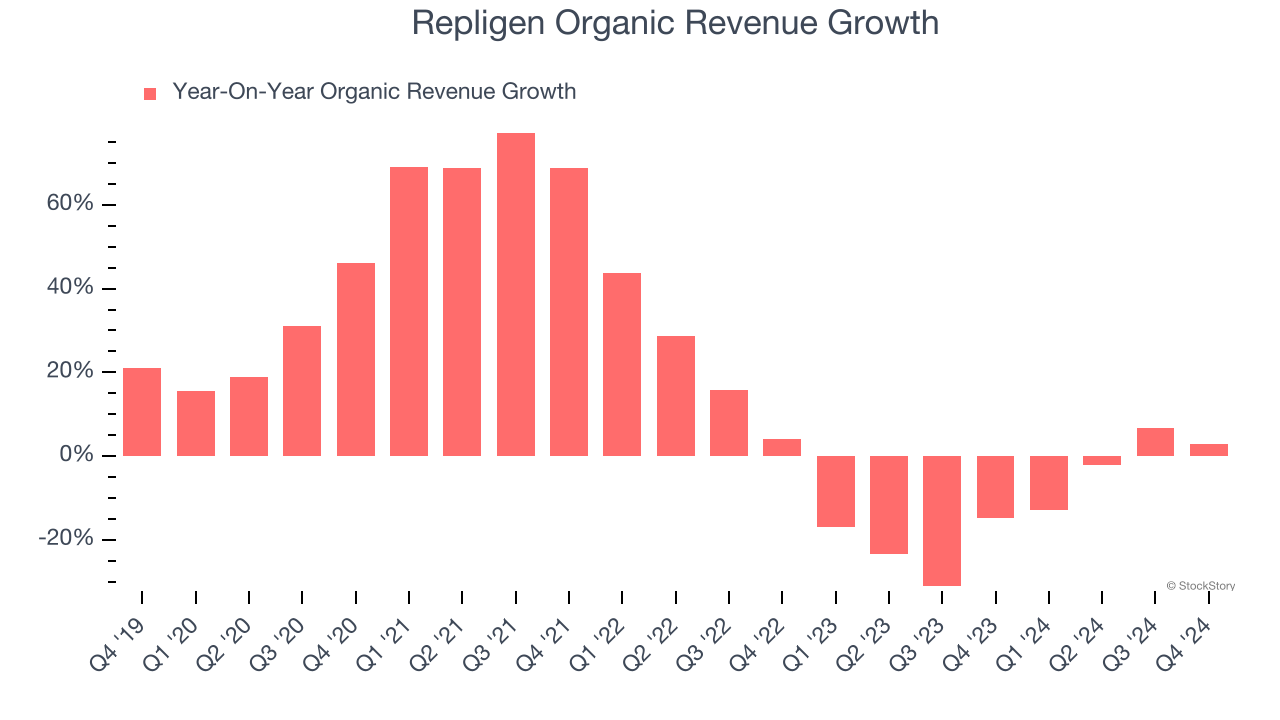

- Organic Revenue rose 3% year on year (-14.9% in the same quarter last year)

- Market Capitalization: $8.44 billion

Olivier Loeillot, President and Chief Executive Officer of Repligen said, “During the fourth quarter, we were very encouraged by the continued momentum across our portfolio. Total revenue in the fourth quarter grew 13% excluding COVID, overcoming two points of currency headwind. Total orders outpaced sales by 6%, driven by our Filtration and Analytics franchises. The strength we saw in the third quarter for CDMOs and capital equipment continued during the fourth quarter, with sequential revenues increasing approximately 20% and 30% respectively. While we continue to monitor China and emerging biotech, the overall bioprocessing market is returning to growth. Our order momentum during the second half gives us confidence that we can achieve our 2025 guidance.”

Company Overview

Founded in 1981, Repligen Corporation (NASDAQ: RGEN) develops and manufactures advanced products used in the production of drugs, with a focus on filtration, chromatography, and process analytics.

