Pangaea Logistics (NASDAQ: PANL) announced better-than-expected revenue in Q4 CY2024, with sales up 11.6% year on year to $147.2 million. Its non-GAAP profit of $0.16 per share was 5.9% below analysts’ consensus estimates.

Is now the time to buy Pangaea? Find out by accessing our full research report, it’s free.

Pangaea (PANL) Q4 CY2024 Highlights:

- Revenue: $147.2 million vs analyst estimates of $127.3 million (11.6% year-on-year growth, 15.6% beat)

- Adjusted EPS: $0.16 vs analyst expectations of $0.17 (5.9% miss)

- Adjusted EBITDA: $23.24 million vs analyst estimates of $19.4 million (15.8% margin, 19.8% beat)

- Operating Margin: 10.1%, up from 8.1% in the same quarter last year

- Free Cash Flow Margin: 52.1%, up from 18.1% in the same quarter last year

- Market Capitalization: $317 million

"Our fourth quarter performance was a strong finish to a transformational year for Pangaea, one in which our strong base of long-term contracts and premium-rate model supported a greater than 18% year-over-year increase in Adjusted EBITDA, despite pronounced softness in the broader dry bulk market," stated Mark Filanowski, Chief Executive Officer of Pangaea Logistics Solutions.

Company Overview

Established in 1996, Pangaea Logistics (NASDAQ: PANL) specializes in global logistics and transportation services, focusing on the shipment of dry bulk cargoes.

Marine Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for marine transportation companies. While ocean freight is more fuel efficient and therefore cheaper than its air and ground counterparts, it results in slower delivery times, presenting a trade off. To improve transit speeds, the industry continues to invest in digitization to optimize fleets and routes. However, marine transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins. Geopolitical tensions can also affect access to trade routes, and if certain countries are banned from using passageways like the Panama Canal, costs can spiral out of control.

