Snack food company Utz Brands (NYSE: UTZ) missed Wall Street’s revenue expectations in Q4 CY2024, with sales falling 3.1% year on year to $341 million. Its non-GAAP profit of $0.22 per share was 14.7% above analysts’ consensus estimates.

Is now the time to buy Utz? Find out by accessing our full research report, it’s free.

Utz (UTZ) Q4 CY2024 Highlights:

- Revenue: $341 million vs analyst estimates of $348.5 million (3.1% year-on-year decline, 2.2% miss)

- Adjusted EPS: $0.22 vs analyst estimates of $0.19 (14.7% beat)

- Adjusted EBITDA: $53.1 million vs analyst estimates of $52.21 million (15.6% margin, 1.7% beat)

- Operating Margin: 2.1%, in line with the same quarter last year

- Free Cash Flow Margin: 4.8%, similar to the same quarter last year

- Organic Revenue was flat year on year, in line with the same quarter last year

- Market Capitalization: $1.11 billion

“In 2024, our Branded Salty Snacks delivered strong Organic Net Sales growth of nearly 4%, while we continued to carefully manage low-margin partner brands, private label, and non-salty snacks. We also met or exceeded our goals for volume share of the Salty Snack category which allowed us to partially offset the category softness as the year progressed. Finally, we exceeded our goals of Adjusted EBITDA Margin, Adjusted Earnings Per Share, and Net Leverage,” said Howard Friedman, Chief Executive Officer of Utz.

Company Overview

Tracing its roots back to 1921 when Bill and Salie Utz began making potato chips in their kitchen, Utz Brands (NYSE: UTZ) offers salty snacks such as potato chips, tortilla chips, pretzels, cheese snacks, and ready-to-eat popcorn, among others.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years.

With $1.41 billion in revenue over the past 12 months, Utz is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

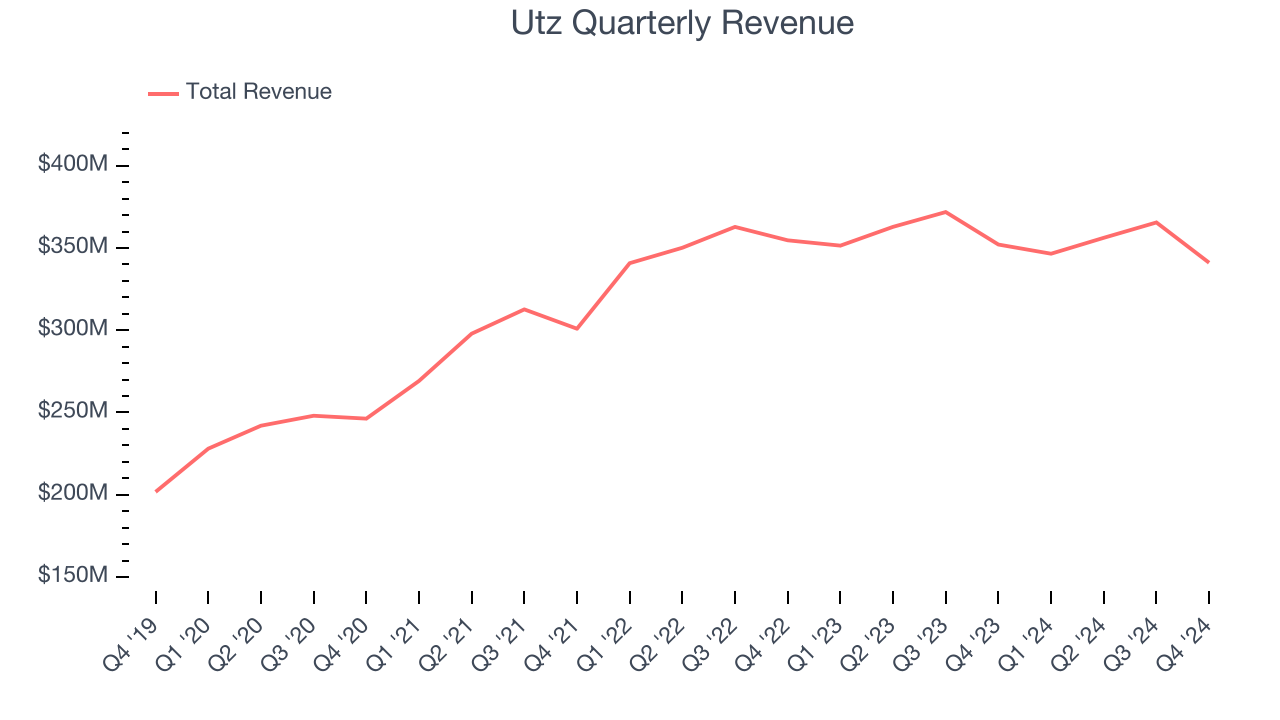

As you can see below, Utz grew its sales at a mediocre 6.1% compounded annual growth rate over the last three years as it failed to grow its volumes. We’ll explore what this means in the "Volume Growth" section.