Drug Development Inputs & Services

Companies specializing in drug development inputs and services play a crucial role in the pharmaceutical and biotechnology value chain. Essential support for drug discovery, preclinical testing, and manufacturing means stable demand, as pharmaceutical companies often outsource non-core functions with medium to long-term contracts. However, the business model faces high capital requirements, customer concentration, and vulnerability to shifts in biopharma R&D budgets or regulatory frameworks. Looking ahead, the industry will likely enjoy tailwinds such as increasing investment in biologics, cell and gene therapies, and advancements in precision medicine, which drive demand for sophisticated tools and services. There is a growing trend of outsourcing in drug development for nimbleness and cost efficiency, which benefits the industry. On the flip side, potential headwinds include pricing pressures as efforts to contain healthcare costs are always top of mind. An evolving regulatory backdrop could also slow innovation or client activity.

Sales Growth

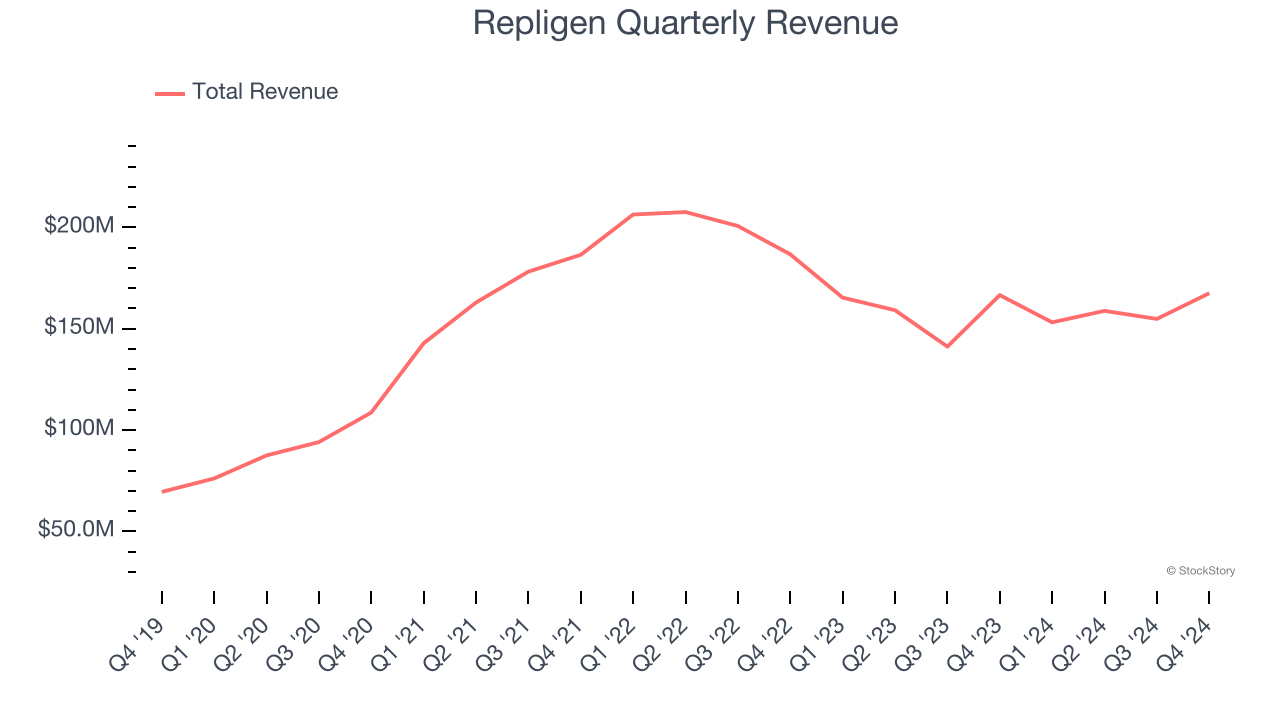

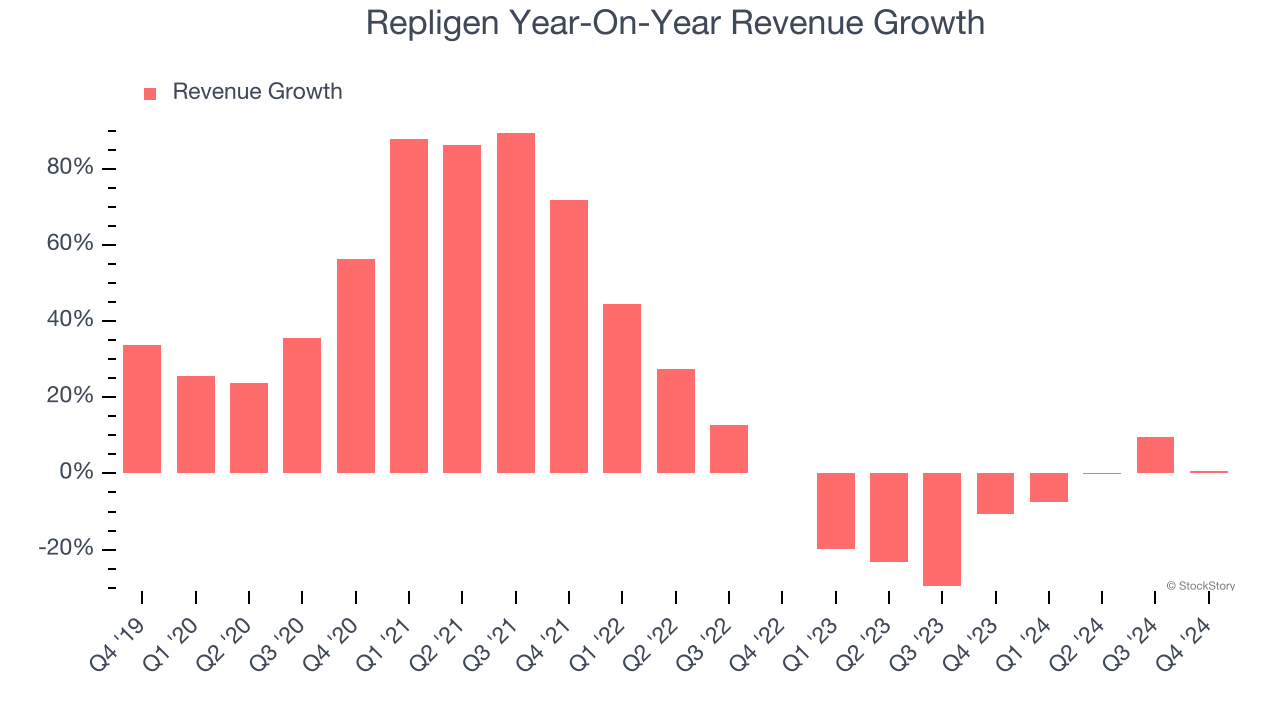

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Repligen’s sales grew at an impressive 18.6% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Repligen’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 11% over the last two years.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Repligen’s organic revenue averaged 11.4% year-on-year declines. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Repligen’s $167.5 million of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9% over the next 12 months, an improvement versus the last two years. This projection is healthy and implies its newer products and services will catalyze better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