Sales Growth

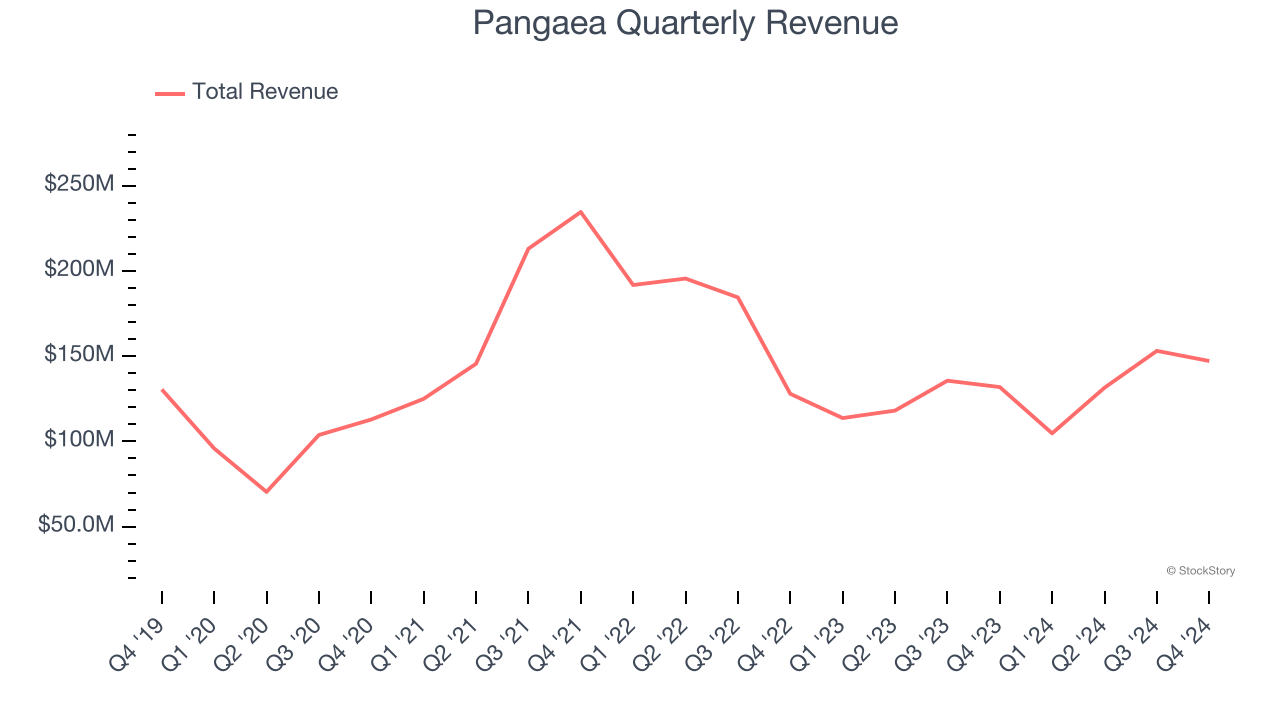

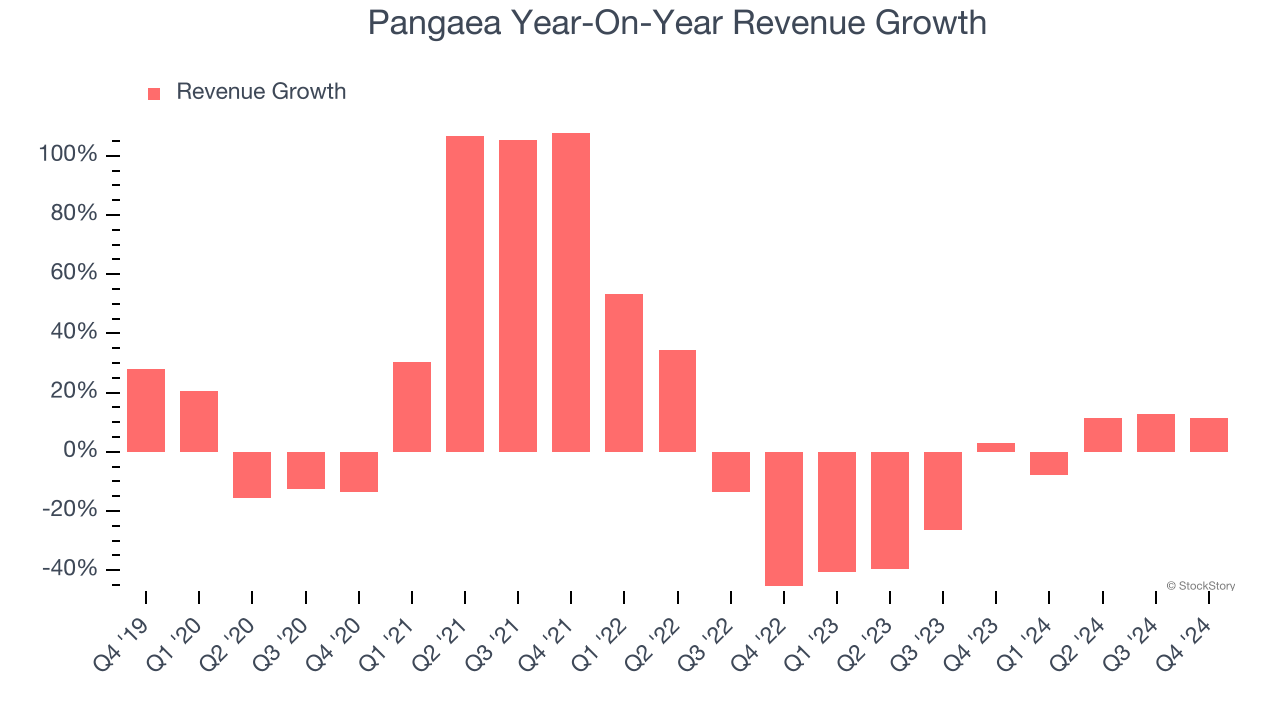

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Pangaea’s 5.4% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Pangaea’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 12.4% annually. Pangaea isn’t alone in its struggles as the Marine Transportation industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Pangaea reported year-on-year revenue growth of 11.6%, and its $147.2 million of revenue exceeded Wall Street’s estimates by 15.6%.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months. While this projection indicates its newer products and services will spur better top-line performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