This quarter, Utz missed Wall Street’s estimates and reported a rather uninspiring 3.1% year-on-year revenue decline, generating $341 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months, a slight deceleration versus the last three years. This projection doesn't excite us and suggests its products will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Organic Revenue Growth

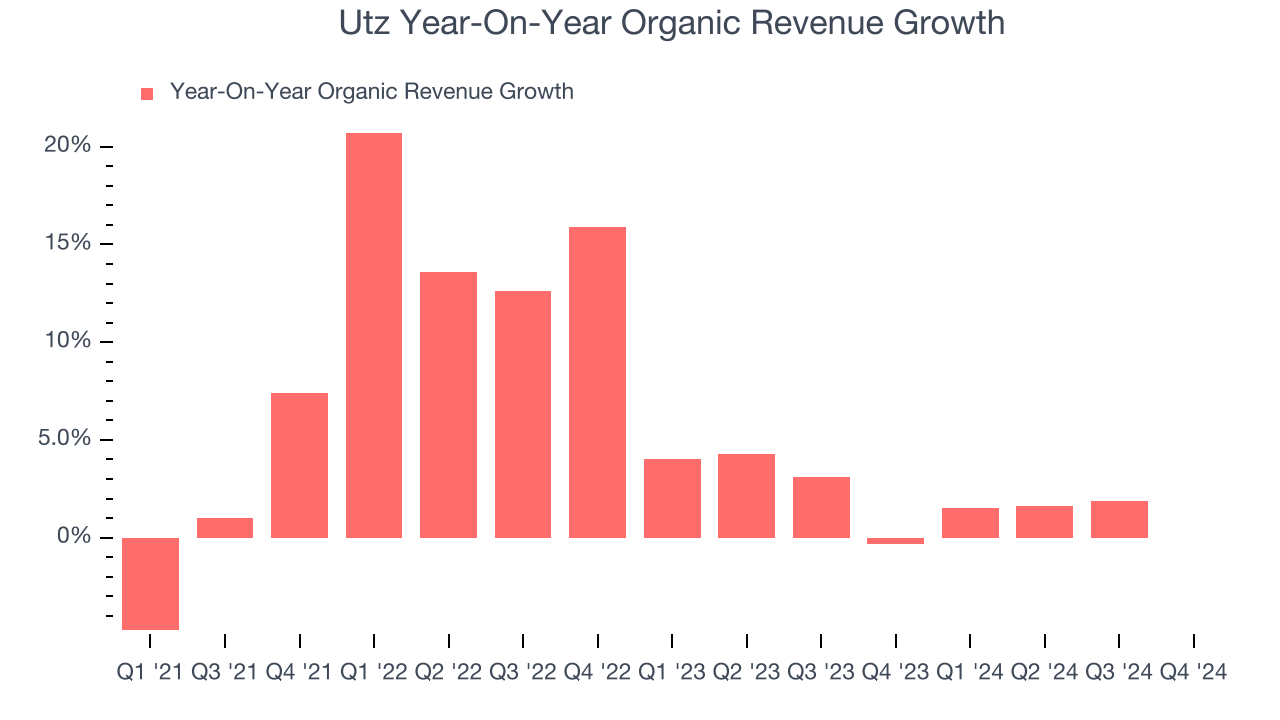

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Utz’s products has been stable over the last eight quarters but fell behind the broader sector. On average, the company has posted feeble year-on-year organic revenue growth of 2%.

In the latest quarter, Utz’s year on year organic sales were flat. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Utz can reaccelerate growth.

Key Takeaways from Utz’s Q4 Results

It was encouraging to see Utz beat analysts’ EPS expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its gross margin missed significantly and its organic revenue fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 1.9% to $13.20 immediately following the results.

Utz underperformed this quarter, but does that create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.