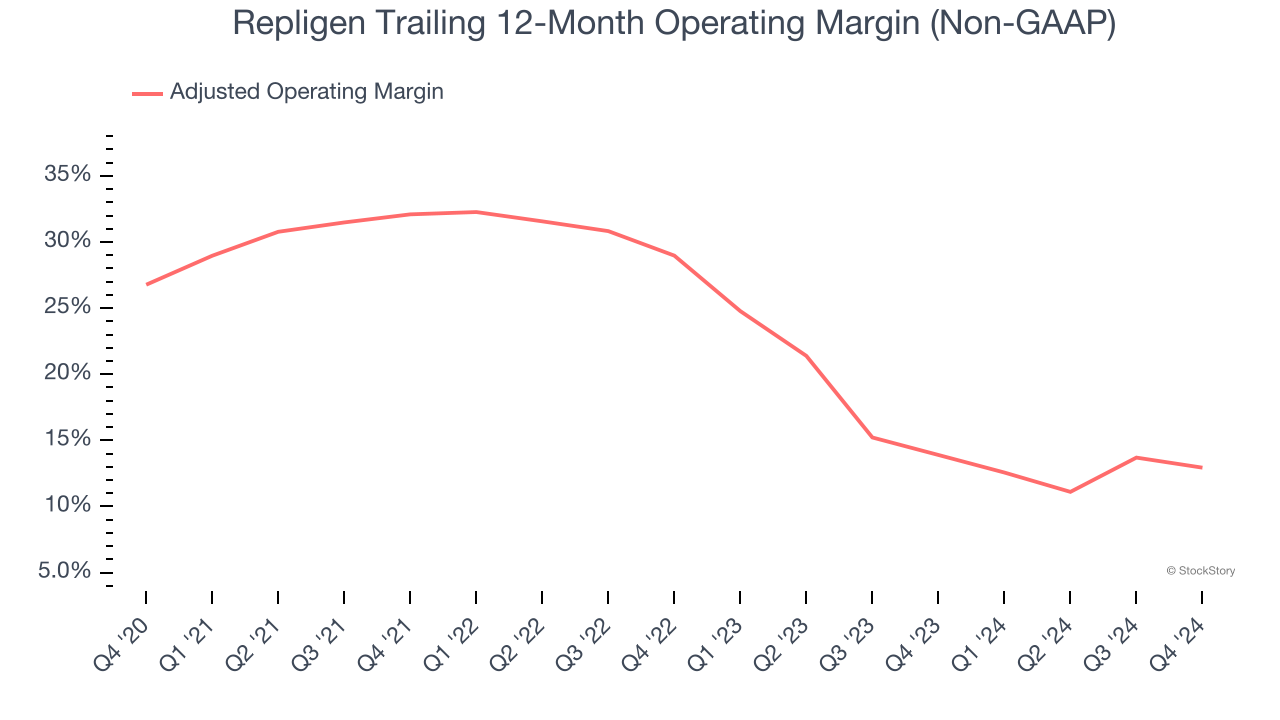

Repligen has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average adjusted operating margin of 23%.

Looking at the trend in its profitability, Repligen’s adjusted operating margin decreased by 13.8 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 16 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q4, Repligen generated an adjusted operating profit margin of 14.9%, down 2.9 percentage points year on year. This contraction shows it was recently less efficient because its expenses increased relative to its revenue.