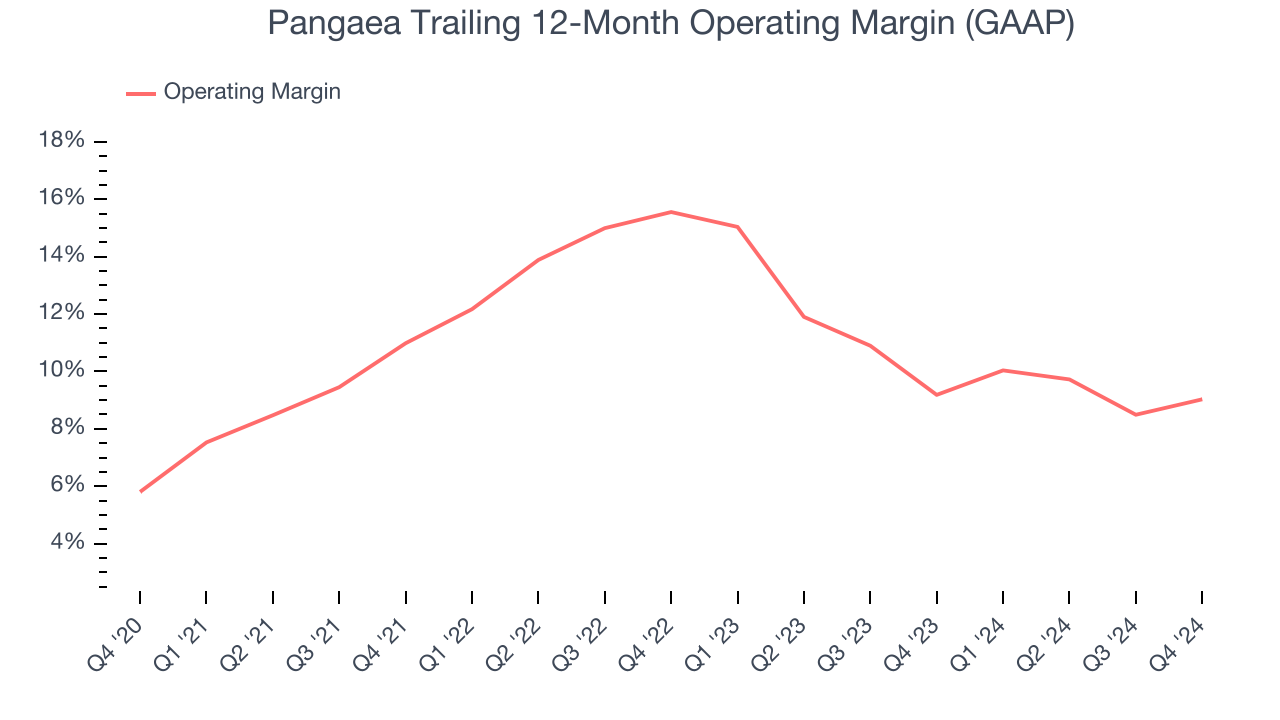

Pangaea has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.7%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Pangaea’s operating margin rose by 3.2 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Pangaea generated an operating profit margin of 10.1%, up 2 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

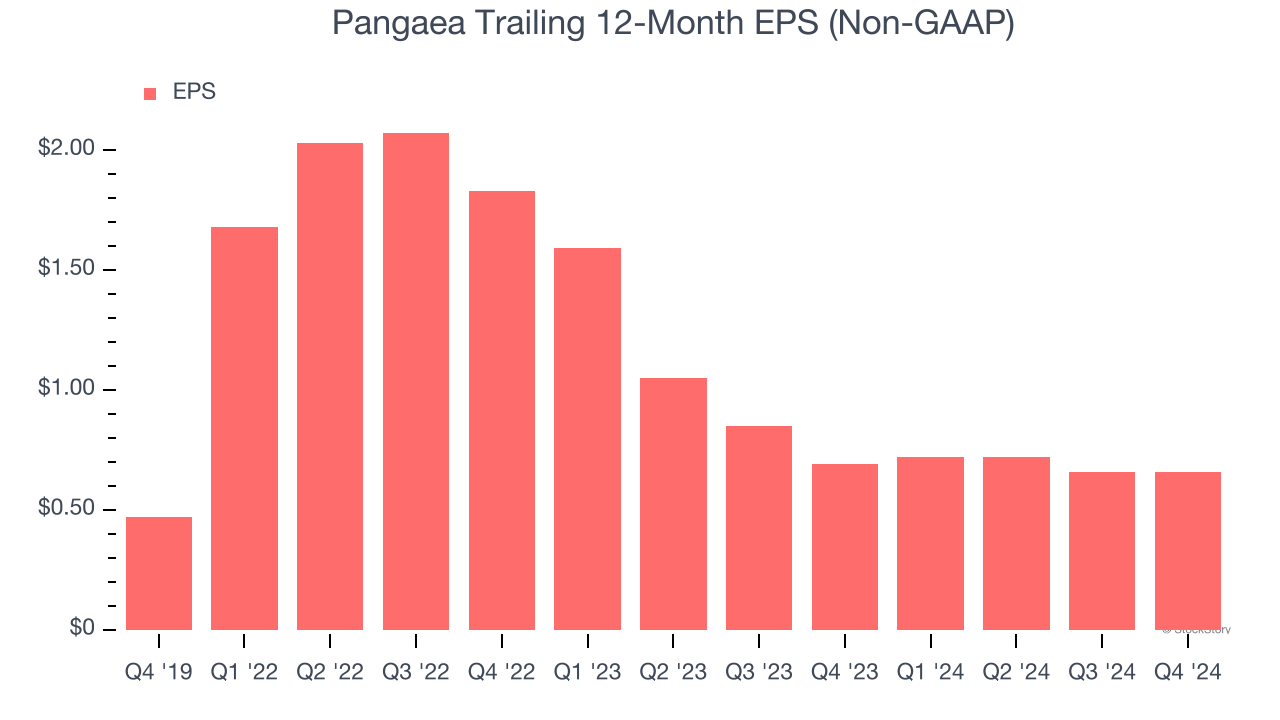

Pangaea’s EPS grew at an unimpressive 6.9% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 5.4% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Pangaea’s earnings can give us a better understanding of its performance. As we mentioned earlier, Pangaea’s operating margin expanded by 3.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Pangaea, its two-year annual EPS declines of 40.2% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Pangaea reported EPS at $0.16, in line with the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Pangaea’s full-year EPS of $0.65 to grow 60.4%.

Key Takeaways from Pangaea’s Q4 Results

We were impressed by how significantly Pangaea blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 7.6% to $5.23 immediately after reporting.

Pangaea had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.