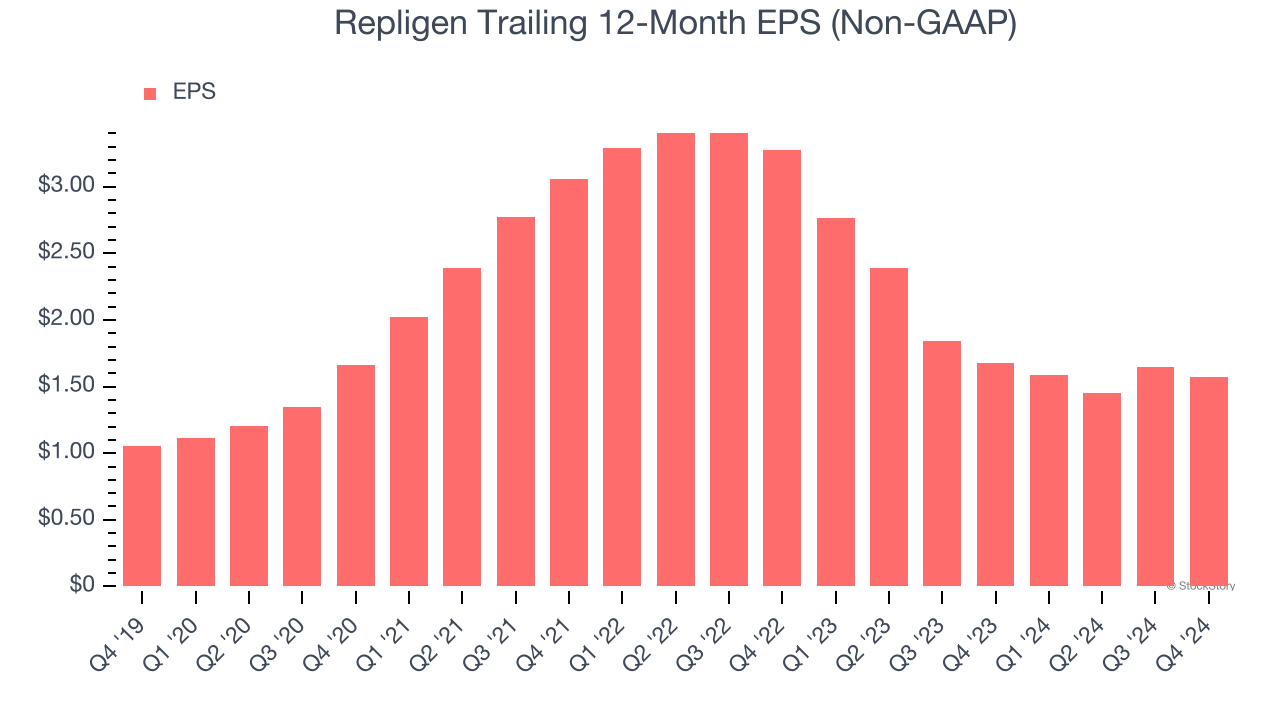

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

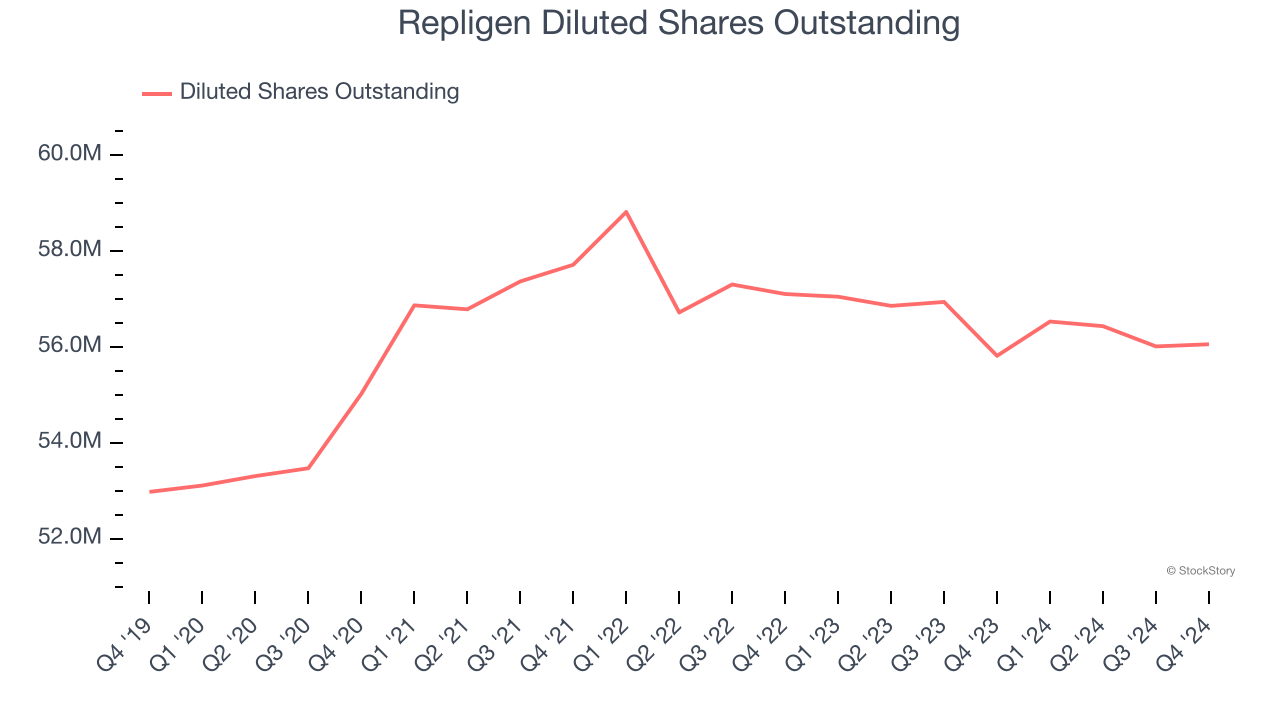

Repligen’s EPS grew at a solid 8.3% compounded annual growth rate over the last five years. However, this performance was lower than its 18.6% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

Diving into Repligen’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Repligen’s adjusted operating margin declined by 13.8 percentage points over the last five years. Its share count also grew by 5.8%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, Repligen reported EPS at $0.44, down from $0.52 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 7.9%. Over the next 12 months, Wall Street expects Repligen’s full-year EPS of $1.57 to grow 9.2%.

Key Takeaways from Repligen’s Q4 Results

It was encouraging to see Repligen beat analysts’ organic revenue, EPS, and EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street's estimates. Zooming out, we think this quarter featured some areas of strength. The stock traded up 1.6% to $153.22 immediately following the results.

Is Repligen an attractive investment opportunity at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.